| __timestamp | Intuit Inc. | Lam Research Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4506000000 | 4607309000 |

| Thursday, January 1, 2015 | 4192000000 | 5259312000 |

| Friday, January 1, 2016 | 4694000000 | 5885893000 |

| Sunday, January 1, 2017 | 5177000000 | 8013620000 |

| Monday, January 1, 2018 | 5964000000 | 11076998000 |

| Tuesday, January 1, 2019 | 6784000000 | 9653559000 |

| Wednesday, January 1, 2020 | 7679000000 | 10044736000 |

| Friday, January 1, 2021 | 9633000000 | 14626150000 |

| Saturday, January 1, 2022 | 12726000000 | 17227039000 |

| Sunday, January 1, 2023 | 14368000000 | 17428516000 |

| Monday, January 1, 2024 | 16285000000 | 14905386000 |

Unleashing insights

In the ever-evolving landscape of technology and finance, Intuit Inc. and Lam Research Corporation have emerged as significant players. Over the past decade, both companies have demonstrated impressive revenue growth, with Intuit's revenue increasing by approximately 260% from 2014 to 2024, and Lam Research showing a similar upward trajectory with a 220% increase.

Starting in 2014, Intuit Inc. reported revenues of around $4.5 billion, while Lam Research was slightly ahead at $4.6 billion. Fast forward to 2024, and Intuit's revenue has surged to $16.3 billion, surpassing Lam Research's $14.9 billion. This growth reflects a compound annual growth rate (CAGR) of about 14% for Intuit and 13% for Lam Research, underscoring their strategic adaptability and market resilience.

The data highlights a pivotal shift in market dynamics, with Intuit's revenue surpassing Lam Research in recent years, indicating a robust expansion strategy. As both companies continue to innovate, their financial trajectories offer valuable insights into the broader tech and finance sectors.

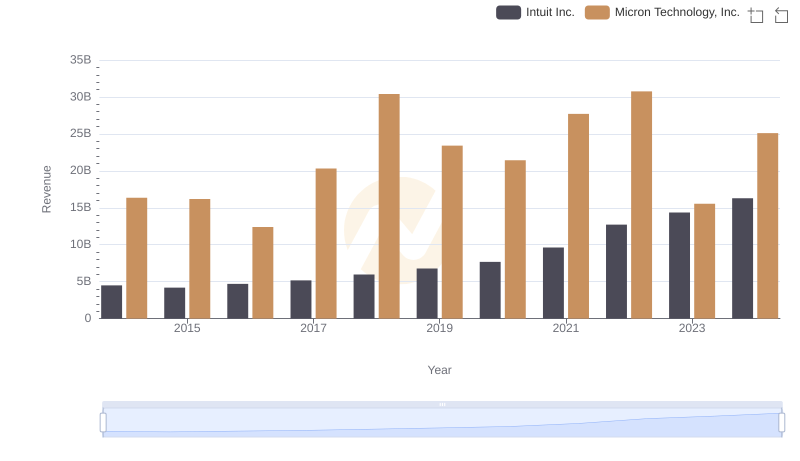

Breaking Down Revenue Trends: Intuit Inc. vs Micron Technology, Inc.

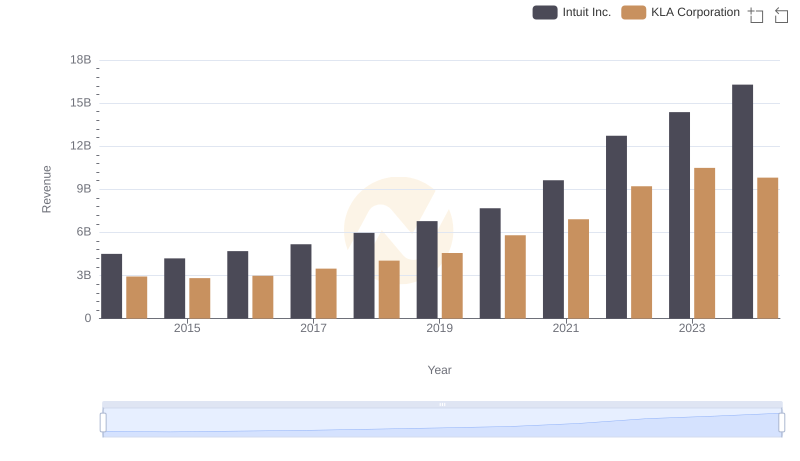

Revenue Showdown: Intuit Inc. vs KLA Corporation

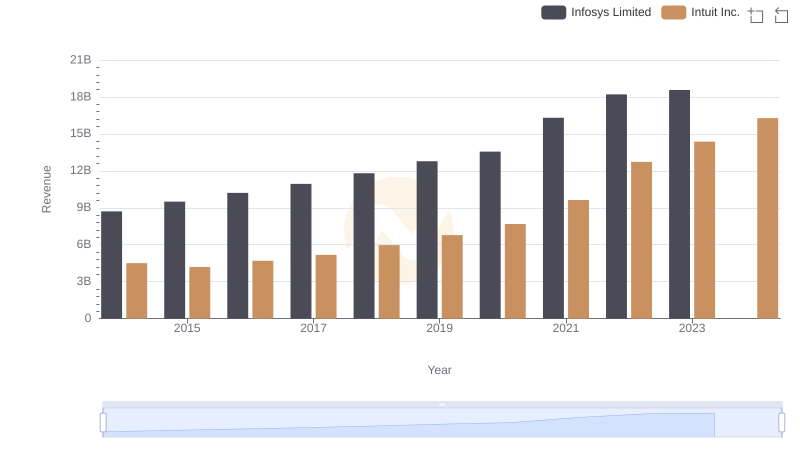

Revenue Showdown: Intuit Inc. vs Infosys Limited

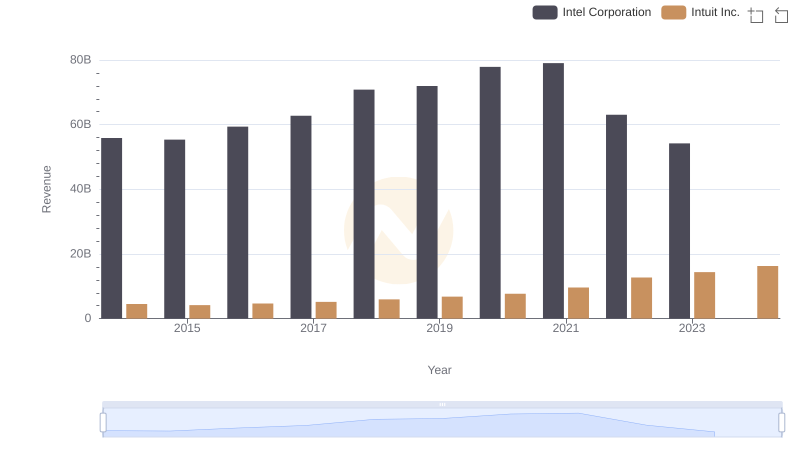

Breaking Down Revenue Trends: Intuit Inc. vs Intel Corporation

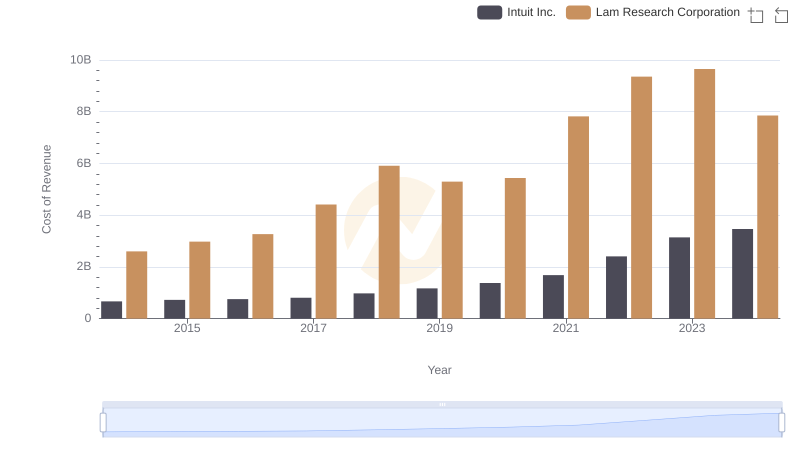

Analyzing Cost of Revenue: Intuit Inc. and Lam Research Corporation

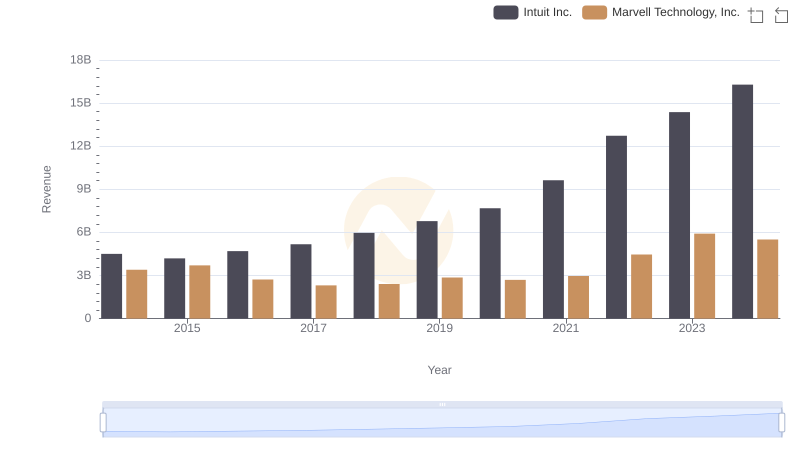

Intuit Inc. vs Marvell Technology, Inc.: Annual Revenue Growth Compared

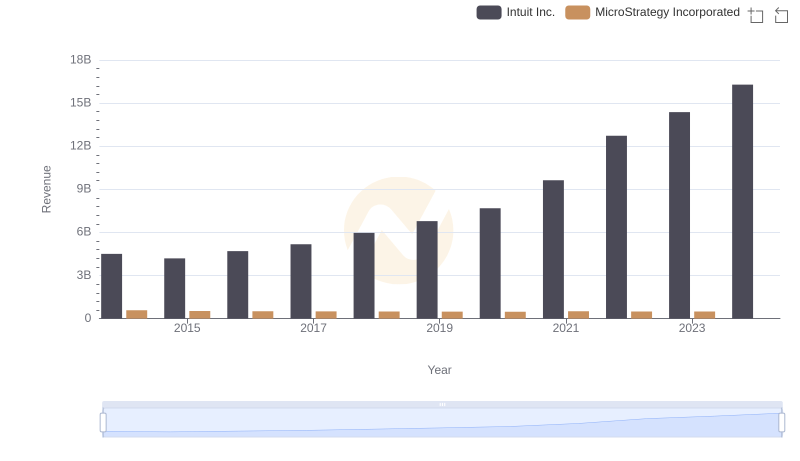

Revenue Showdown: Intuit Inc. vs MicroStrategy Incorporated

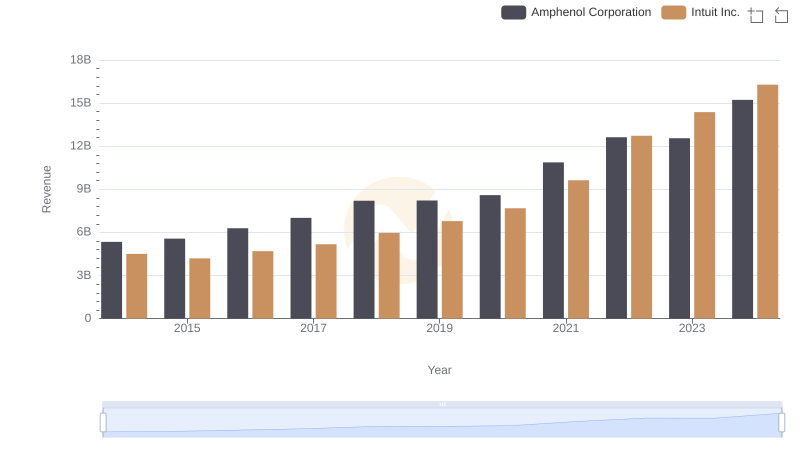

Revenue Insights: Intuit Inc. and Amphenol Corporation Performance Compared

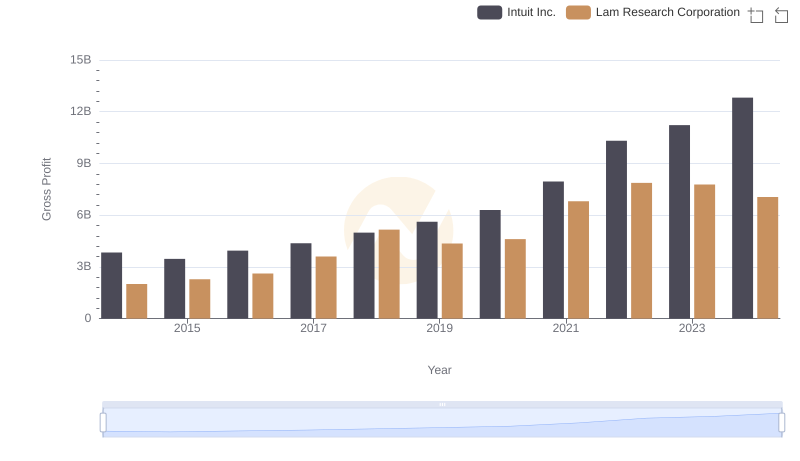

Gross Profit Comparison: Intuit Inc. and Lam Research Corporation Trends

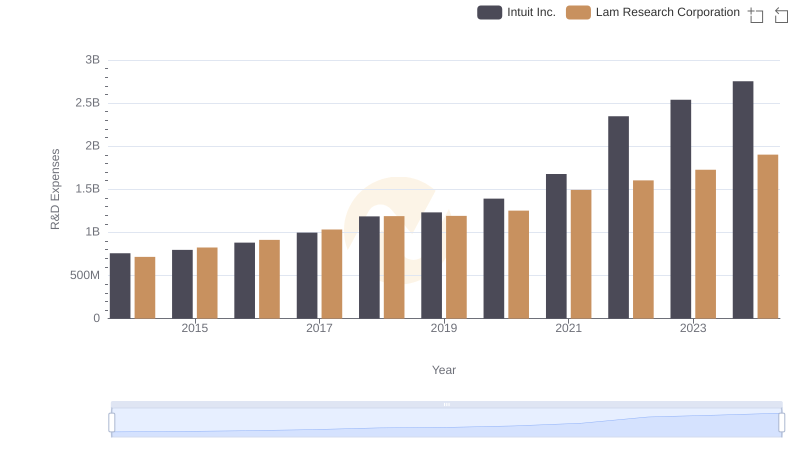

Analyzing R&D Budgets: Intuit Inc. vs Lam Research Corporation

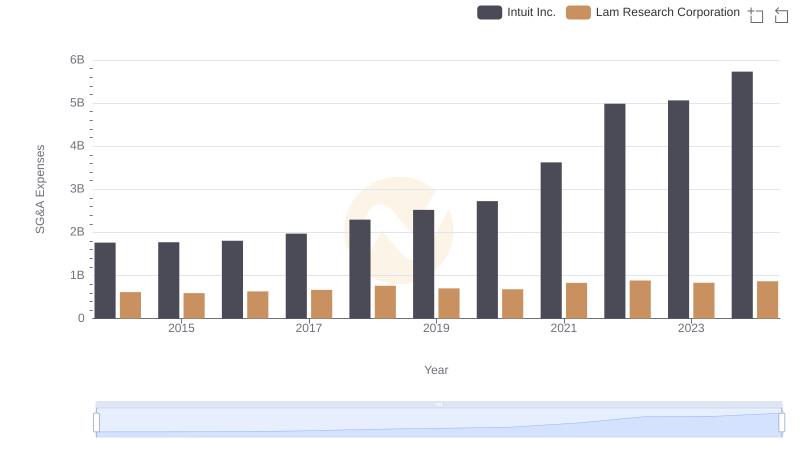

Comparing SG&A Expenses: Intuit Inc. vs Lam Research Corporation Trends and Insights

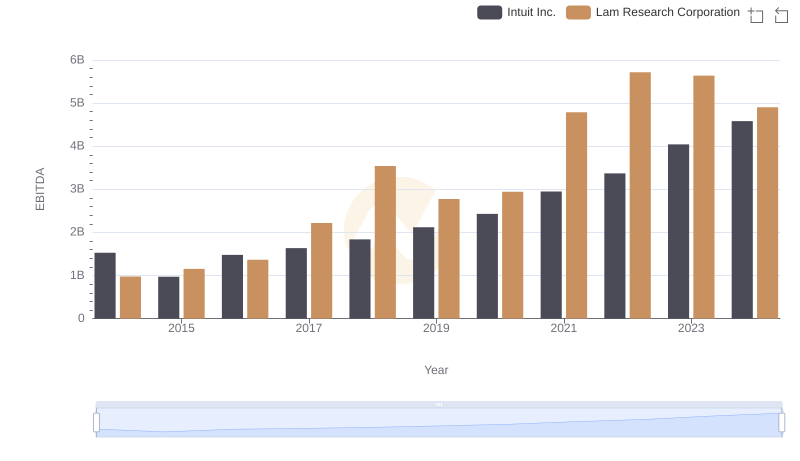

Intuit Inc. and Lam Research Corporation: A Detailed Examination of EBITDA Performance