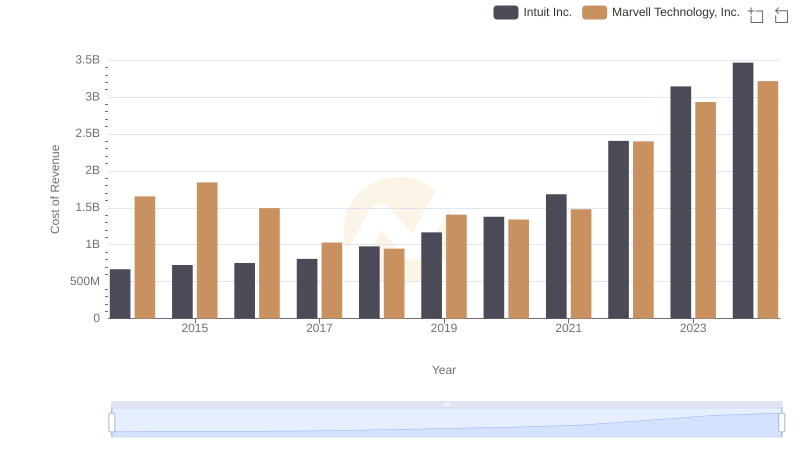

| __timestamp | Intuit Inc. | Synopsys, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 668000000 | 456885000 |

| Thursday, January 1, 2015 | 725000000 | 518920000 |

| Friday, January 1, 2016 | 752000000 | 542962000 |

| Sunday, January 1, 2017 | 809000000 | 654184000 |

| Monday, January 1, 2018 | 977000000 | 735898000 |

| Tuesday, January 1, 2019 | 1167000000 | 752946000 |

| Wednesday, January 1, 2020 | 1378000000 | 794690000 |

| Friday, January 1, 2021 | 1683000000 | 861777000 |

| Saturday, January 1, 2022 | 2406000000 | 1063697000 |

| Sunday, January 1, 2023 | 3143000000 | 1222193000 |

| Monday, January 1, 2024 | 3465000000 | 1245289000 |

Unleashing insights

In the ever-evolving landscape of technology, cost efficiency remains a pivotal factor for success. Over the past decade, Intuit Inc. and Synopsys, Inc. have demonstrated contrasting trajectories in managing their cost of revenue. From 2014 to 2024, Intuit's cost of revenue surged by over 400%, reflecting its aggressive growth strategy and expansion into new markets. In contrast, Synopsys, Inc. exhibited a more moderate increase of approximately 170%, indicating a steady yet cautious approach.

By 2024, Intuit's cost of revenue reached nearly three times that of Synopsys, highlighting its larger scale of operations. This comparison underscores the diverse strategies employed by these tech giants in navigating the competitive landscape. As we look to the future, understanding these trends offers valuable insights into the financial health and strategic priorities of leading technology companies.

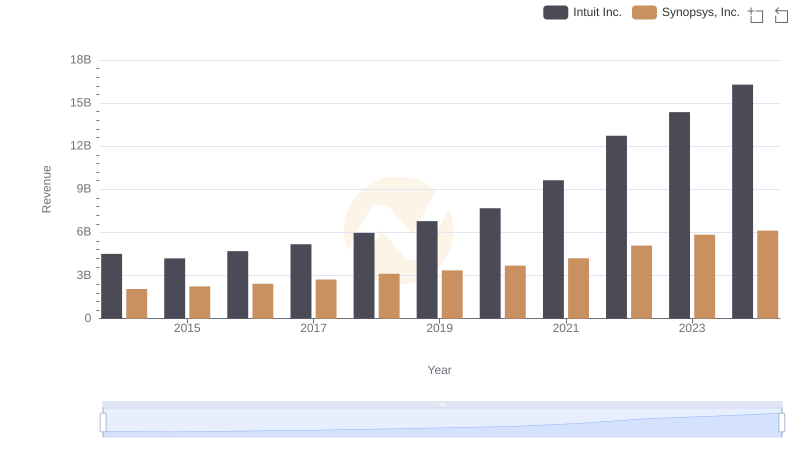

Intuit Inc. vs Synopsys, Inc.: Annual Revenue Growth Compared

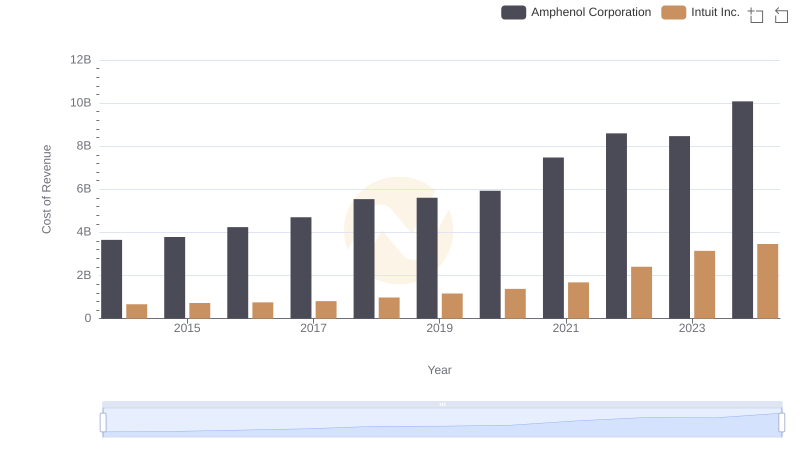

Analyzing Cost of Revenue: Intuit Inc. and Amphenol Corporation

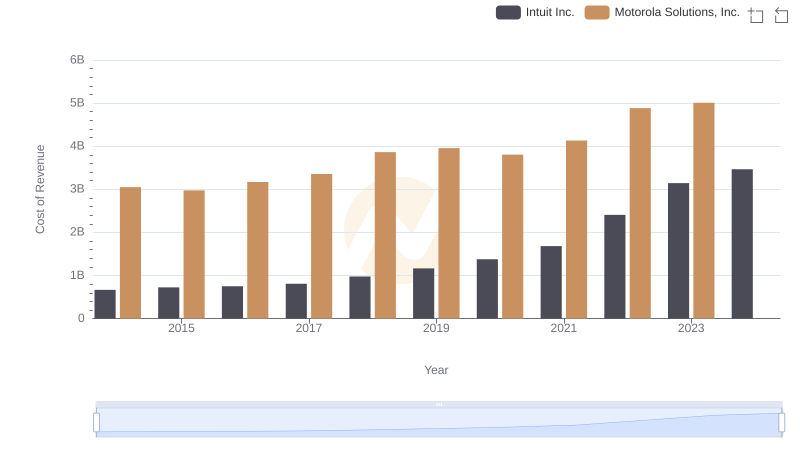

Cost Insights: Breaking Down Intuit Inc. and Motorola Solutions, Inc.'s Expenses

Cost of Revenue Comparison: Intuit Inc. vs Marvell Technology, Inc.

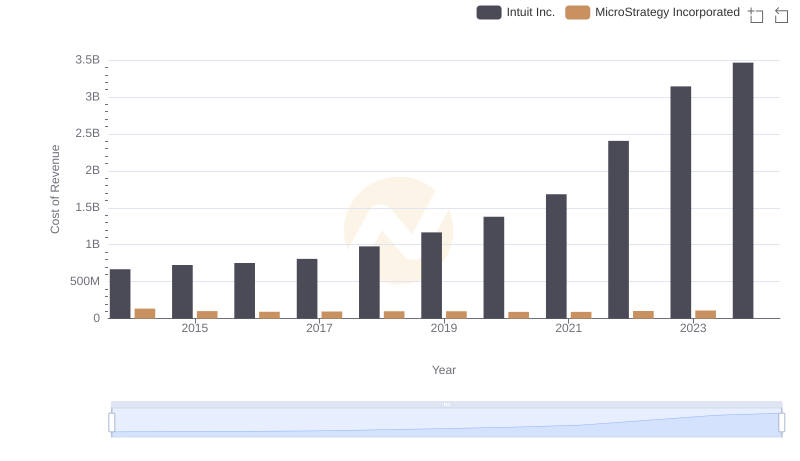

Analyzing Cost of Revenue: Intuit Inc. and MicroStrategy Incorporated

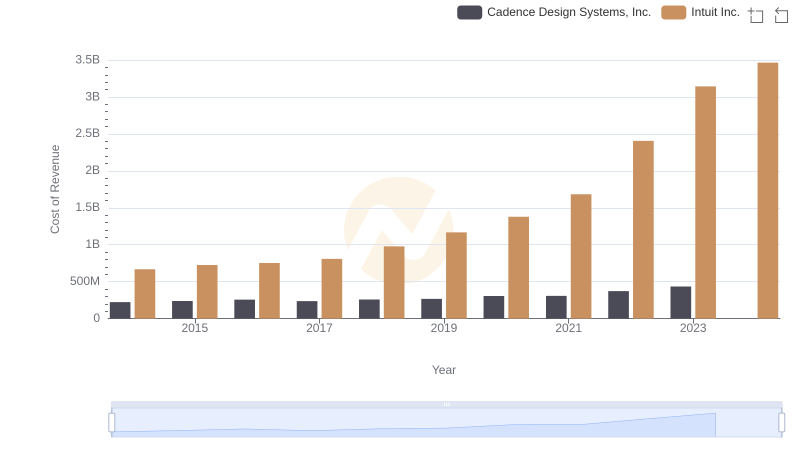

Cost of Revenue Trends: Intuit Inc. vs Cadence Design Systems, Inc.

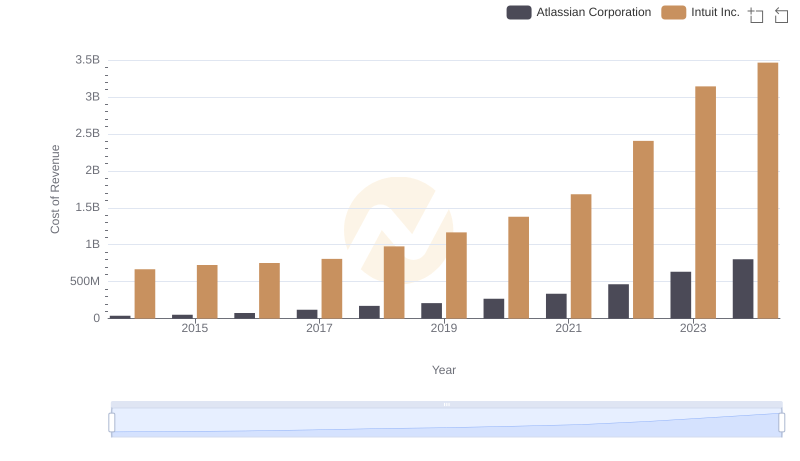

Analyzing Cost of Revenue: Intuit Inc. and Atlassian Corporation

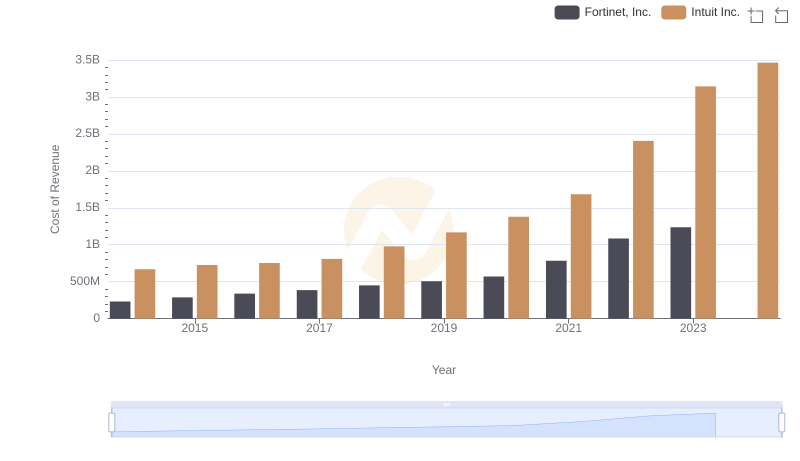

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Fortinet, Inc.

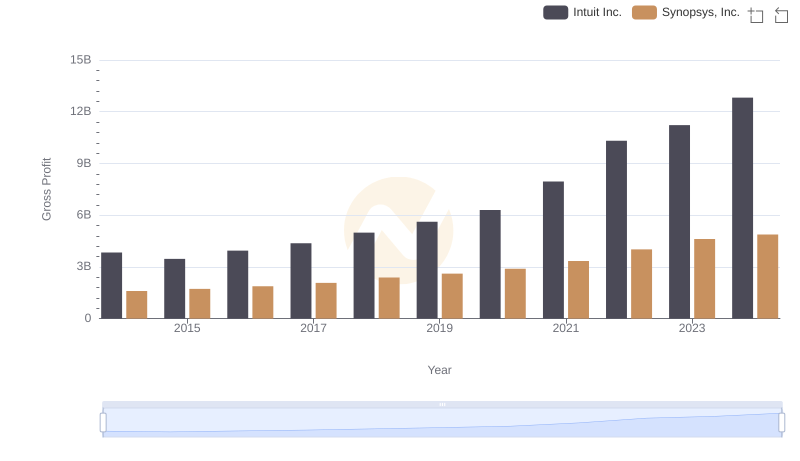

Intuit Inc. and Synopsys, Inc.: A Detailed Gross Profit Analysis

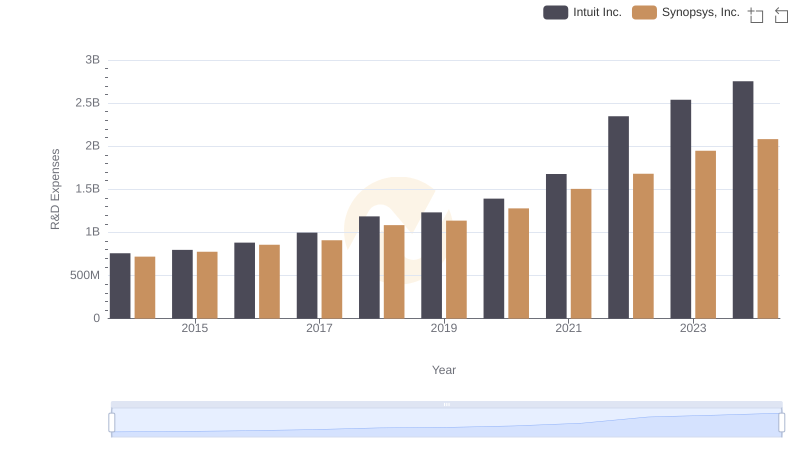

R&D Insights: How Intuit Inc. and Synopsys, Inc. Allocate Funds

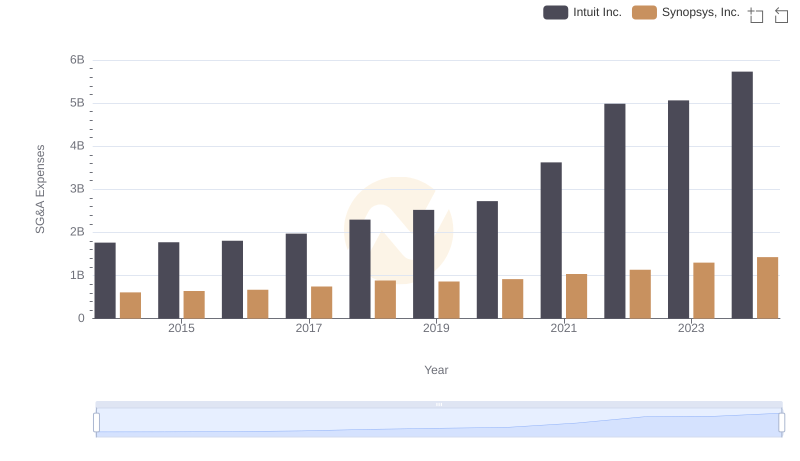

Who Optimizes SG&A Costs Better? Intuit Inc. or Synopsys, Inc.

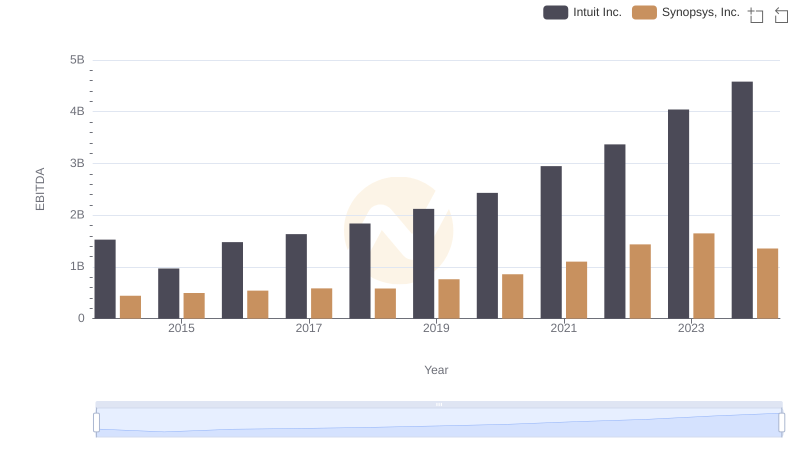

EBITDA Analysis: Evaluating Intuit Inc. Against Synopsys, Inc.