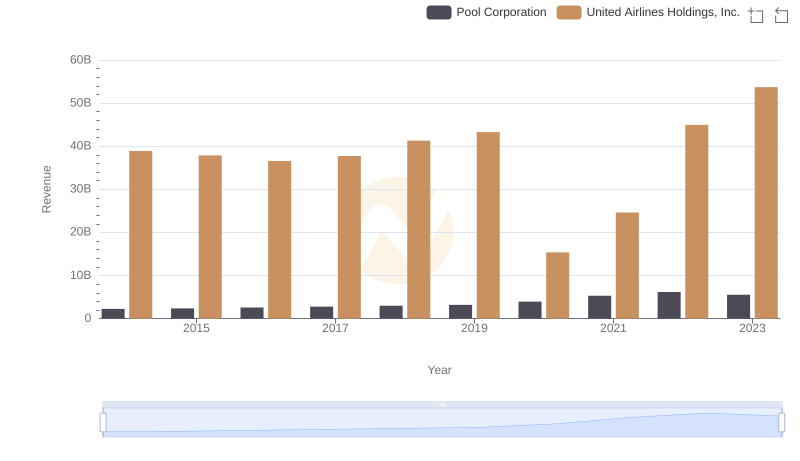

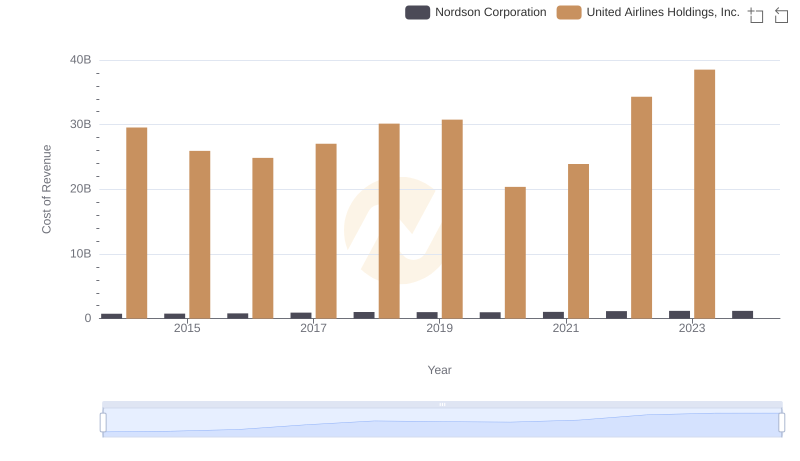

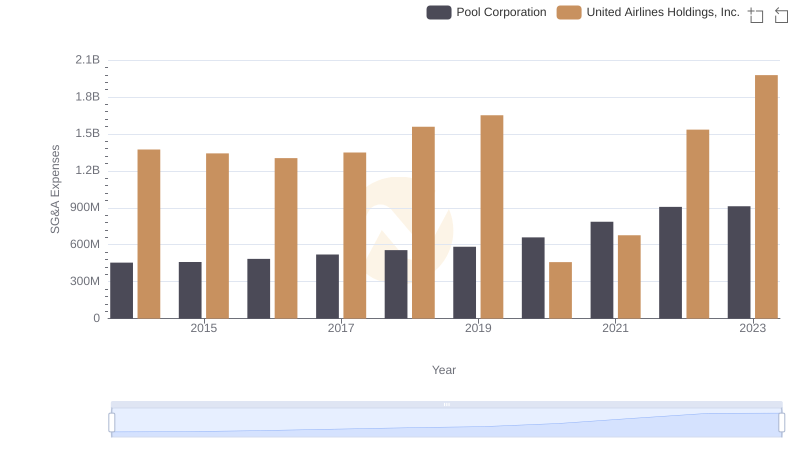

| __timestamp | Pool Corporation | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1603222000 | 29569000000 |

| Thursday, January 1, 2015 | 1687495000 | 25952000000 |

| Friday, January 1, 2016 | 1829716000 | 24856000000 |

| Sunday, January 1, 2017 | 1982899000 | 27056000000 |

| Monday, January 1, 2018 | 2127924000 | 30165000000 |

| Tuesday, January 1, 2019 | 2274592000 | 30786000000 |

| Wednesday, January 1, 2020 | 2805721000 | 20385000000 |

| Friday, January 1, 2021 | 3678492000 | 23913000000 |

| Saturday, January 1, 2022 | 4246315000 | 34315000000 |

| Sunday, January 1, 2023 | 3881551000 | 38518000000 |

| Monday, January 1, 2024 | 37643000000 |

Unlocking the unknown

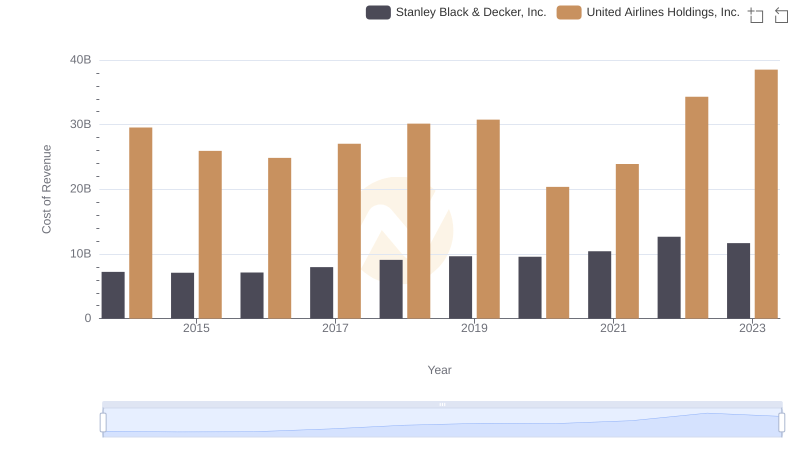

In the ever-evolving landscape of corporate finance, understanding cost structures is crucial. This analysis delves into the cost of revenue for United Airlines Holdings, Inc. and Pool Corporation from 2014 to 2023. Over this period, United Airlines consistently reported higher costs, peaking in 2023 with a 30% increase from its 2020 low. Meanwhile, Pool Corporation's cost of revenue grew steadily, nearly doubling from 2014 to 2022, before a slight dip in 2023. This trend highlights the resilience and growth strategies of both companies, with United Airlines navigating the volatile airline industry and Pool Corporation capitalizing on the booming home improvement market. Such insights are invaluable for investors and analysts seeking to understand the financial health and strategic direction of these industry leaders.

Revenue Showdown: United Airlines Holdings, Inc. vs Pool Corporation

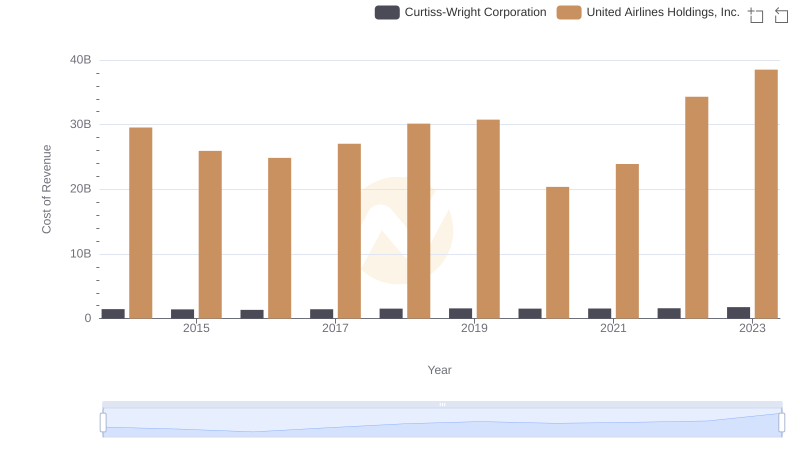

Cost of Revenue: Key Insights for United Airlines Holdings, Inc. and Curtiss-Wright Corporation

United Airlines Holdings, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

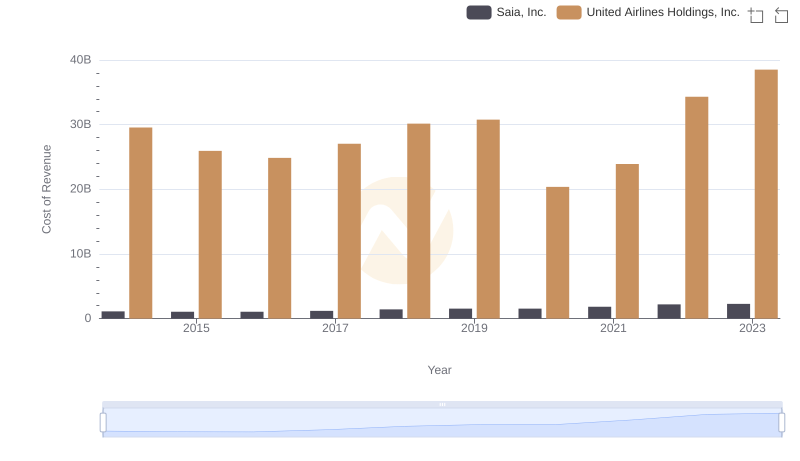

Comparing Cost of Revenue Efficiency: United Airlines Holdings, Inc. vs Saia, Inc.

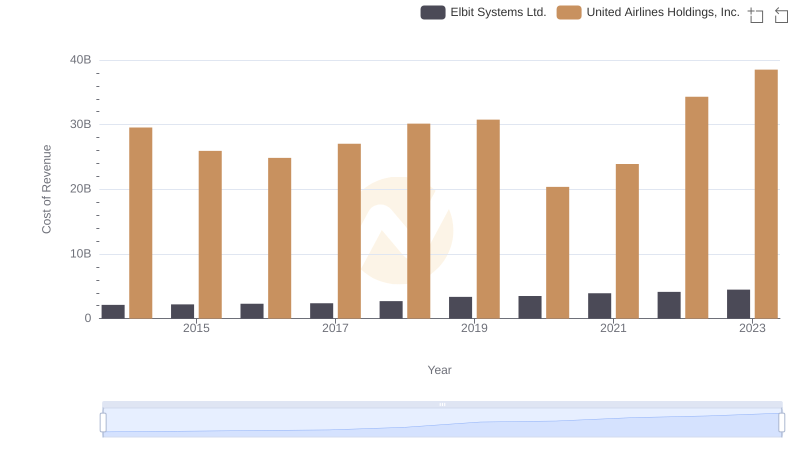

Cost Insights: Breaking Down United Airlines Holdings, Inc. and Elbit Systems Ltd.'s Expenses

Cost of Revenue: Key Insights for United Airlines Holdings, Inc. and U-Haul Holding Company

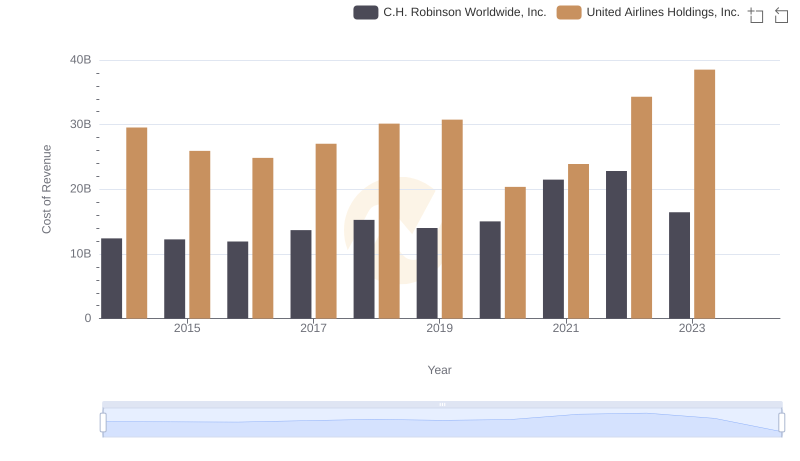

Cost of Revenue Comparison: United Airlines Holdings, Inc. vs C.H. Robinson Worldwide, Inc.

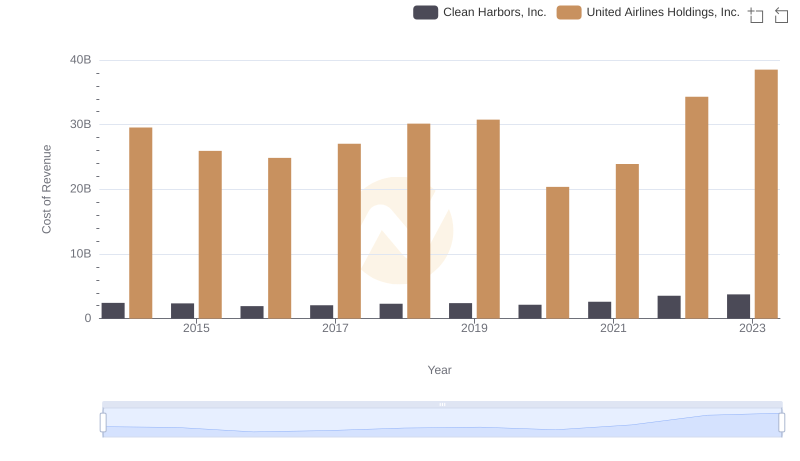

Cost Insights: Breaking Down United Airlines Holdings, Inc. and Clean Harbors, Inc.'s Expenses

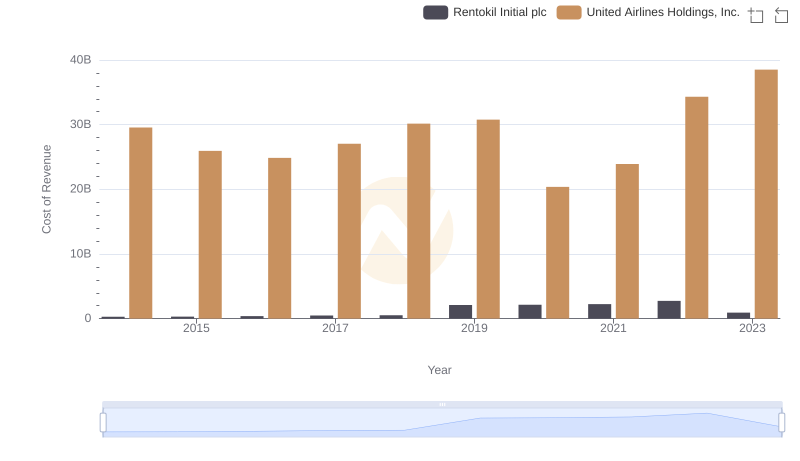

Comparing Cost of Revenue Efficiency: United Airlines Holdings, Inc. vs Rentokil Initial plc

Comparing Cost of Revenue Efficiency: United Airlines Holdings, Inc. vs Nordson Corporation

SG&A Efficiency Analysis: Comparing United Airlines Holdings, Inc. and Pool Corporation