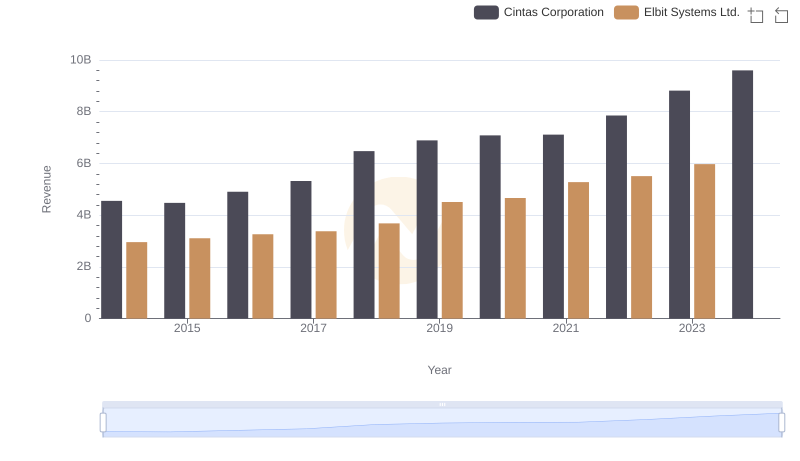

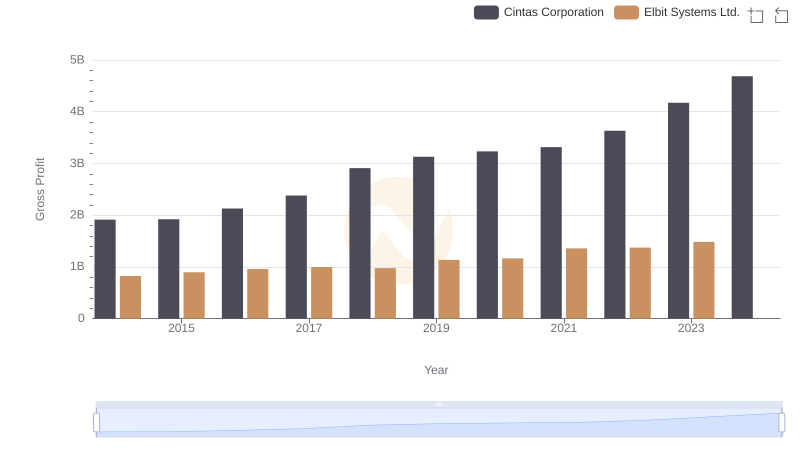

| __timestamp | Cintas Corporation | Elbit Systems Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 2133151000 |

| Thursday, January 1, 2015 | 2555549000 | 2210528000 |

| Friday, January 1, 2016 | 2775588000 | 2300636000 |

| Sunday, January 1, 2017 | 2943086000 | 2379905000 |

| Monday, January 1, 2018 | 3568109000 | 2707505000 |

| Tuesday, January 1, 2019 | 3763715000 | 3371933000 |

| Wednesday, January 1, 2020 | 3851372000 | 3497465000 |

| Friday, January 1, 2021 | 3801689000 | 3920473000 |

| Saturday, January 1, 2022 | 4222213000 | 4138266000 |

| Sunday, January 1, 2023 | 4642401000 | 4491790000 |

| Monday, January 1, 2024 | 4910199000 |

In pursuit of knowledge

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's efficiency and profitability. This analysis focuses on two industry leaders: Cintas Corporation, a prominent player in corporate services, and Elbit Systems Ltd., a key figure in defense technology. From 2014 to 2023, Cintas Corporation's cost of revenue surged by approximately 86%, reflecting its expanding operations and market reach. In contrast, Elbit Systems Ltd. experienced a 111% increase over the same period, highlighting its strategic growth in defense contracts. Notably, Cintas consistently outpaced Elbit in cost of revenue, peaking at $4.91 billion in 2024, while Elbit's data for 2024 remains unavailable. This comparison underscores the dynamic nature of these industries and the strategic maneuvers companies must undertake to maintain their competitive edge.

Who Generates More Revenue? Cintas Corporation or Elbit Systems Ltd.

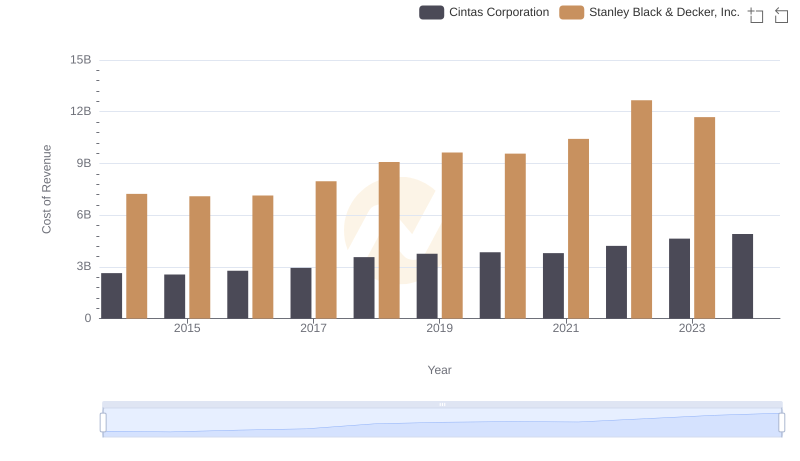

Analyzing Cost of Revenue: Cintas Corporation and Stanley Black & Decker, Inc.

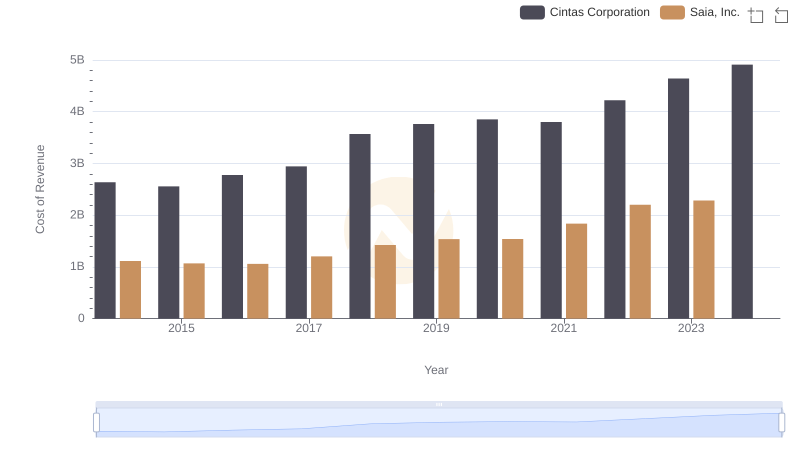

Cost of Revenue Trends: Cintas Corporation vs Saia, Inc.

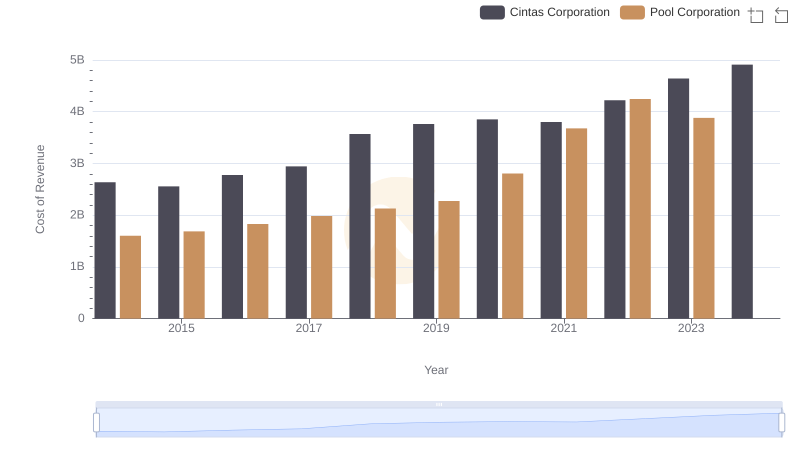

Cost of Revenue: Key Insights for Cintas Corporation and Pool Corporation

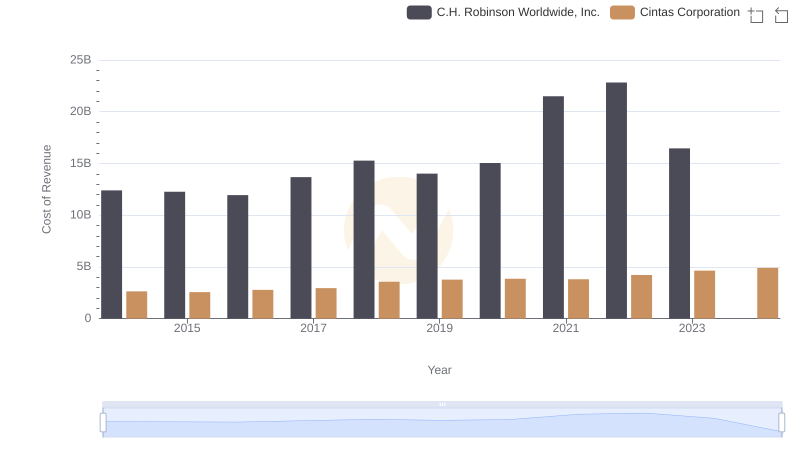

Cost of Revenue Trends: Cintas Corporation vs C.H. Robinson Worldwide, Inc.

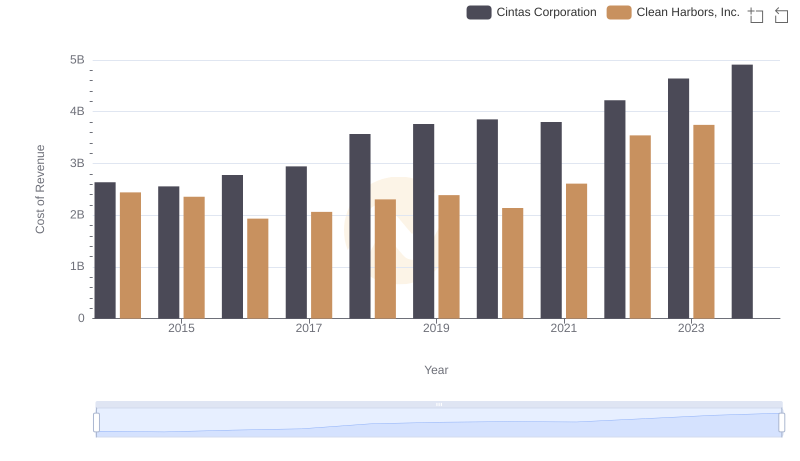

Analyzing Cost of Revenue: Cintas Corporation and Clean Harbors, Inc.

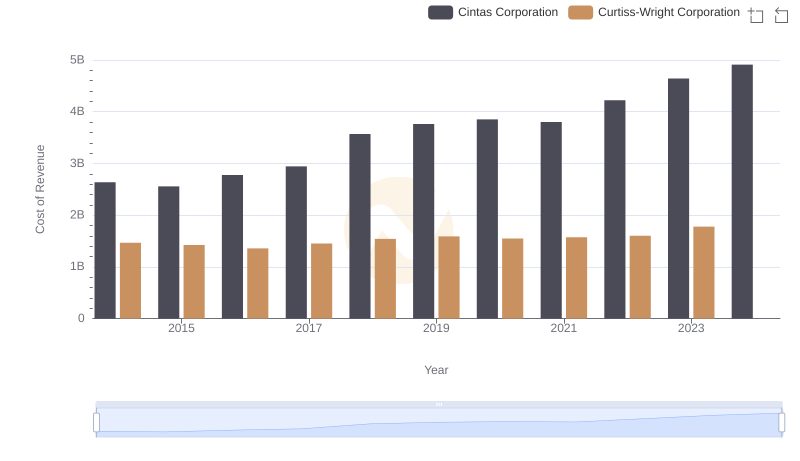

Cost of Revenue Comparison: Cintas Corporation vs Curtiss-Wright Corporation

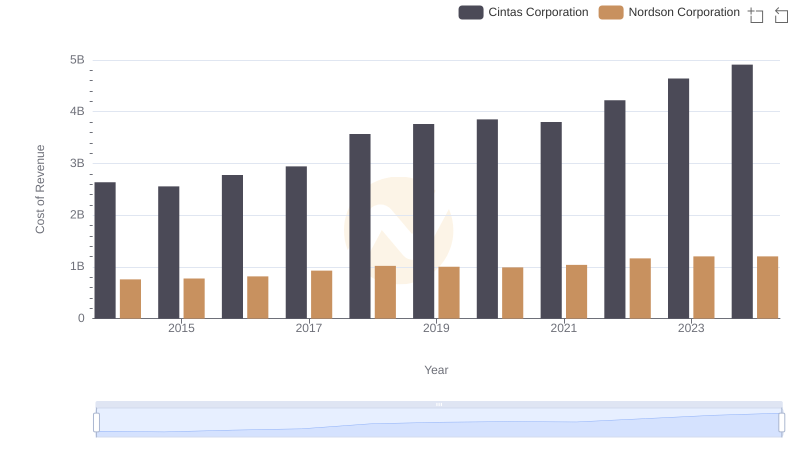

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Nordson Corporation

Gross Profit Trends Compared: Cintas Corporation vs Elbit Systems Ltd.

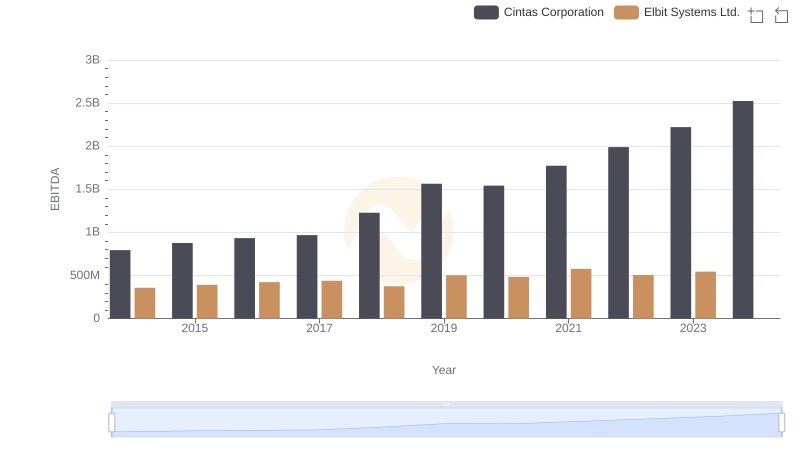

Comprehensive EBITDA Comparison: Cintas Corporation vs Elbit Systems Ltd.