| __timestamp | Analog Devices, Inc. | Marvell Technology, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 259169000 |

| Thursday, January 1, 2015 | 478972000 | 273982000 |

| Friday, January 1, 2016 | 461438000 | 280970000 |

| Sunday, January 1, 2017 | 691046000 | 299727000 |

| Monday, January 1, 2018 | 695937000 | 238166000 |

| Tuesday, January 1, 2019 | 648094000 | 424360000 |

| Wednesday, January 1, 2020 | 659923000 | 464580000 |

| Friday, January 1, 2021 | 915418000 | 467240000 |

| Saturday, January 1, 2022 | 1266175000 | 955245000 |

| Sunday, January 1, 2023 | 1273584000 | 843600000 |

| Monday, January 1, 2024 | 1068640000 | 834000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology, understanding the financial efficiency of companies is crucial. Over the past decade, Analog Devices, Inc. and Marvell Technology, Inc. have showcased distinct trajectories in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2024, Analog Devices saw a staggering 180% increase in SG&A expenses, peaking in 2023. In contrast, Marvell Technology's expenses grew by approximately 220%, with a notable surge in 2022. This divergence highlights the strategic differences in managing operational costs. While Analog Devices maintained a steady growth, Marvell's expenses fluctuated, reflecting its dynamic market strategies. As we step into 2024, both companies are poised to redefine their financial strategies, making it an exciting time for investors and analysts alike. Dive deeper into this analysis to uncover the financial narratives shaping the tech industry.

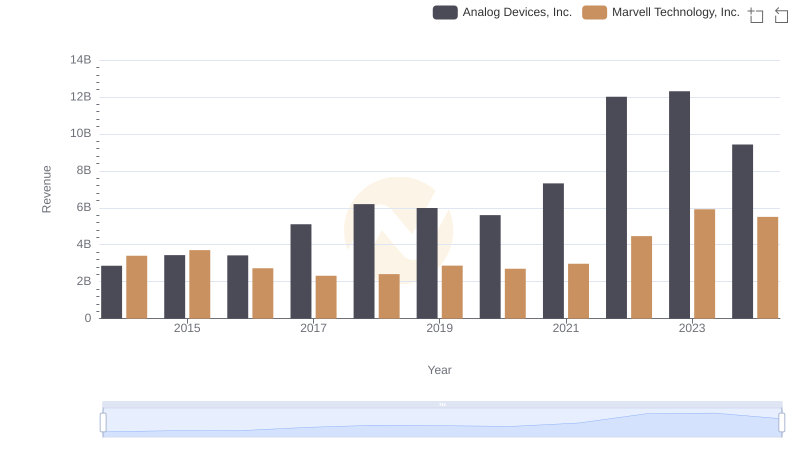

Analog Devices, Inc. vs Marvell Technology, Inc.: Examining Key Revenue Metrics

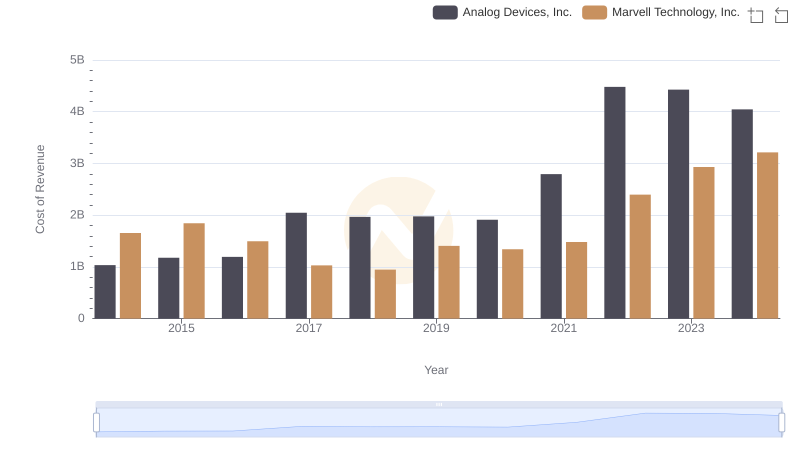

Cost of Revenue Comparison: Analog Devices, Inc. vs Marvell Technology, Inc.

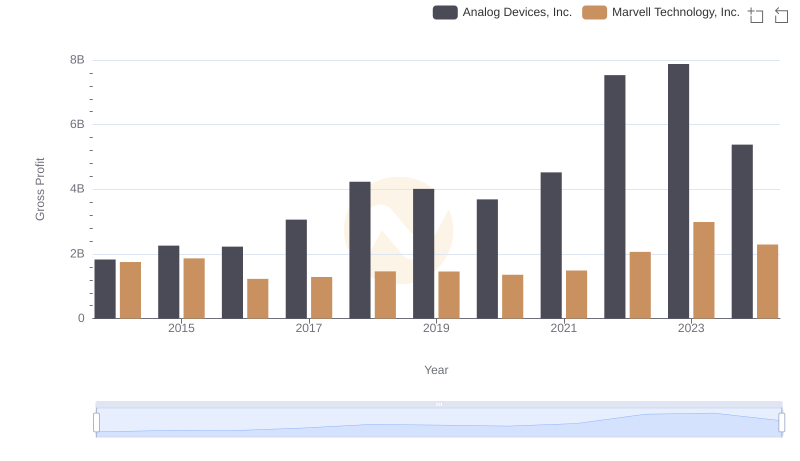

Who Generates Higher Gross Profit? Analog Devices, Inc. or Marvell Technology, Inc.

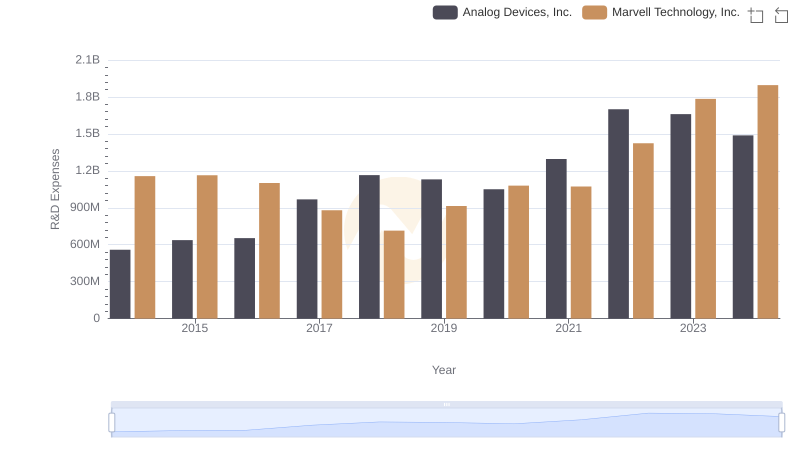

Analyzing R&D Budgets: Analog Devices, Inc. vs Marvell Technology, Inc.

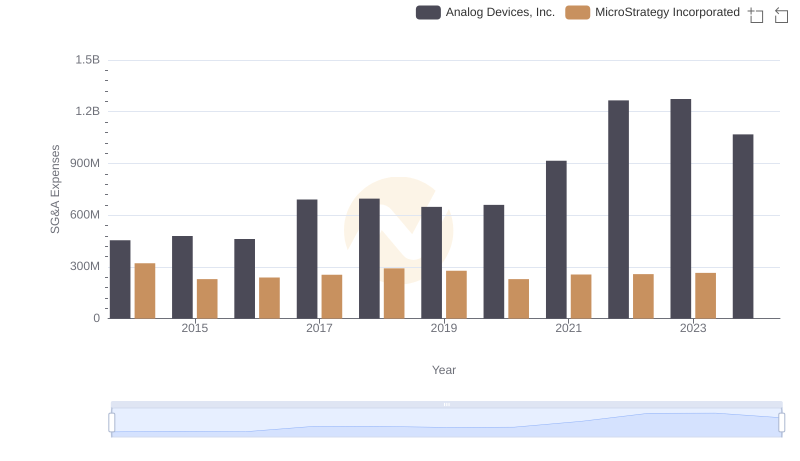

Comparing SG&A Expenses: Analog Devices, Inc. vs MicroStrategy Incorporated Trends and Insights

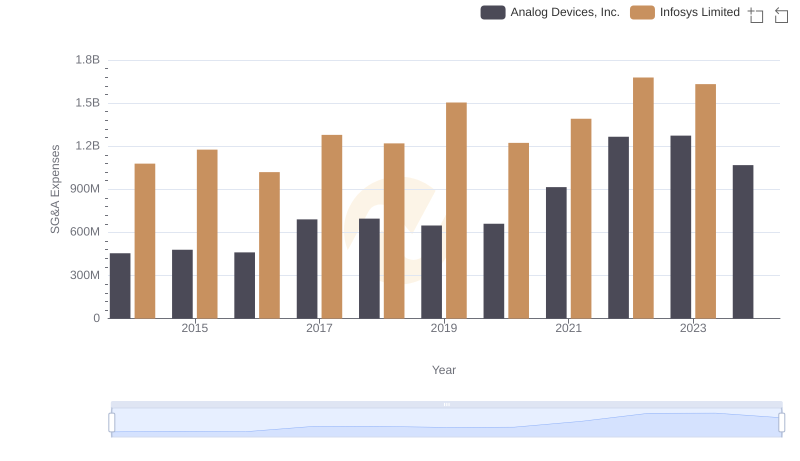

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Infosys Limited

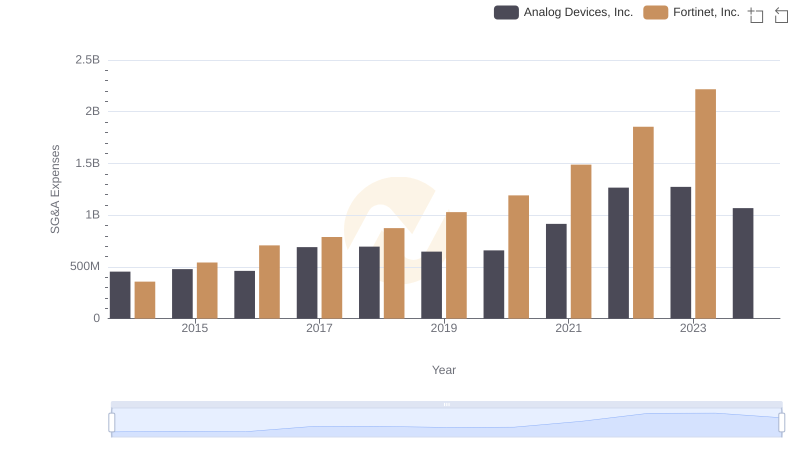

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.

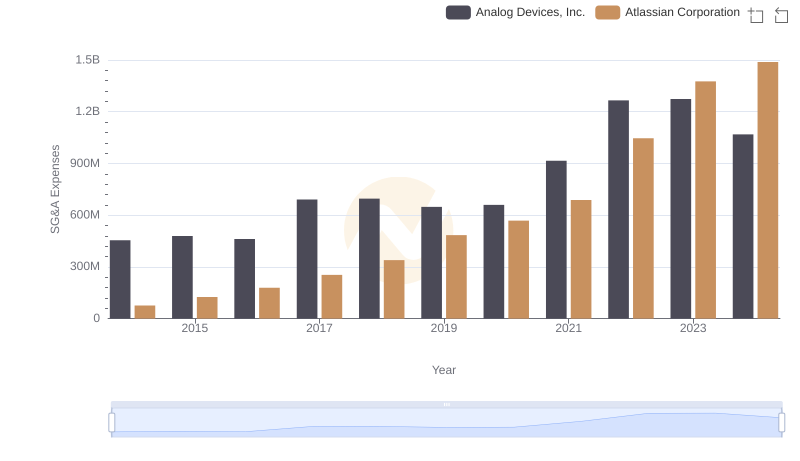

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Atlassian Corporation

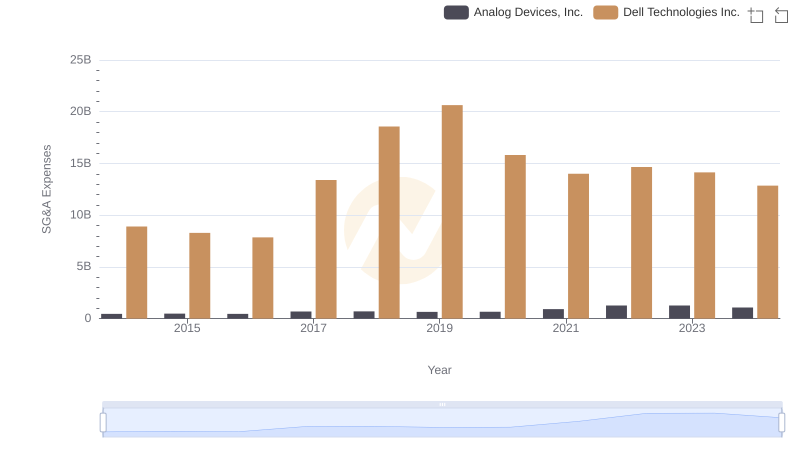

Breaking Down SG&A Expenses: Analog Devices, Inc. vs Dell Technologies Inc.

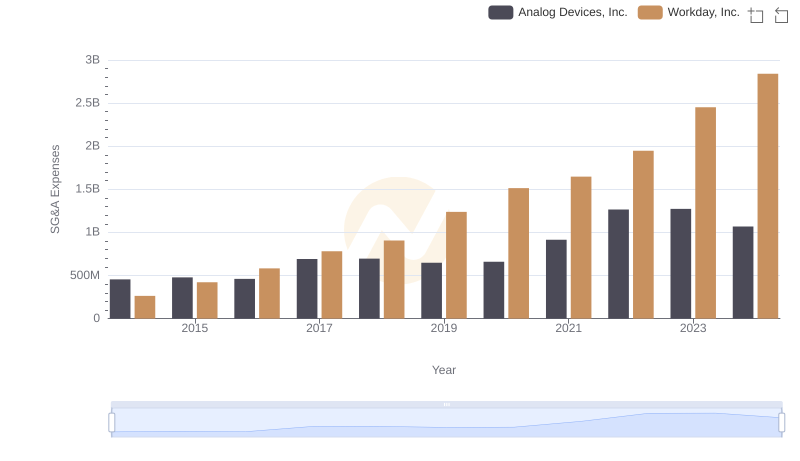

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Workday, Inc.

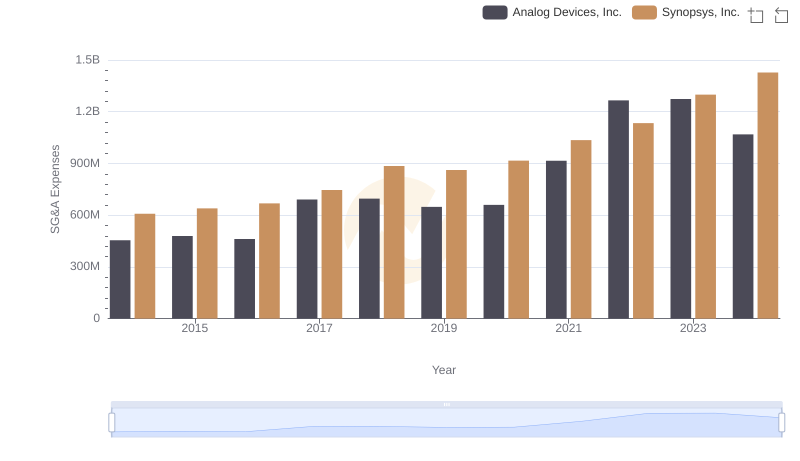

Analog Devices, Inc. vs Synopsys, Inc.: SG&A Expense Trends

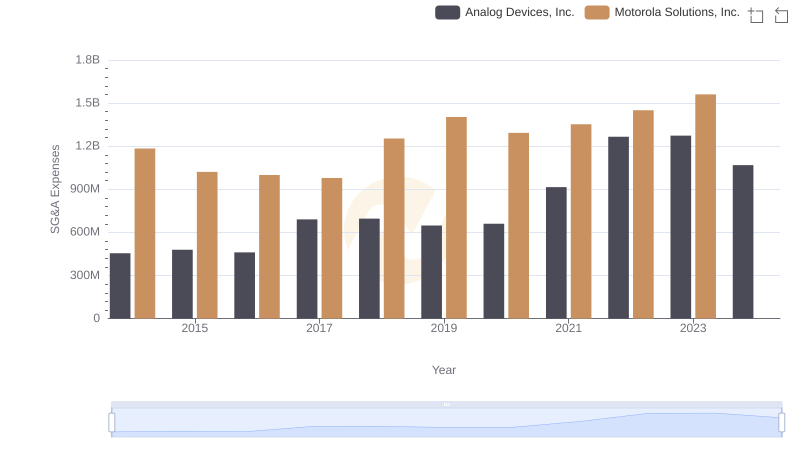

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Motorola Solutions, Inc.