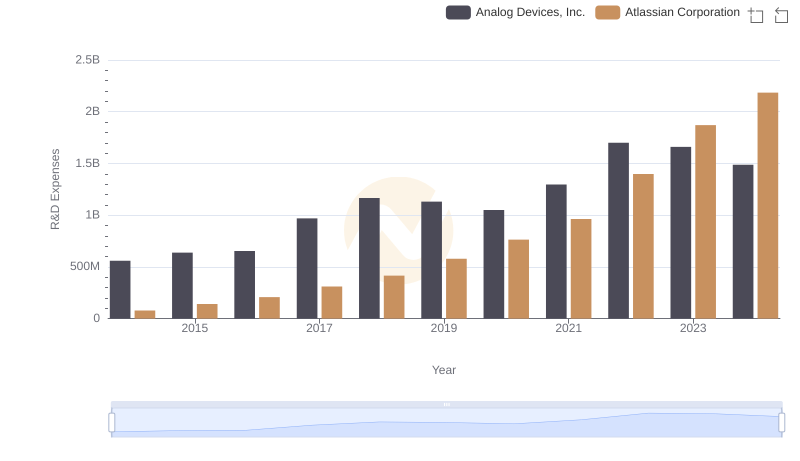

| __timestamp | Analog Devices, Inc. | Atlassian Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 75782000 |

| Thursday, January 1, 2015 | 478972000 | 125319000 |

| Friday, January 1, 2016 | 461438000 | 178849000 |

| Sunday, January 1, 2017 | 691046000 | 253693000 |

| Monday, January 1, 2018 | 695937000 | 339232000 |

| Tuesday, January 1, 2019 | 648094000 | 484070000 |

| Wednesday, January 1, 2020 | 659923000 | 568092000 |

| Friday, January 1, 2021 | 915418000 | 688151000 |

| Saturday, January 1, 2022 | 1266175000 | 1046064000 |

| Sunday, January 1, 2023 | 1273584000 | 1376223000 |

| Monday, January 1, 2024 | 1068640000 | 1488074000 |

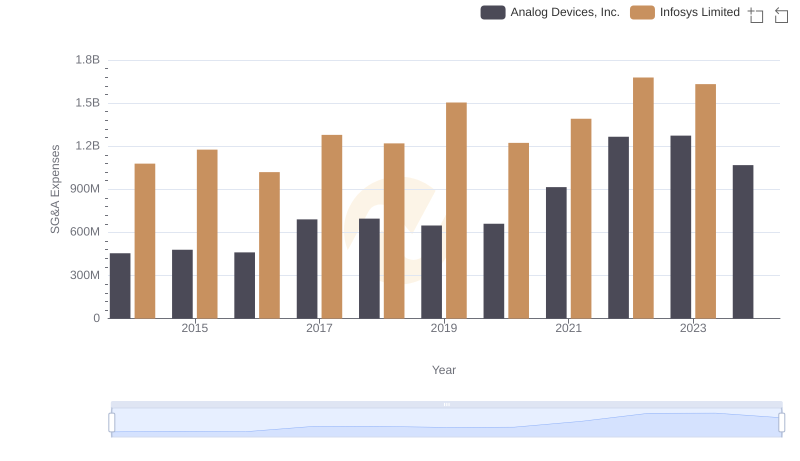

Igniting the spark of knowledge

In the ever-evolving landscape of technology, understanding the financial strategies of industry leaders is crucial. This chart offers a fascinating glimpse into the Selling, General, and Administrative (SG&A) expenses of two tech giants: Analog Devices, Inc. and Atlassian Corporation, from 2014 to 2024.

Analog Devices, Inc., a stalwart in the semiconductor industry, has seen its SG&A expenses grow steadily, peaking in 2023 with a 180% increase from 2014. Meanwhile, Atlassian Corporation, a leader in software development tools, has experienced a staggering 1,860% rise in SG&A expenses over the same period, reflecting its aggressive growth strategy.

By 2023, Atlassian's SG&A expenses surpassed those of Analog Devices, highlighting its rapid expansion and investment in market presence. This data underscores the contrasting approaches of these companies: Analog Devices' steady growth versus Atlassian's dynamic expansion.

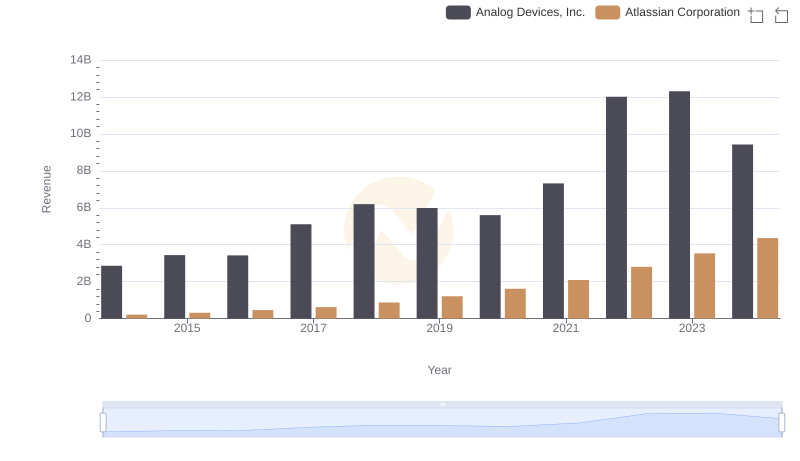

Revenue Showdown: Analog Devices, Inc. vs Atlassian Corporation

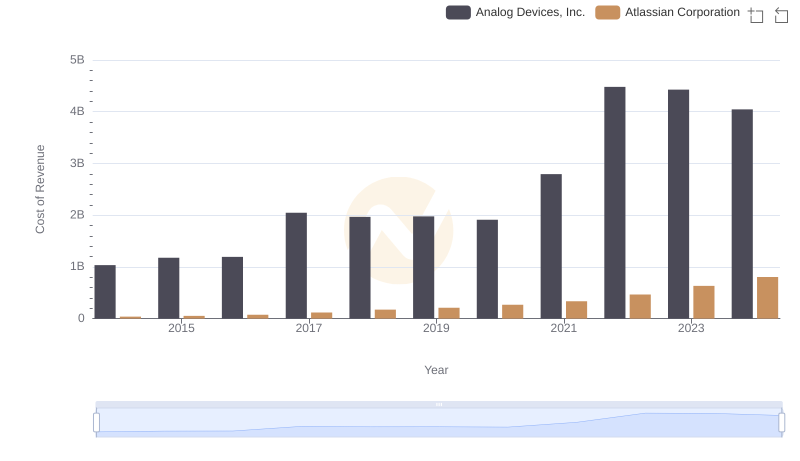

Cost Insights: Breaking Down Analog Devices, Inc. and Atlassian Corporation's Expenses

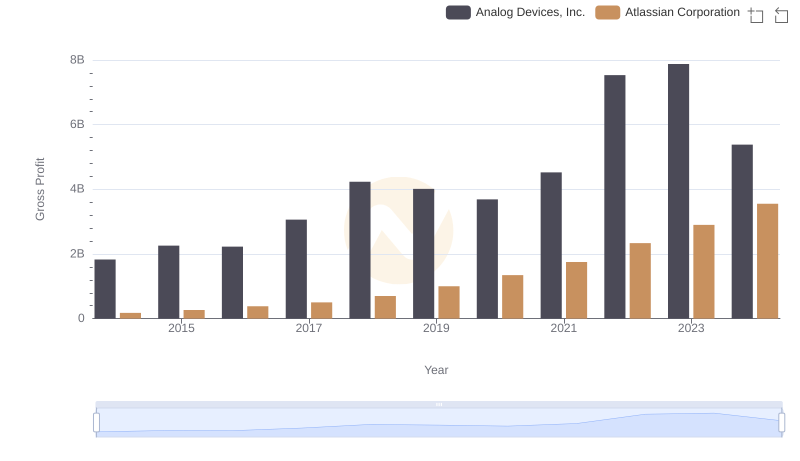

Gross Profit Analysis: Comparing Analog Devices, Inc. and Atlassian Corporation

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Infosys Limited

R&D Insights: How Analog Devices, Inc. and Atlassian Corporation Allocate Funds

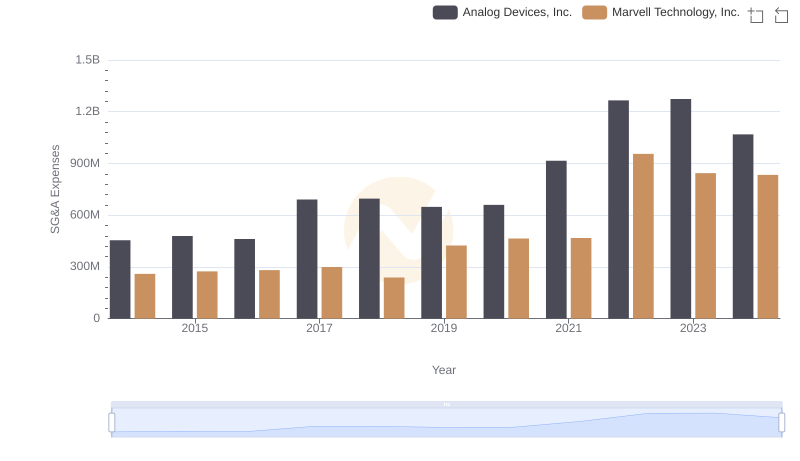

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.

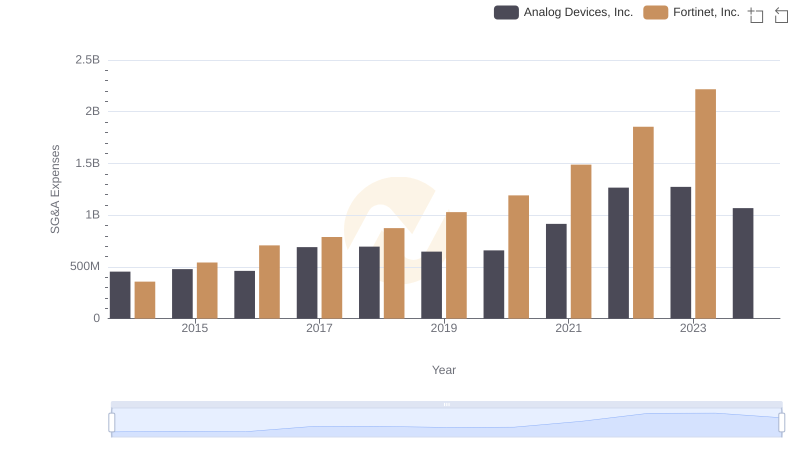

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.

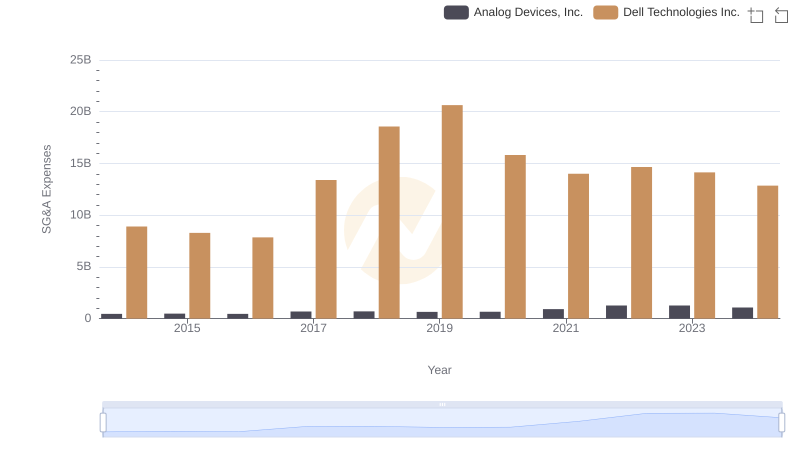

Breaking Down SG&A Expenses: Analog Devices, Inc. vs Dell Technologies Inc.

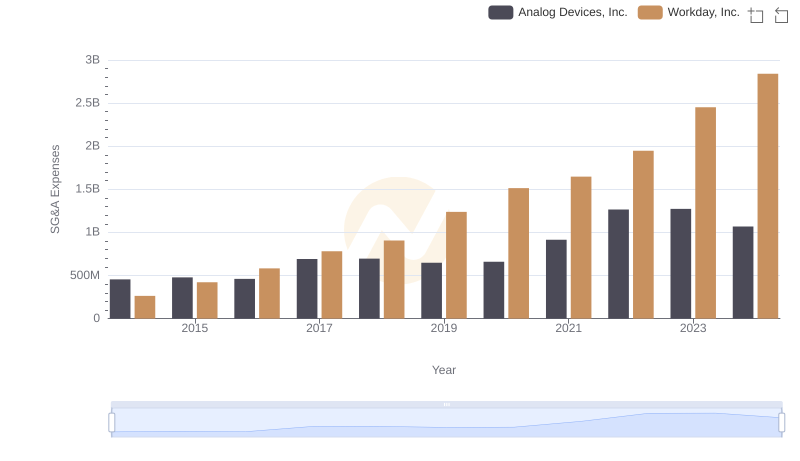

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Workday, Inc.

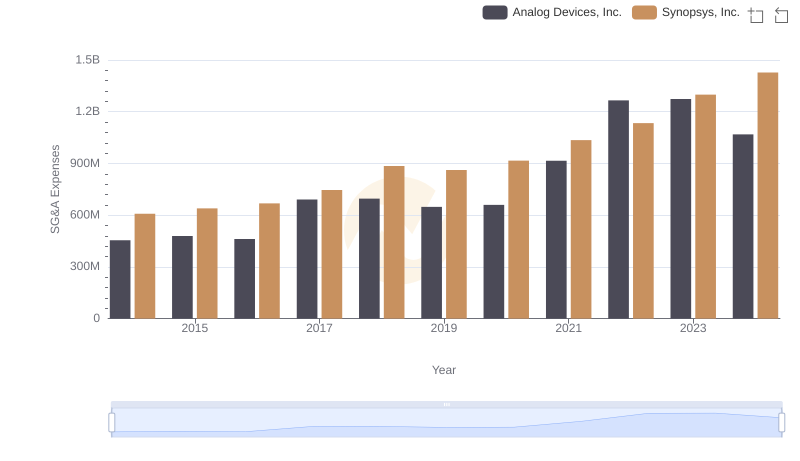

Analog Devices, Inc. vs Synopsys, Inc.: SG&A Expense Trends

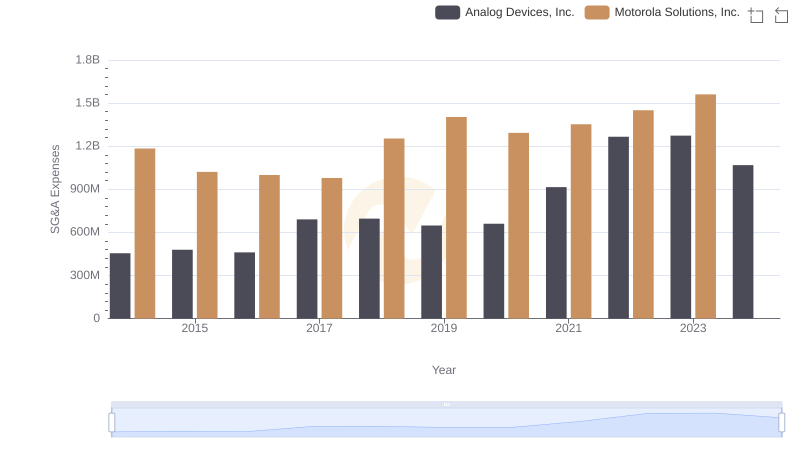

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Motorola Solutions, Inc.

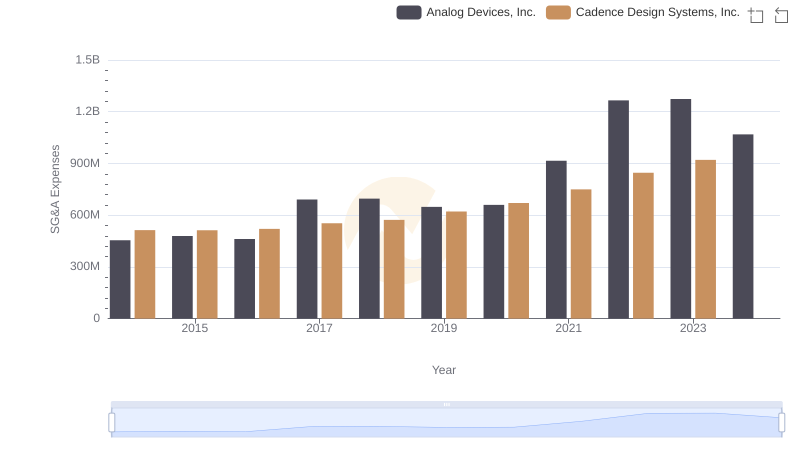

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or Cadence Design Systems, Inc.