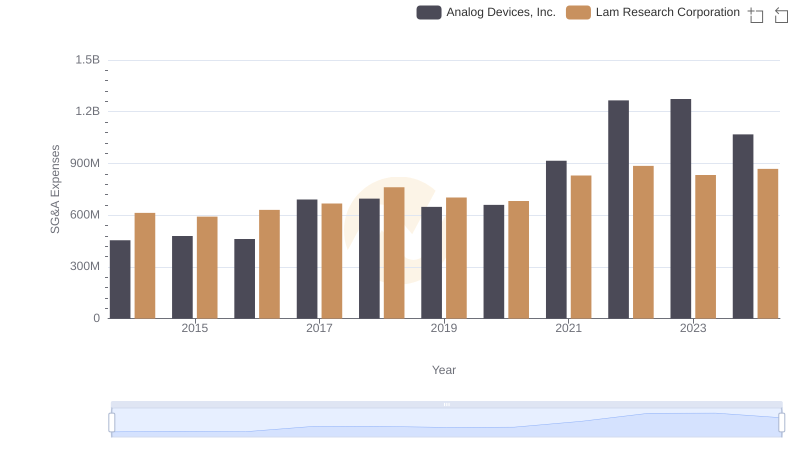

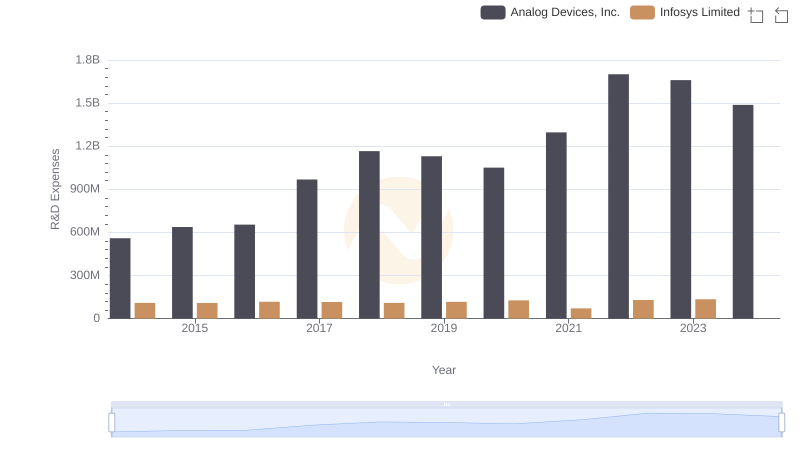

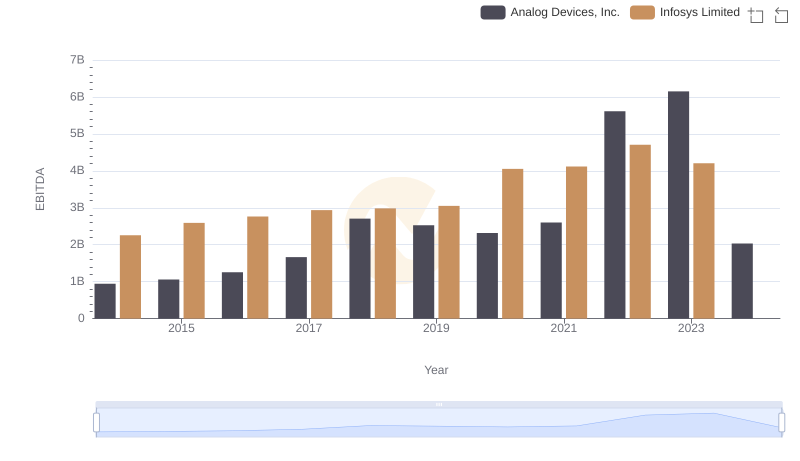

| __timestamp | Analog Devices, Inc. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 1079000000 |

| Thursday, January 1, 2015 | 478972000 | 1176000000 |

| Friday, January 1, 2016 | 461438000 | 1020000000 |

| Sunday, January 1, 2017 | 691046000 | 1279000000 |

| Monday, January 1, 2018 | 695937000 | 1220000000 |

| Tuesday, January 1, 2019 | 648094000 | 1504000000 |

| Wednesday, January 1, 2020 | 659923000 | 1223000000 |

| Friday, January 1, 2021 | 915418000 | 1391000000 |

| Saturday, January 1, 2022 | 1266175000 | 1678000000 |

| Sunday, January 1, 2023 | 1273584000 | 1632000000 |

| Monday, January 1, 2024 | 1068640000 |

Data in motion

In the ever-evolving landscape of global business, effective cost management is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Analog Devices, Inc. and Infosys Limited, from 2014 to 2023. Over this decade, Infosys consistently outpaced Analog Devices in SG&A expenses, peaking in 2022 with a 56% higher expenditure. Notably, Analog Devices saw a significant rise in 2022, with expenses surging by 39% compared to 2021. This trend highlights the dynamic nature of cost management strategies in response to market demands and operational expansions. However, 2024 data for Infosys remains elusive, leaving room for speculation on future trends. As businesses navigate the complexities of global markets, understanding these financial nuances becomes imperative for strategic planning and competitive advantage.

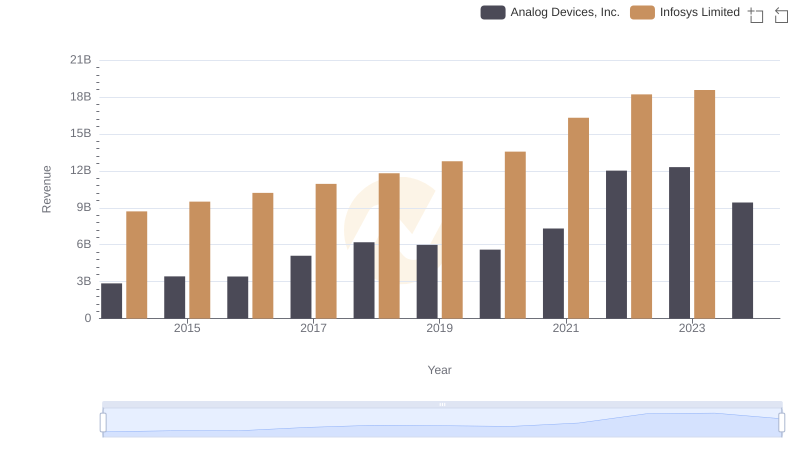

Analog Devices, Inc. or Infosys Limited: Who Leads in Yearly Revenue?

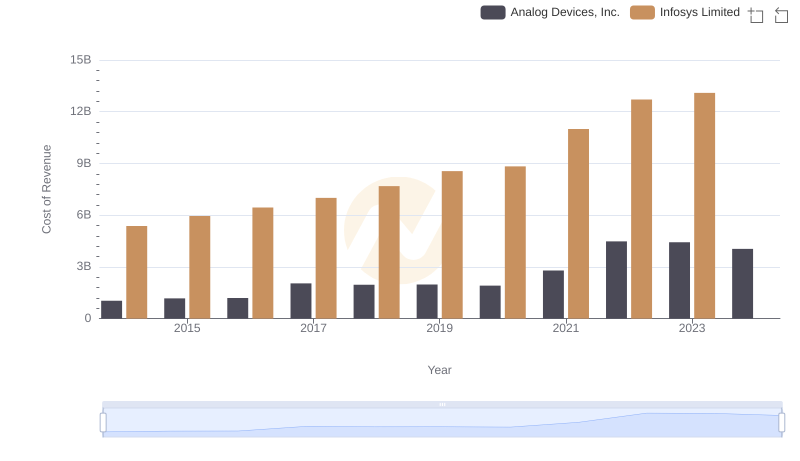

Comparing Cost of Revenue Efficiency: Analog Devices, Inc. vs Infosys Limited

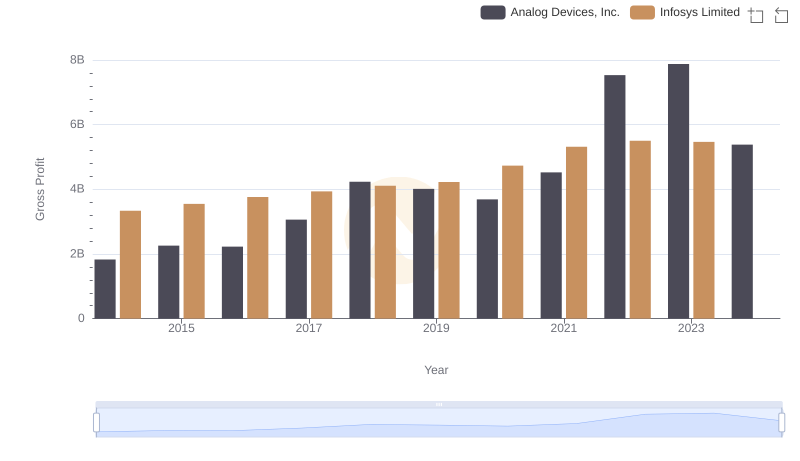

Key Insights on Gross Profit: Analog Devices, Inc. vs Infosys Limited

Analog Devices, Inc. or Lam Research Corporation: Who Manages SG&A Costs Better?

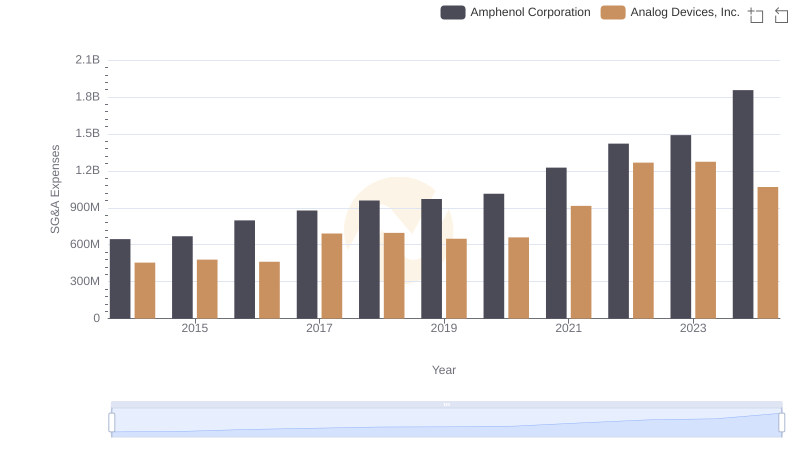

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Amphenol Corporation

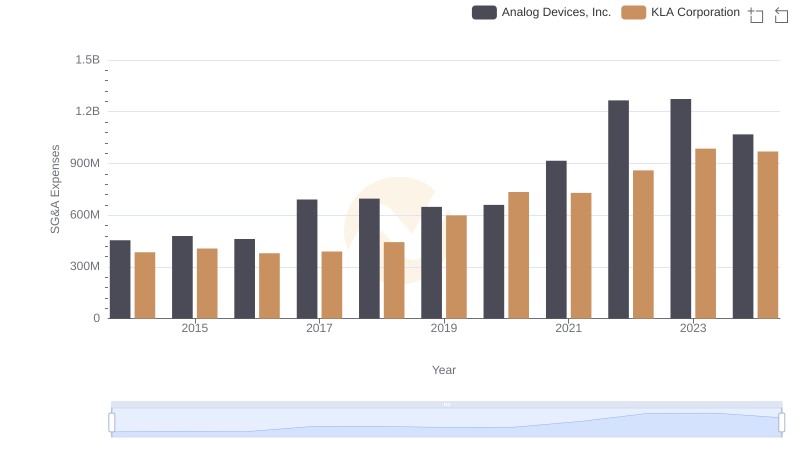

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or KLA Corporation

Research and Development: Comparing Key Metrics for Analog Devices, Inc. and Infosys Limited

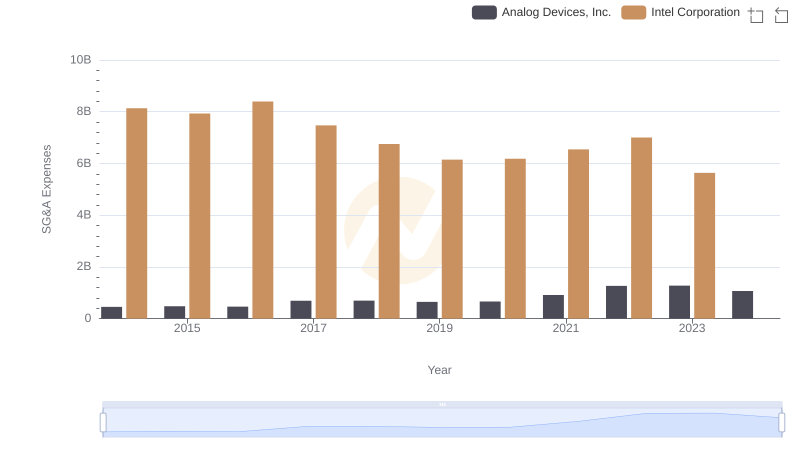

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Intel Corporation

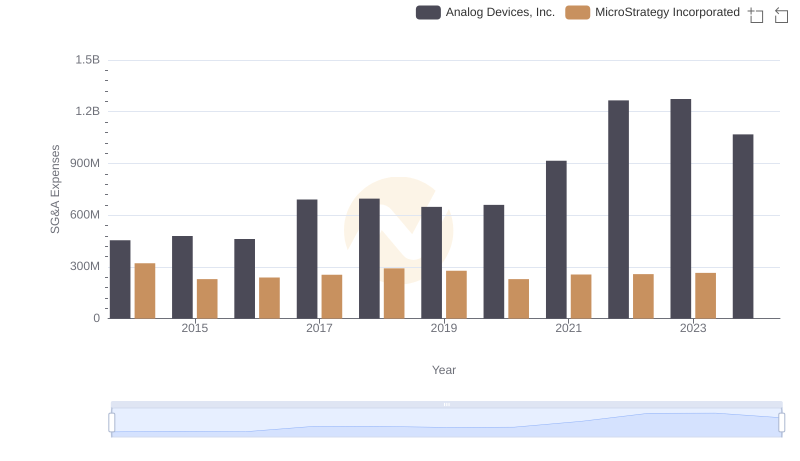

Comparing SG&A Expenses: Analog Devices, Inc. vs MicroStrategy Incorporated Trends and Insights

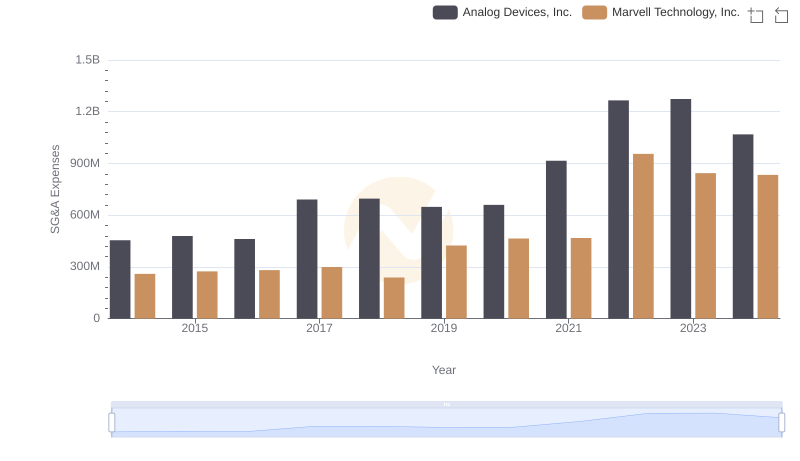

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.

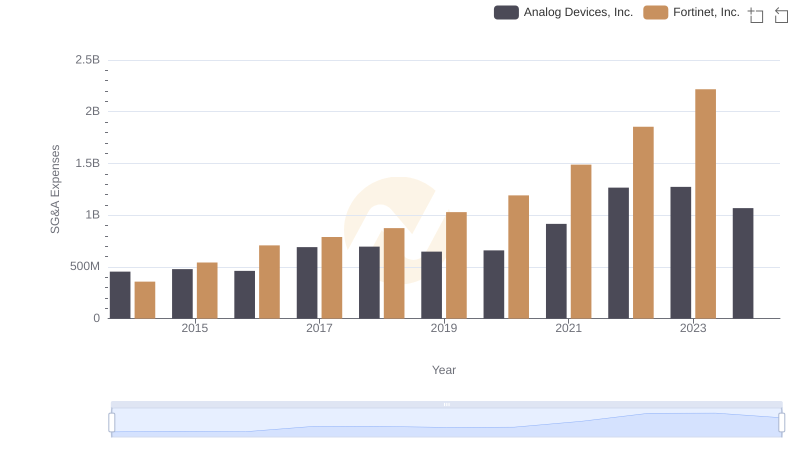

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Infosys Limited