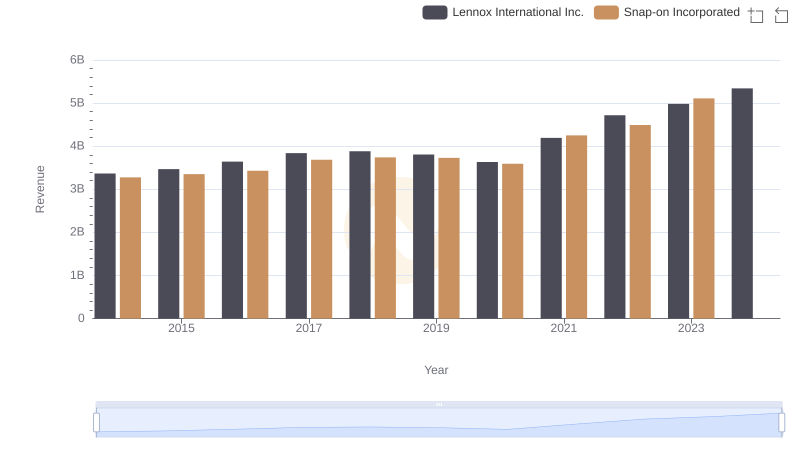

| __timestamp | Lennox International Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2464100000 | 1693400000 |

| Thursday, January 1, 2015 | 2520000000 | 1704500000 |

| Friday, January 1, 2016 | 2565100000 | 1720800000 |

| Sunday, January 1, 2017 | 2714400000 | 1862000000 |

| Monday, January 1, 2018 | 2772700000 | 1870700000 |

| Tuesday, January 1, 2019 | 2727400000 | 1886000000 |

| Wednesday, January 1, 2020 | 2594000000 | 1844000000 |

| Friday, January 1, 2021 | 3005700000 | 2141200000 |

| Saturday, January 1, 2022 | 3433700000 | 2311700000 |

| Sunday, January 1, 2023 | 3434100000 | 2488500000 |

| Monday, January 1, 2024 | 3569400000 | 2329500000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial manufacturing, understanding cost structures is pivotal. Lennox International Inc. and Snap-on Incorporated, two giants in their respective fields, have shown intriguing trends in their cost of revenue over the past decade. From 2014 to 2023, Lennox International's cost of revenue surged by approximately 45%, reflecting a robust growth trajectory. In contrast, Snap-on Incorporated experienced a more modest increase of around 47% during the same period. Notably, Lennox's cost of revenue peaked in 2024, while Snap-on's data for that year remains elusive, hinting at potential strategic shifts. This analysis not only highlights the financial dynamics of these companies but also underscores the broader economic trends influencing the industrial sector. As we delve deeper into these insights, it becomes evident that cost management remains a critical factor in sustaining competitive advantage.

Lennox International Inc. vs Snap-on Incorporated: Examining Key Revenue Metrics

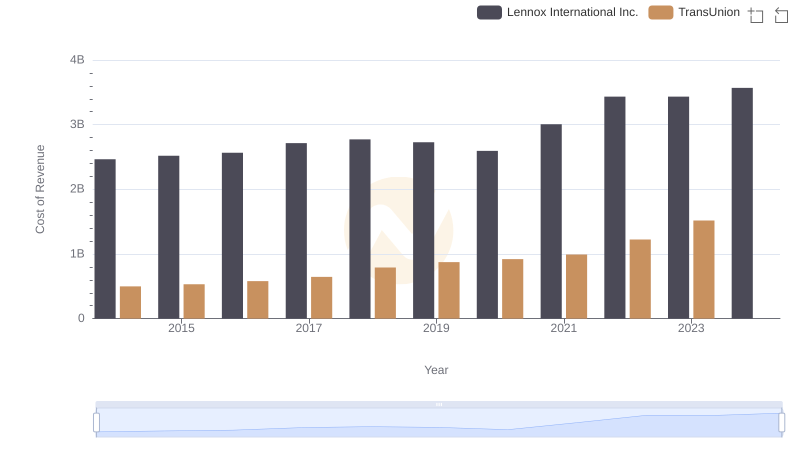

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs TransUnion

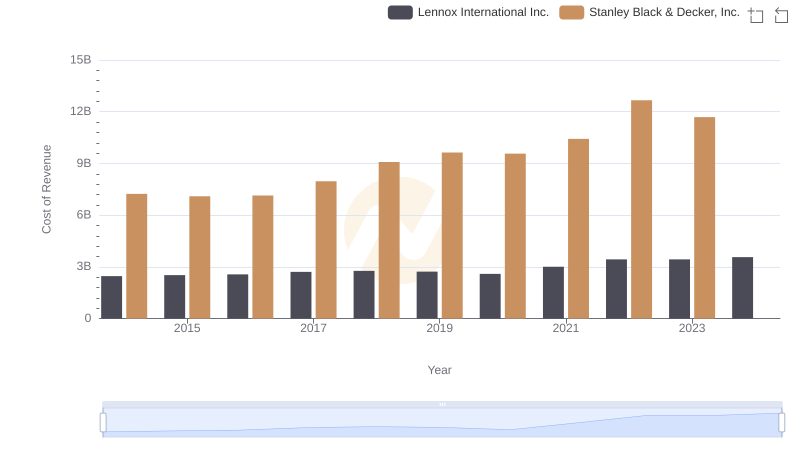

Lennox International Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

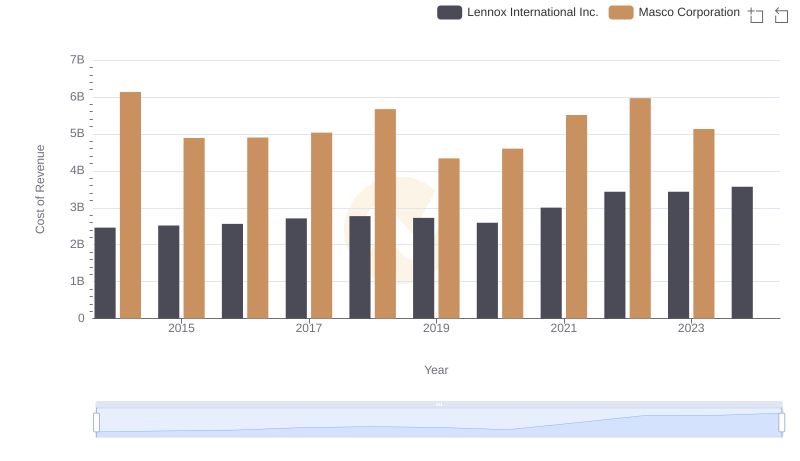

Analyzing Cost of Revenue: Lennox International Inc. and Masco Corporation

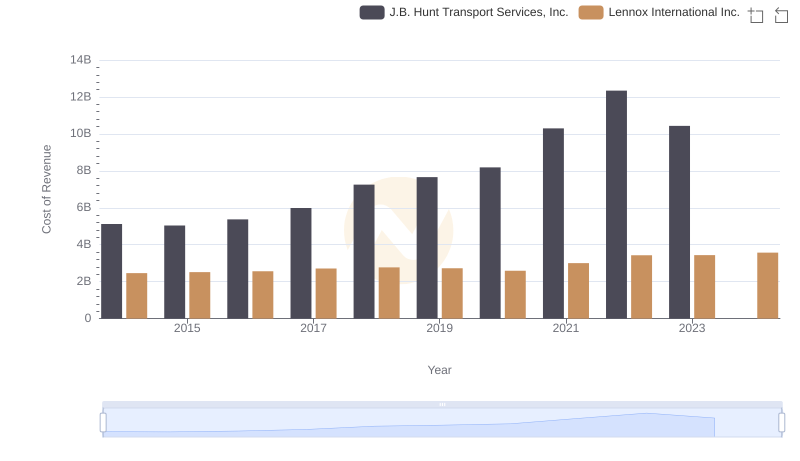

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs J.B. Hunt Transport Services, Inc.

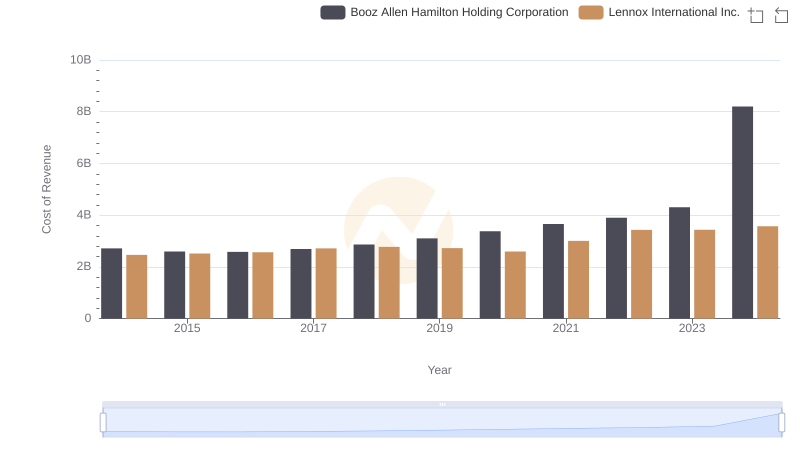

Analyzing Cost of Revenue: Lennox International Inc. and Booz Allen Hamilton Holding Corporation

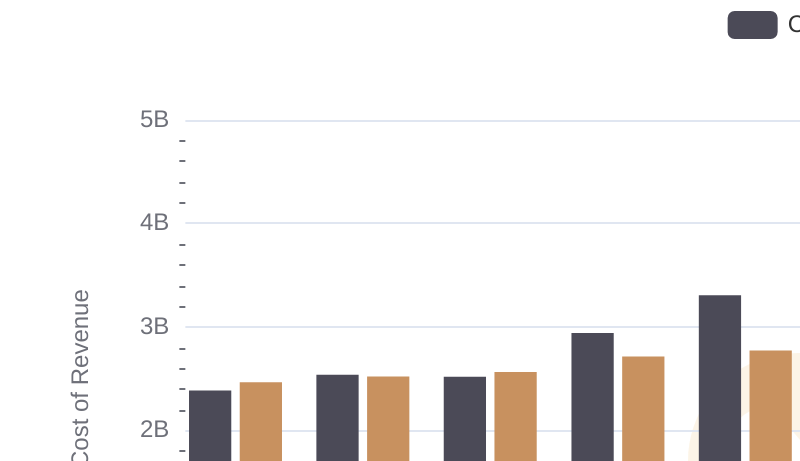

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs Carlisle Companies Incorporated

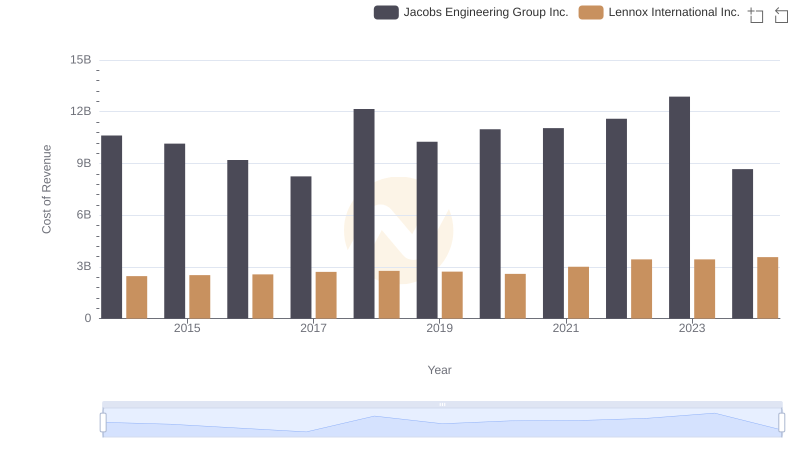

Cost of Revenue Trends: Lennox International Inc. vs Jacobs Engineering Group Inc.

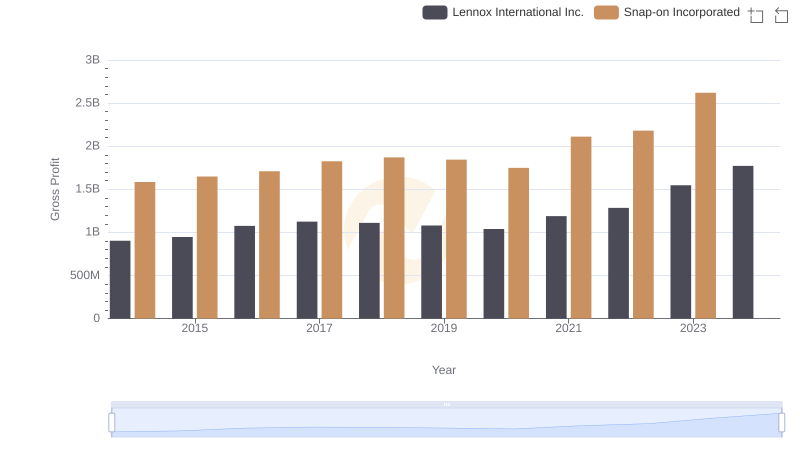

Lennox International Inc. vs Snap-on Incorporated: A Gross Profit Performance Breakdown

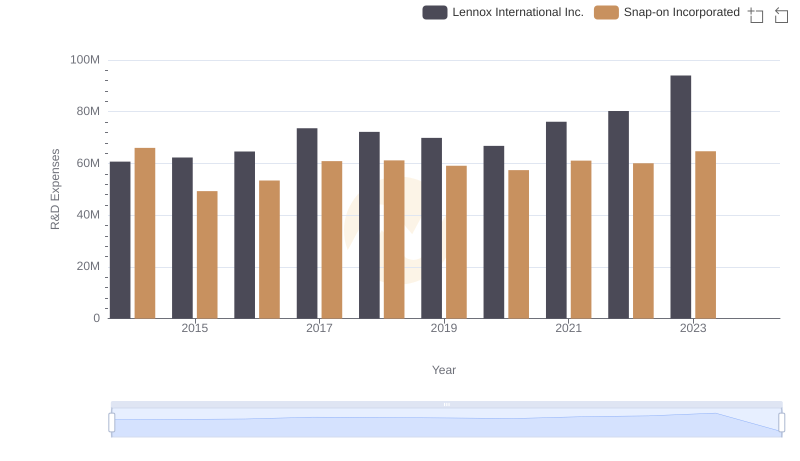

Comparing Innovation Spending: Lennox International Inc. and Snap-on Incorporated

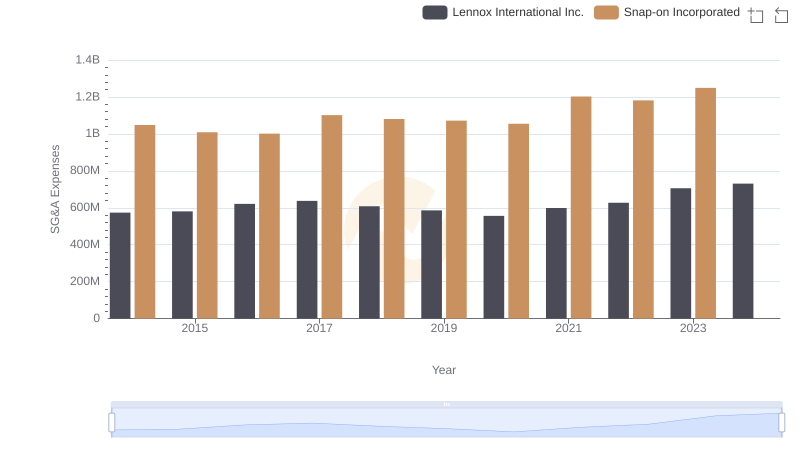

Breaking Down SG&A Expenses: Lennox International Inc. vs Snap-on Incorporated

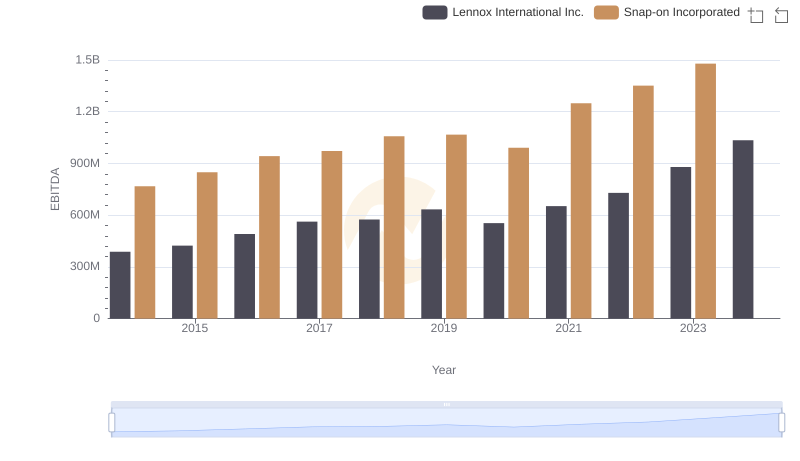

Lennox International Inc. and Snap-on Incorporated: A Detailed Examination of EBITDA Performance