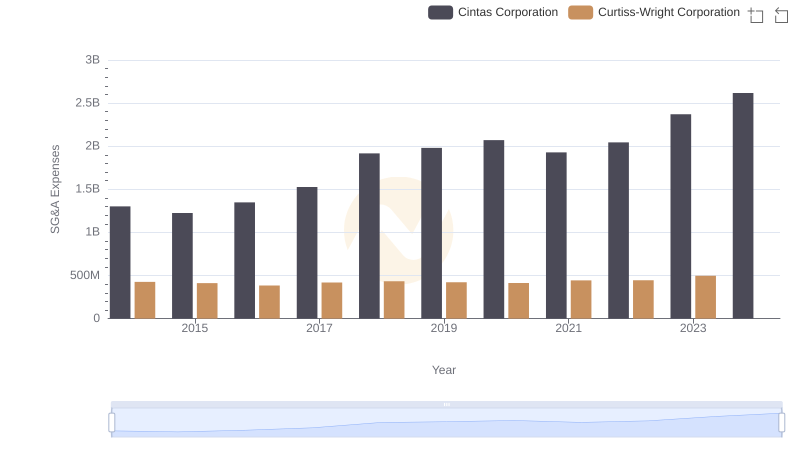

| __timestamp | Cintas Corporation | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 1466610000 |

| Thursday, January 1, 2015 | 2555549000 | 1422428000 |

| Friday, January 1, 2016 | 2775588000 | 1358448000 |

| Sunday, January 1, 2017 | 2943086000 | 1452431000 |

| Monday, January 1, 2018 | 3568109000 | 1540574000 |

| Tuesday, January 1, 2019 | 3763715000 | 1589216000 |

| Wednesday, January 1, 2020 | 3851372000 | 1550109000 |

| Friday, January 1, 2021 | 3801689000 | 1572575000 |

| Saturday, January 1, 2022 | 4222213000 | 1602416000 |

| Sunday, January 1, 2023 | 4642401000 | 1778195000 |

| Monday, January 1, 2024 | 4910199000 | 1967640000 |

In pursuit of knowledge

In the ever-evolving landscape of American industry, Cintas Corporation and Curtiss-Wright Corporation stand as titans in their respective fields. From 2014 to 2023, Cintas has consistently outpaced Curtiss-Wright in terms of cost of revenue, showcasing a robust growth trajectory. Starting at approximately $2.6 billion in 2014, Cintas saw a remarkable increase of nearly 86% by 2023, reaching around $4.6 billion. In contrast, Curtiss-Wright's cost of revenue grew modestly by about 21% over the same period, from $1.5 billion to $1.8 billion.

This disparity highlights Cintas's aggressive expansion and operational scaling, while Curtiss-Wright maintains a steady, albeit slower, growth. The data for 2024 is incomplete, with Cintas projecting further growth, whereas Curtiss-Wright's figures remain elusive. This comparison underscores the dynamic nature of corporate strategies and their impact on financial metrics.

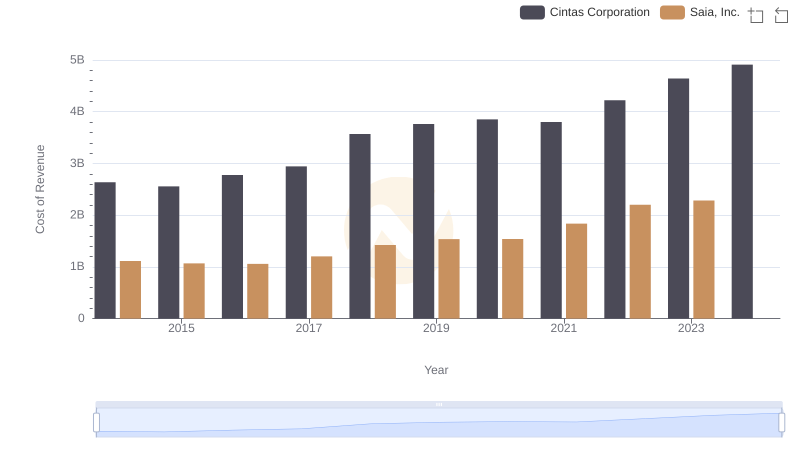

Cost of Revenue Trends: Cintas Corporation vs Saia, Inc.

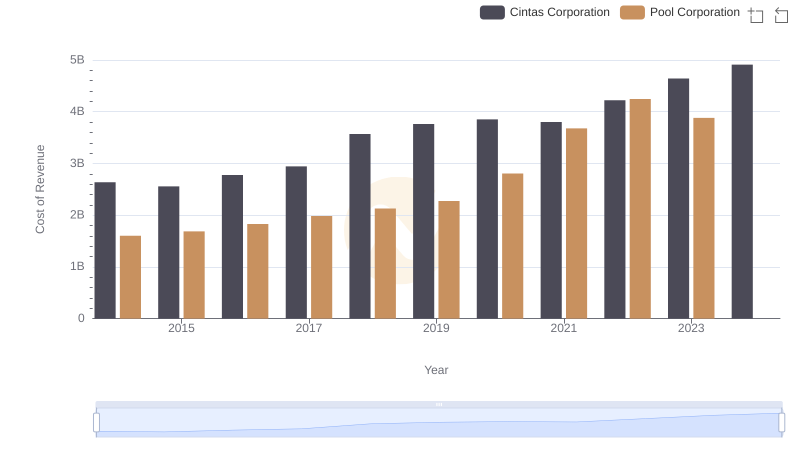

Cost of Revenue: Key Insights for Cintas Corporation and Pool Corporation

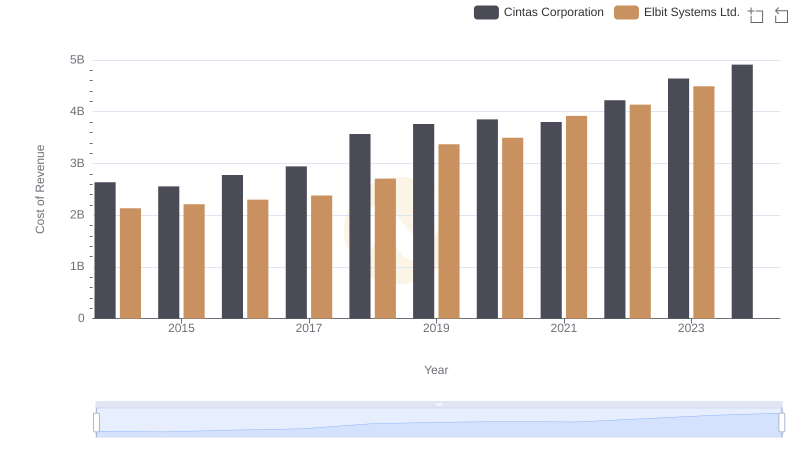

Analyzing Cost of Revenue: Cintas Corporation and Elbit Systems Ltd.

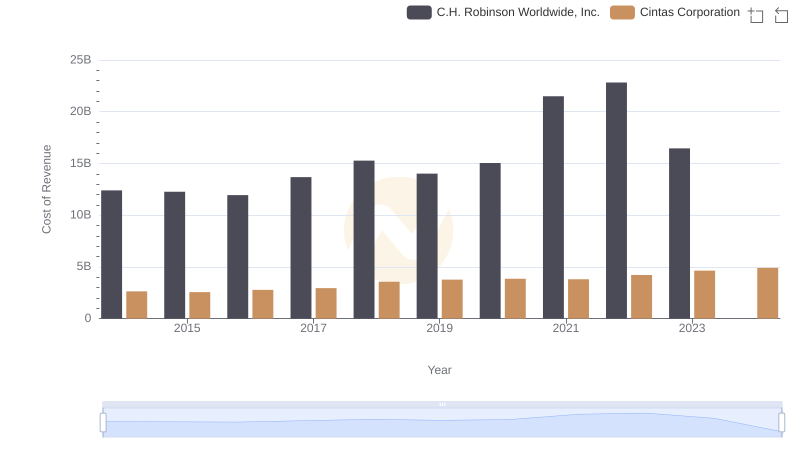

Cost of Revenue Trends: Cintas Corporation vs C.H. Robinson Worldwide, Inc.

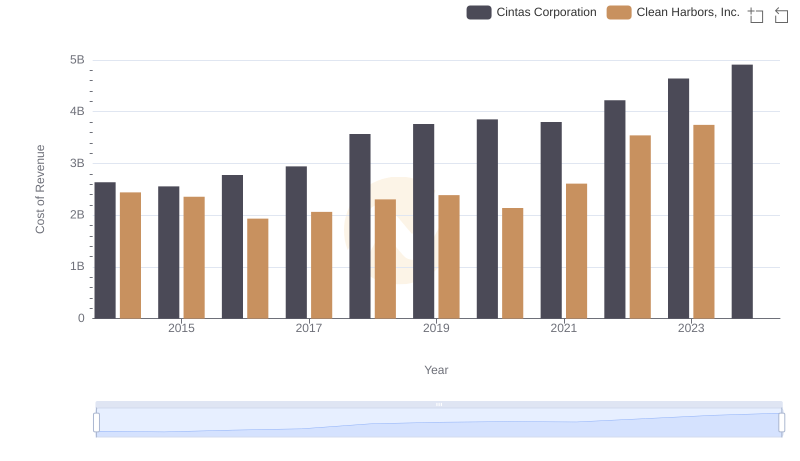

Analyzing Cost of Revenue: Cintas Corporation and Clean Harbors, Inc.

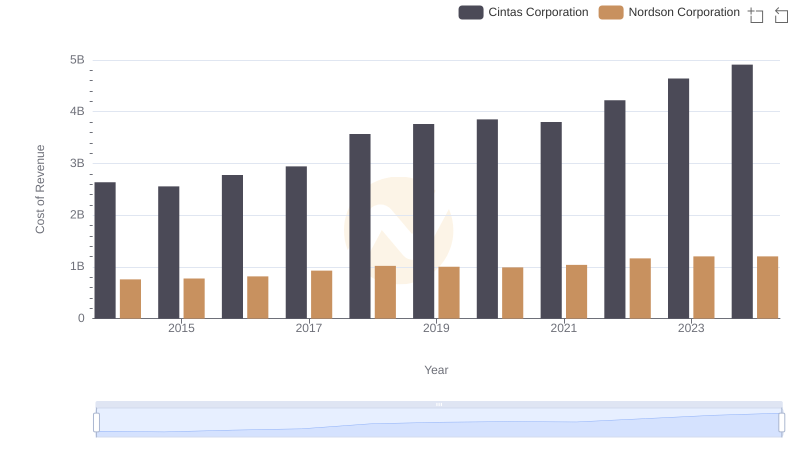

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Nordson Corporation

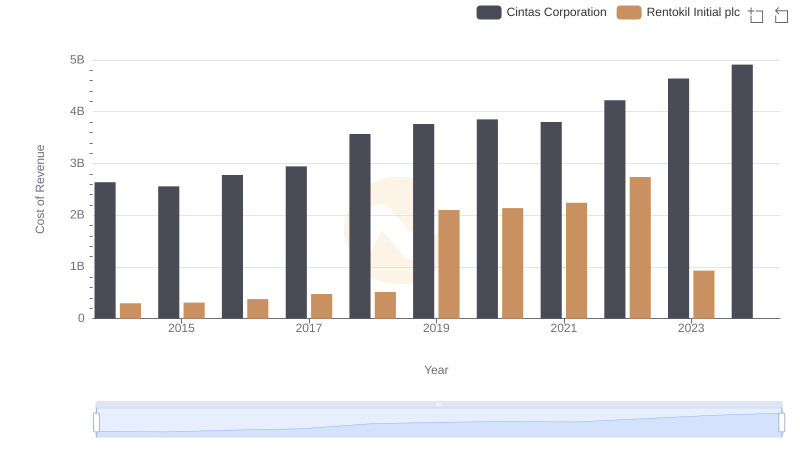

Cintas Corporation vs Rentokil Initial plc: Efficiency in Cost of Revenue Explored

Who Generates Higher Gross Profit? Cintas Corporation or Curtiss-Wright Corporation

Who Optimizes SG&A Costs Better? Cintas Corporation or Curtiss-Wright Corporation

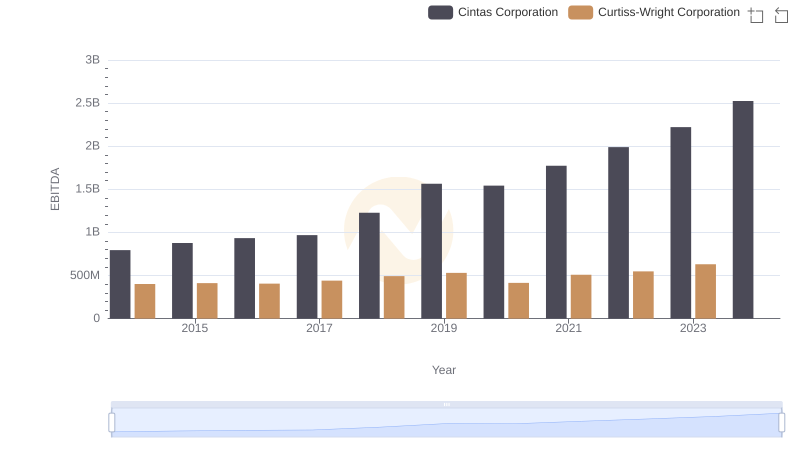

Comprehensive EBITDA Comparison: Cintas Corporation vs Curtiss-Wright Corporation