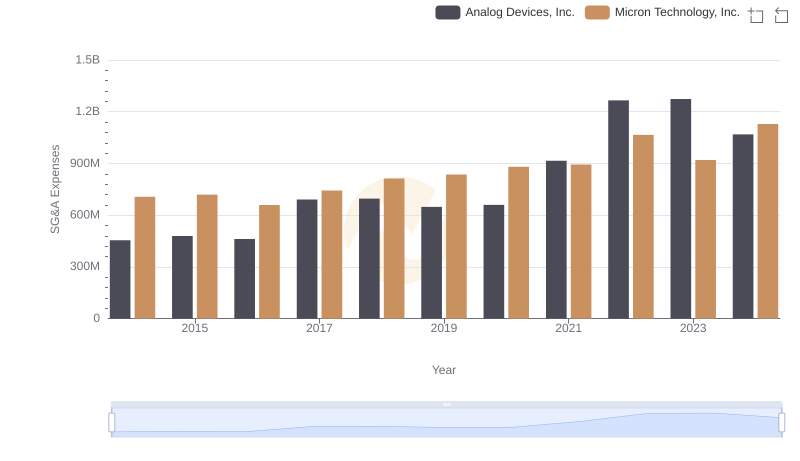

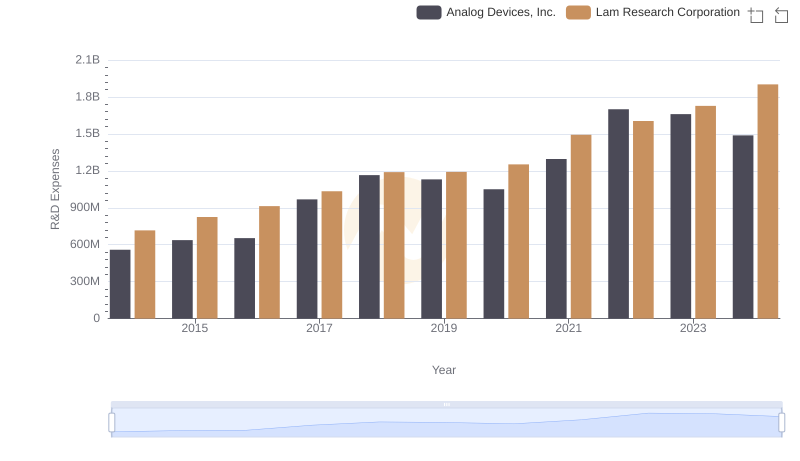

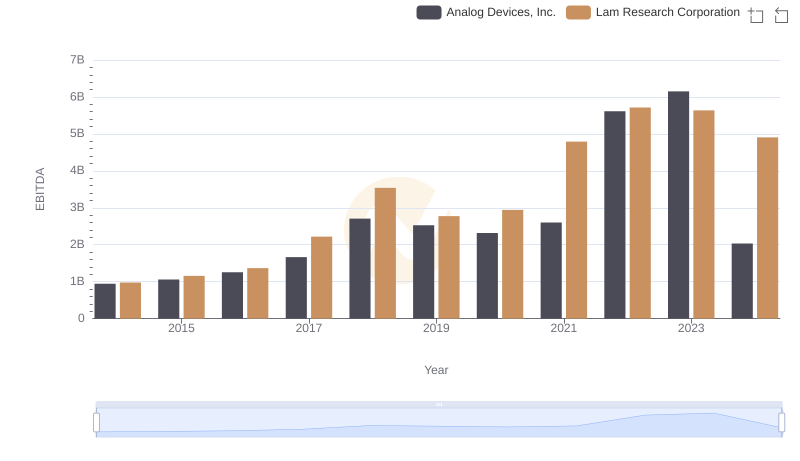

| __timestamp | Analog Devices, Inc. | Lam Research Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 613341000 |

| Thursday, January 1, 2015 | 478972000 | 591611000 |

| Friday, January 1, 2016 | 461438000 | 630954000 |

| Sunday, January 1, 2017 | 691046000 | 667485000 |

| Monday, January 1, 2018 | 695937000 | 762219000 |

| Tuesday, January 1, 2019 | 648094000 | 702407000 |

| Wednesday, January 1, 2020 | 659923000 | 682479000 |

| Friday, January 1, 2021 | 915418000 | 829875000 |

| Saturday, January 1, 2022 | 1266175000 | 885737000 |

| Sunday, January 1, 2023 | 1273584000 | 832753000 |

| Monday, January 1, 2024 | 1068640000 | 868247000 |

Unveiling the hidden dimensions of data

In the competitive landscape of semiconductor companies, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Analog Devices, Inc. and Lam Research Corporation have shown distinct trends in their SG&A management. From 2014 to 2024, Analog Devices saw a significant increase in SG&A expenses, peaking in 2023 with a 180% rise from 2014. In contrast, Lam Research maintained a more stable trajectory, with a 44% increase over the same period. Notably, in 2022, Analog Devices' SG&A expenses were 43% higher than Lam Research's, highlighting their differing strategies. As the semiconductor industry continues to evolve, these companies' ability to manage operational costs will be pivotal in determining their market leadership. This analysis provides a window into their financial strategies, offering insights for investors and industry analysts alike.

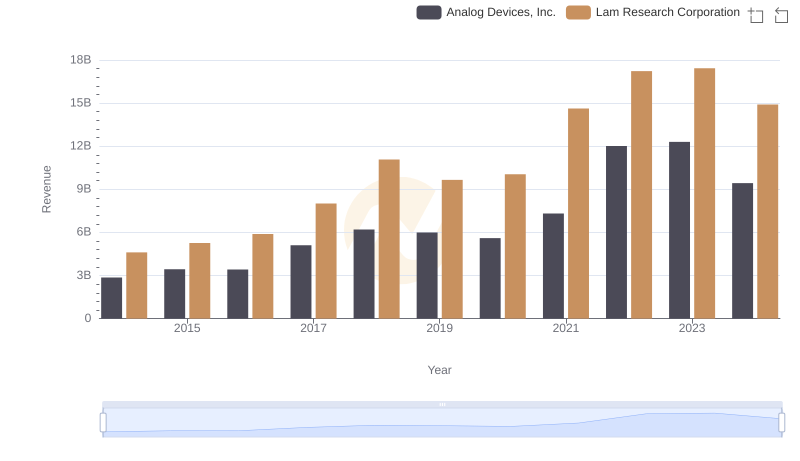

Breaking Down Revenue Trends: Analog Devices, Inc. vs Lam Research Corporation

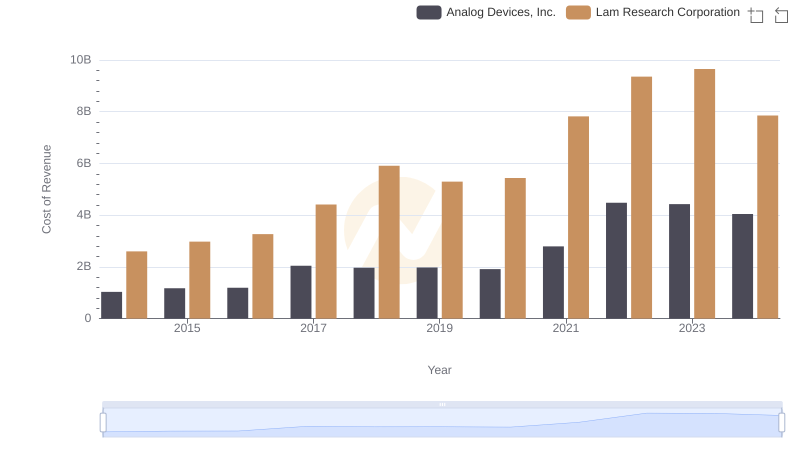

Comparing Cost of Revenue Efficiency: Analog Devices, Inc. vs Lam Research Corporation

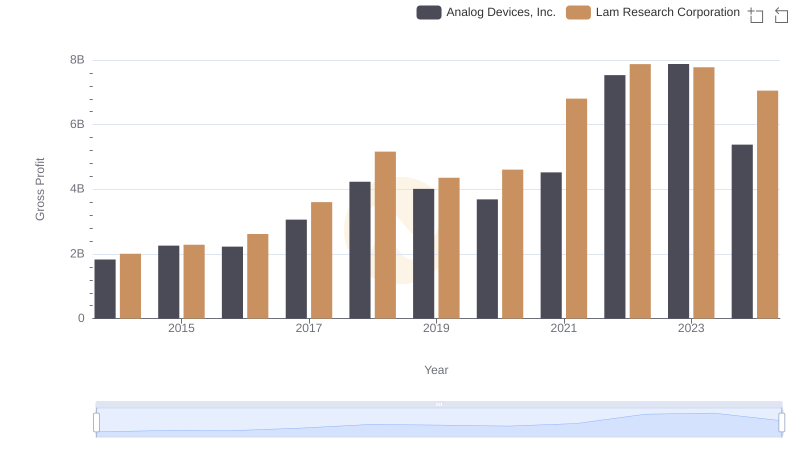

Analog Devices, Inc. vs Lam Research Corporation: A Gross Profit Performance Breakdown

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Micron Technology, Inc.

Analog Devices, Inc. or Lam Research Corporation: Who Invests More in Innovation?

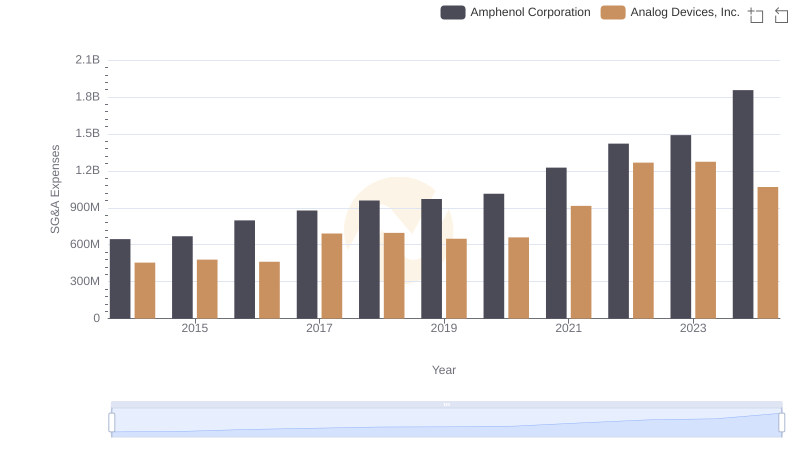

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Amphenol Corporation

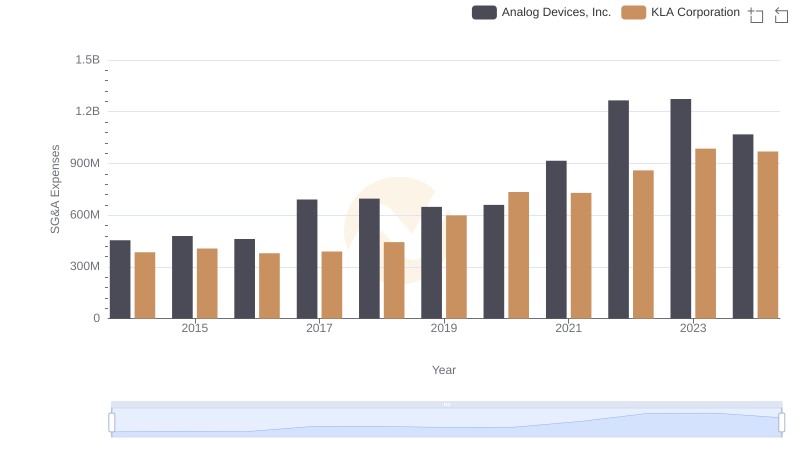

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or KLA Corporation

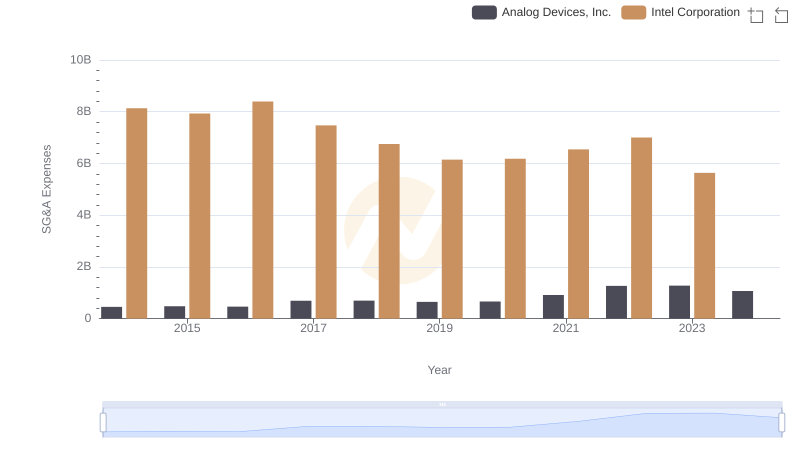

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Intel Corporation

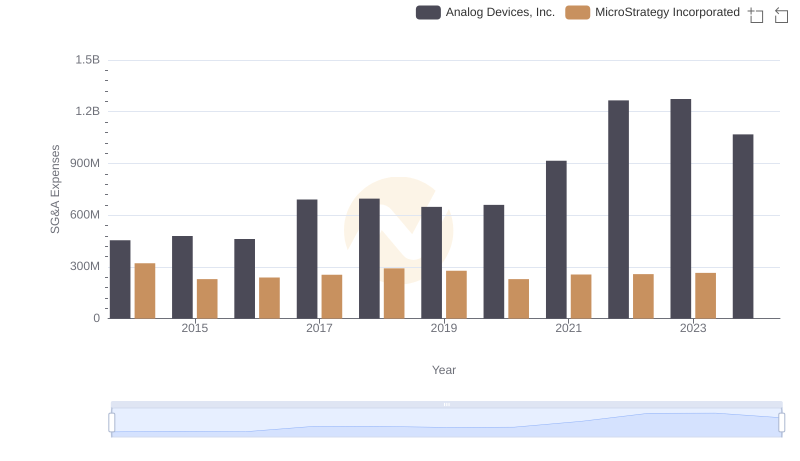

Comparing SG&A Expenses: Analog Devices, Inc. vs MicroStrategy Incorporated Trends and Insights

Analog Devices, Inc. vs Lam Research Corporation: In-Depth EBITDA Performance Comparison

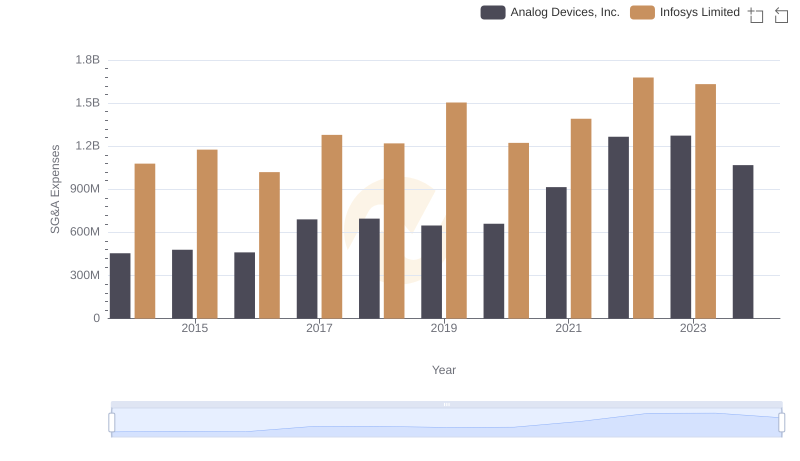

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Infosys Limited

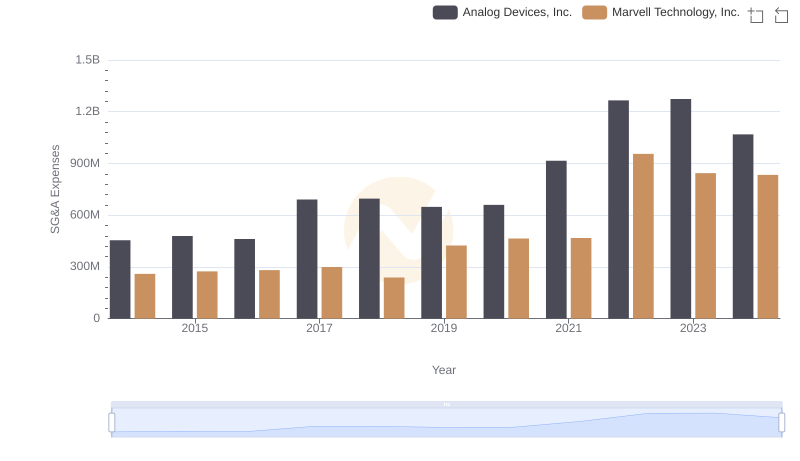

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.