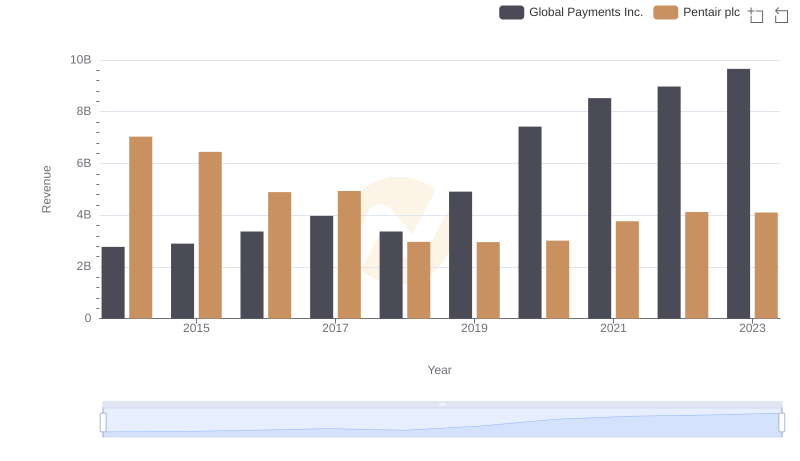

| __timestamp | Global Payments Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 594102000 | 1109300000 |

| Thursday, January 1, 2015 | 618109000 | 842400000 |

| Friday, January 1, 2016 | 748136000 | 890400000 |

| Sunday, January 1, 2017 | 1010019000 | 488600000 |

| Monday, January 1, 2018 | 1315968000 | 552800000 |

| Tuesday, January 1, 2019 | 1764994000 | 513200000 |

| Wednesday, January 1, 2020 | 2508393000 | 527600000 |

| Friday, January 1, 2021 | 3233589000 | 714400000 |

| Saturday, January 1, 2022 | 2427684000 | 830400000 |

| Sunday, January 1, 2023 | 3606789000 | 852000000 |

| Monday, January 1, 2024 | 2333605000 | 803800000 |

Unleashing insights

In the ever-evolving landscape of global finance, understanding the financial health of industry leaders is crucial. This analysis pits Global Payments Inc. against Pentair plc, two titans in their respective fields, over a decade-long journey from 2014 to 2023.

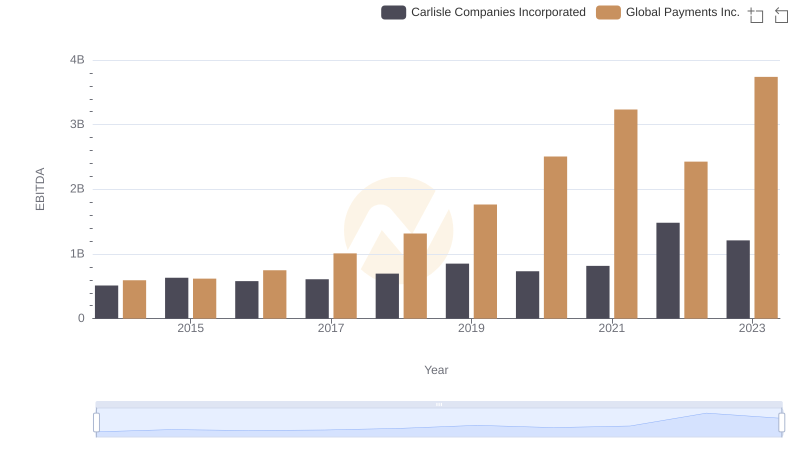

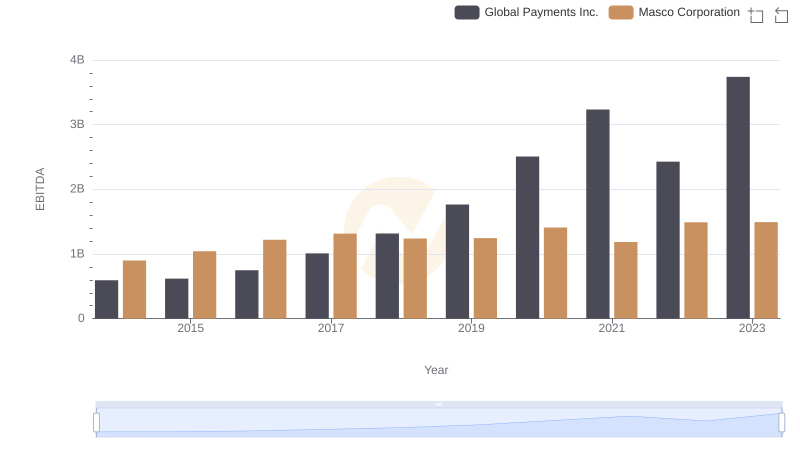

Global Payments Inc. has demonstrated a remarkable growth trajectory, with its EBITDA soaring by over 530% from 2014 to 2023. This growth reflects the company's strategic expansions and robust market positioning. In contrast, Pentair plc has experienced a more modest increase of approximately 23% in the same period, highlighting a steady yet less aggressive growth strategy.

The data reveals a compelling narrative of contrasting business strategies and market responses, offering valuable insights for investors and industry analysts alike. As we delve deeper into these financial metrics, the story of resilience and strategic foresight unfolds, painting a vivid picture of corporate success.

Global Payments Inc. vs Pentair plc: Examining Key Revenue Metrics

EBITDA Analysis: Evaluating Global Payments Inc. Against Carlisle Companies Incorporated

EBITDA Performance Review: Global Payments Inc. vs Masco Corporation

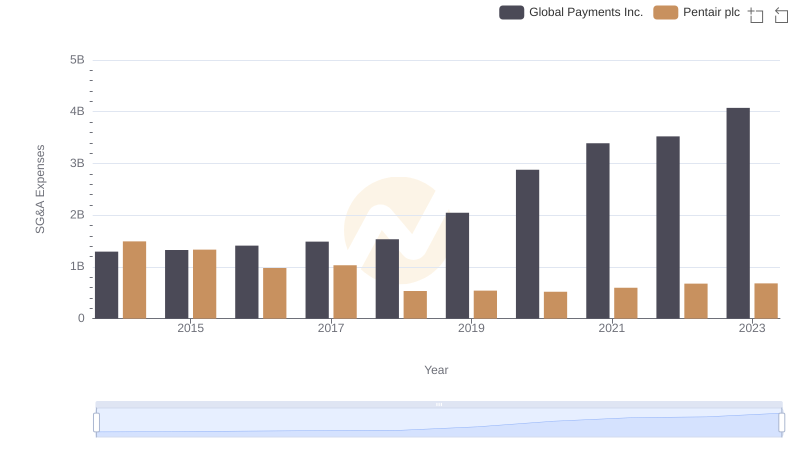

Selling, General, and Administrative Costs: Global Payments Inc. vs Pentair plc

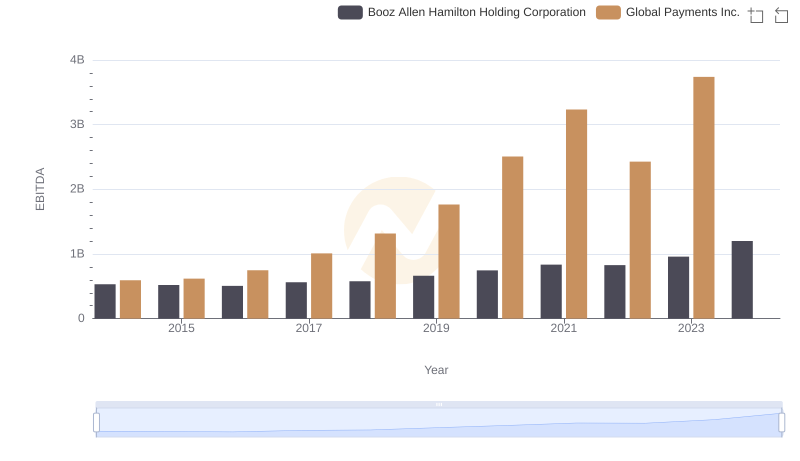

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and Booz Allen Hamilton Holding Corporation

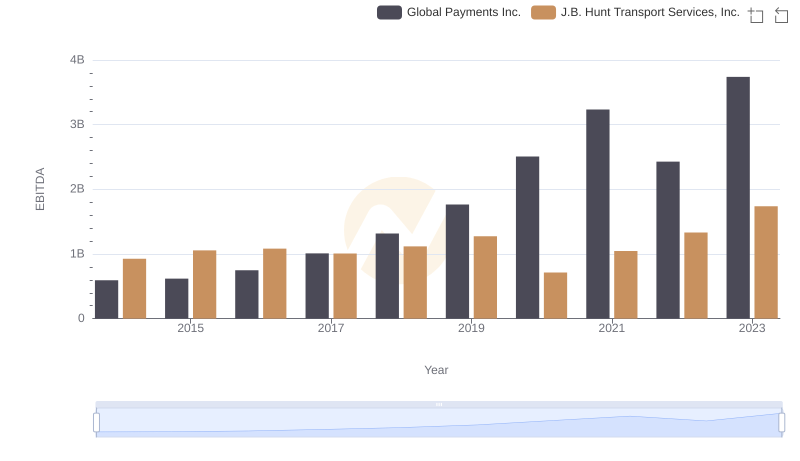

Comprehensive EBITDA Comparison: Global Payments Inc. vs J.B. Hunt Transport Services, Inc.

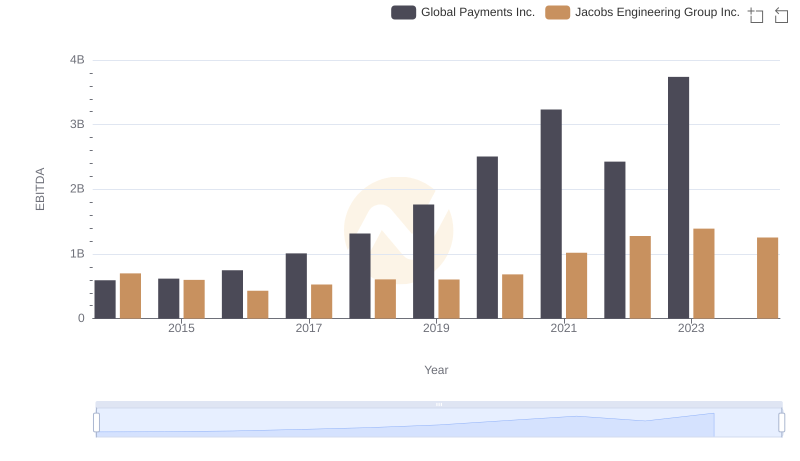

EBITDA Analysis: Evaluating Global Payments Inc. Against Jacobs Engineering Group Inc.

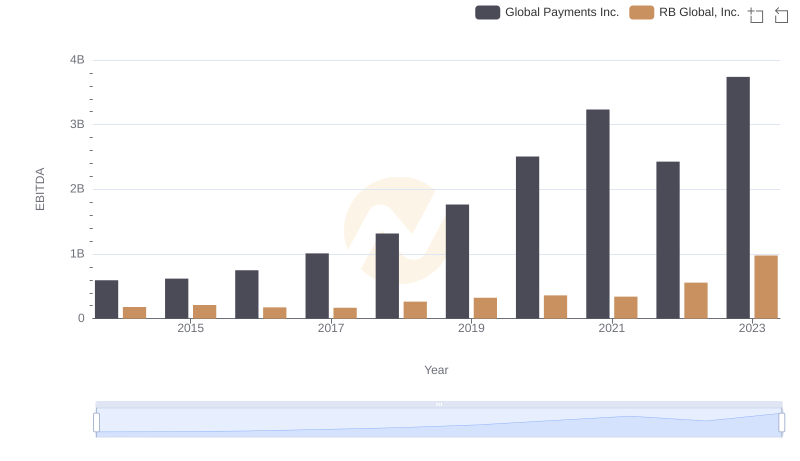

Comprehensive EBITDA Comparison: Global Payments Inc. vs RB Global, Inc.

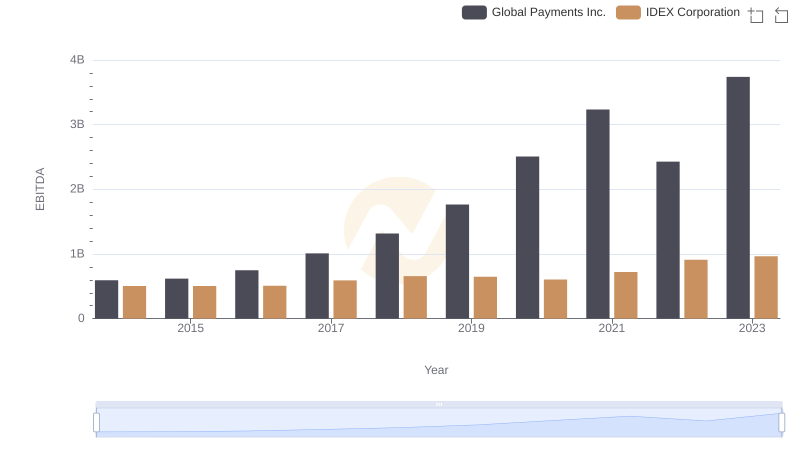

Global Payments Inc. vs IDEX Corporation: In-Depth EBITDA Performance Comparison

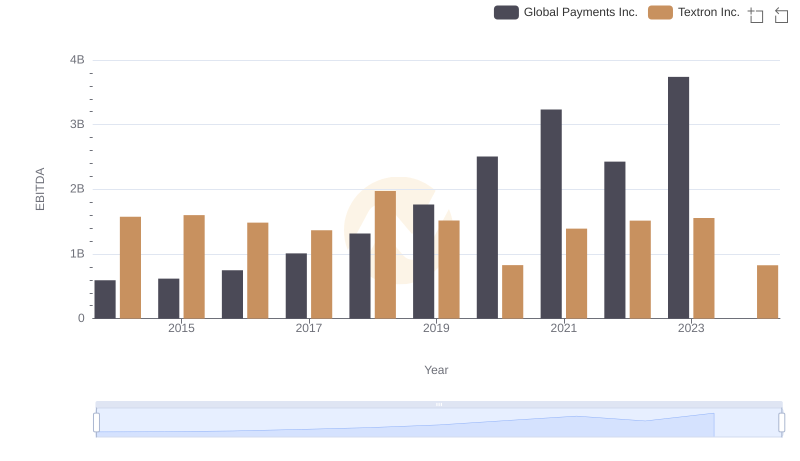

EBITDA Analysis: Evaluating Global Payments Inc. Against Textron Inc.