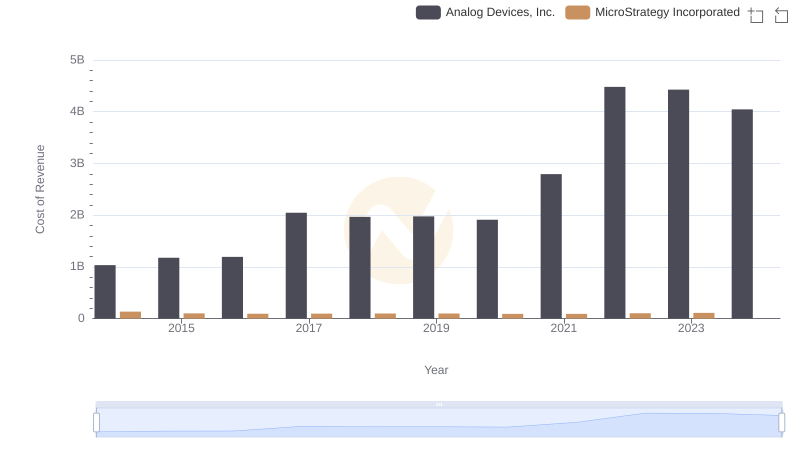

| __timestamp | Analog Devices, Inc. | MicroStrategy Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2864773000 | 579830000 |

| Thursday, January 1, 2015 | 3435092000 | 529869000 |

| Friday, January 1, 2016 | 3421409000 | 512161000 |

| Sunday, January 1, 2017 | 5107503000 | 504543000 |

| Monday, January 1, 2018 | 6200942000 | 497638000 |

| Tuesday, January 1, 2019 | 5991065000 | 486327000 |

| Wednesday, January 1, 2020 | 5603056000 | 480735000 |

| Friday, January 1, 2021 | 7318286000 | 510762000 |

| Saturday, January 1, 2022 | 12013953000 | 499264000 |

| Sunday, January 1, 2023 | 12305539000 | 496261000 |

| Monday, January 1, 2024 | 9427157000 | 463456000 |

Unleashing insights

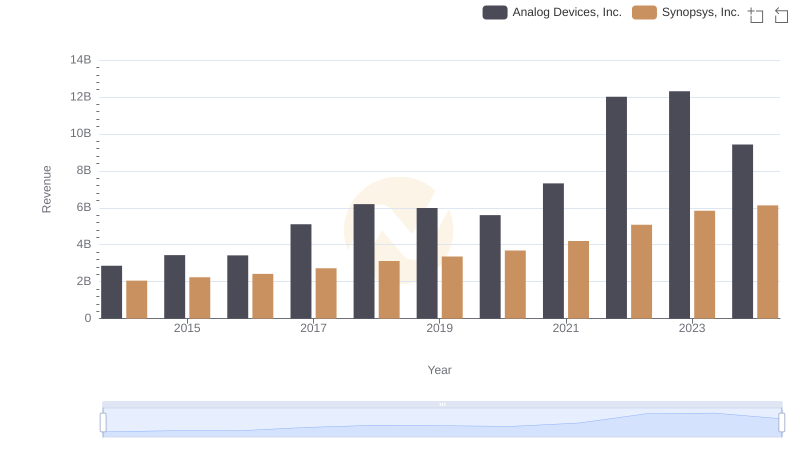

In the ever-evolving landscape of technology, revenue generation is a key indicator of a company's market position and growth potential. Over the past decade, Analog Devices, Inc. has consistently outperformed MicroStrategy Incorporated in terms of revenue. From 2014 to 2023, Analog Devices saw a remarkable increase of over 330% in revenue, peaking at approximately $12.3 billion in 2023. In contrast, MicroStrategy's revenue remained relatively stable, hovering around the $500 million mark annually.

This stark contrast highlights Analog Devices' robust growth strategy and market adaptability, especially in the face of global economic challenges. While MicroStrategy's revenue remained steady, it underscores a different business model focused on niche markets. The data from 2024 is incomplete, but the trend suggests Analog Devices continues to lead. This comparison offers valuable insights for investors and industry analysts alike, emphasizing the importance of strategic growth and market positioning.

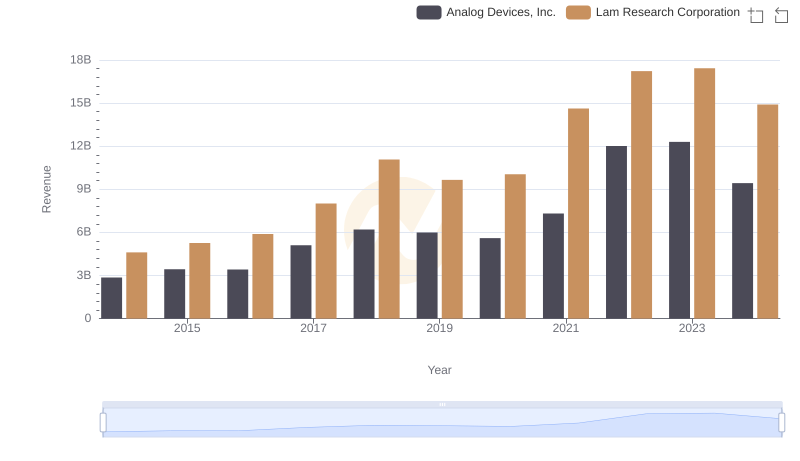

Breaking Down Revenue Trends: Analog Devices, Inc. vs Lam Research Corporation

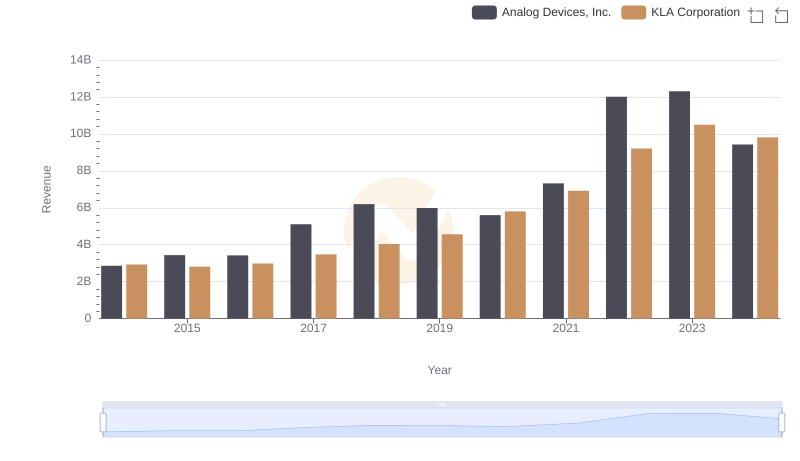

Analog Devices, Inc. or KLA Corporation: Who Leads in Yearly Revenue?

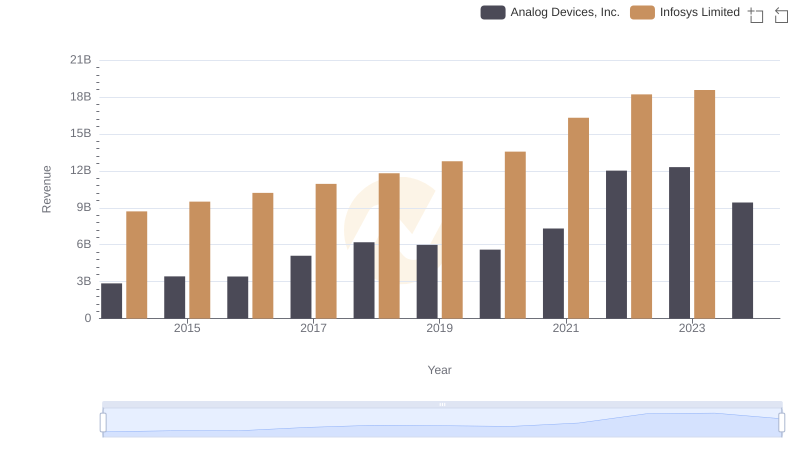

Analog Devices, Inc. or Infosys Limited: Who Leads in Yearly Revenue?

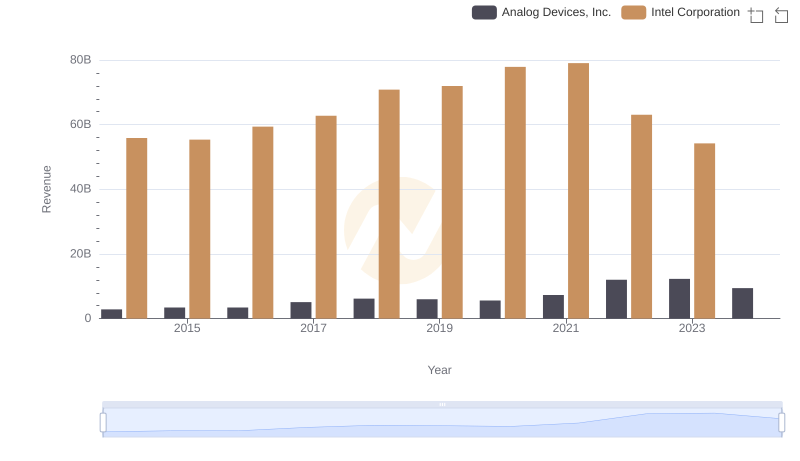

Revenue Insights: Analog Devices, Inc. and Intel Corporation Performance Compared

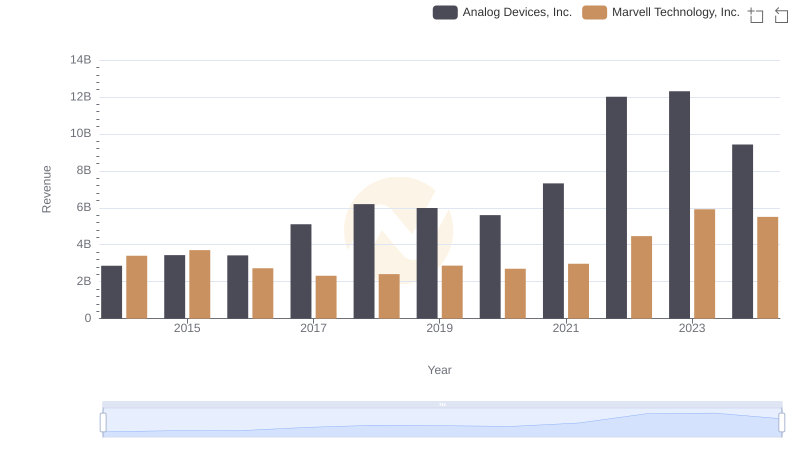

Analog Devices, Inc. vs Marvell Technology, Inc.: Examining Key Revenue Metrics

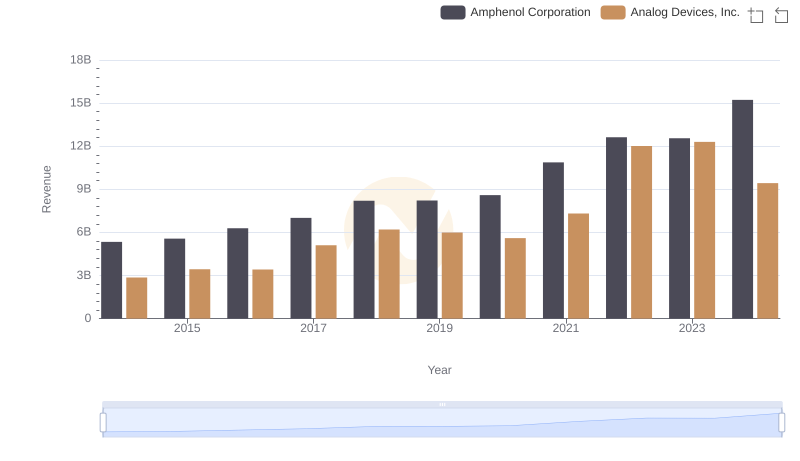

Analog Devices, Inc. vs Amphenol Corporation: Examining Key Revenue Metrics

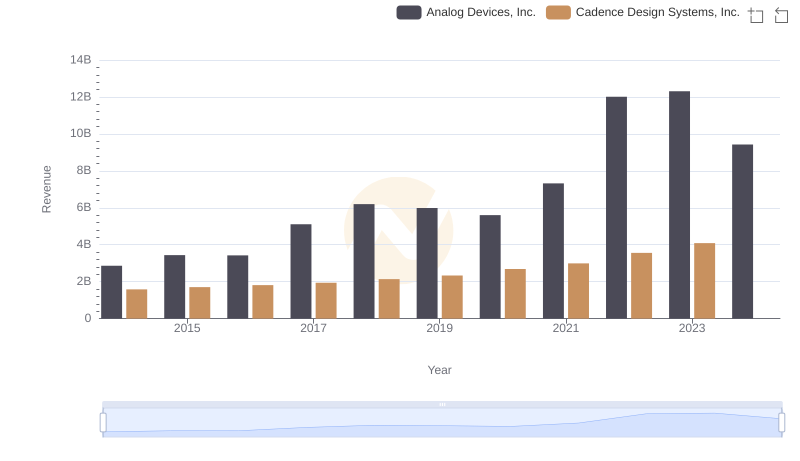

Analog Devices, Inc. vs Cadence Design Systems, Inc.: Annual Revenue Growth Compared

Cost of Revenue Comparison: Analog Devices, Inc. vs MicroStrategy Incorporated

Annual Revenue Comparison: Analog Devices, Inc. vs Synopsys, Inc.

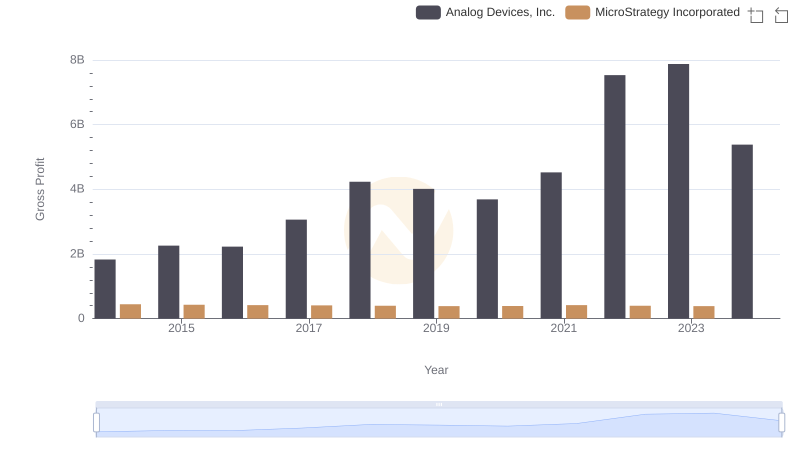

Gross Profit Comparison: Analog Devices, Inc. and MicroStrategy Incorporated Trends

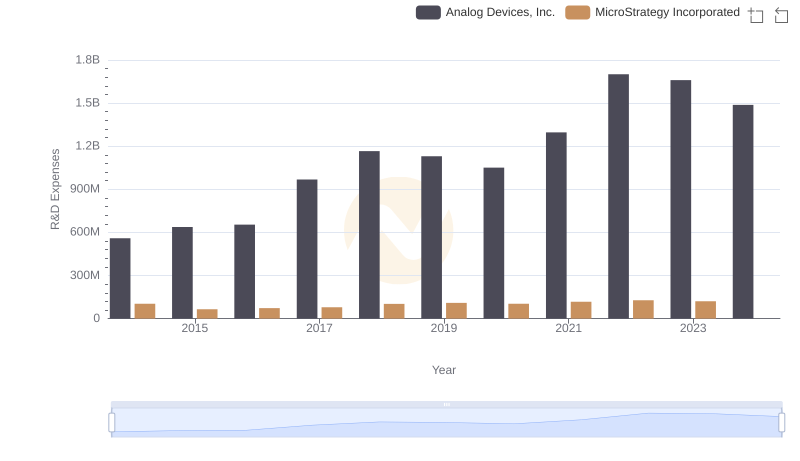

Comparing Innovation Spending: Analog Devices, Inc. and MicroStrategy Incorporated

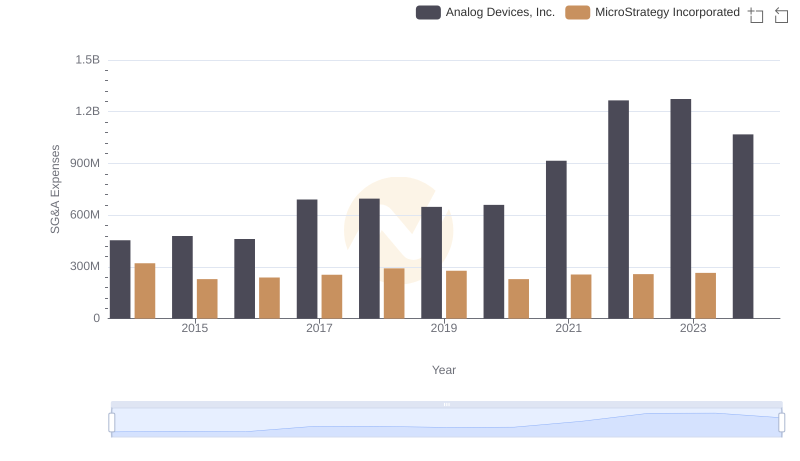

Comparing SG&A Expenses: Analog Devices, Inc. vs MicroStrategy Incorporated Trends and Insights