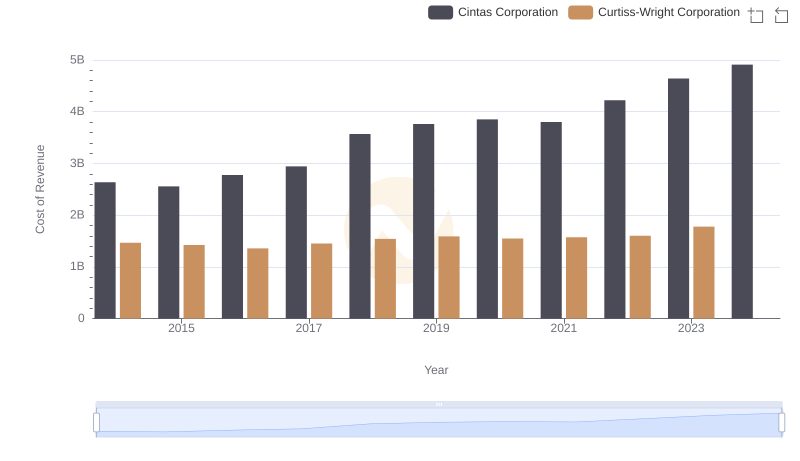

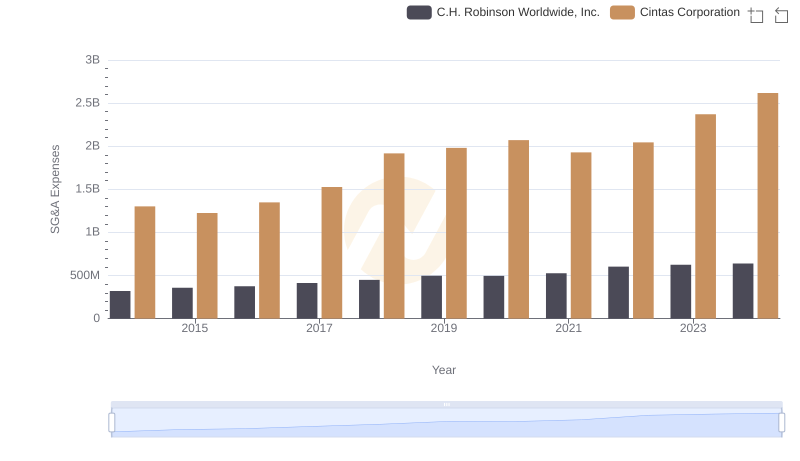

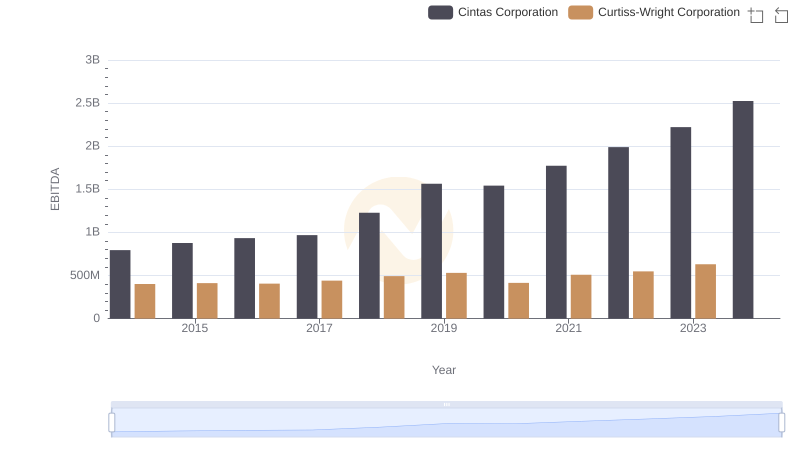

| __timestamp | Cintas Corporation | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 426301000 |

| Thursday, January 1, 2015 | 1224930000 | 411801000 |

| Friday, January 1, 2016 | 1348122000 | 383793000 |

| Sunday, January 1, 2017 | 1527380000 | 418544000 |

| Monday, January 1, 2018 | 1916792000 | 433110000 |

| Tuesday, January 1, 2019 | 1980644000 | 422272000 |

| Wednesday, January 1, 2020 | 2071052000 | 412825000 |

| Friday, January 1, 2021 | 1929159000 | 443096000 |

| Saturday, January 1, 2022 | 2044876000 | 445679000 |

| Sunday, January 1, 2023 | 2370704000 | 496812000 |

| Monday, January 1, 2024 | 2617783000 | 518857000 |

Infusing magic into the data realm

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cintas Corporation and Curtiss-Wright Corporation, two industry giants, have shown distinct strategies in optimizing these costs over the past decade. From 2014 to 2023, Cintas Corporation's SG&A expenses have surged by approximately 101%, reflecting its aggressive expansion and operational scaling. In contrast, Curtiss-Wright Corporation has maintained a more stable SG&A trajectory, with only a 17% increase over the same period.

While Cintas's expenses peaked in 2023, Curtiss-Wright's data for 2024 remains elusive, leaving room for speculation on its future strategy. This comparison highlights the diverse approaches companies take in managing operational costs, with Cintas focusing on growth and Curtiss-Wright on stability. As businesses navigate economic uncertainties, understanding these strategies offers valuable insights into corporate financial management.

Cost of Revenue Comparison: Cintas Corporation vs Curtiss-Wright Corporation

Who Generates Higher Gross Profit? Cintas Corporation or Curtiss-Wright Corporation

Cintas Corporation or C.H. Robinson Worldwide, Inc.: Who Manages SG&A Costs Better?

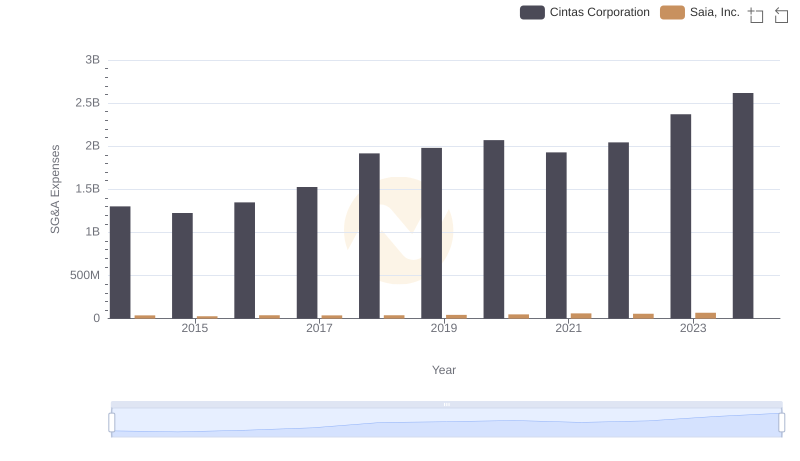

Selling, General, and Administrative Costs: Cintas Corporation vs Saia, Inc.

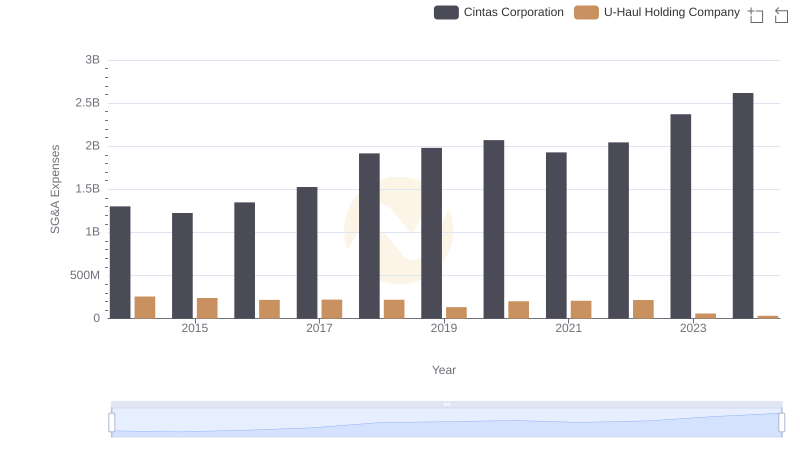

Cintas Corporation vs U-Haul Holding Company: SG&A Expense Trends

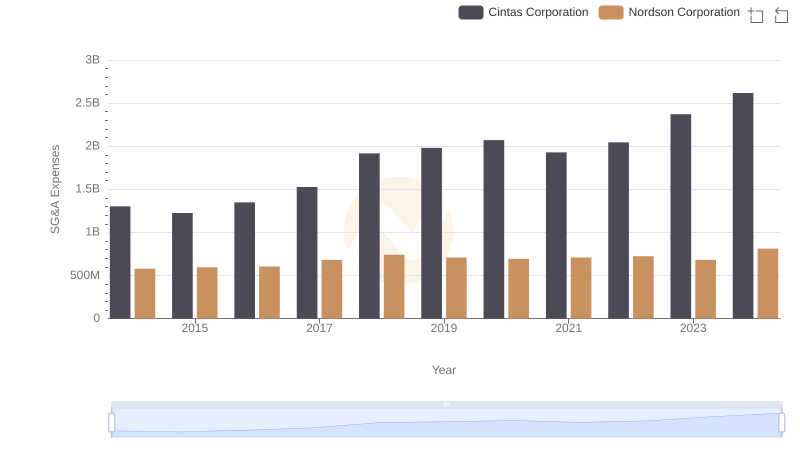

Breaking Down SG&A Expenses: Cintas Corporation vs Nordson Corporation

Comprehensive EBITDA Comparison: Cintas Corporation vs Curtiss-Wright Corporation