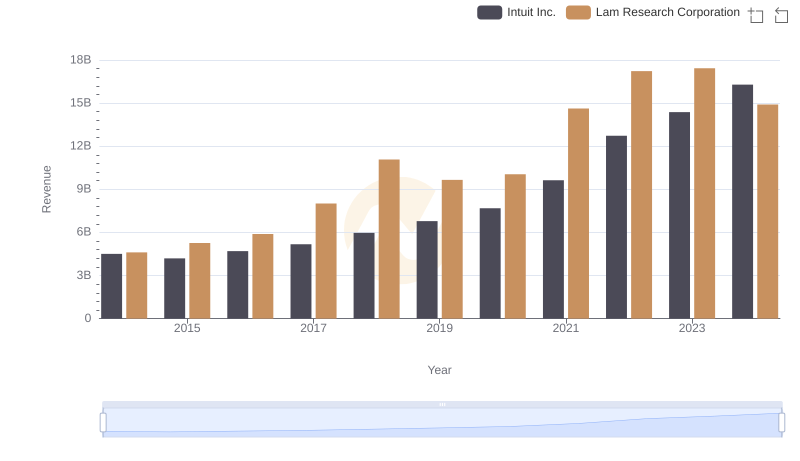

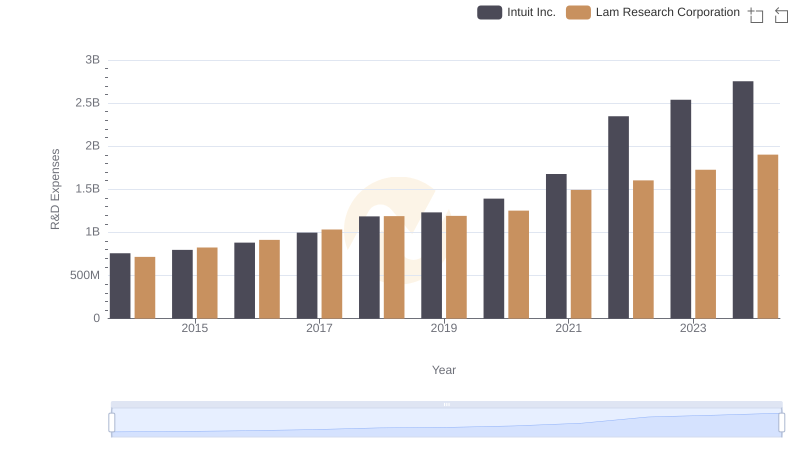

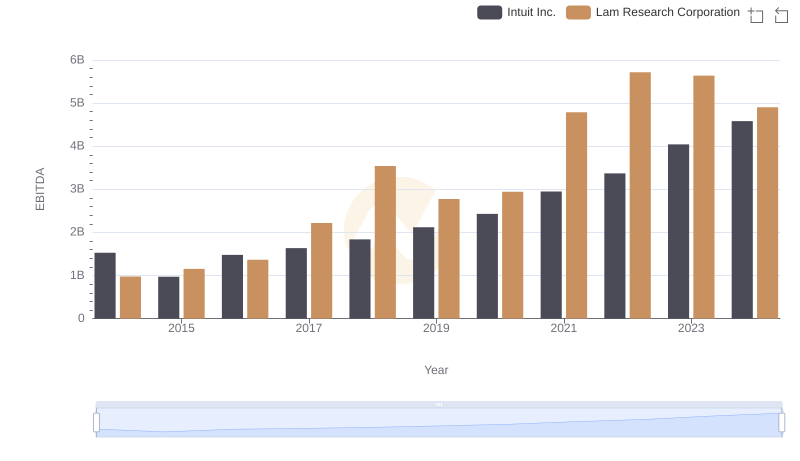

| __timestamp | Intuit Inc. | Lam Research Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 2007481000 |

| Thursday, January 1, 2015 | 3467000000 | 2284336000 |

| Friday, January 1, 2016 | 3942000000 | 2618922000 |

| Sunday, January 1, 2017 | 4368000000 | 3603359000 |

| Monday, January 1, 2018 | 4987000000 | 5165032000 |

| Tuesday, January 1, 2019 | 5617000000 | 4358459000 |

| Wednesday, January 1, 2020 | 6301000000 | 4608693000 |

| Friday, January 1, 2021 | 7950000000 | 6805306000 |

| Saturday, January 1, 2022 | 10320000000 | 7871807000 |

| Sunday, January 1, 2023 | 11225000000 | 7776925000 |

| Monday, January 1, 2024 | 12820000000 | 7052791000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology and finance, Intuit Inc. and Lam Research Corporation have demonstrated remarkable growth over the past decade. From 2014 to 2024, Intuit's gross profit surged by approximately 234%, reflecting its robust expansion in financial software solutions. Meanwhile, Lam Research, a key player in semiconductor manufacturing, saw its gross profit grow by nearly 251% during the same period, underscoring its pivotal role in the tech industry.

This comparison not only showcases the dynamic growth trajectories of these industry giants but also reflects broader trends in technology and finance.

Revenue Insights: Intuit Inc. and Lam Research Corporation Performance Compared

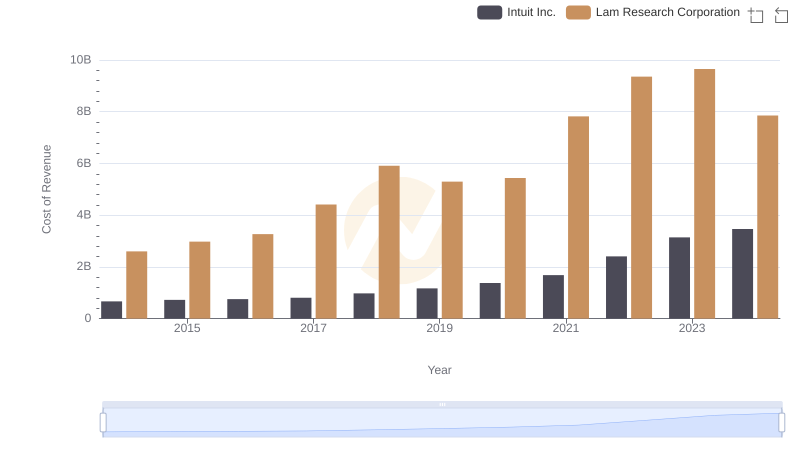

Analyzing Cost of Revenue: Intuit Inc. and Lam Research Corporation

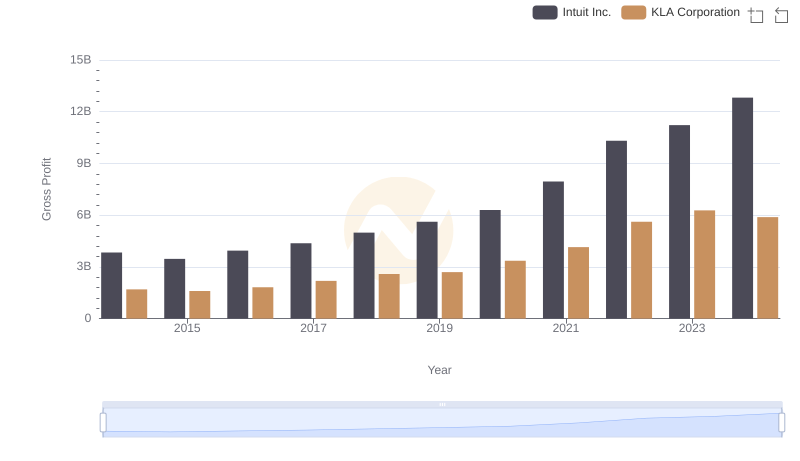

Intuit Inc. and KLA Corporation: A Detailed Gross Profit Analysis

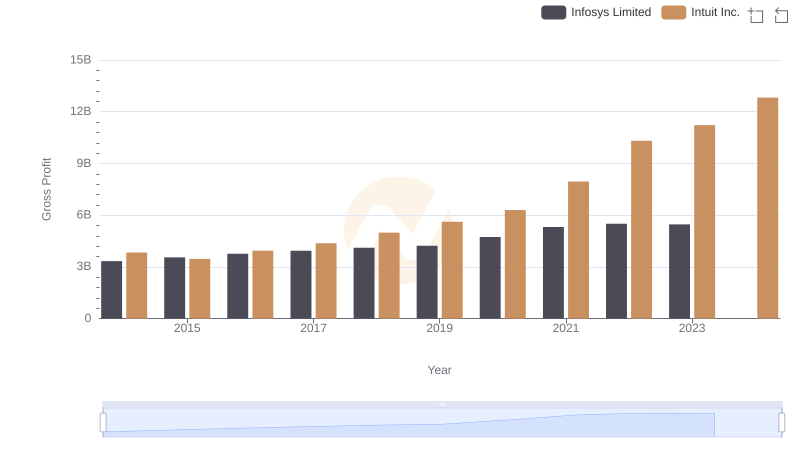

Gross Profit Trends Compared: Intuit Inc. vs Infosys Limited

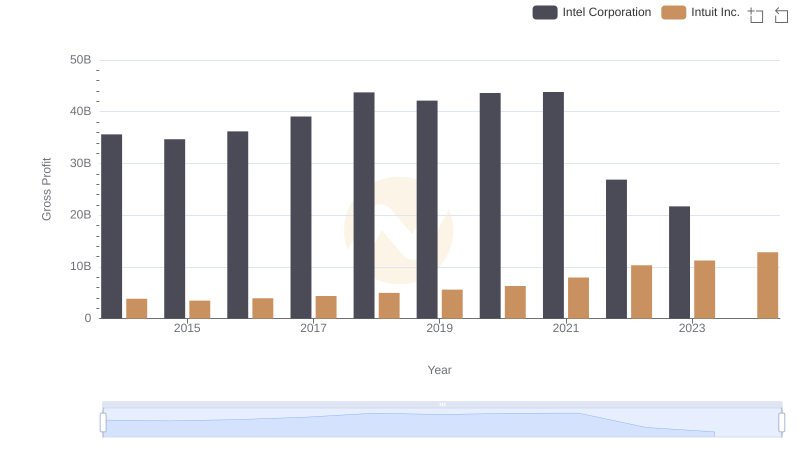

Intuit Inc. vs Intel Corporation: A Gross Profit Performance Breakdown

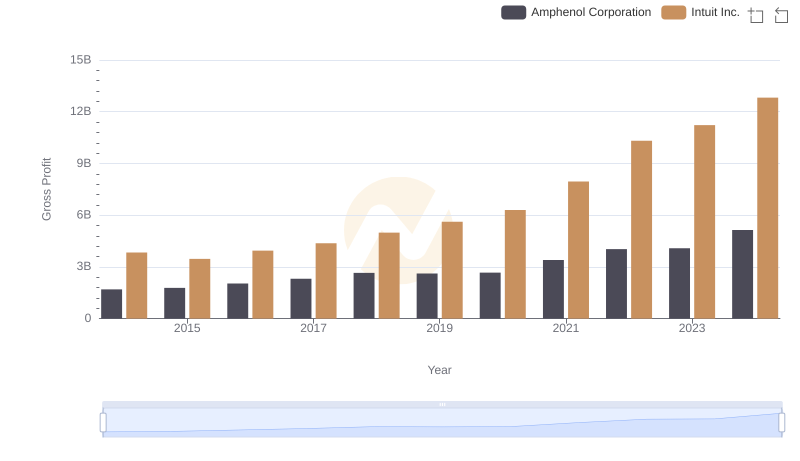

Gross Profit Analysis: Comparing Intuit Inc. and Amphenol Corporation

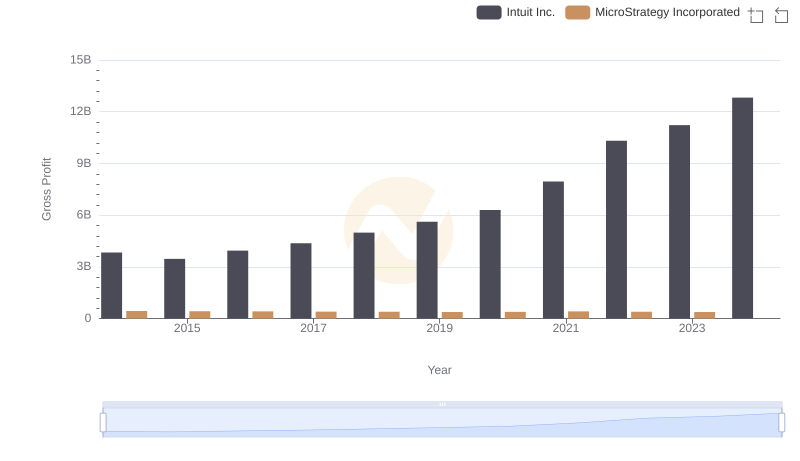

Gross Profit Comparison: Intuit Inc. and MicroStrategy Incorporated Trends

Analyzing R&D Budgets: Intuit Inc. vs Lam Research Corporation

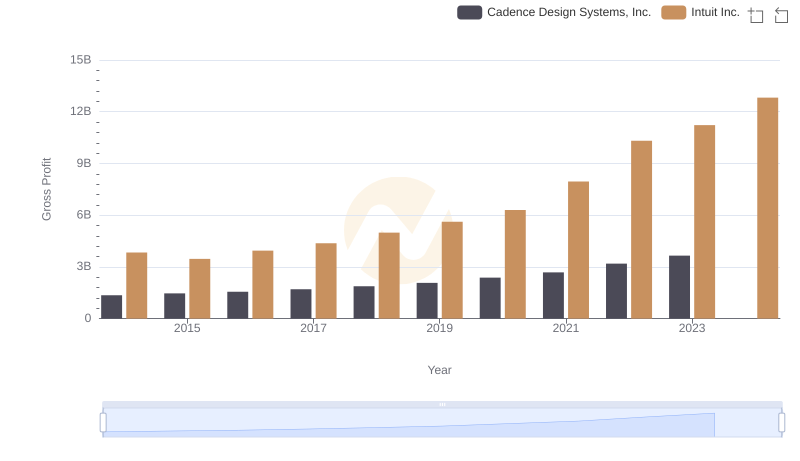

Key Insights on Gross Profit: Intuit Inc. vs Cadence Design Systems, Inc.

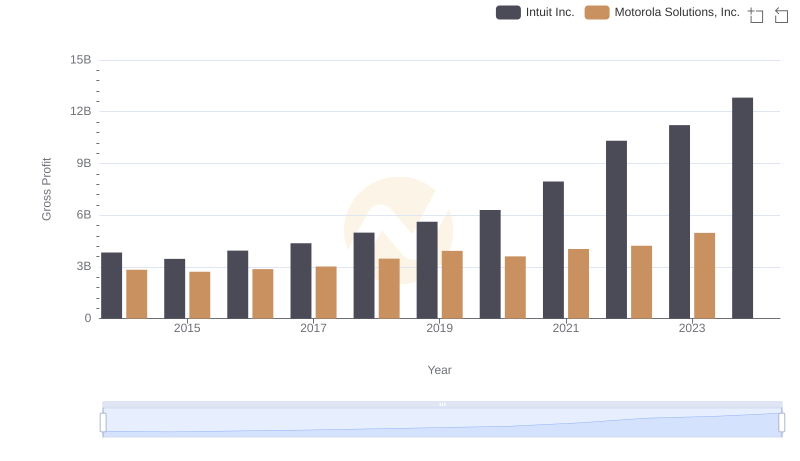

Intuit Inc. and Motorola Solutions, Inc.: A Detailed Gross Profit Analysis

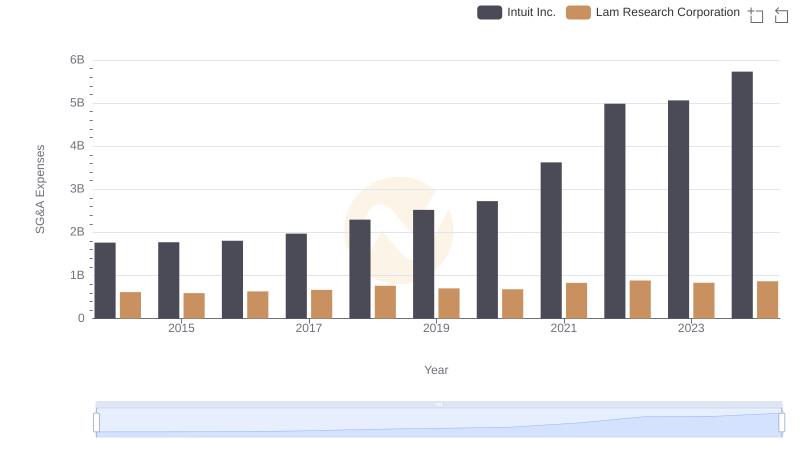

Comparing SG&A Expenses: Intuit Inc. vs Lam Research Corporation Trends and Insights

Intuit Inc. and Lam Research Corporation: A Detailed Examination of EBITDA Performance