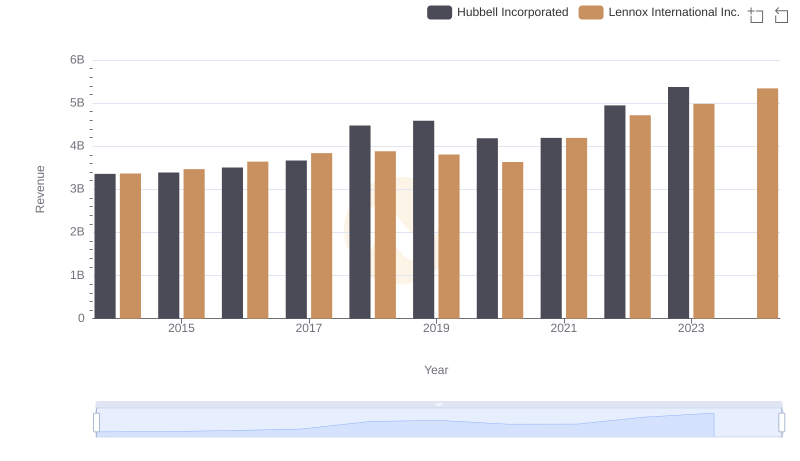

| __timestamp | Hubbell Incorporated | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2250400000 | 2464100000 |

| Thursday, January 1, 2015 | 2298600000 | 2520000000 |

| Friday, January 1, 2016 | 2404500000 | 2565100000 |

| Sunday, January 1, 2017 | 2516900000 | 2714400000 |

| Monday, January 1, 2018 | 3181300000 | 2772700000 |

| Tuesday, January 1, 2019 | 3238300000 | 2727400000 |

| Wednesday, January 1, 2020 | 2976700000 | 2594000000 |

| Friday, January 1, 2021 | 3042600000 | 3005700000 |

| Saturday, January 1, 2022 | 3476300000 | 3433700000 |

| Sunday, January 1, 2023 | 3484800000 | 3434100000 |

| Monday, January 1, 2024 | 3724400000 | 3569400000 |

Data in motion

In the ever-evolving landscape of industrial manufacturing, Lennox International Inc. and Hubbell Incorporated have been pivotal players. Over the past decade, these companies have shown remarkable resilience and growth. From 2014 to 2023, Lennox International Inc. consistently maintained a higher cost of revenue compared to Hubbell Incorporated, peaking in 2024 with a 45% increase from its 2014 figures. Meanwhile, Hubbell Incorporated saw a steady rise, culminating in a 55% increase by 2023. This trend highlights the dynamic nature of the industry, where strategic investments and operational efficiencies play crucial roles. Notably, 2020 marked a dip for both companies, reflecting broader economic challenges. As we look to the future, the missing data for Hubbell in 2024 leaves room for speculation, but the trajectory suggests continued growth and competition.

Revenue Showdown: Lennox International Inc. vs Hubbell Incorporated

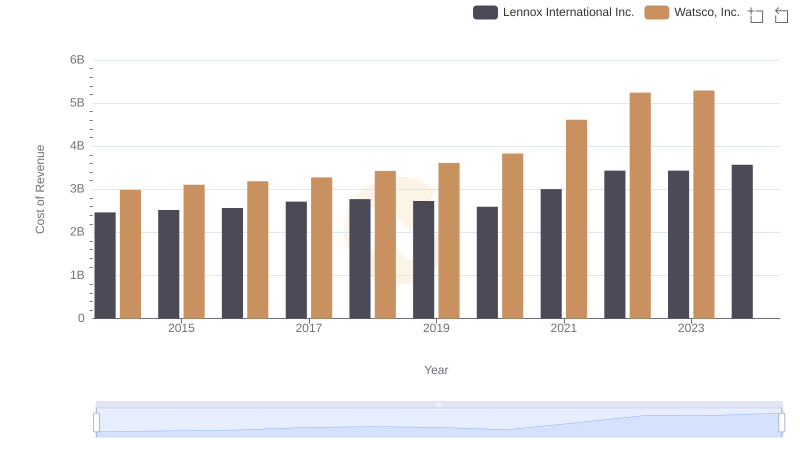

Cost of Revenue Trends: Lennox International Inc. vs Watsco, Inc.

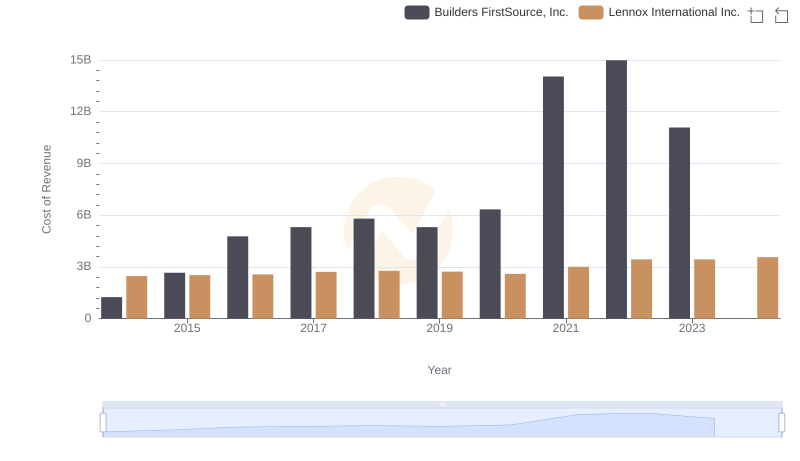

Cost Insights: Breaking Down Lennox International Inc. and Builders FirstSource, Inc.'s Expenses

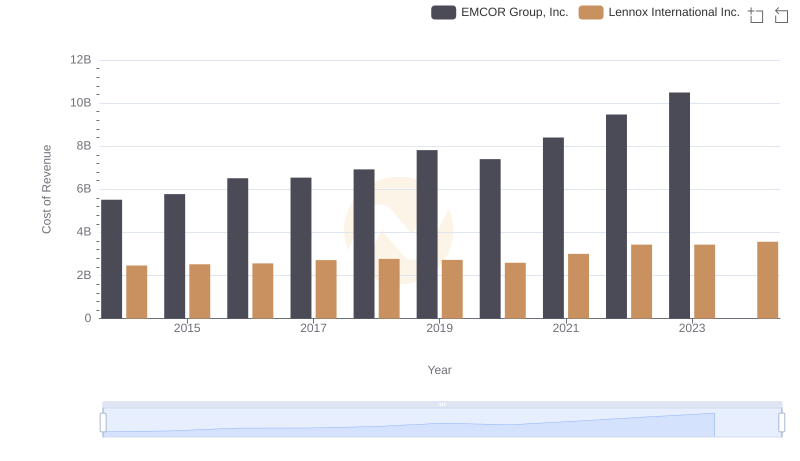

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs EMCOR Group, Inc.

Analyzing Cost of Revenue: Lennox International Inc. and AerCap Holdings N.V.

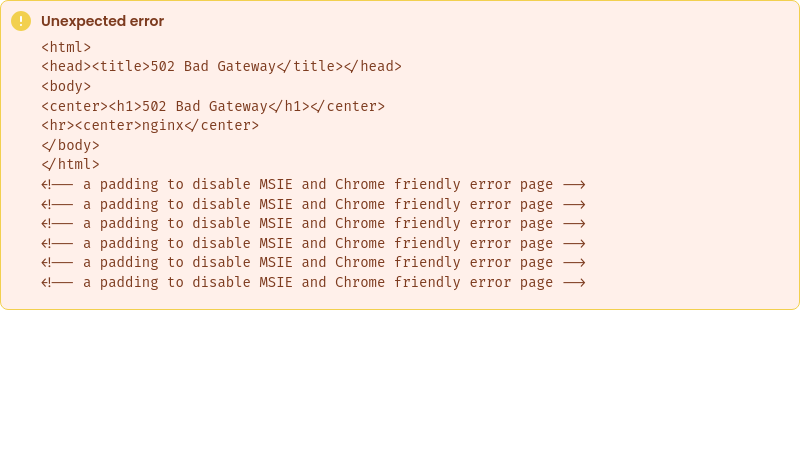

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs Southwest Airlines Co.

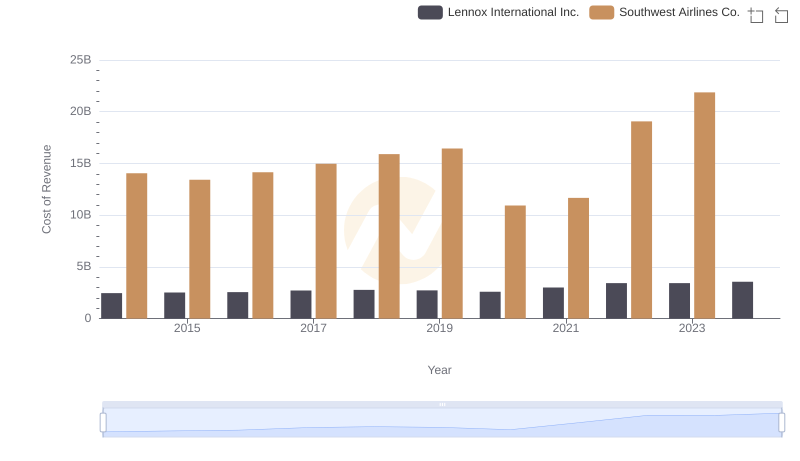

Key Insights on Gross Profit: Lennox International Inc. vs Hubbell Incorporated

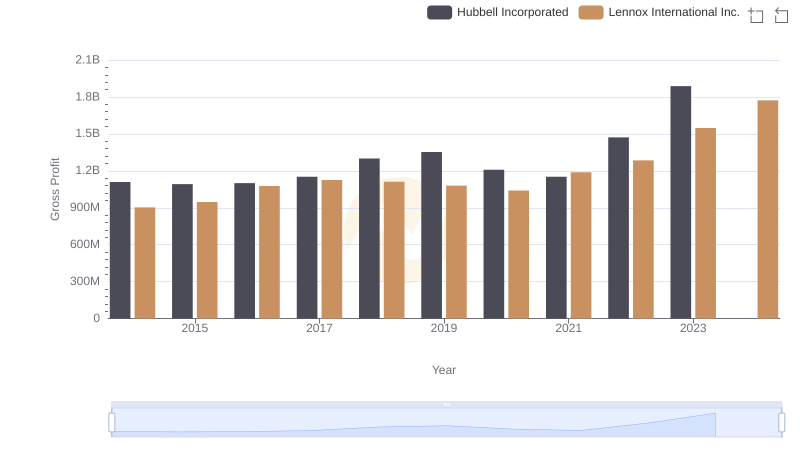

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs TransUnion

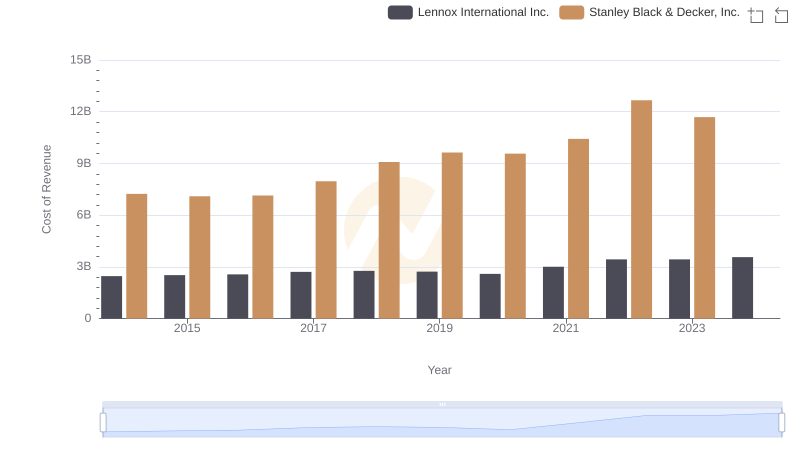

Lennox International Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

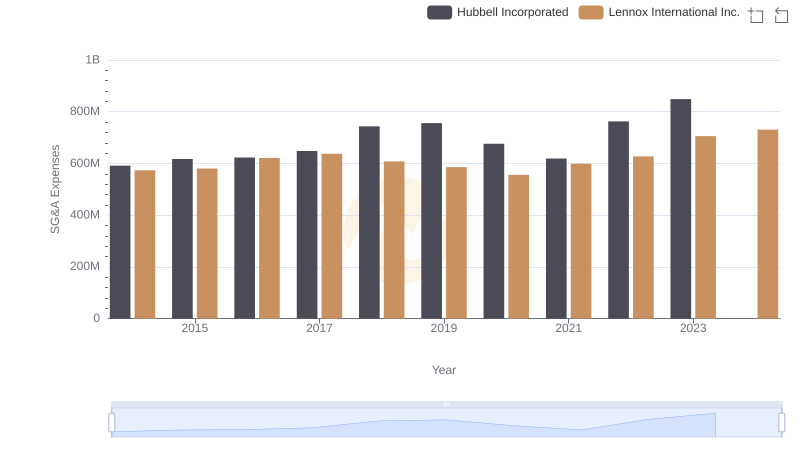

Breaking Down SG&A Expenses: Lennox International Inc. vs Hubbell Incorporated

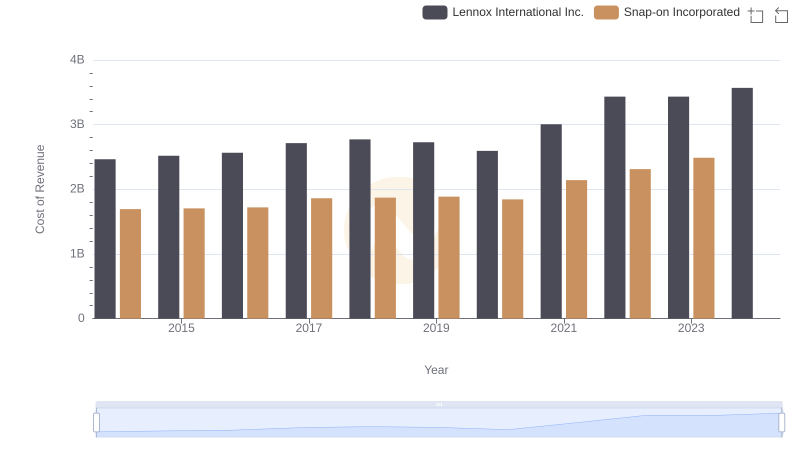

Cost Insights: Breaking Down Lennox International Inc. and Snap-on Incorporated's Expenses

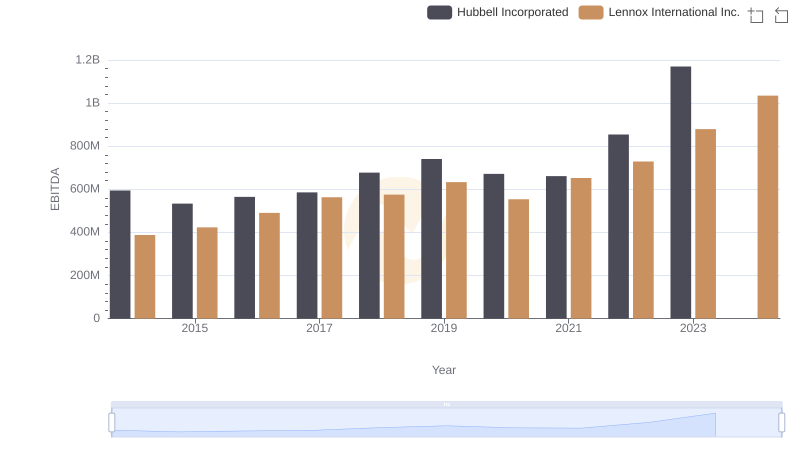

A Side-by-Side Analysis of EBITDA: Lennox International Inc. and Hubbell Incorporated