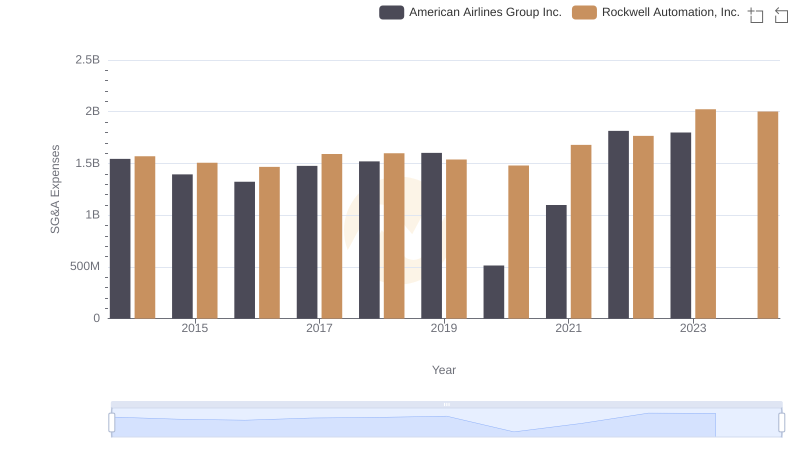

| __timestamp | American Airlines Group Inc. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 31939000000 | 3869600000 |

| Thursday, January 1, 2015 | 27967000000 | 3604800000 |

| Friday, January 1, 2016 | 28339000000 | 3404000000 |

| Sunday, January 1, 2017 | 31154000000 | 3687100000 |

| Monday, January 1, 2018 | 34490000000 | 3793800000 |

| Tuesday, January 1, 2019 | 35379000000 | 3794700000 |

| Wednesday, January 1, 2020 | 24933000000 | 3734600000 |

| Friday, January 1, 2021 | 29855000000 | 4099700000 |

| Saturday, January 1, 2022 | 39934000000 | 4658400000 |

| Sunday, January 1, 2023 | 40978000000 | 5341000000 |

| Monday, January 1, 2024 | 5070800000 |

Unlocking the unknown

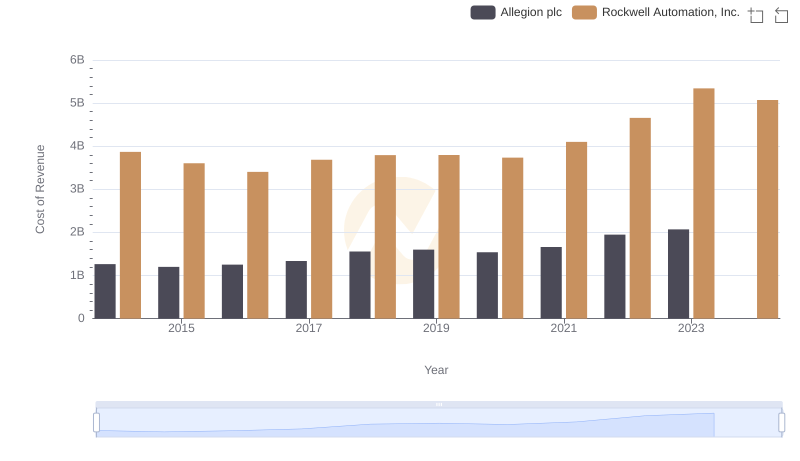

In the ever-evolving landscape of corporate finance, understanding cost structures is pivotal. This analysis delves into the cost of revenue trends for Rockwell Automation, Inc. and American Airlines Group Inc. from 2014 to 2023. Over this decade, American Airlines' cost of revenue fluctuated, peaking in 2023 with a 28% increase from its 2020 low. Meanwhile, Rockwell Automation demonstrated a steady upward trajectory, culminating in a 44% rise by 2023. Notably, 2020 marked a challenging year for both companies, with American Airlines experiencing a significant dip, likely due to the global pandemic's impact on travel. In contrast, Rockwell Automation's costs remained relatively stable, reflecting its resilience. The data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting. This comparative insight underscores the importance of strategic cost management in navigating economic uncertainties.

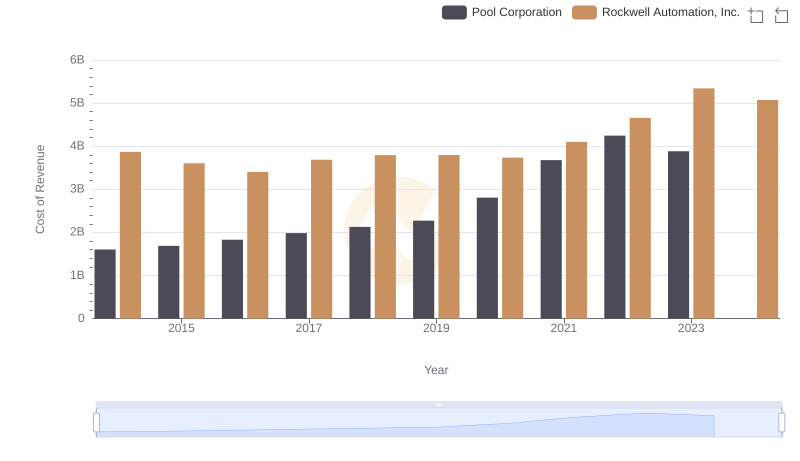

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Pool Corporation

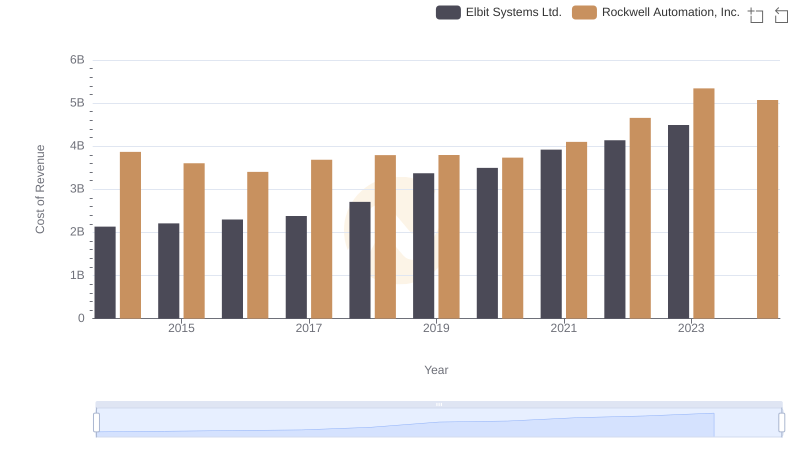

Cost Insights: Breaking Down Rockwell Automation, Inc. and Elbit Systems Ltd.'s Expenses

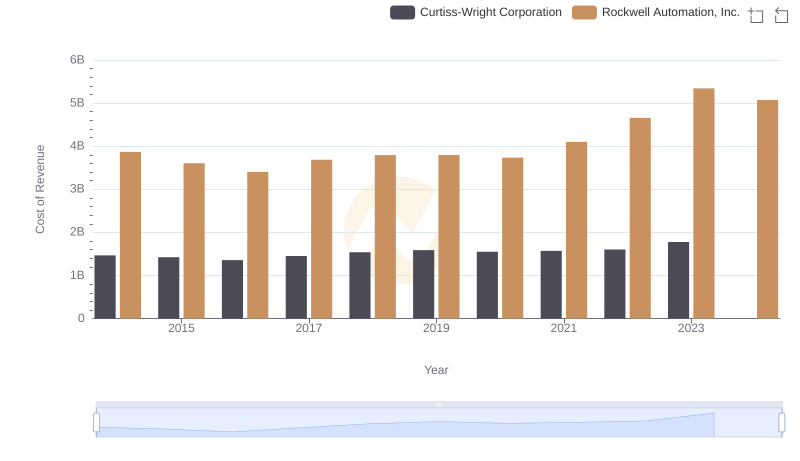

Cost of Revenue Trends: Rockwell Automation, Inc. vs Curtiss-Wright Corporation

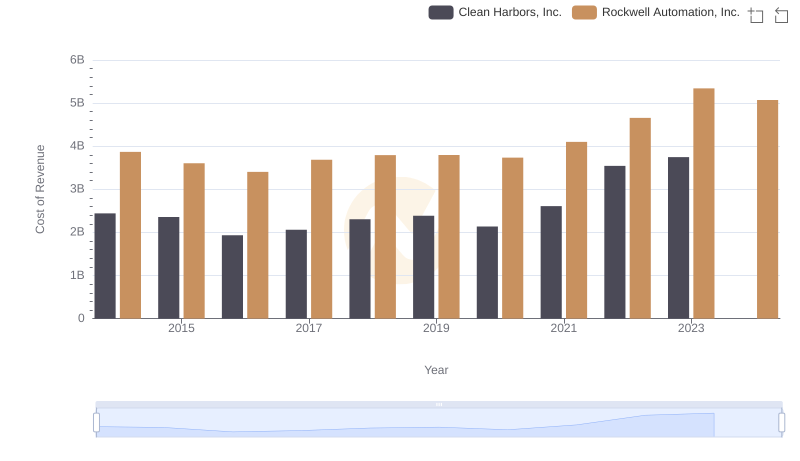

Comparing Cost of Revenue Efficiency: Rockwell Automation, Inc. vs Clean Harbors, Inc.

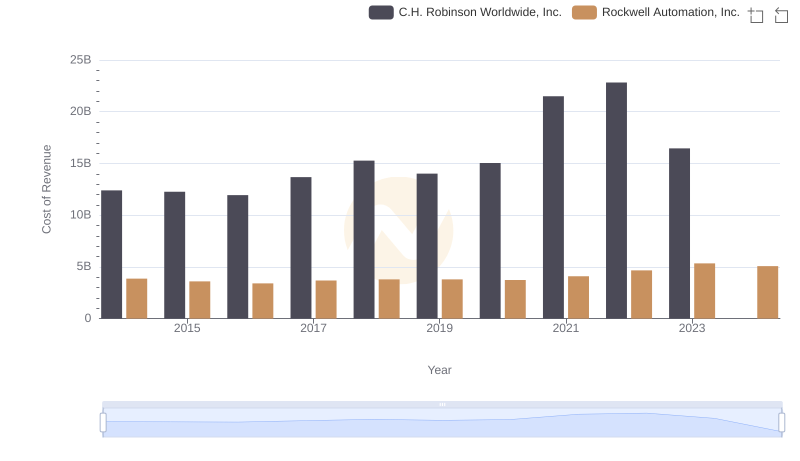

Analyzing Cost of Revenue: Rockwell Automation, Inc. and C.H. Robinson Worldwide, Inc.

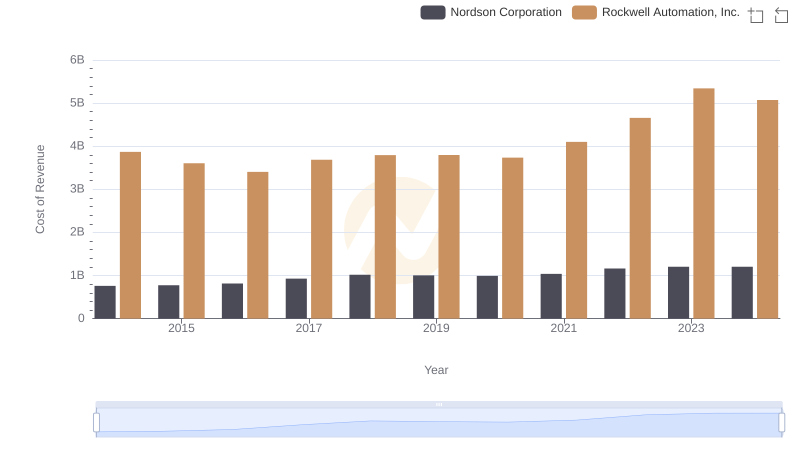

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Nordson Corporation

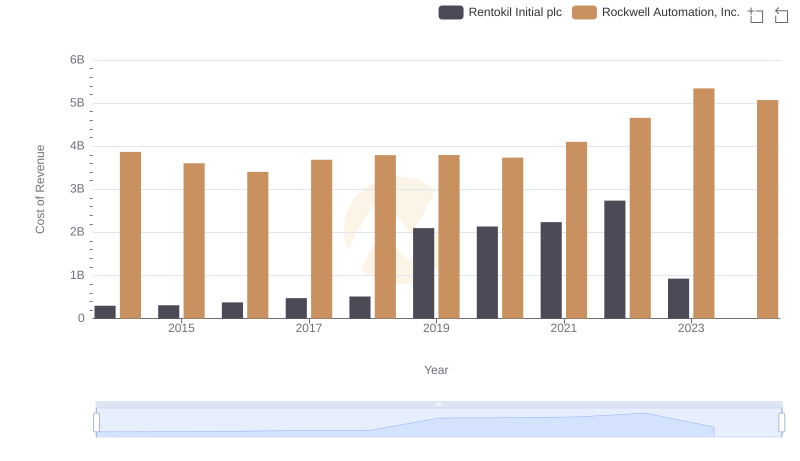

Cost Insights: Breaking Down Rockwell Automation, Inc. and Rentokil Initial plc's Expenses

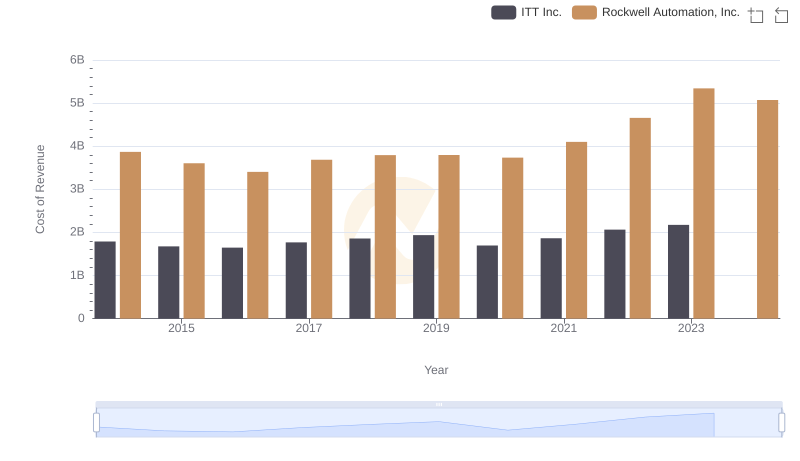

Cost of Revenue Trends: Rockwell Automation, Inc. vs ITT Inc.

Cost of Revenue Comparison: Rockwell Automation, Inc. vs Allegion plc

Rockwell Automation, Inc. vs American Airlines Group Inc.: SG&A Expense Trends