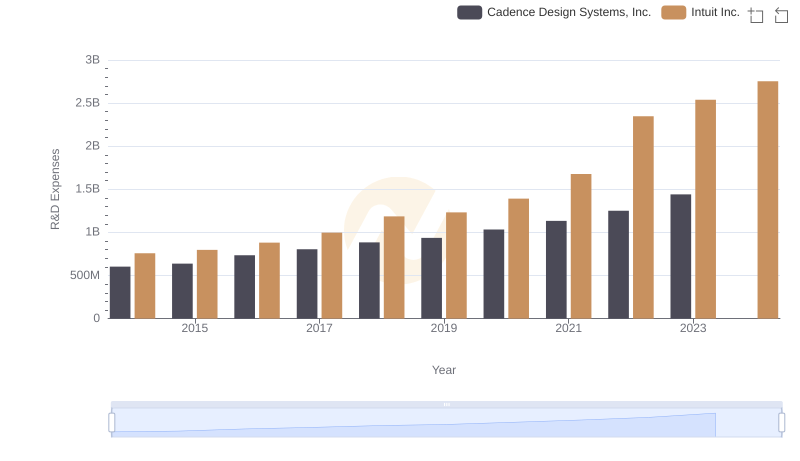

| __timestamp | Intuit Inc. | Synopsys, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 718768000 |

| Thursday, January 1, 2015 | 798000000 | 776229000 |

| Friday, January 1, 2016 | 881000000 | 856705000 |

| Sunday, January 1, 2017 | 998000000 | 908841000 |

| Monday, January 1, 2018 | 1186000000 | 1084822000 |

| Tuesday, January 1, 2019 | 1233000000 | 1136932000 |

| Wednesday, January 1, 2020 | 1392000000 | 1279022000 |

| Friday, January 1, 2021 | 1678000000 | 1504823000 |

| Saturday, January 1, 2022 | 2347000000 | 1680379000 |

| Sunday, January 1, 2023 | 2539000000 | 1946813000 |

| Monday, January 1, 2024 | 2754000000 | 2082360000 |

Infusing magic into the data realm

In the ever-evolving tech landscape, research and development (R&D) are the lifeblood of innovation. Over the past decade, Intuit Inc. and Synopsys, Inc. have demonstrated a steadfast commitment to R&D, with their spending reflecting a strategic focus on future growth.

From 2014 to 2024, Intuit Inc. has increased its R&D expenses by over 260%, showcasing a robust investment in innovation. This upward trajectory highlights Intuit's dedication to enhancing its financial software solutions, ensuring they remain at the forefront of the industry.

Similarly, Synopsys, Inc. has seen a 190% rise in R&D spending over the same period. This consistent growth underscores Synopsys's commitment to advancing its electronic design automation tools, crucial for the semiconductor industry.

Both companies exemplify how strategic R&D investments can drive technological advancements and maintain competitive edges in their respective fields.

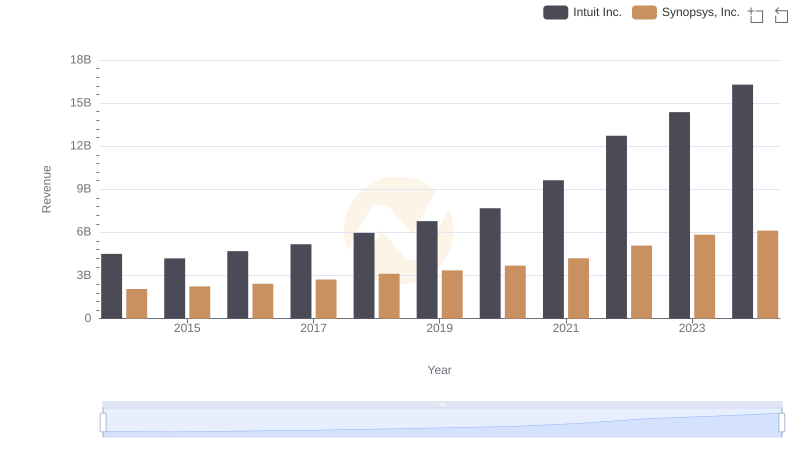

Intuit Inc. vs Synopsys, Inc.: Annual Revenue Growth Compared

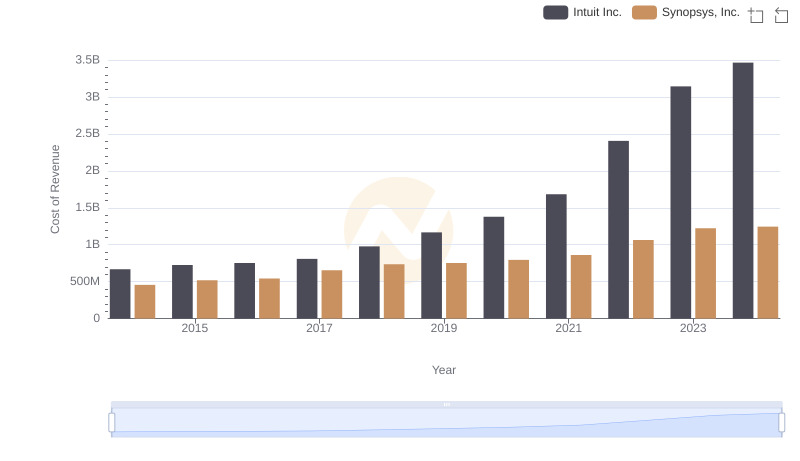

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Synopsys, Inc.

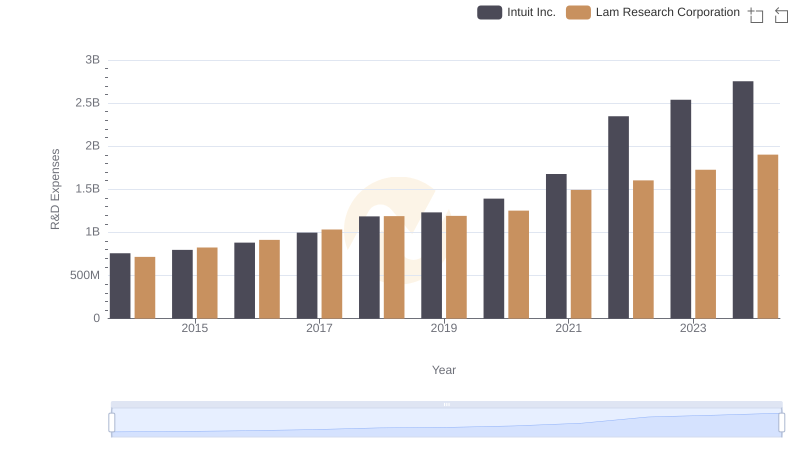

Analyzing R&D Budgets: Intuit Inc. vs Lam Research Corporation

Comparing Innovation Spending: Intuit Inc. and Cadence Design Systems, Inc.

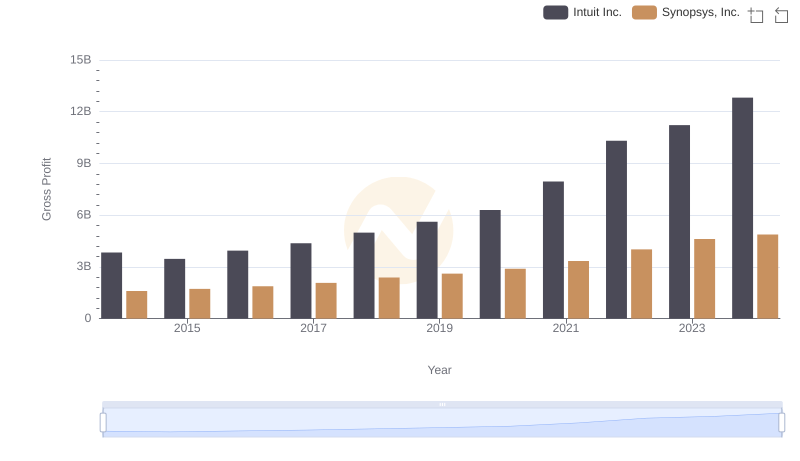

Intuit Inc. and Synopsys, Inc.: A Detailed Gross Profit Analysis

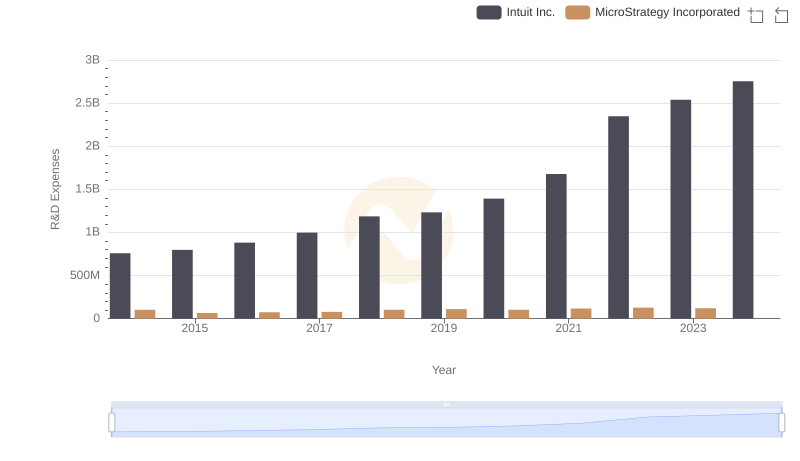

Intuit Inc. or MicroStrategy Incorporated: Who Invests More in Innovation?

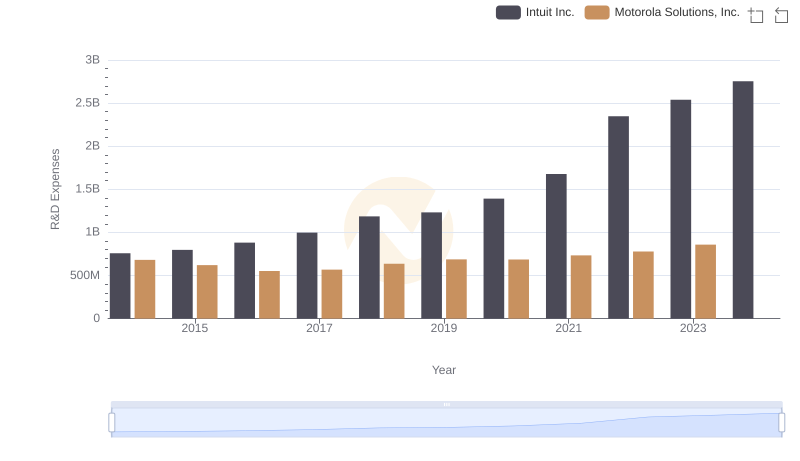

Analyzing R&D Budgets: Intuit Inc. vs Motorola Solutions, Inc.

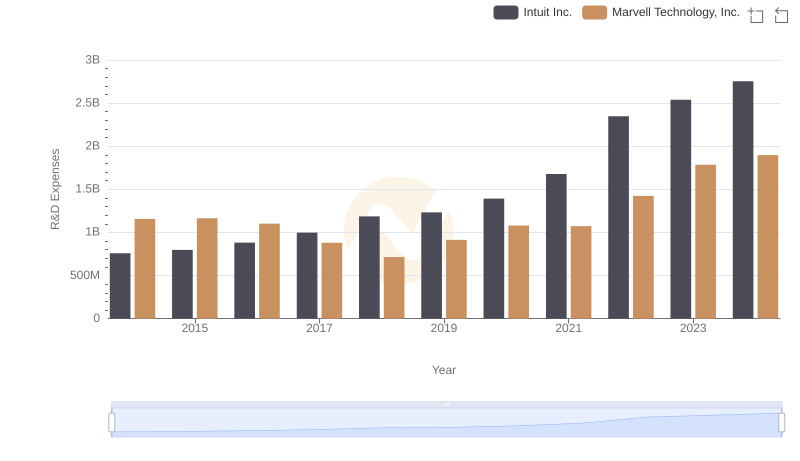

Research and Development Expenses Breakdown: Intuit Inc. vs Marvell Technology, Inc.

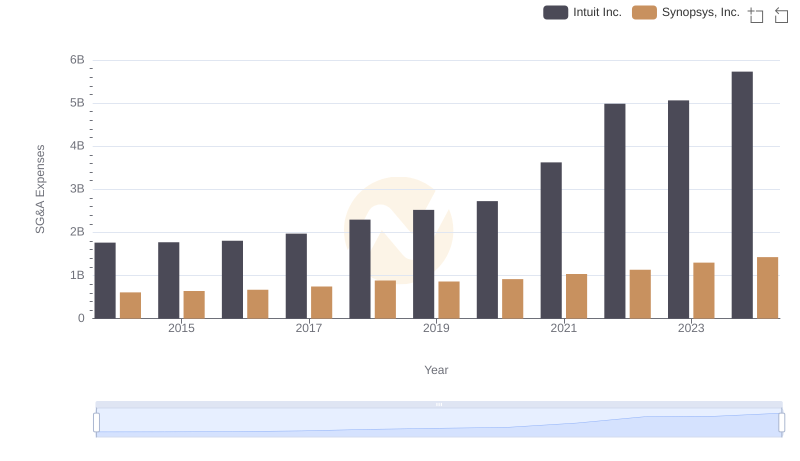

Who Optimizes SG&A Costs Better? Intuit Inc. or Synopsys, Inc.

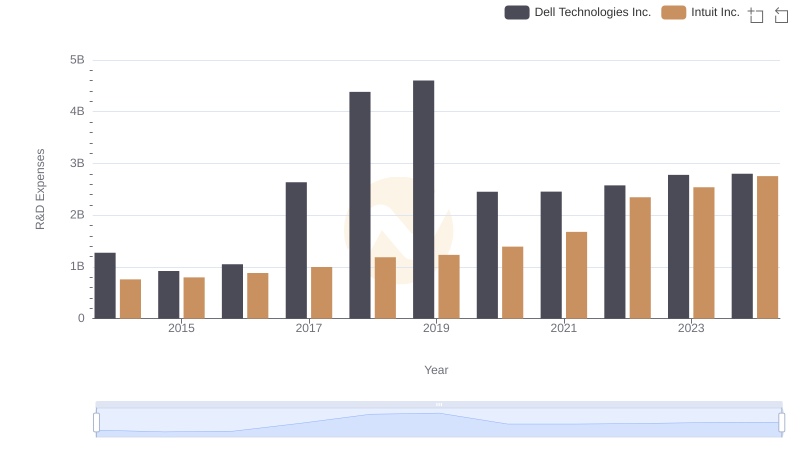

Intuit Inc. vs Dell Technologies Inc.: Strategic Focus on R&D Spending

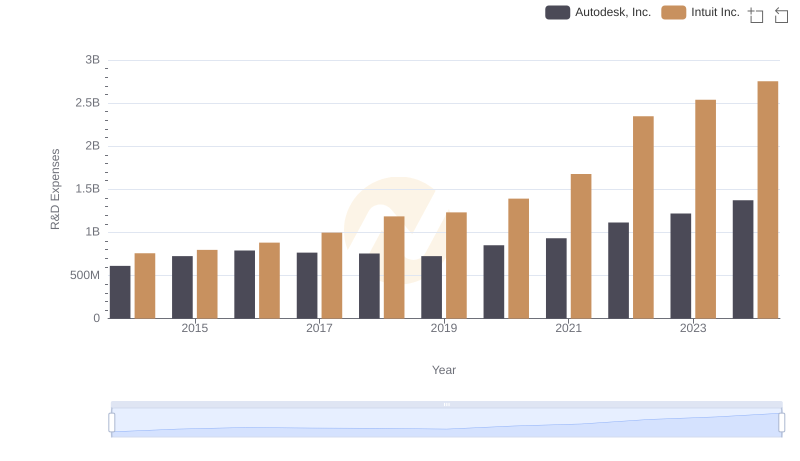

Research and Development Investment: Intuit Inc. vs Autodesk, Inc.

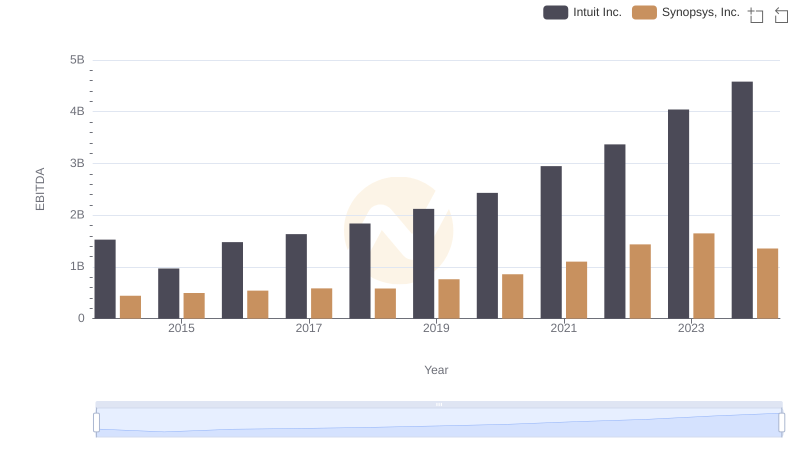

EBITDA Analysis: Evaluating Intuit Inc. Against Synopsys, Inc.