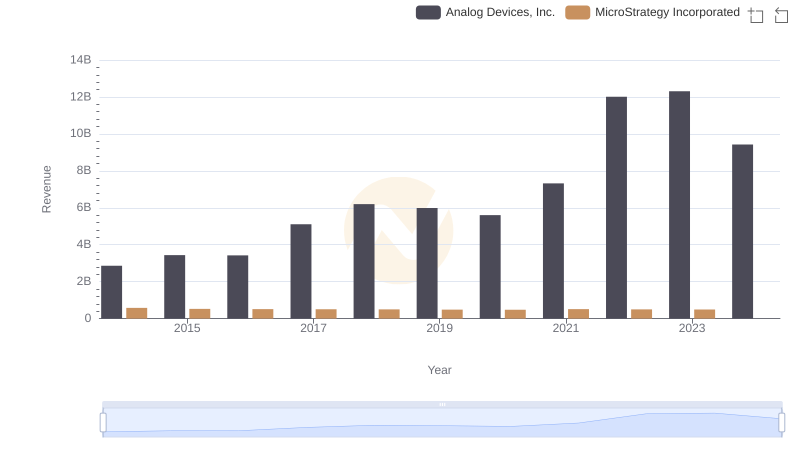

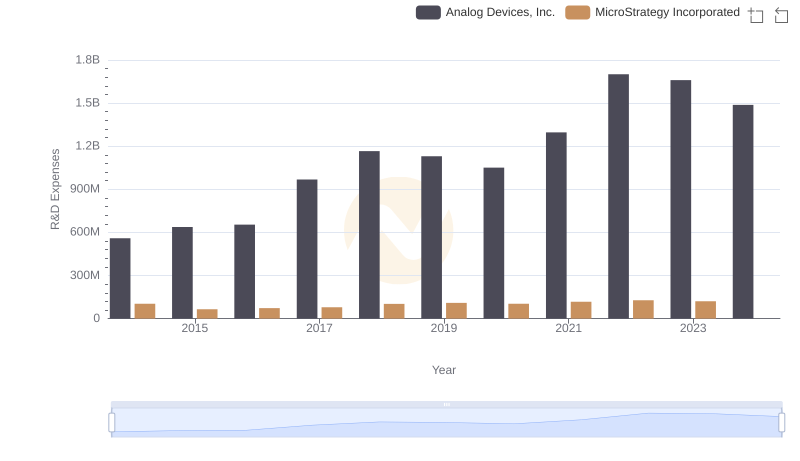

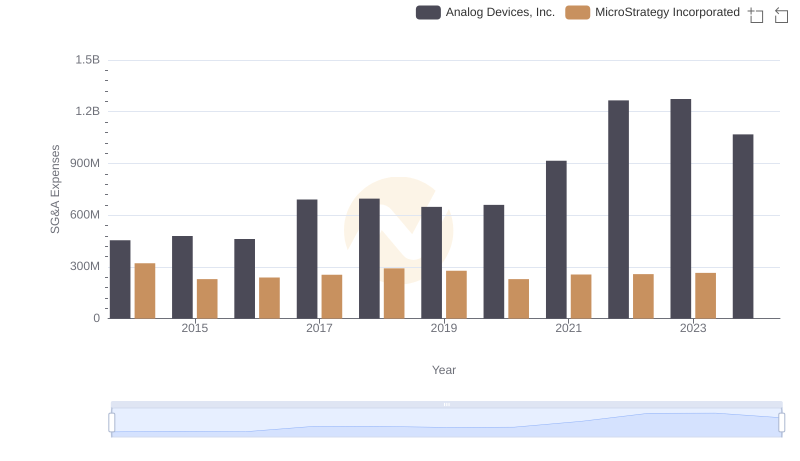

| __timestamp | Analog Devices, Inc. | MicroStrategy Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 1830188000 | 444620000 |

| Thursday, January 1, 2015 | 2259262000 | 428761000 |

| Friday, January 1, 2016 | 2227173000 | 419014000 |

| Sunday, January 1, 2017 | 3061596000 | 407894000 |

| Monday, January 1, 2018 | 4233302000 | 398139000 |

| Tuesday, January 1, 2019 | 4013750000 | 386353000 |

| Wednesday, January 1, 2020 | 3690478000 | 389680000 |

| Friday, January 1, 2021 | 4525012000 | 418853000 |

| Saturday, January 1, 2022 | 7532474000 | 396275000 |

| Sunday, January 1, 2023 | 7877218000 | 386317000 |

| Monday, January 1, 2024 | 5381343000 | 333988000 |

Cracking the code

In the ever-evolving landscape of technology, Analog Devices, Inc. and MicroStrategy Incorporated have showcased distinct financial trajectories over the past decade. From 2014 to 2023, Analog Devices experienced a remarkable growth in gross profit, peaking in 2023 with a staggering 330% increase from its 2014 figures. This growth reflects the company's strategic advancements and market adaptability.

Conversely, MicroStrategy's gross profit remained relatively stable, with minor fluctuations around the $400 million mark. This stability highlights the company's consistent performance, albeit without the explosive growth seen in its counterpart.

Interestingly, 2022 marked a significant year for Analog Devices, with a 66% surge in gross profit compared to the previous year, underscoring a pivotal moment in its financial journey. As we look to the future, these trends offer valuable insights into the strategic directions and market positions of these two industry players.

Who Generates More Revenue? Analog Devices, Inc. or MicroStrategy Incorporated

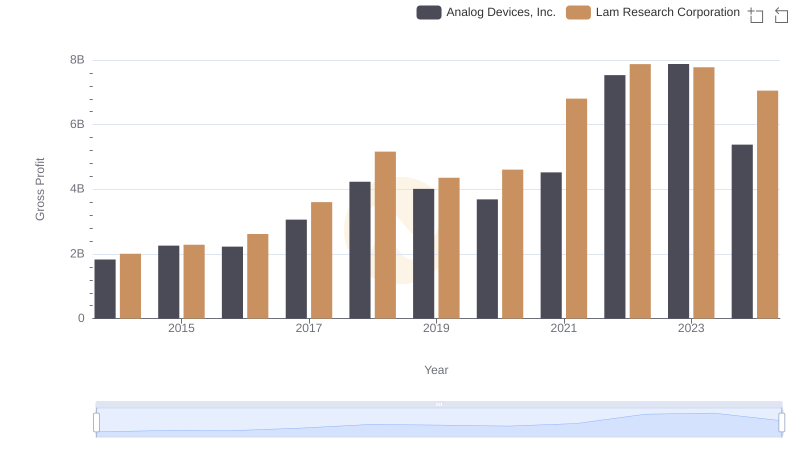

Analog Devices, Inc. vs Lam Research Corporation: A Gross Profit Performance Breakdown

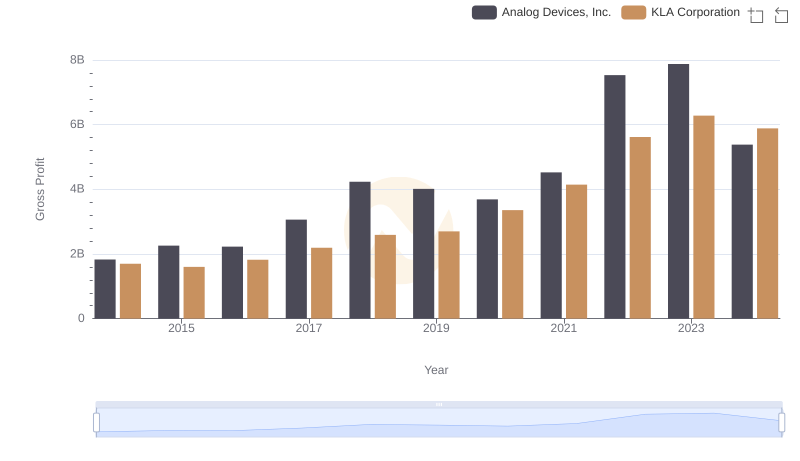

Key Insights on Gross Profit: Analog Devices, Inc. vs KLA Corporation

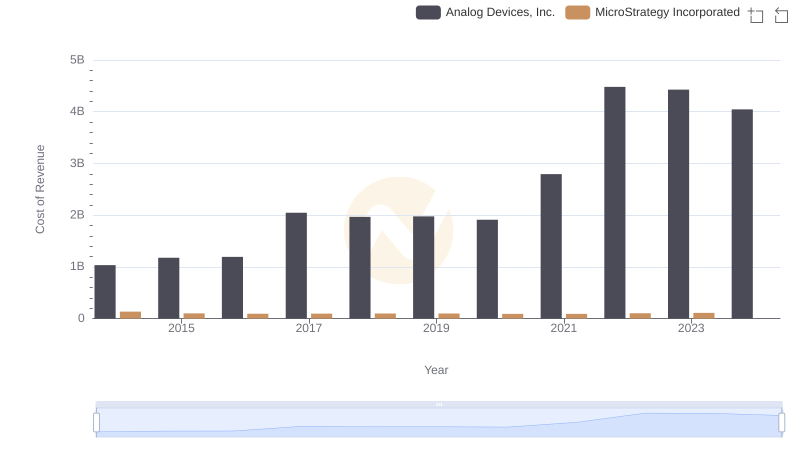

Cost of Revenue Comparison: Analog Devices, Inc. vs MicroStrategy Incorporated

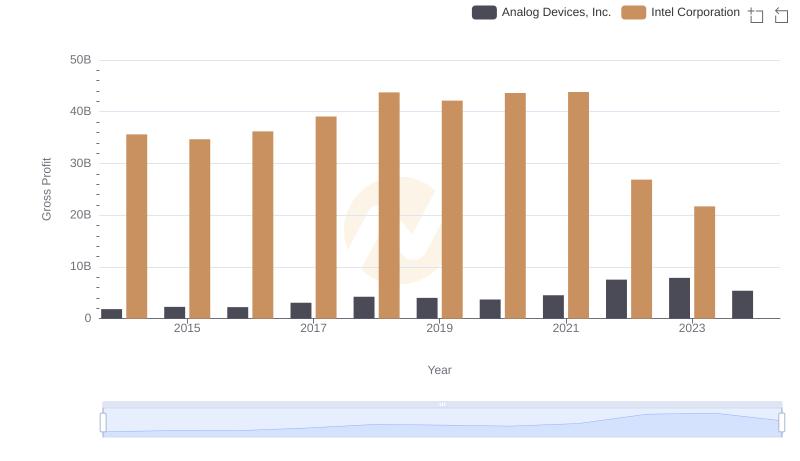

Who Generates Higher Gross Profit? Analog Devices, Inc. or Intel Corporation

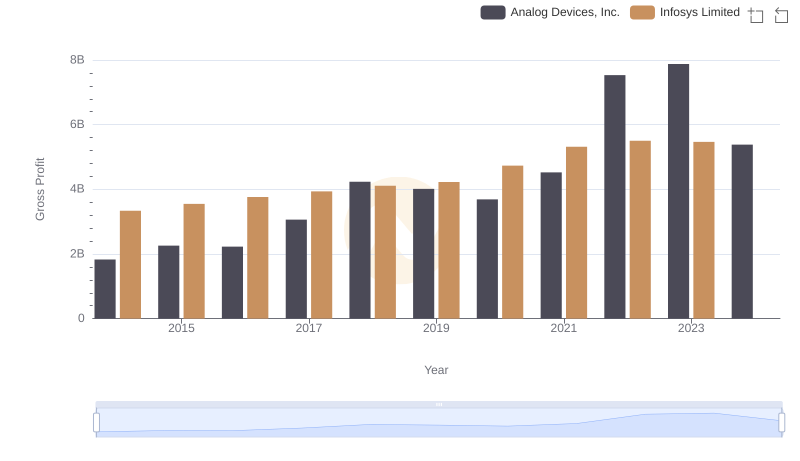

Key Insights on Gross Profit: Analog Devices, Inc. vs Infosys Limited

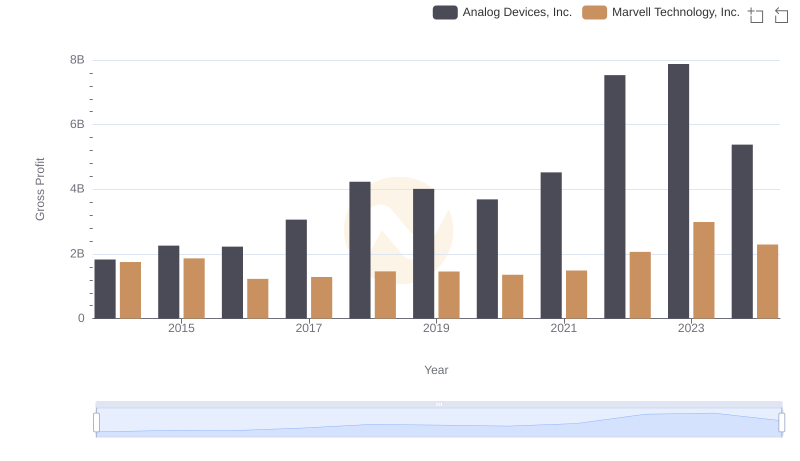

Who Generates Higher Gross Profit? Analog Devices, Inc. or Marvell Technology, Inc.

Comparing Innovation Spending: Analog Devices, Inc. and MicroStrategy Incorporated

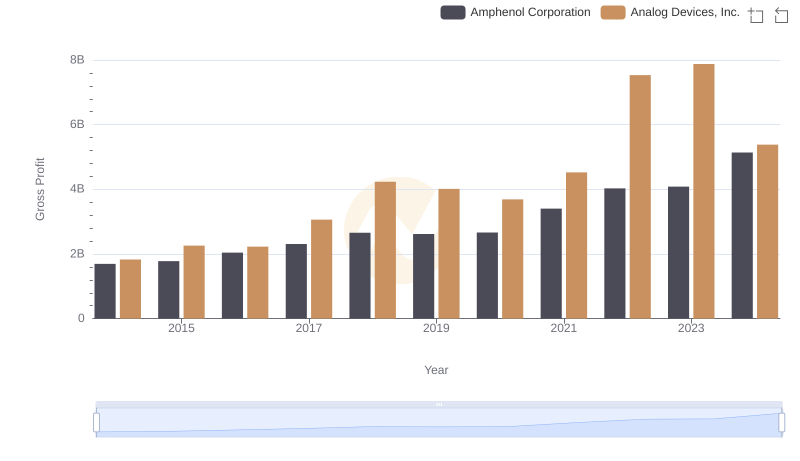

Who Generates Higher Gross Profit? Analog Devices, Inc. or Amphenol Corporation

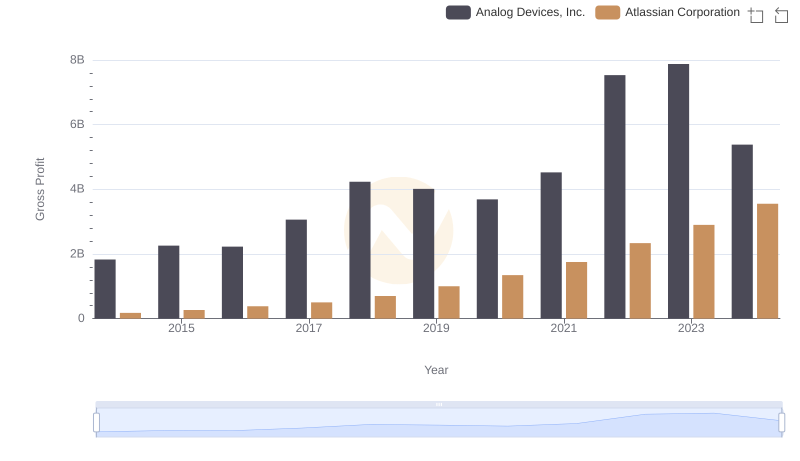

Gross Profit Analysis: Comparing Analog Devices, Inc. and Atlassian Corporation

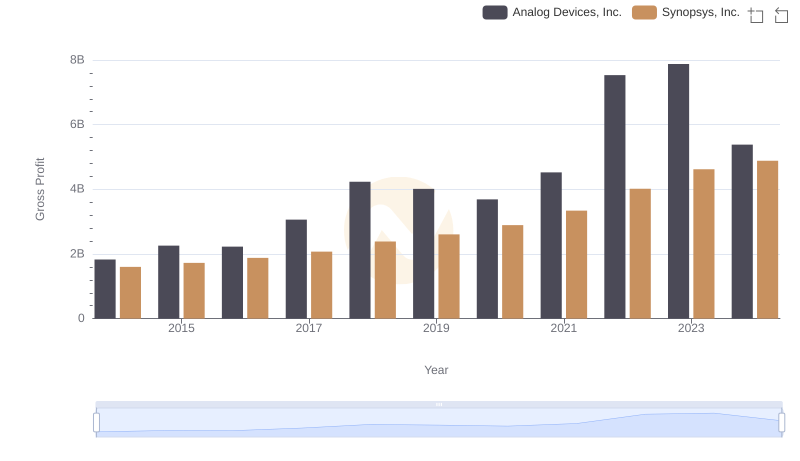

Key Insights on Gross Profit: Analog Devices, Inc. vs Synopsys, Inc.

Comparing SG&A Expenses: Analog Devices, Inc. vs MicroStrategy Incorporated Trends and Insights