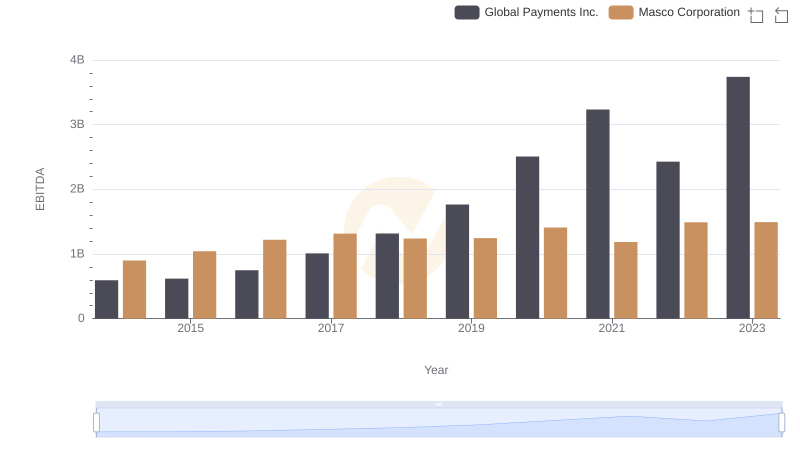

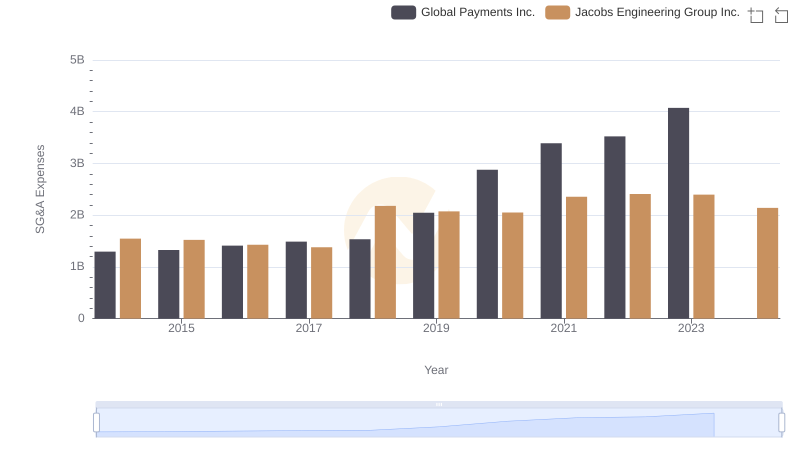

| __timestamp | Global Payments Inc. | Jacobs Engineering Group Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 594102000 | 699015000 |

| Thursday, January 1, 2015 | 618109000 | 598932000 |

| Friday, January 1, 2016 | 748136000 | 431954000 |

| Sunday, January 1, 2017 | 1010019000 | 527765000 |

| Monday, January 1, 2018 | 1315968000 | 606328000 |

| Tuesday, January 1, 2019 | 1764994000 | 604075000 |

| Wednesday, January 1, 2020 | 2508393000 | 685042000 |

| Friday, January 1, 2021 | 3233589000 | 1019116000 |

| Saturday, January 1, 2022 | 2427684000 | 1277649000 |

| Sunday, January 1, 2023 | 3606789000 | 1392039000 |

| Monday, January 1, 2024 | 2333605000 | 1255083000 |

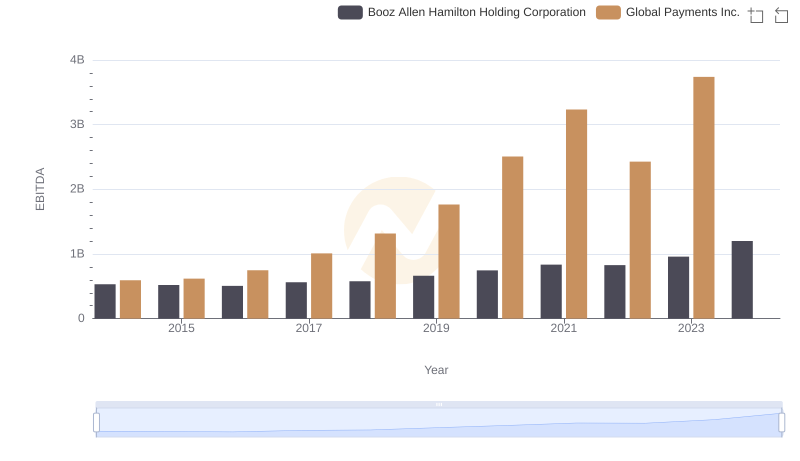

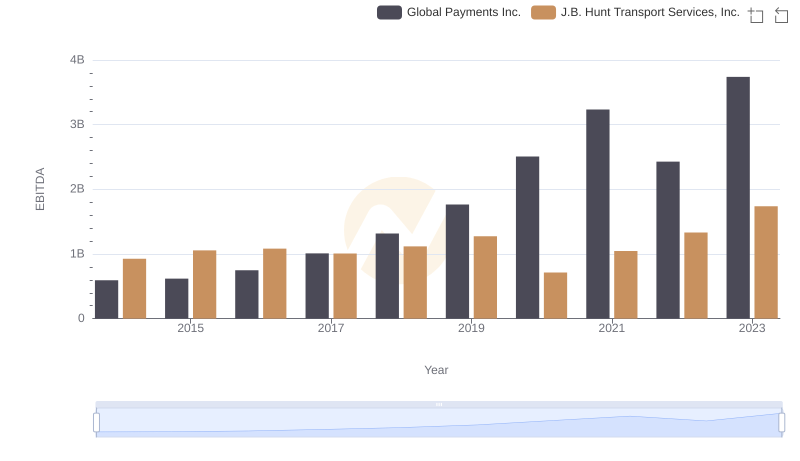

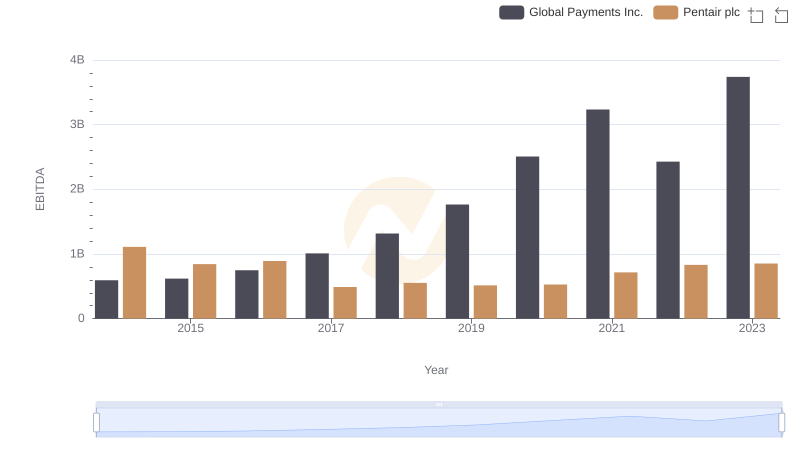

Data in motion

In the ever-evolving landscape of financial performance, EBITDA serves as a crucial metric for evaluating a company's operational efficiency. Over the past decade, Global Payments Inc. has demonstrated a remarkable growth trajectory, with its EBITDA increasing by over 500% from 2014 to 2023. This growth underscores the company's strategic initiatives and market adaptability. In contrast, Jacobs Engineering Group Inc. has shown a steady, albeit more modest, increase of approximately 100% in the same period, reflecting its consistent operational performance.

The data reveals that Global Payments Inc. experienced its most significant surge between 2019 and 2021, with a 45% increase, while Jacobs Engineering Group Inc. saw its highest growth of 25% between 2021 and 2023. Notably, the data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting. This analysis provides a compelling snapshot of how these industry leaders have navigated the financial landscape over the years.

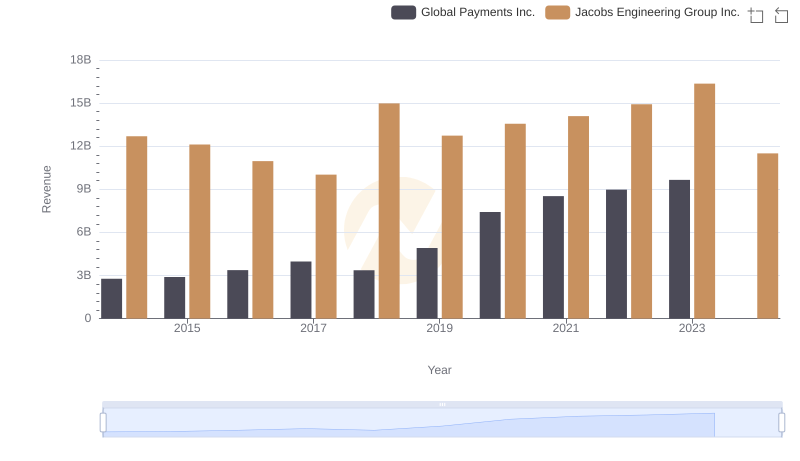

Revenue Insights: Global Payments Inc. and Jacobs Engineering Group Inc. Performance Compared

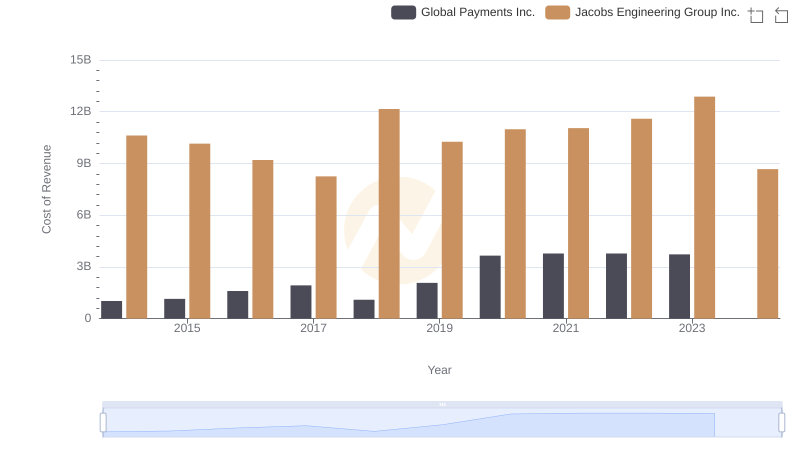

Cost Insights: Breaking Down Global Payments Inc. and Jacobs Engineering Group Inc.'s Expenses

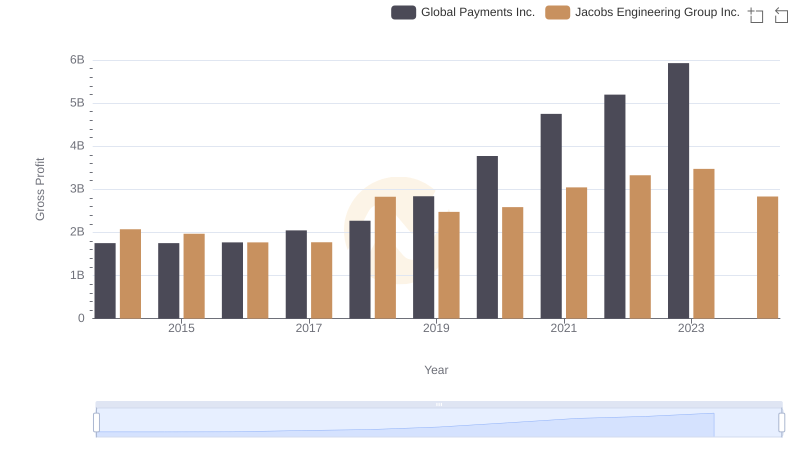

Global Payments Inc. vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

EBITDA Performance Review: Global Payments Inc. vs Masco Corporation

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Jacobs Engineering Group Inc.

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and Booz Allen Hamilton Holding Corporation

Comprehensive EBITDA Comparison: Global Payments Inc. vs J.B. Hunt Transport Services, Inc.

Professional EBITDA Benchmarking: Global Payments Inc. vs Pentair plc

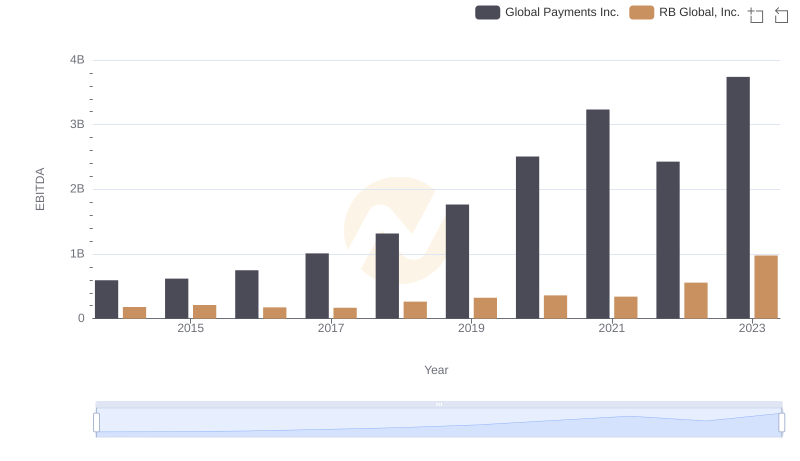

Comprehensive EBITDA Comparison: Global Payments Inc. vs RB Global, Inc.

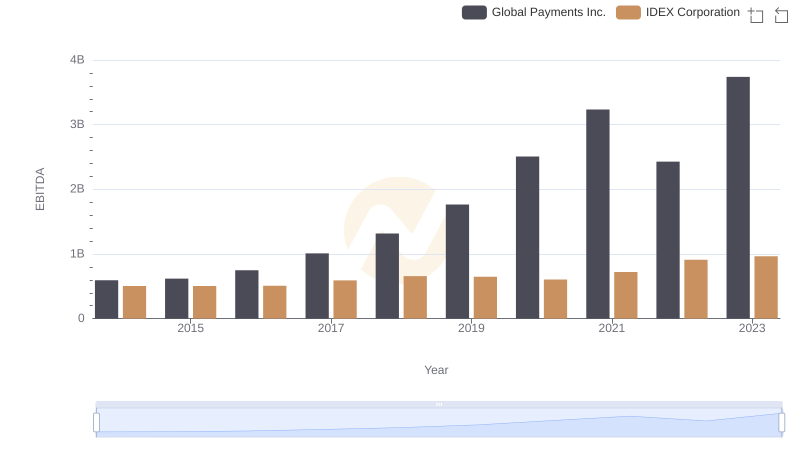

Global Payments Inc. vs IDEX Corporation: In-Depth EBITDA Performance Comparison

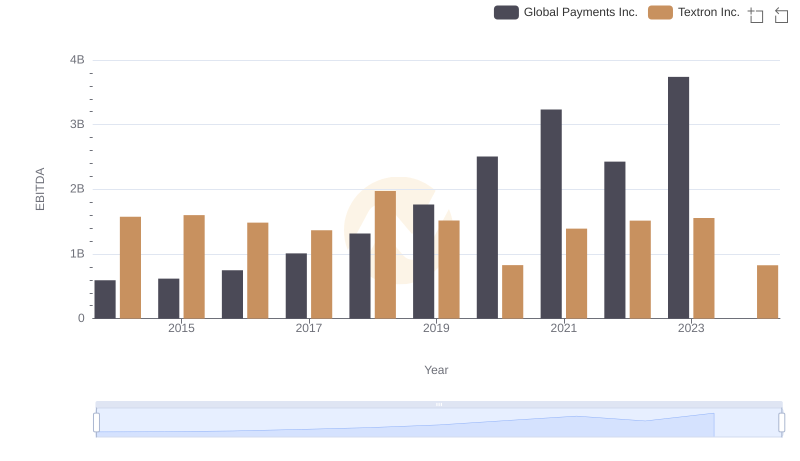

EBITDA Analysis: Evaluating Global Payments Inc. Against Textron Inc.

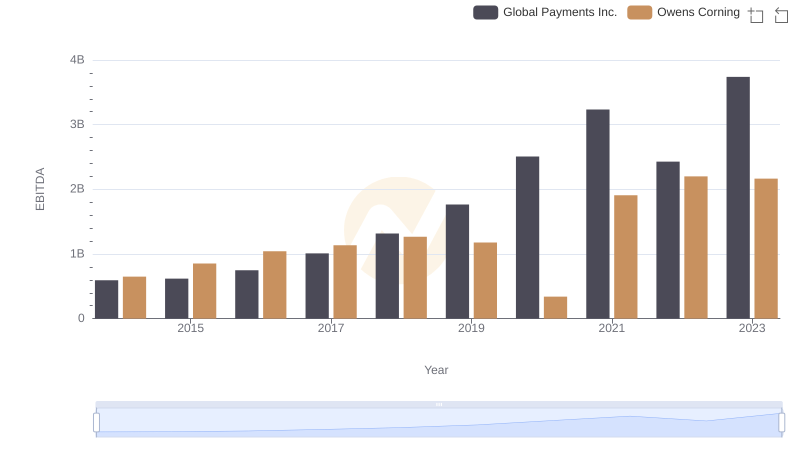

EBITDA Analysis: Evaluating Global Payments Inc. Against Owens Corning