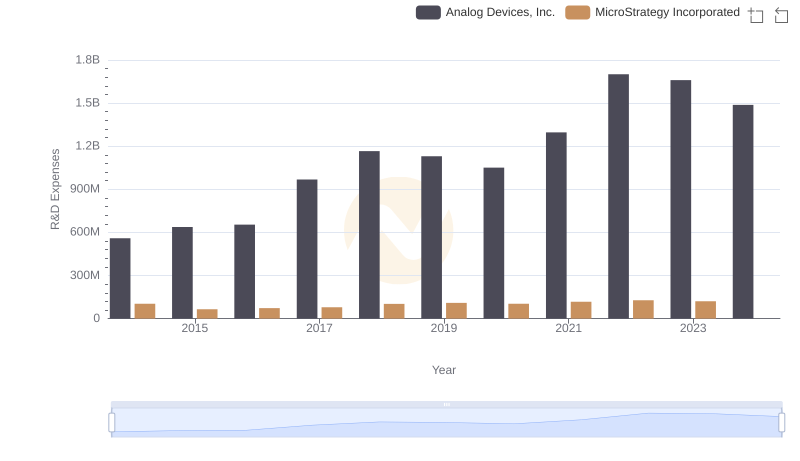

| __timestamp | Analog Devices, Inc. | MicroStrategy Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 321429000 |

| Thursday, January 1, 2015 | 478972000 | 229254000 |

| Friday, January 1, 2016 | 461438000 | 238202000 |

| Sunday, January 1, 2017 | 691046000 | 254773000 |

| Monday, January 1, 2018 | 695937000 | 291659000 |

| Tuesday, January 1, 2019 | 648094000 | 277932000 |

| Wednesday, January 1, 2020 | 659923000 | 229046000 |

| Friday, January 1, 2021 | 915418000 | 255642000 |

| Saturday, January 1, 2022 | 1266175000 | 258303000 |

| Sunday, January 1, 2023 | 1273584000 | 264983000 |

| Monday, January 1, 2024 | 1068640000 | 278618000 |

Unleashing the power of data

In the ever-evolving landscape of technology, understanding the financial strategies of industry leaders is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Analog Devices, Inc. and MicroStrategy Incorporated from 2014 to 2023. Over this decade, Analog Devices has seen a significant increase in SG&A expenses, peaking at approximately 1.27 billion in 2023, a 180% rise from 2014. In contrast, MicroStrategy's expenses have remained relatively stable, fluctuating around 260 million in recent years.

This divergence highlights differing strategic priorities: Analog Devices appears to be investing heavily in growth and expansion, while MicroStrategy maintains a more conservative approach. Notably, the data for 2024 is incomplete, suggesting a need for further analysis as new information becomes available. This financial narrative underscores the dynamic nature of corporate strategy in the tech sector.

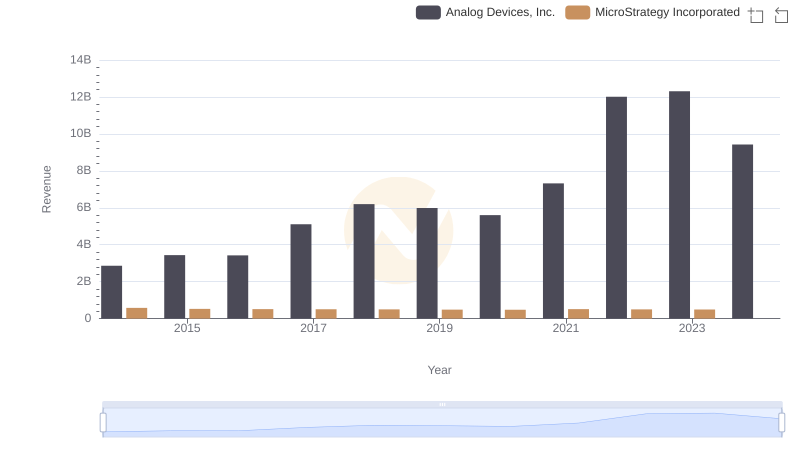

Who Generates More Revenue? Analog Devices, Inc. or MicroStrategy Incorporated

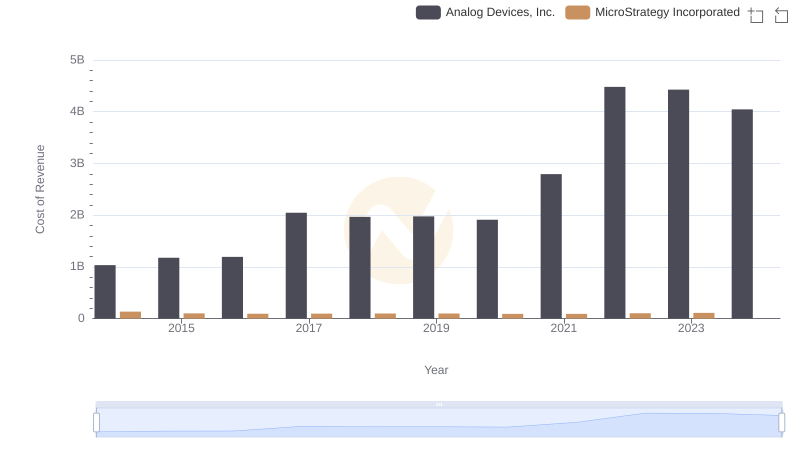

Cost of Revenue Comparison: Analog Devices, Inc. vs MicroStrategy Incorporated

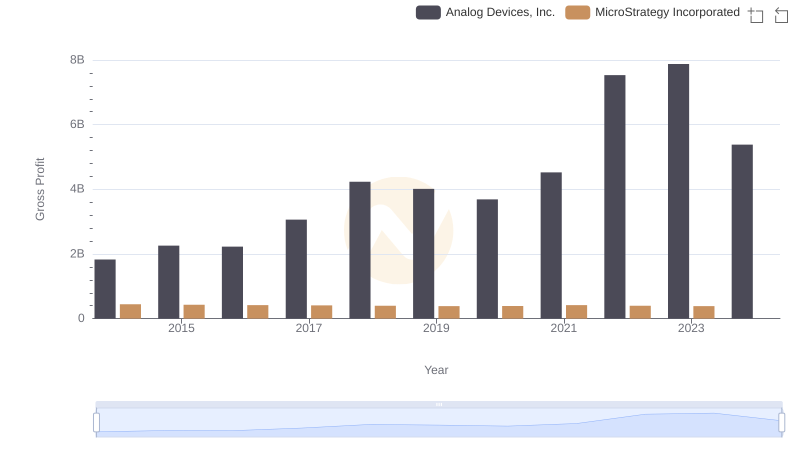

Gross Profit Comparison: Analog Devices, Inc. and MicroStrategy Incorporated Trends

Comparing Innovation Spending: Analog Devices, Inc. and MicroStrategy Incorporated

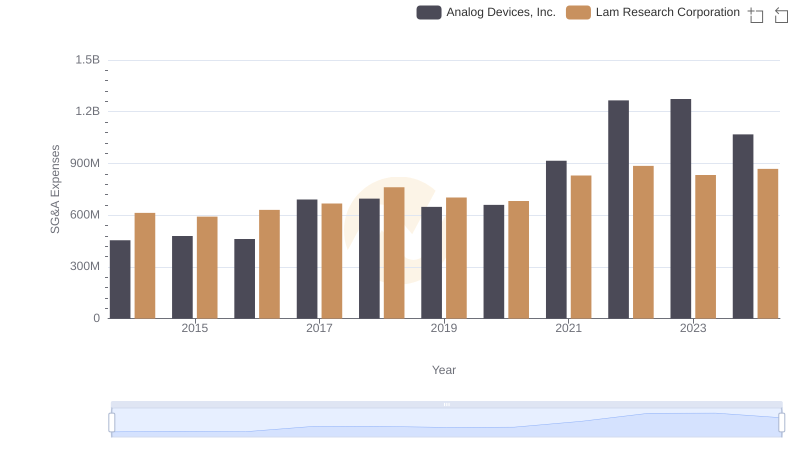

Analog Devices, Inc. or Lam Research Corporation: Who Manages SG&A Costs Better?

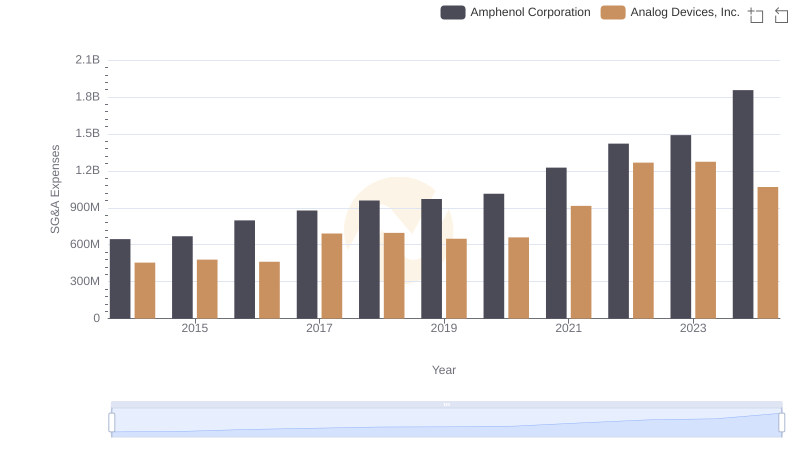

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Amphenol Corporation

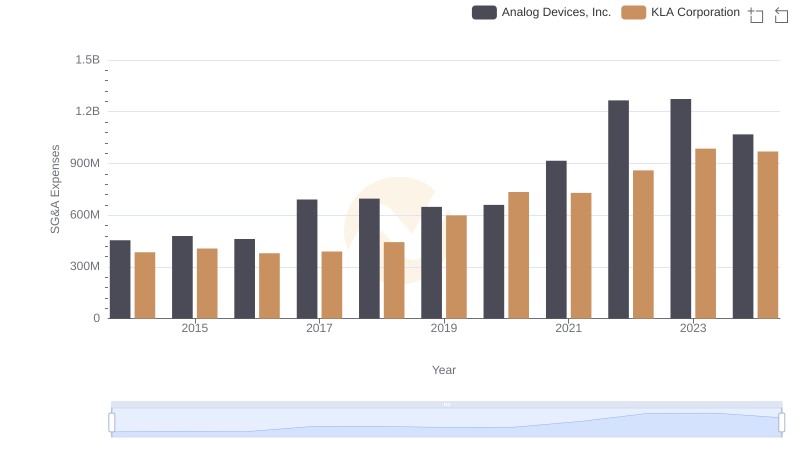

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or KLA Corporation

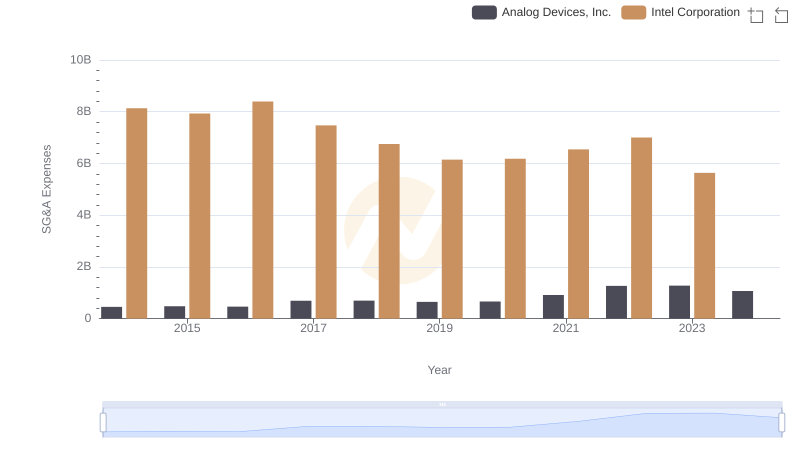

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Intel Corporation

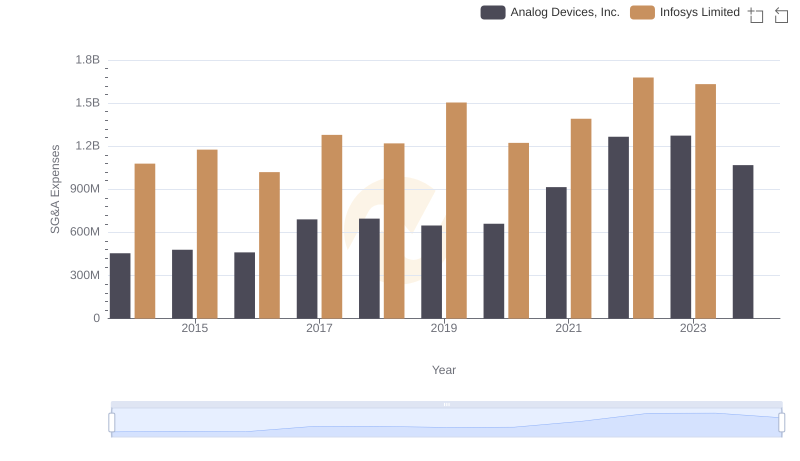

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Infosys Limited

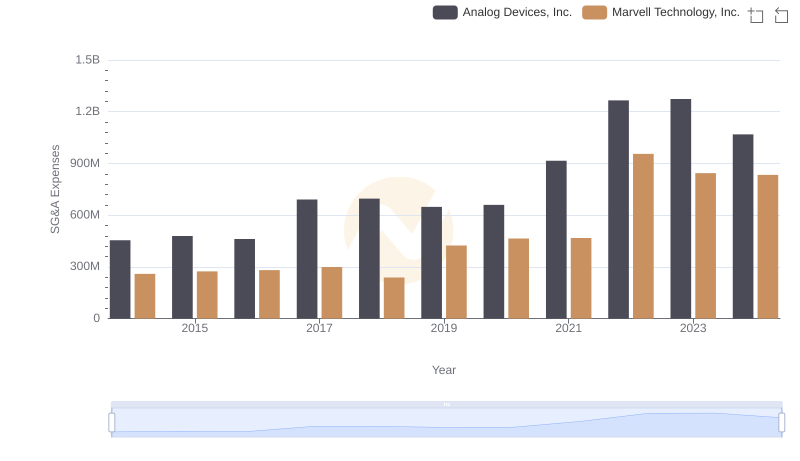

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.

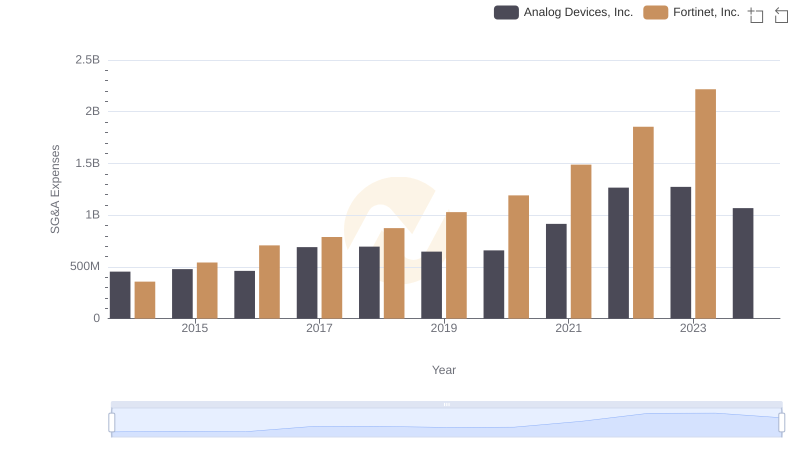

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.

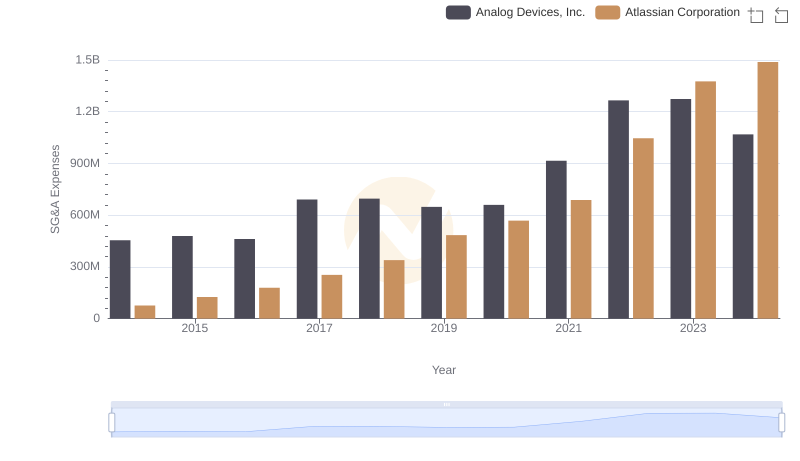

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Atlassian Corporation