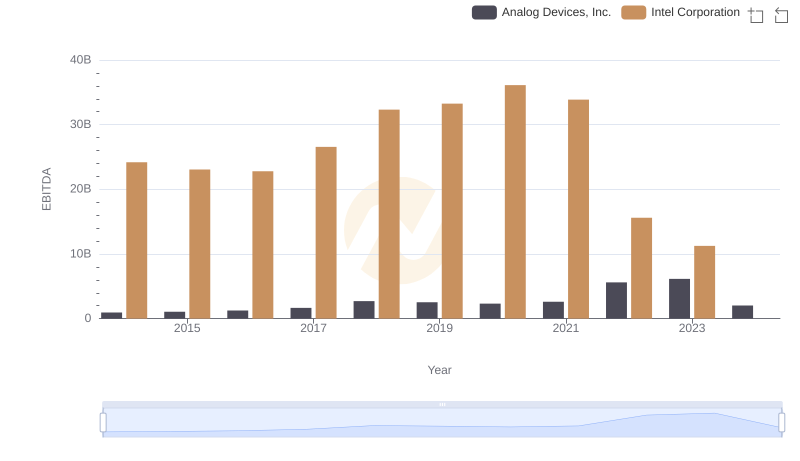

| __timestamp | Analog Devices, Inc. | Intel Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 8136000000 |

| Thursday, January 1, 2015 | 478972000 | 7930000000 |

| Friday, January 1, 2016 | 461438000 | 8397000000 |

| Sunday, January 1, 2017 | 691046000 | 7474000000 |

| Monday, January 1, 2018 | 695937000 | 6750000000 |

| Tuesday, January 1, 2019 | 648094000 | 6150000000 |

| Wednesday, January 1, 2020 | 659923000 | 6180000000 |

| Friday, January 1, 2021 | 915418000 | 6543000000 |

| Saturday, January 1, 2022 | 1266175000 | 7002000000 |

| Sunday, January 1, 2023 | 1273584000 | 5634000000 |

| Monday, January 1, 2024 | 1068640000 | 5507000000 |

In pursuit of knowledge

In the ever-evolving landscape of the semiconductor industry, understanding the financial strategies of key players is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Analog Devices, Inc. and Intel Corporation from 2014 to 2023. Over this decade, Intel consistently allocated a significant portion of its budget to SG&A, peaking in 2016 with expenses nearly 18% higher than its 2023 figures. In contrast, Analog Devices, Inc. demonstrated a steady increase, with a notable 180% rise from 2014 to 2023. This trend highlights Analog Devices' strategic investment in operational efficiency and market expansion. Interestingly, 2023 marks a pivotal year where Analog Devices' SG&A expenses reached 22% of Intel's, reflecting a narrowing gap. Such insights underscore the dynamic financial maneuvers within the semiconductor giants, offering a glimpse into their competitive strategies.

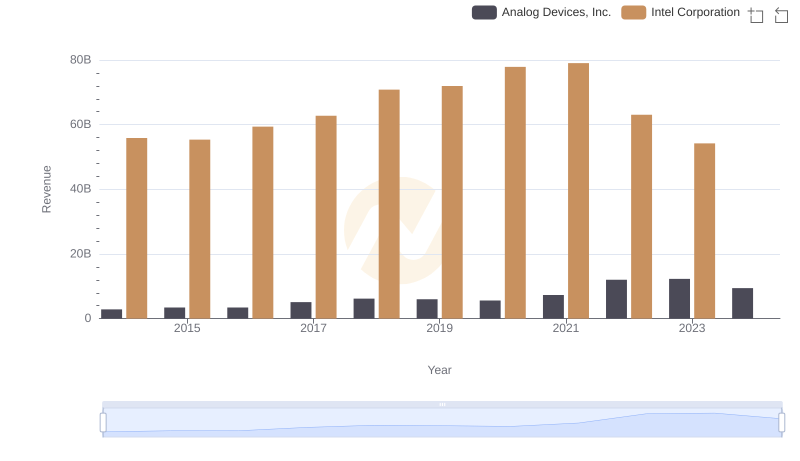

Revenue Insights: Analog Devices, Inc. and Intel Corporation Performance Compared

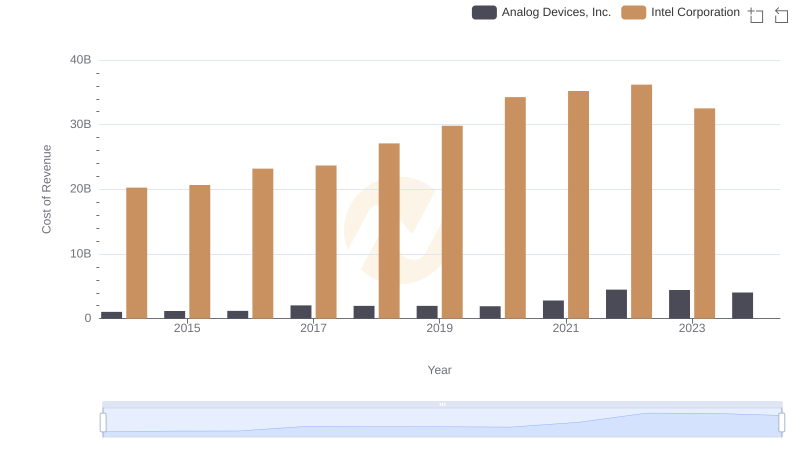

Cost of Revenue: Key Insights for Analog Devices, Inc. and Intel Corporation

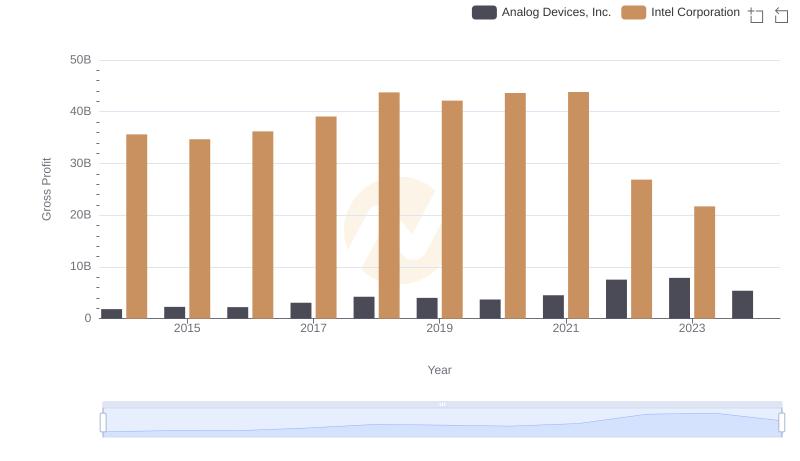

Who Generates Higher Gross Profit? Analog Devices, Inc. or Intel Corporation

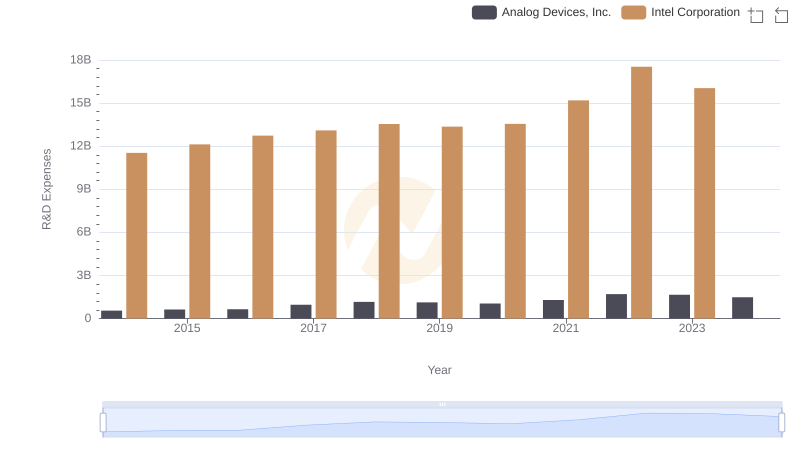

Research and Development Investment: Analog Devices, Inc. vs Intel Corporation

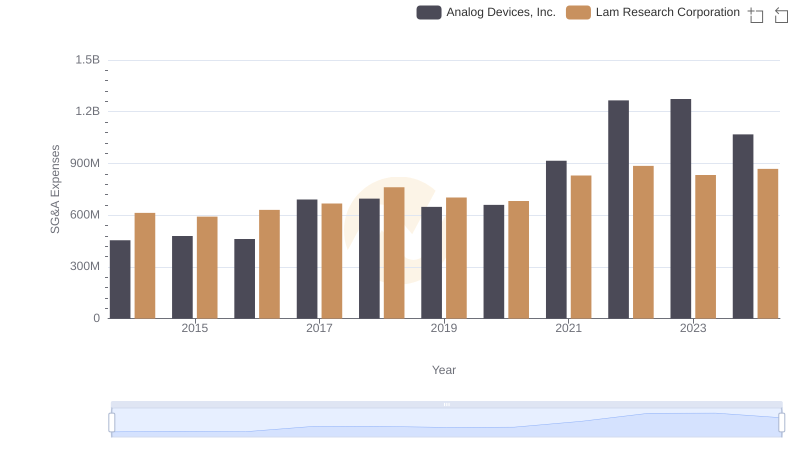

Analog Devices, Inc. or Lam Research Corporation: Who Manages SG&A Costs Better?

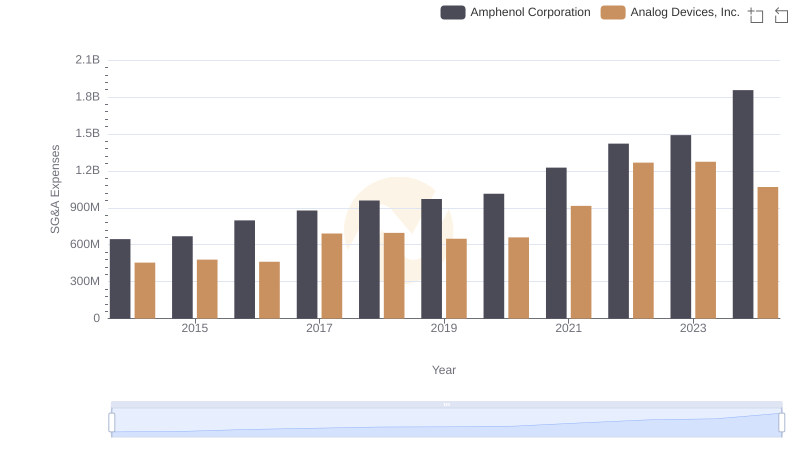

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Amphenol Corporation

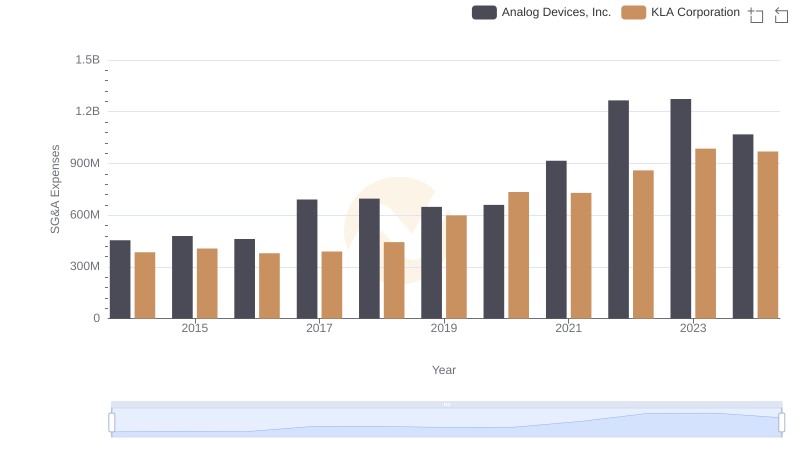

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or KLA Corporation

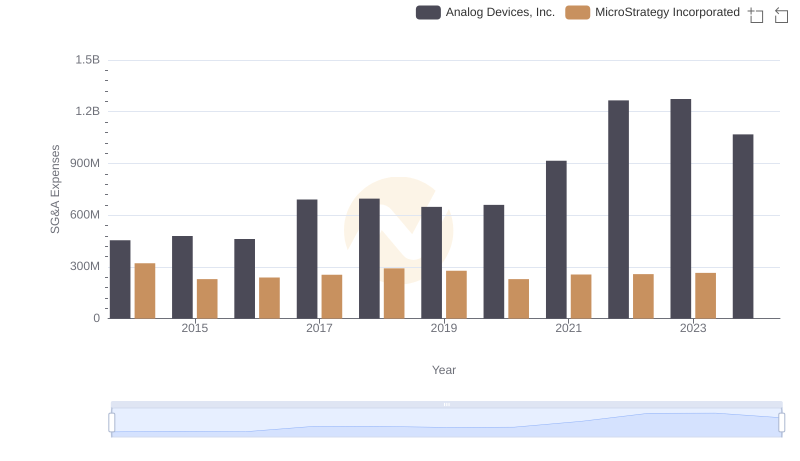

Comparing SG&A Expenses: Analog Devices, Inc. vs MicroStrategy Incorporated Trends and Insights

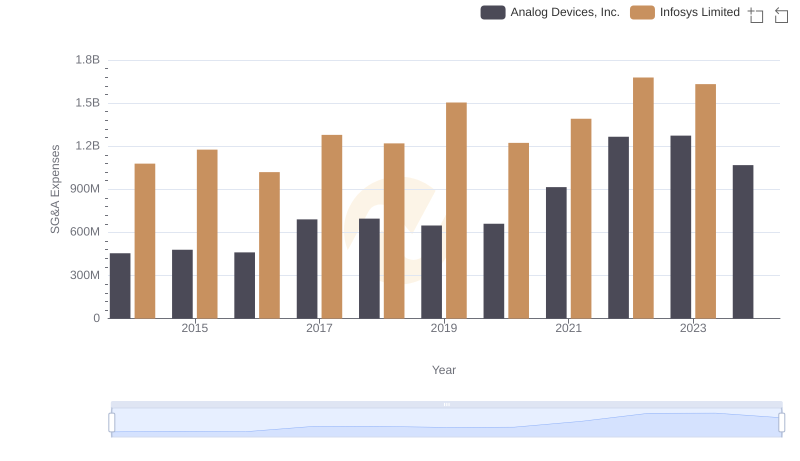

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Infosys Limited

Professional EBITDA Benchmarking: Analog Devices, Inc. vs Intel Corporation

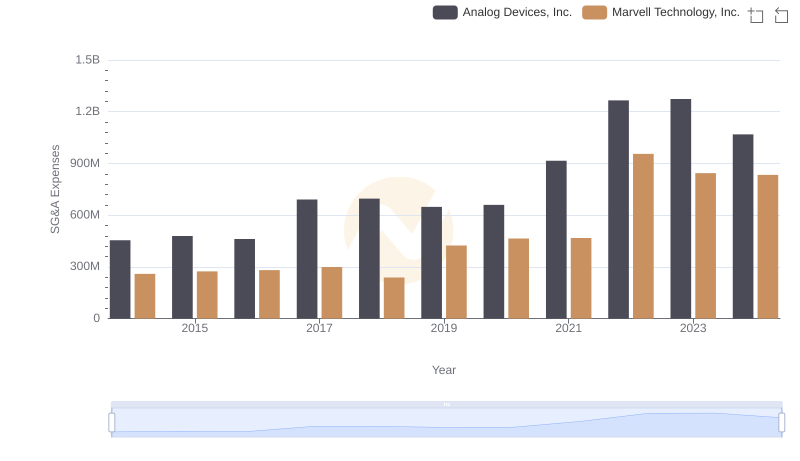

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.

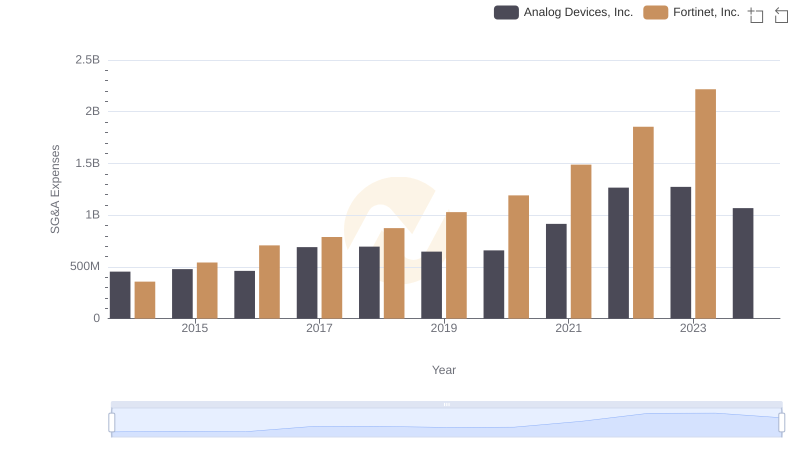

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.