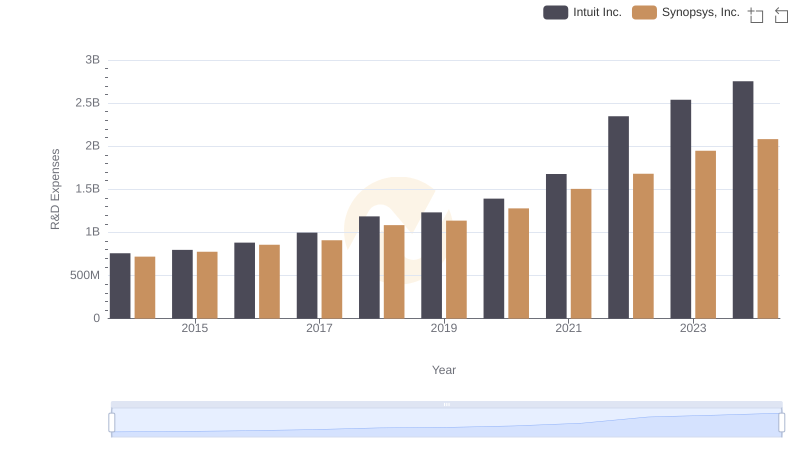

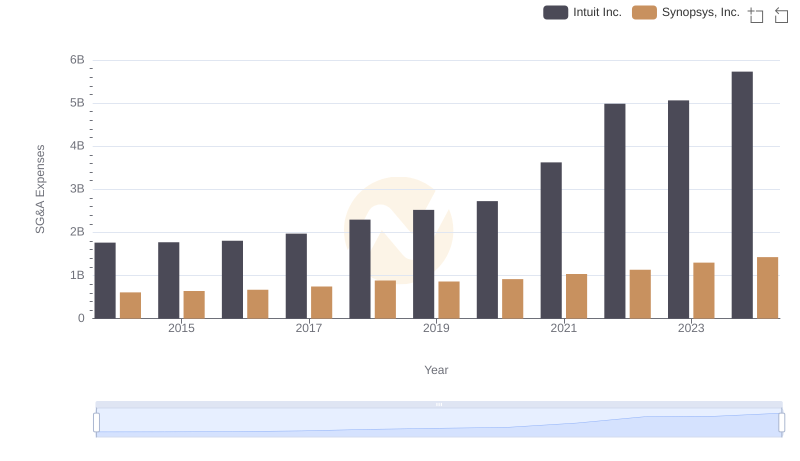

| __timestamp | Intuit Inc. | Synopsys, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1528000000 | 441543000 |

| Thursday, January 1, 2015 | 970000000 | 496245000 |

| Friday, January 1, 2016 | 1480000000 | 540351000 |

| Sunday, January 1, 2017 | 1634000000 | 584909000 |

| Monday, January 1, 2018 | 1839000000 | 581213000 |

| Tuesday, January 1, 2019 | 2121000000 | 761347000 |

| Wednesday, January 1, 2020 | 2430000000 | 857403000 |

| Friday, January 1, 2021 | 2948000000 | 1101071000 |

| Saturday, January 1, 2022 | 3369000000 | 1435158000 |

| Sunday, January 1, 2023 | 4043000000 | 1647785000 |

| Monday, January 1, 2024 | 4581000000 | 1355711000 |

In pursuit of knowledge

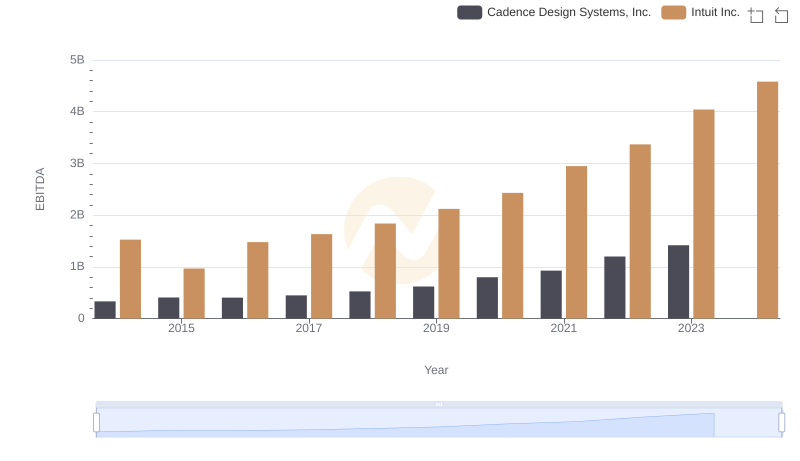

In the ever-evolving landscape of financial technology and software solutions, Intuit Inc. and Synopsys, Inc. have emerged as formidable players. Over the past decade, Intuit has demonstrated a remarkable growth trajectory, with its EBITDA increasing by approximately 200% from 2014 to 2024. This growth underscores Intuit's strategic focus on innovation and customer-centric solutions.

Conversely, Synopsys, Inc. has also shown a steady upward trend, albeit at a more modest pace. From 2014 to 2023, Synopsys' EBITDA grew by nearly 273%, reflecting its stronghold in the electronic design automation industry.

The data reveals that while both companies have experienced growth, Intuit's aggressive expansion strategies have positioned it as a leader in the sector. As we look to the future, these trends highlight the dynamic nature of the industry and the importance of strategic foresight.

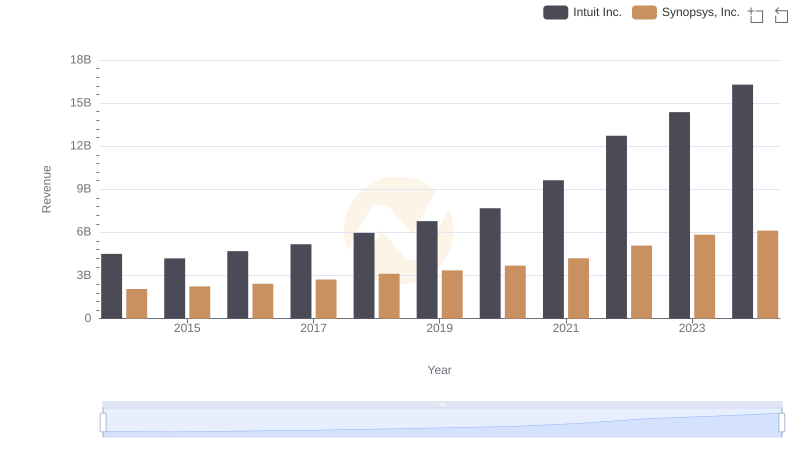

Intuit Inc. vs Synopsys, Inc.: Annual Revenue Growth Compared

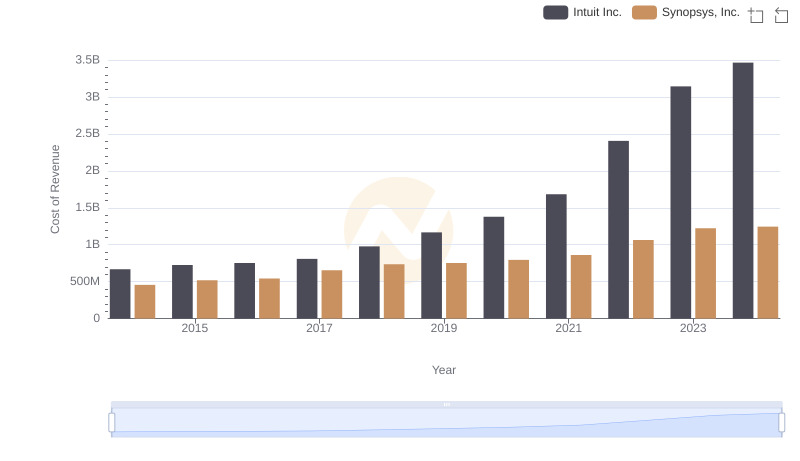

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Synopsys, Inc.

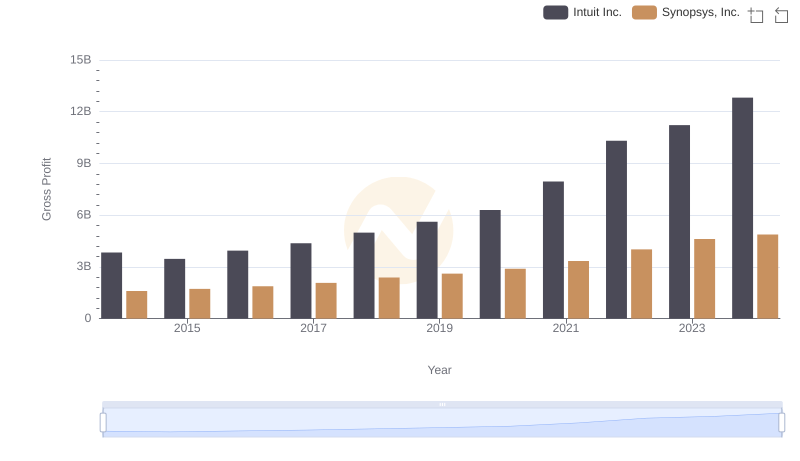

Intuit Inc. and Synopsys, Inc.: A Detailed Gross Profit Analysis

R&D Insights: How Intuit Inc. and Synopsys, Inc. Allocate Funds

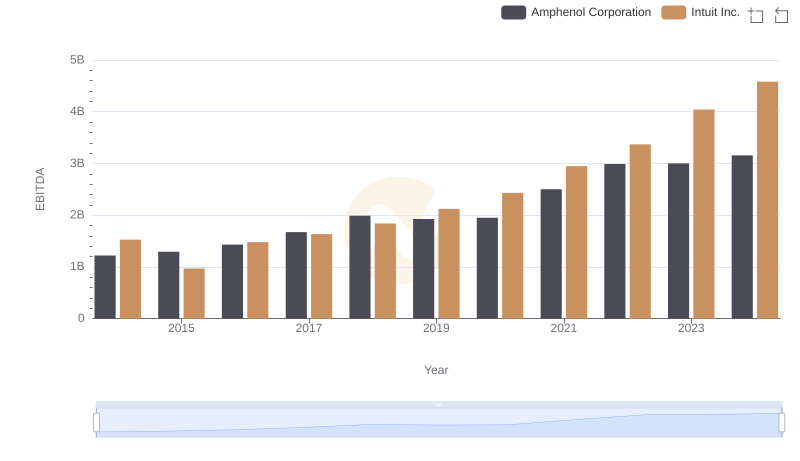

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Amphenol Corporation

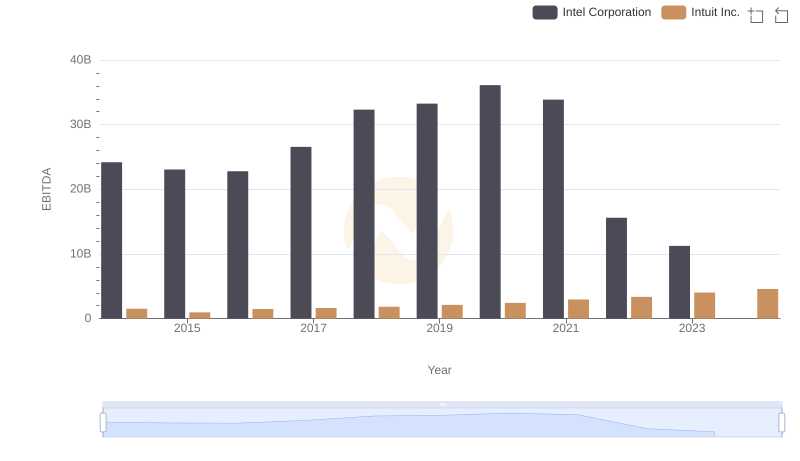

A Professional Review of EBITDA: Intuit Inc. Compared to Intel Corporation

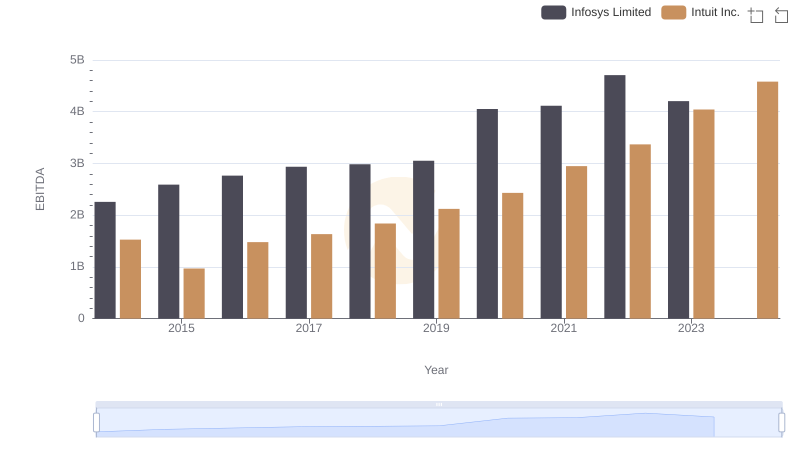

Intuit Inc. and Infosys Limited: A Detailed Examination of EBITDA Performance

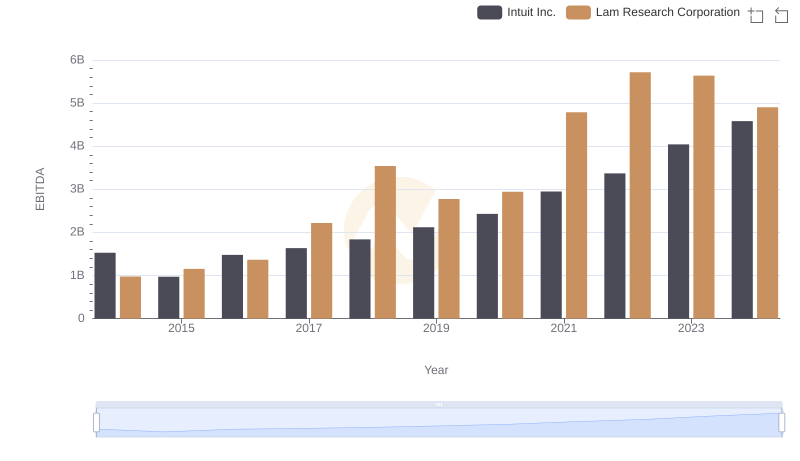

Intuit Inc. and Lam Research Corporation: A Detailed Examination of EBITDA Performance

Who Optimizes SG&A Costs Better? Intuit Inc. or Synopsys, Inc.

Comparative EBITDA Analysis: Intuit Inc. vs Cadence Design Systems, Inc.

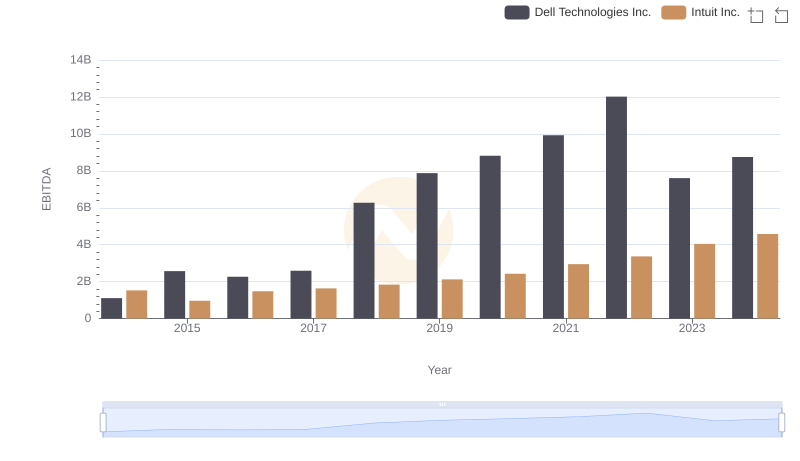

Intuit Inc. vs Dell Technologies Inc.: In-Depth EBITDA Performance Comparison

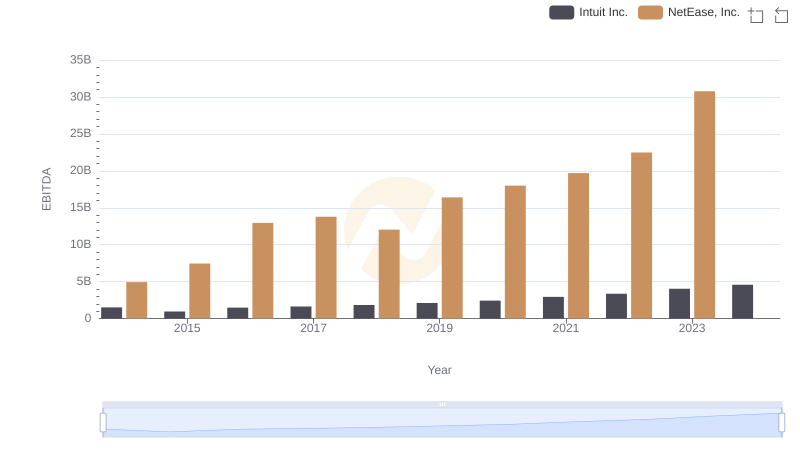

EBITDA Performance Review: Intuit Inc. vs NetEase, Inc.