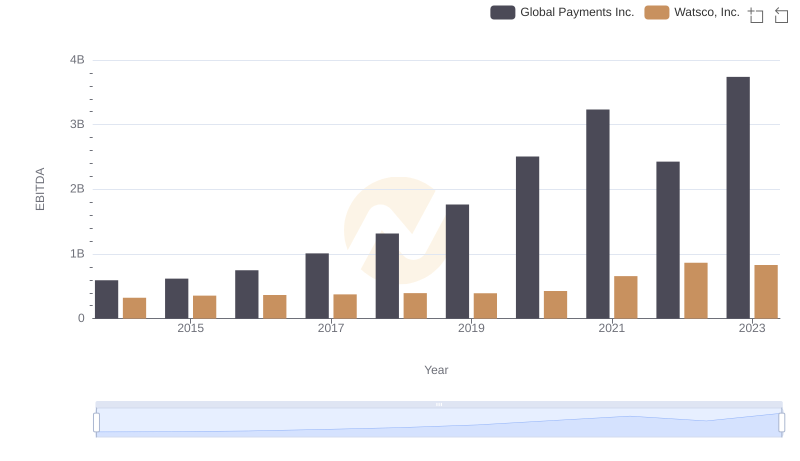

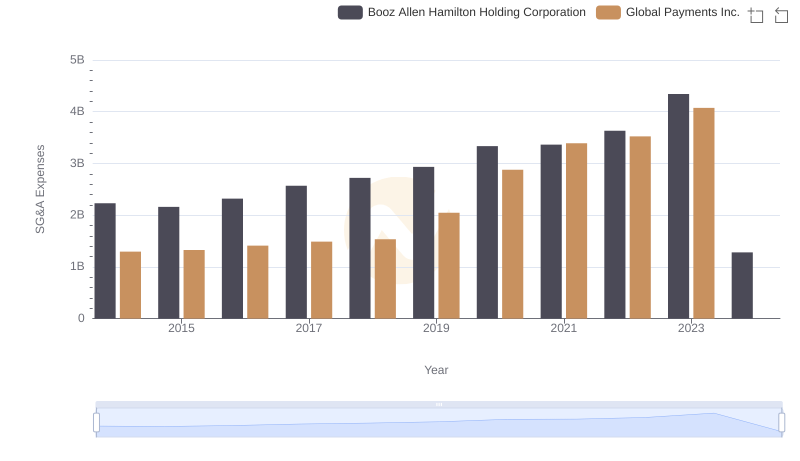

| __timestamp | Booz Allen Hamilton Holding Corporation | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 531144000 | 594102000 |

| Thursday, January 1, 2015 | 520410000 | 618109000 |

| Friday, January 1, 2016 | 506120000 | 748136000 |

| Sunday, January 1, 2017 | 561524000 | 1010019000 |

| Monday, January 1, 2018 | 577061000 | 1315968000 |

| Tuesday, January 1, 2019 | 663731000 | 1764994000 |

| Wednesday, January 1, 2020 | 745424000 | 2508393000 |

| Friday, January 1, 2021 | 834449000 | 3233589000 |

| Saturday, January 1, 2022 | 826865000 | 2427684000 |

| Sunday, January 1, 2023 | 958150000 | 3606789000 |

| Monday, January 1, 2024 | 1199992000 | 2333605000 |

Unleashing insights

In the ever-evolving landscape of financial services and consulting, understanding the EBITDA trends of industry giants like Global Payments Inc. and Booz Allen Hamilton Holding Corporation offers valuable insights. From 2014 to 2023, Global Payments Inc. demonstrated a remarkable growth trajectory, with EBITDA increasing by over 500%, peaking at approximately $3.74 billion in 2023. In contrast, Booz Allen Hamilton's EBITDA grew steadily, achieving a 126% increase over the same period, reaching around $1.2 billion in 2024.

This side-by-side analysis highlights the dynamic nature of these sectors. While Global Payments Inc. experienced a significant surge, Booz Allen Hamilton maintained consistent growth, reflecting their strategic focus on consulting services. Notably, the data for Global Payments Inc. in 2024 is missing, indicating potential future developments. This analysis underscores the importance of strategic adaptability in achieving financial success.

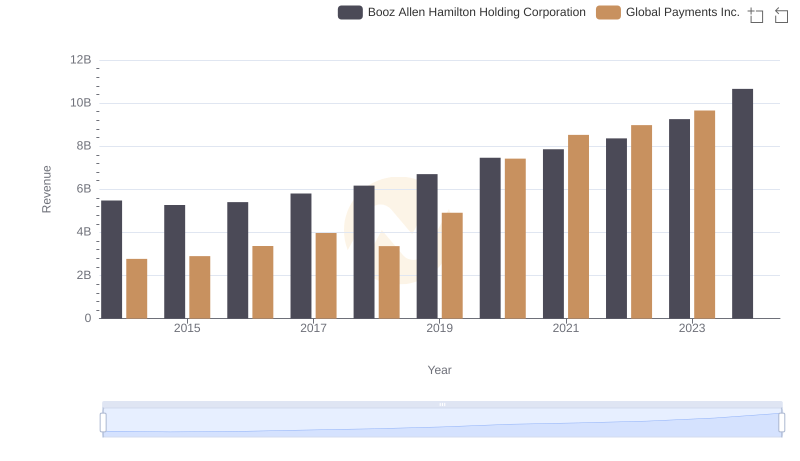

Comparing Revenue Performance: Global Payments Inc. or Booz Allen Hamilton Holding Corporation?

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs Booz Allen Hamilton Holding Corporation

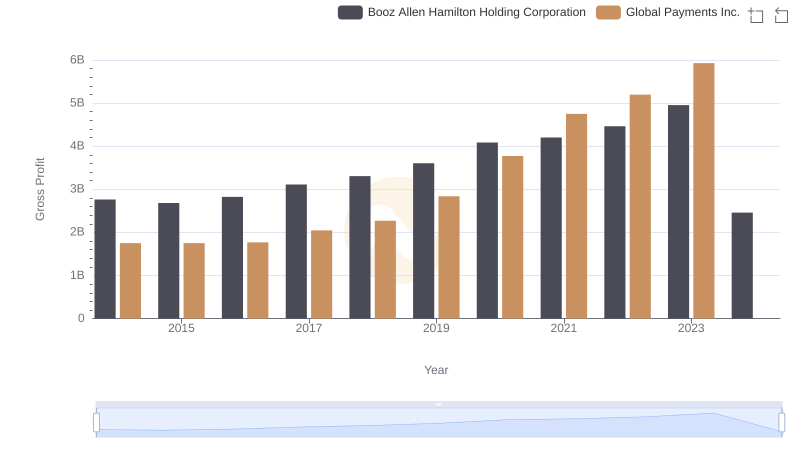

Gross Profit Analysis: Comparing Global Payments Inc. and Booz Allen Hamilton Holding Corporation

EBITDA Metrics Evaluated: Global Payments Inc. vs Watsco, Inc.

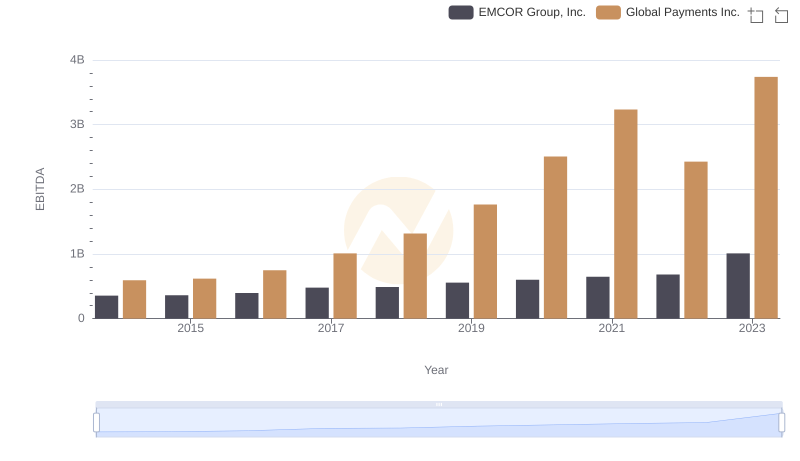

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and EMCOR Group, Inc.

Global Payments Inc. vs TransUnion: In-Depth EBITDA Performance Comparison

Who Optimizes SG&A Costs Better? Global Payments Inc. or Booz Allen Hamilton Holding Corporation

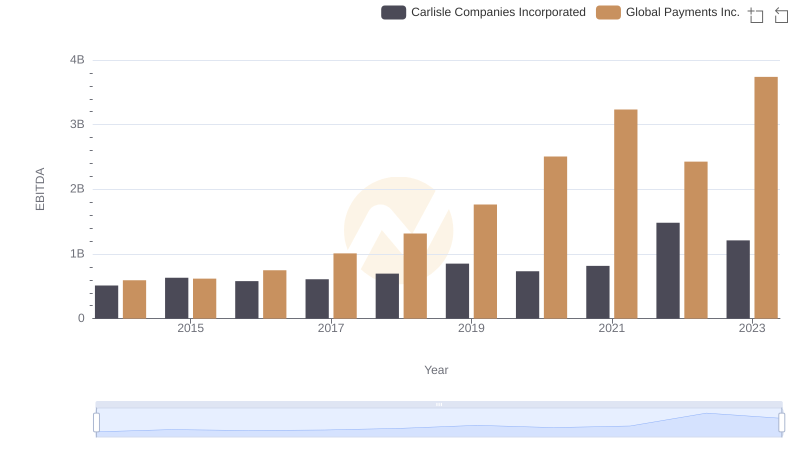

EBITDA Analysis: Evaluating Global Payments Inc. Against Carlisle Companies Incorporated

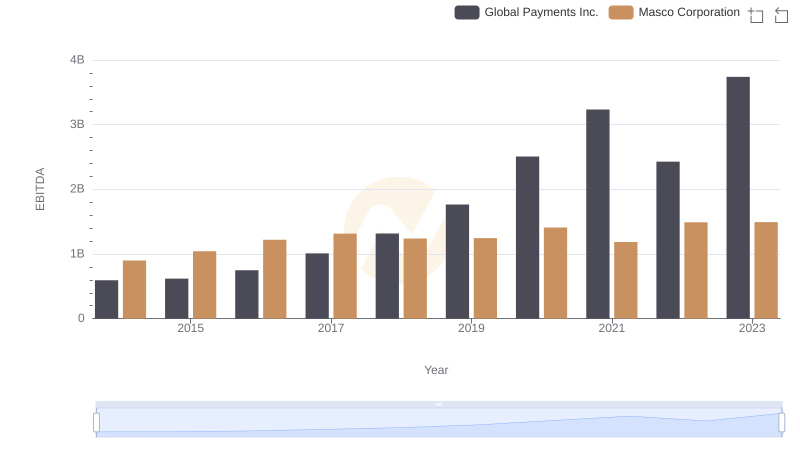

EBITDA Performance Review: Global Payments Inc. vs Masco Corporation

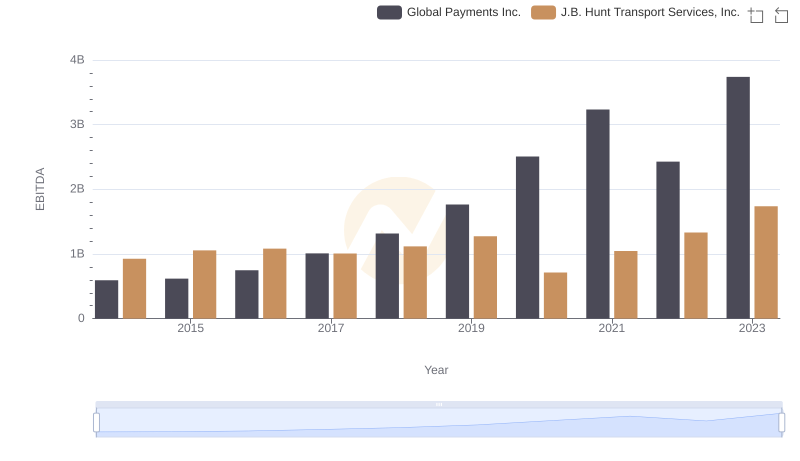

Comprehensive EBITDA Comparison: Global Payments Inc. vs J.B. Hunt Transport Services, Inc.

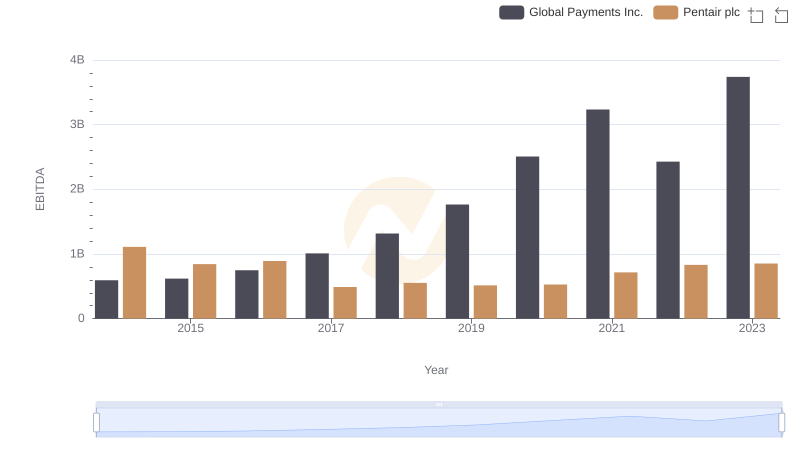

Professional EBITDA Benchmarking: Global Payments Inc. vs Pentair plc

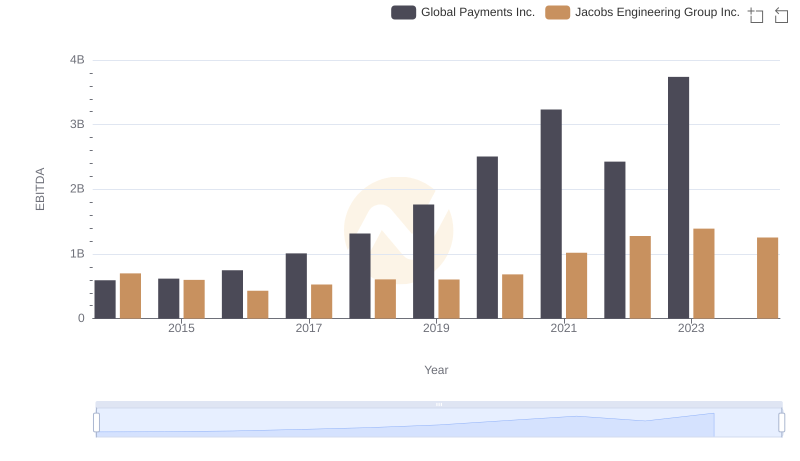

EBITDA Analysis: Evaluating Global Payments Inc. Against Jacobs Engineering Group Inc.