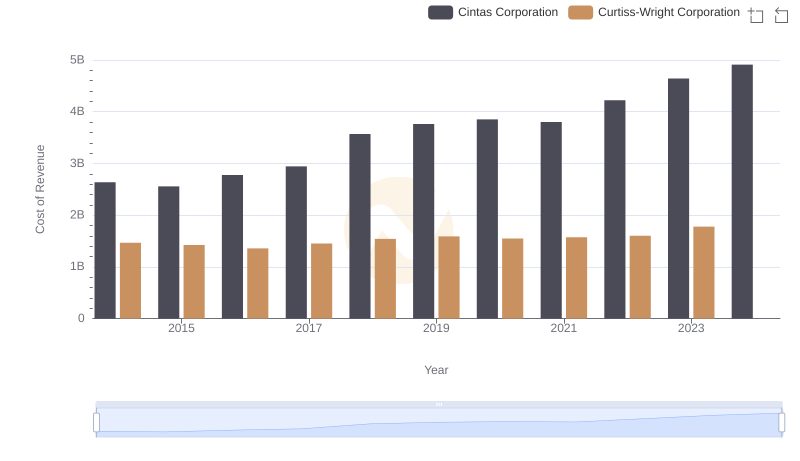

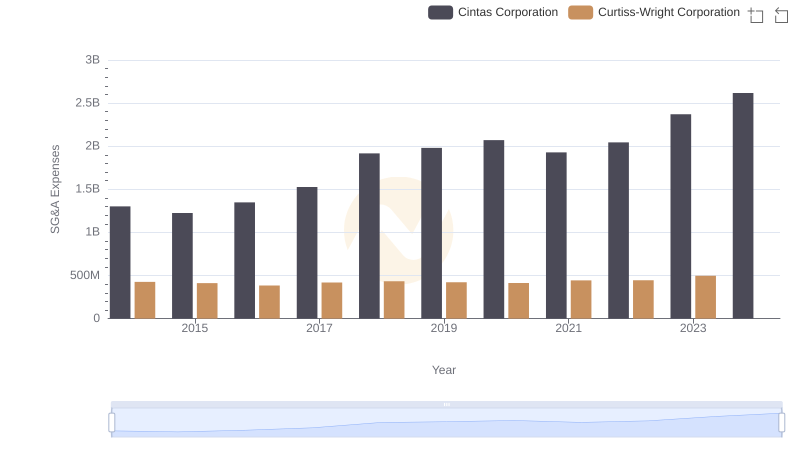

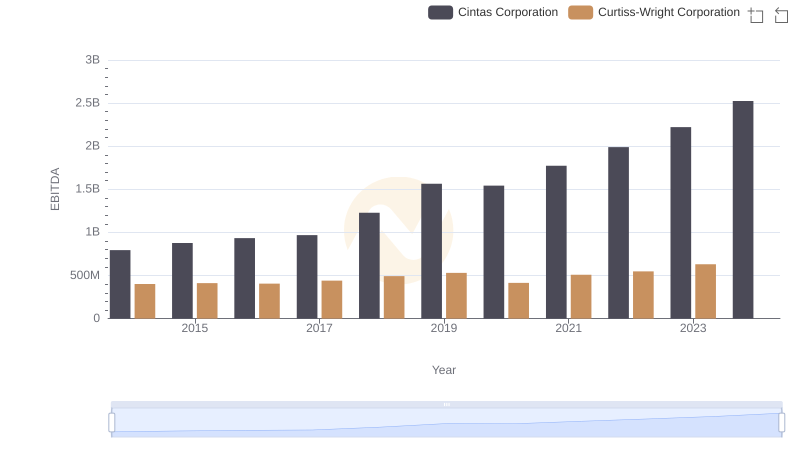

| __timestamp | Cintas Corporation | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 776516000 |

| Thursday, January 1, 2015 | 1921337000 | 783255000 |

| Friday, January 1, 2016 | 2129870000 | 750483000 |

| Sunday, January 1, 2017 | 2380295000 | 818595000 |

| Monday, January 1, 2018 | 2908523000 | 871261000 |

| Tuesday, January 1, 2019 | 3128588000 | 898745000 |

| Wednesday, January 1, 2020 | 3233748000 | 841227000 |

| Friday, January 1, 2021 | 3314651000 | 933356000 |

| Saturday, January 1, 2022 | 3632246000 | 954609000 |

| Sunday, January 1, 2023 | 4173368000 | 1067178000 |

| Monday, January 1, 2024 | 4686416000 | 1153549000 |

Igniting the spark of knowledge

In the competitive landscape of American industry, Cintas Corporation and Curtiss-Wright Corporation stand as titans in their respective fields. Over the past decade, Cintas has consistently outperformed Curtiss-Wright in terms of gross profit. From 2014 to 2023, Cintas saw a remarkable growth of over 145% in gross profit, peaking at approximately $4.17 billion in 2023. In contrast, Curtiss-Wright's growth was more modest, with a 37% increase, reaching around $1.07 billion in the same year.

This disparity highlights Cintas's robust business model and strategic market positioning. While Curtiss-Wright has shown steady growth, the gap in profitability underscores the different scales and market dynamics each company faces. As we look to the future, the absence of data for Curtiss-Wright in 2024 leaves room for speculation on how these trends might evolve.

Cost of Revenue Comparison: Cintas Corporation vs Curtiss-Wright Corporation

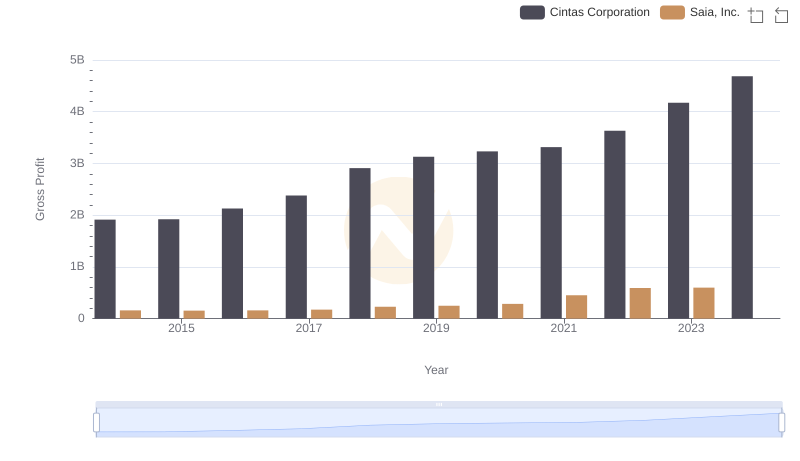

Who Generates Higher Gross Profit? Cintas Corporation or Saia, Inc.

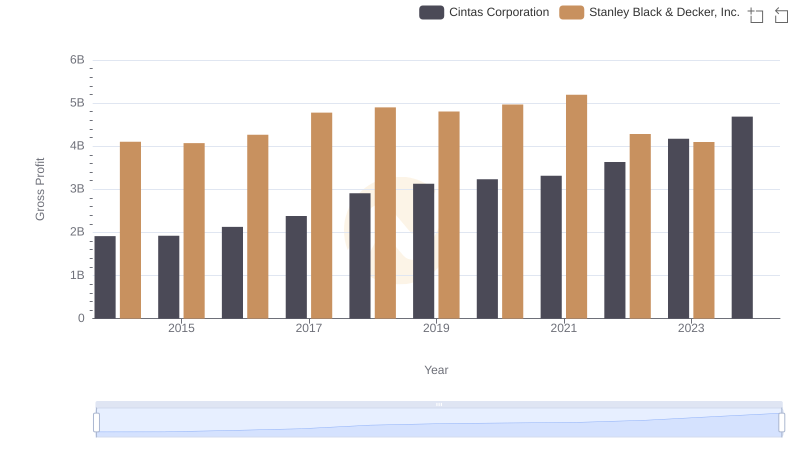

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

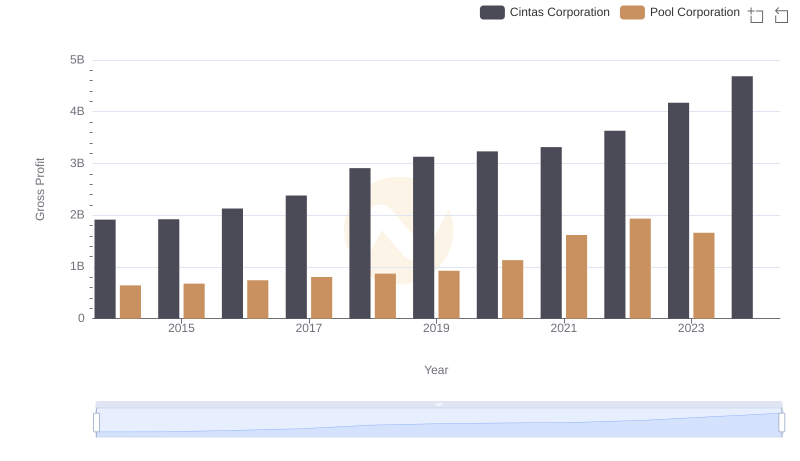

Who Generates Higher Gross Profit? Cintas Corporation or Pool Corporation

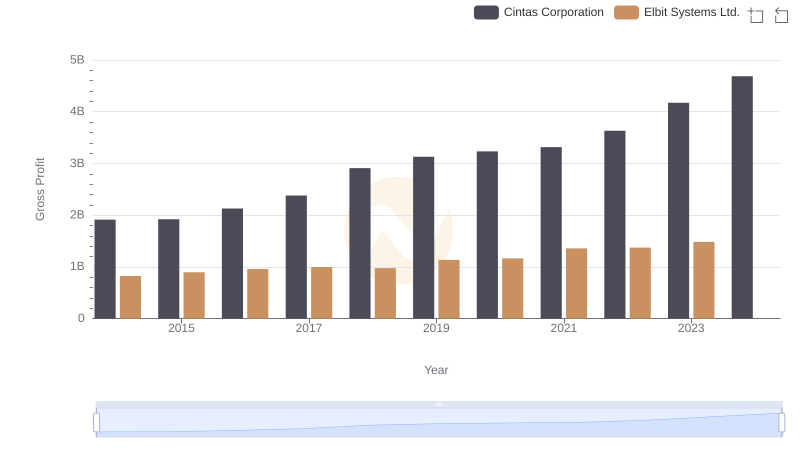

Gross Profit Trends Compared: Cintas Corporation vs Elbit Systems Ltd.

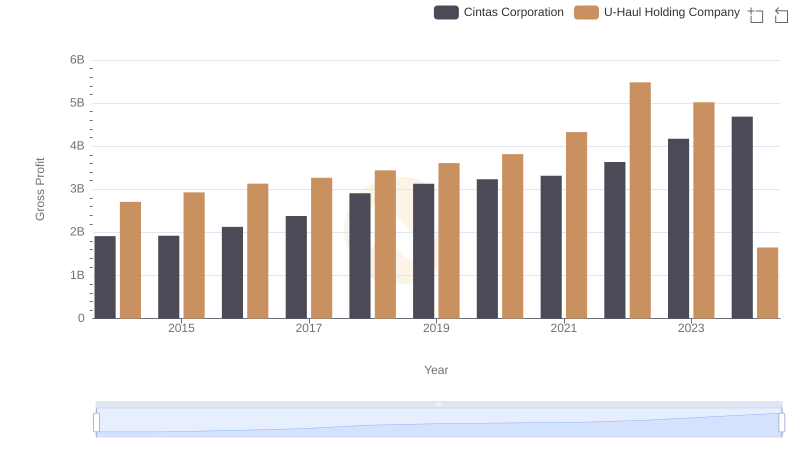

Gross Profit Analysis: Comparing Cintas Corporation and U-Haul Holding Company

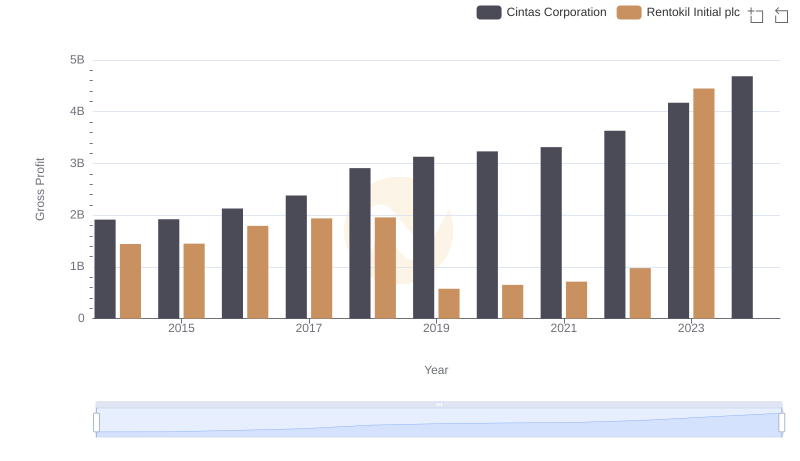

Gross Profit Trends Compared: Cintas Corporation vs Rentokil Initial plc

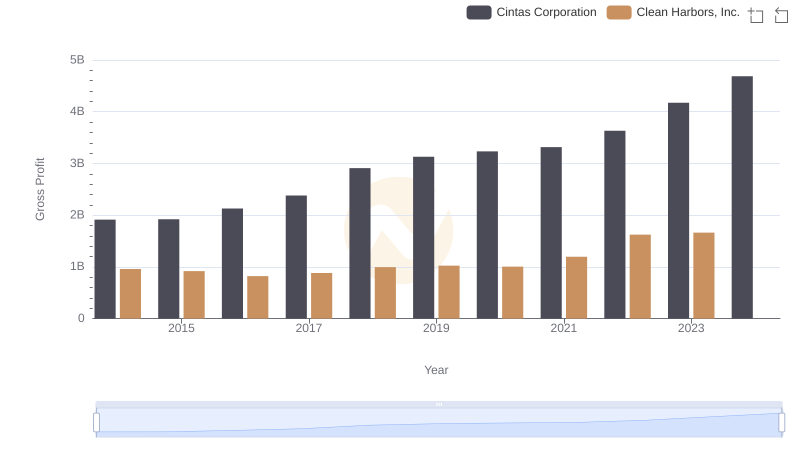

Gross Profit Trends Compared: Cintas Corporation vs Clean Harbors, Inc.

Who Optimizes SG&A Costs Better? Cintas Corporation or Curtiss-Wright Corporation

Comprehensive EBITDA Comparison: Cintas Corporation vs Curtiss-Wright Corporation