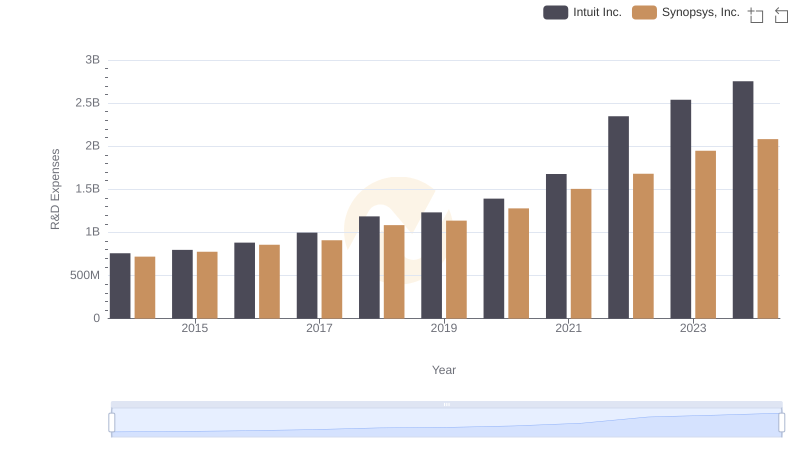

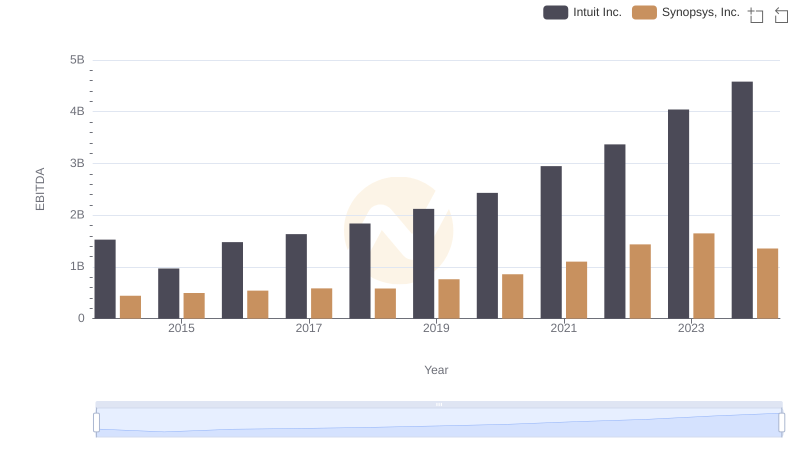

| __timestamp | Intuit Inc. | Synopsys, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 608294000 |

| Thursday, January 1, 2015 | 1771000000 | 639504000 |

| Friday, January 1, 2016 | 1807000000 | 668330000 |

| Sunday, January 1, 2017 | 1973000000 | 746092000 |

| Monday, January 1, 2018 | 2298000000 | 885538000 |

| Tuesday, January 1, 2019 | 2524000000 | 862108000 |

| Wednesday, January 1, 2020 | 2727000000 | 916540000 |

| Friday, January 1, 2021 | 3626000000 | 1035479000 |

| Saturday, January 1, 2022 | 4986000000 | 1133617000 |

| Sunday, January 1, 2023 | 5062000000 | 1299327000 |

| Monday, January 1, 2024 | 5730000000 | 1427838000 |

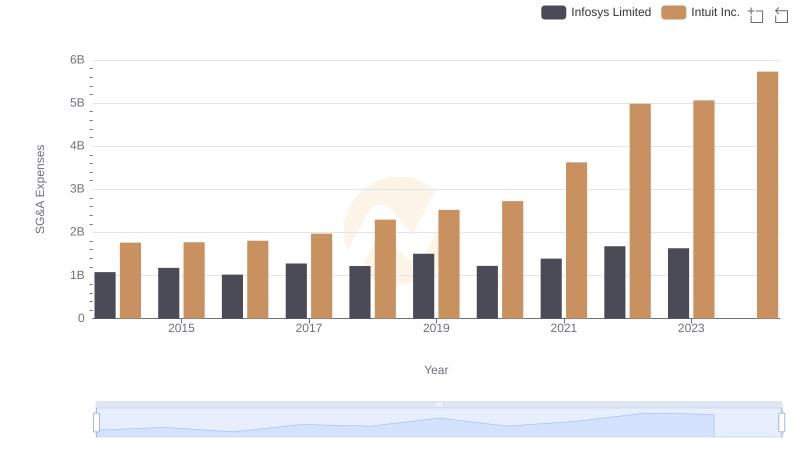

Cracking the code

In the competitive landscape of financial management, optimizing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Intuit Inc. and Synopsys, Inc. have demonstrated contrasting strategies in managing these costs. From 2014 to 2024, Intuit's SG&A expenses have surged by over 225%, reflecting a strategic investment in growth and innovation. In contrast, Synopsys has maintained a more conservative increase of approximately 135%, indicating a focus on efficiency and cost control.

Intuit's expenses peaked in 2024, reaching nearly 5.73 billion, while Synopsys managed to keep its costs below 1.43 billion. This disparity highlights Intuit's aggressive expansion strategy compared to Synopsys's steady, controlled growth. As businesses navigate the complexities of financial management, these insights offer valuable lessons in balancing growth with cost efficiency.

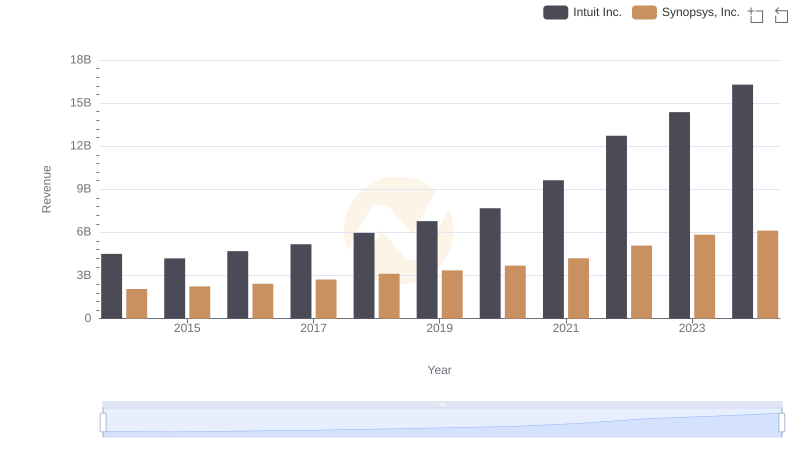

Intuit Inc. vs Synopsys, Inc.: Annual Revenue Growth Compared

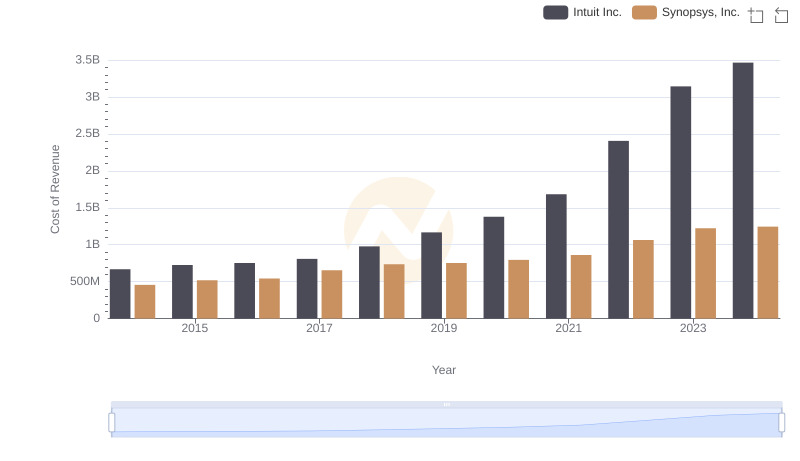

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Synopsys, Inc.

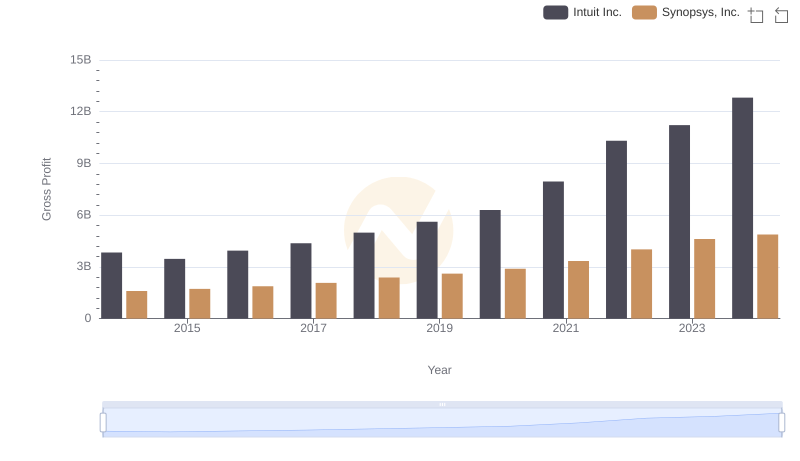

Intuit Inc. and Synopsys, Inc.: A Detailed Gross Profit Analysis

Intuit Inc. and Infosys Limited: SG&A Spending Patterns Compared

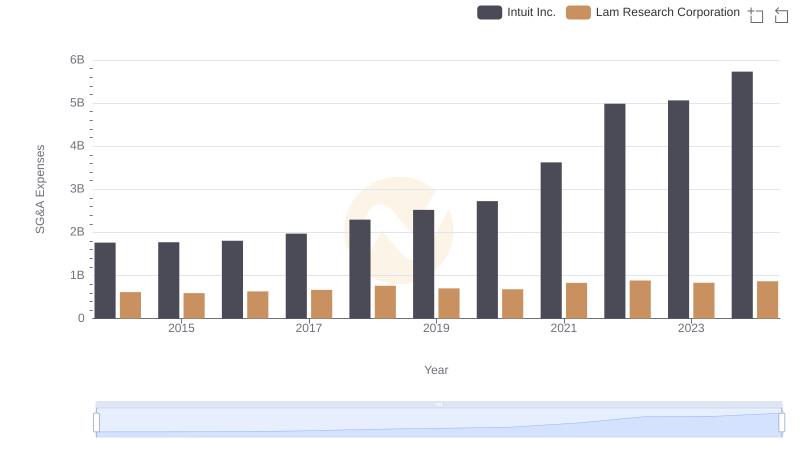

Comparing SG&A Expenses: Intuit Inc. vs Lam Research Corporation Trends and Insights

R&D Insights: How Intuit Inc. and Synopsys, Inc. Allocate Funds

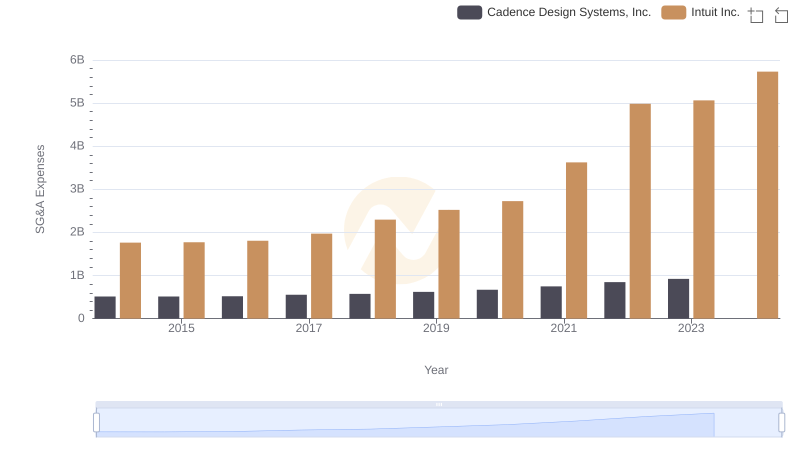

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Cadence Design Systems, Inc.

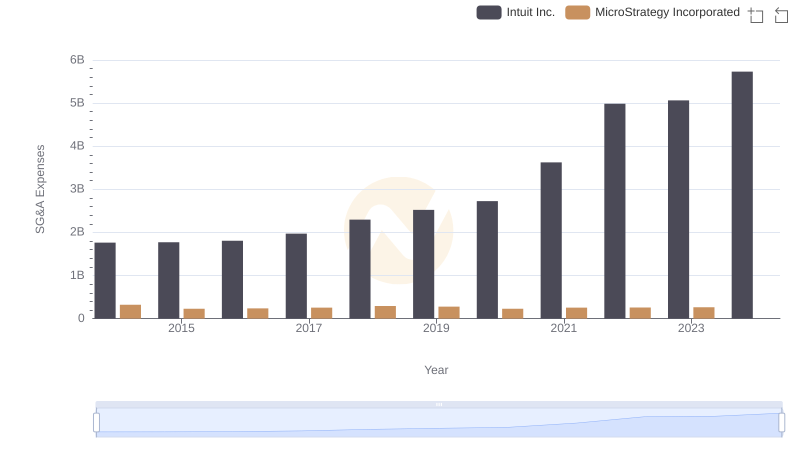

Intuit Inc. and MicroStrategy Incorporated: SG&A Spending Patterns Compared

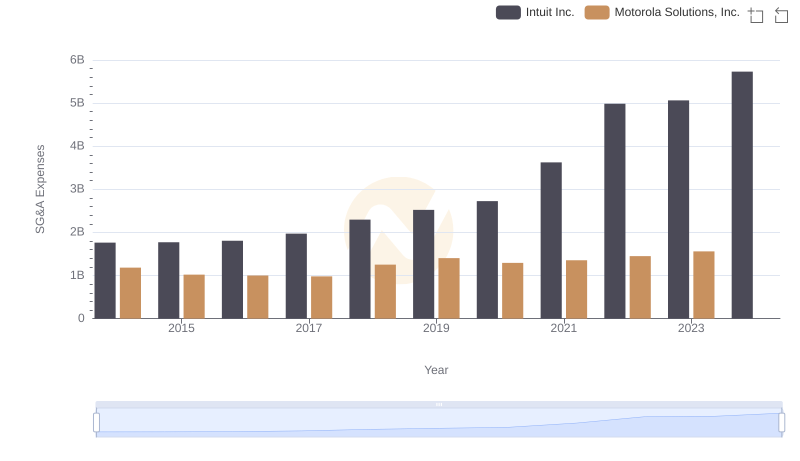

Selling, General, and Administrative Costs: Intuit Inc. vs Motorola Solutions, Inc.

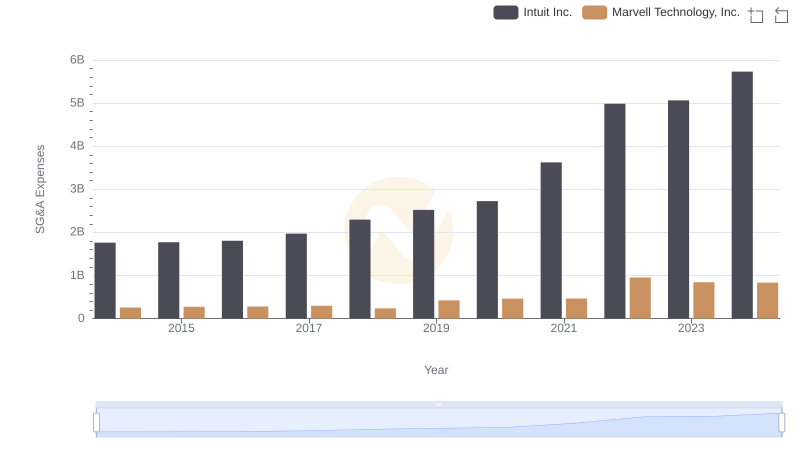

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Marvell Technology, Inc.

EBITDA Analysis: Evaluating Intuit Inc. Against Synopsys, Inc.

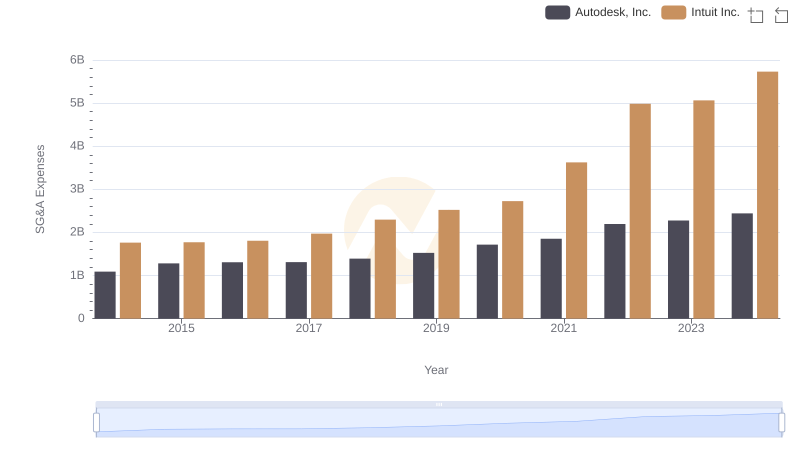

Intuit Inc. vs Autodesk, Inc.: SG&A Expense Trends