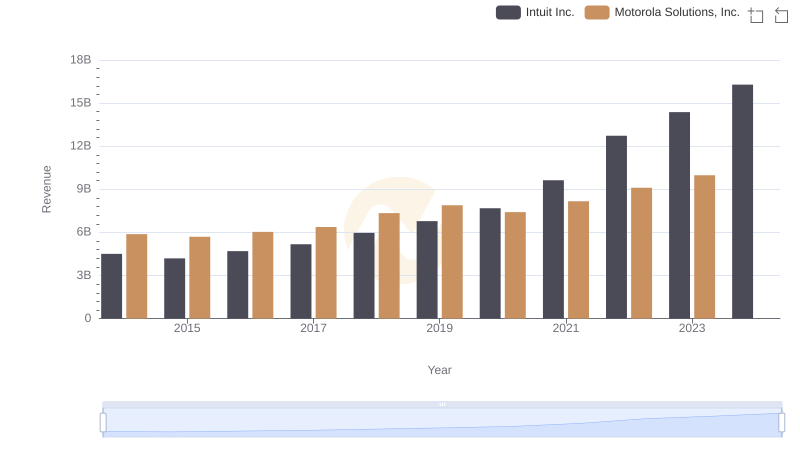

| __timestamp | Intuit Inc. | Motorola Solutions, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 668000000 | 3050000000 |

| Thursday, January 1, 2015 | 725000000 | 2976000000 |

| Friday, January 1, 2016 | 752000000 | 3169000000 |

| Sunday, January 1, 2017 | 809000000 | 3356000000 |

| Monday, January 1, 2018 | 977000000 | 3863000000 |

| Tuesday, January 1, 2019 | 1167000000 | 3956000000 |

| Wednesday, January 1, 2020 | 1378000000 | 3806000000 |

| Friday, January 1, 2021 | 1683000000 | 4131000000 |

| Saturday, January 1, 2022 | 2406000000 | 4883000000 |

| Sunday, January 1, 2023 | 3143000000 | 5008000000 |

| Monday, January 1, 2024 | 3465000000 | 5305000000 |

Data in motion

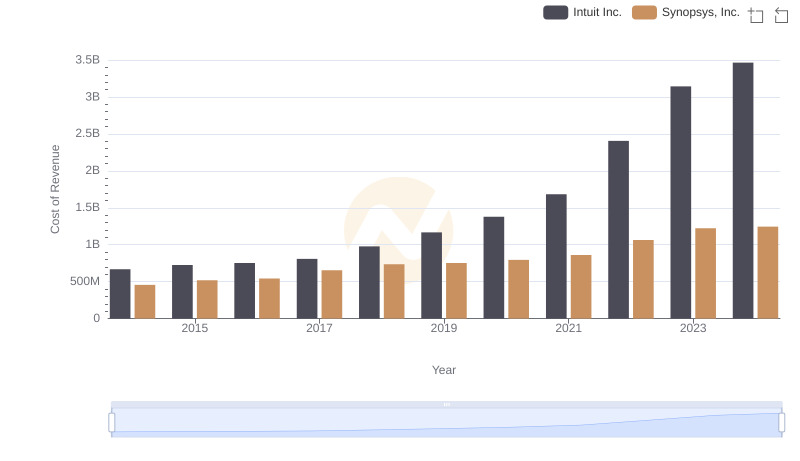

In the ever-evolving landscape of technology and telecommunications, understanding cost structures is crucial. This analysis delves into the cost of revenue for Intuit Inc. and Motorola Solutions, Inc. from 2014 to 2023. Over this decade, Intuit's cost of revenue surged by over 400%, reflecting its aggressive growth strategy and expansion into new markets. In contrast, Motorola Solutions maintained a steady increase, with a 64% rise, showcasing its stable operational efficiency.

This data provides a window into the strategic priorities of these industry giants, with Intuit focusing on rapid growth and Motorola on sustained efficiency.

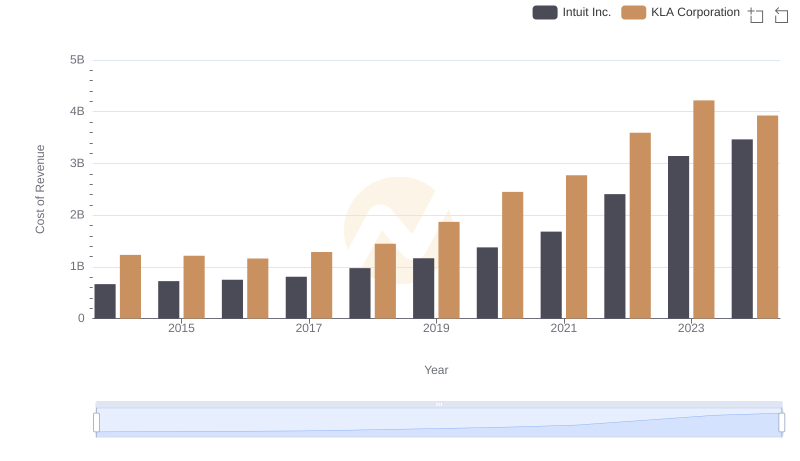

Cost of Revenue Trends: Intuit Inc. vs KLA Corporation

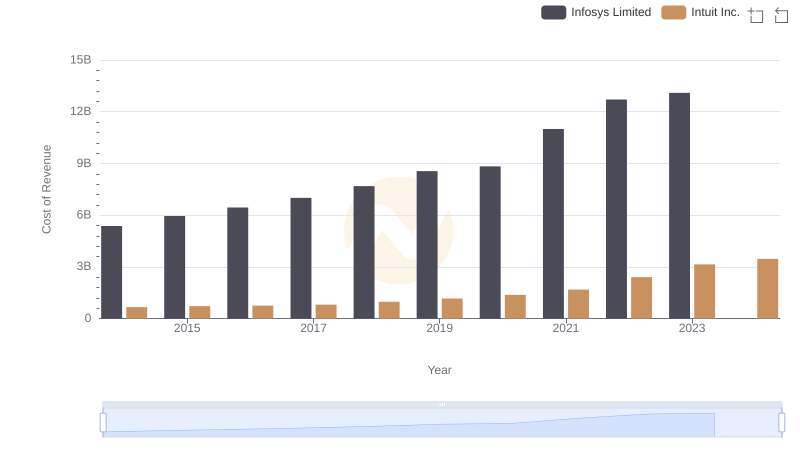

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Infosys Limited

Breaking Down Revenue Trends: Intuit Inc. vs Motorola Solutions, Inc.

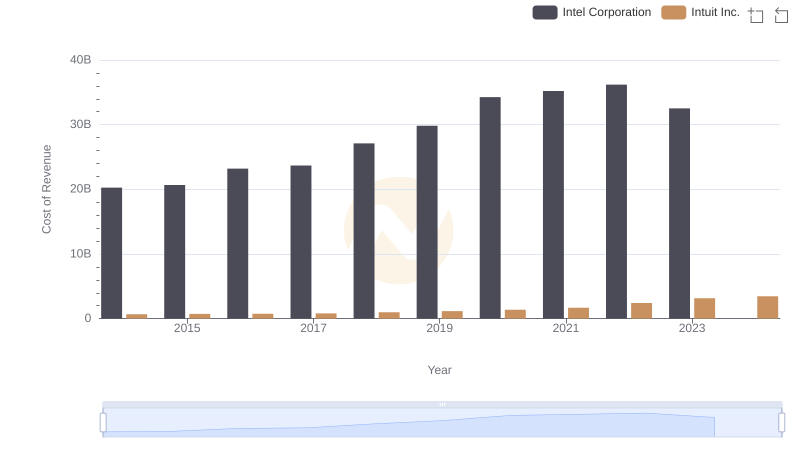

Intuit Inc. vs Intel Corporation: Efficiency in Cost of Revenue Explored

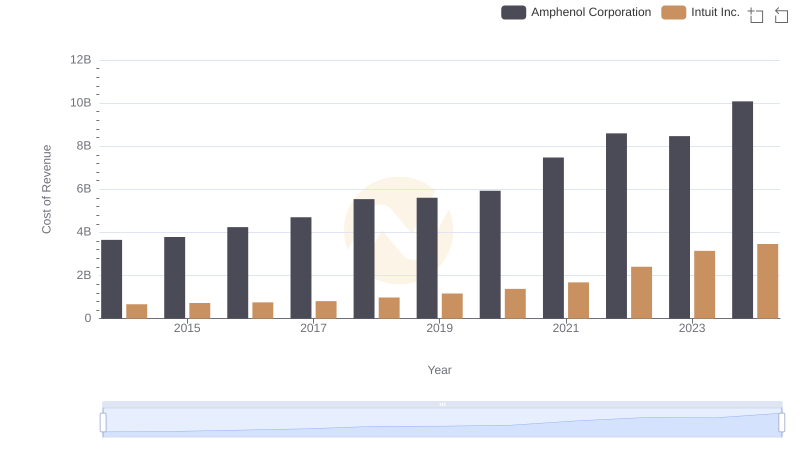

Analyzing Cost of Revenue: Intuit Inc. and Amphenol Corporation

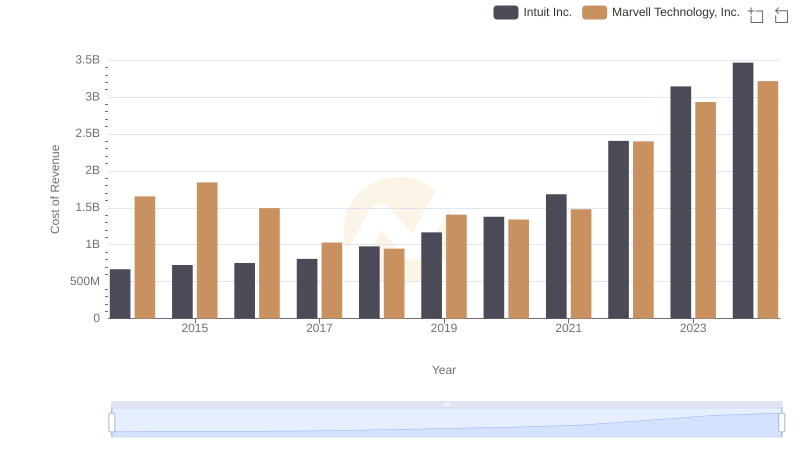

Cost of Revenue Comparison: Intuit Inc. vs Marvell Technology, Inc.

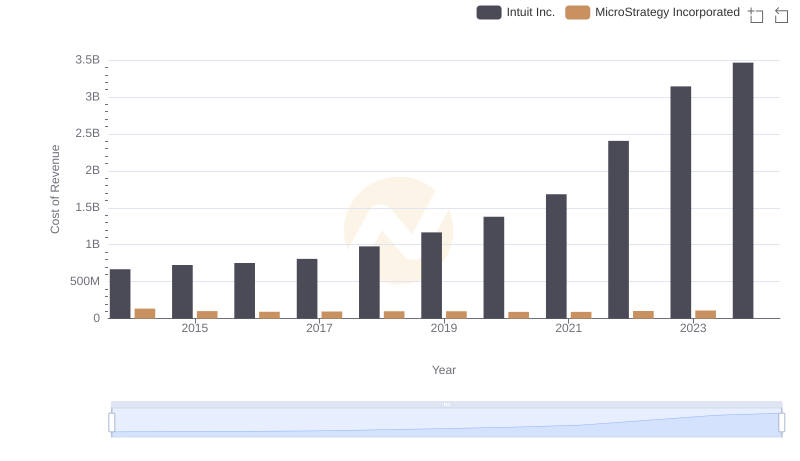

Analyzing Cost of Revenue: Intuit Inc. and MicroStrategy Incorporated

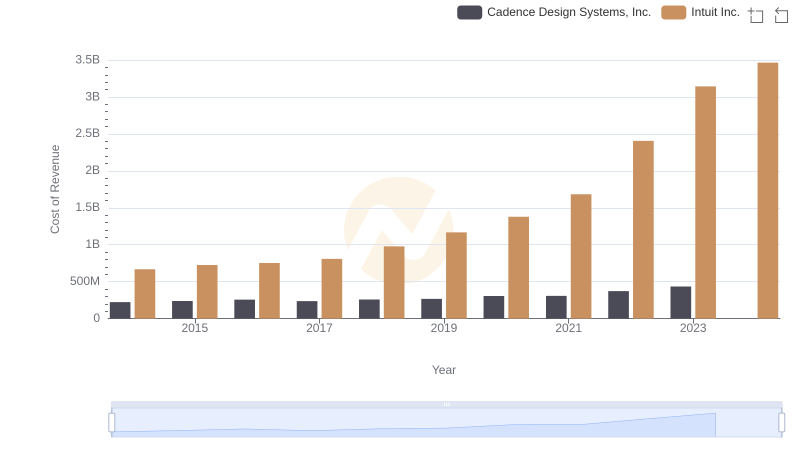

Cost of Revenue Trends: Intuit Inc. vs Cadence Design Systems, Inc.

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Synopsys, Inc.

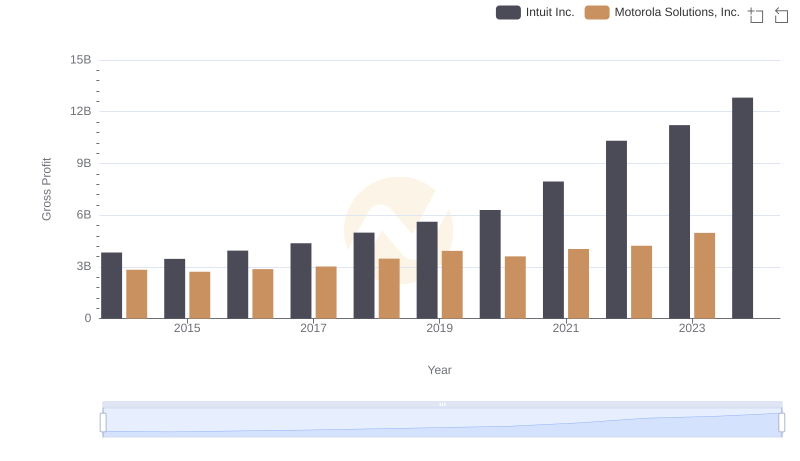

Intuit Inc. and Motorola Solutions, Inc.: A Detailed Gross Profit Analysis

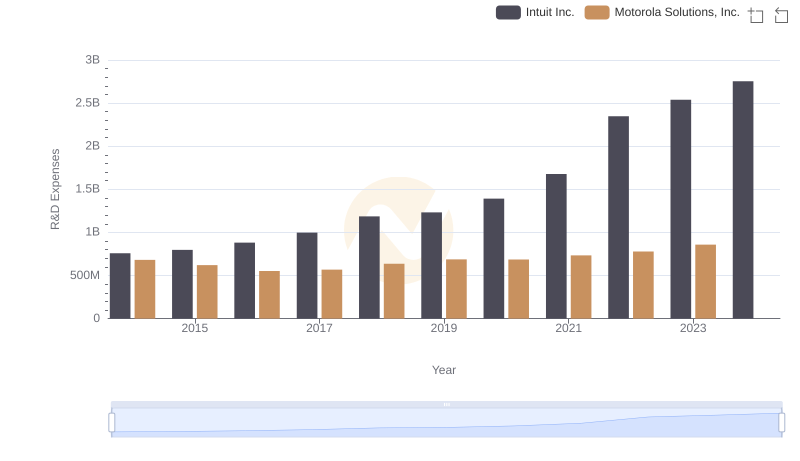

Analyzing R&D Budgets: Intuit Inc. vs Motorola Solutions, Inc.

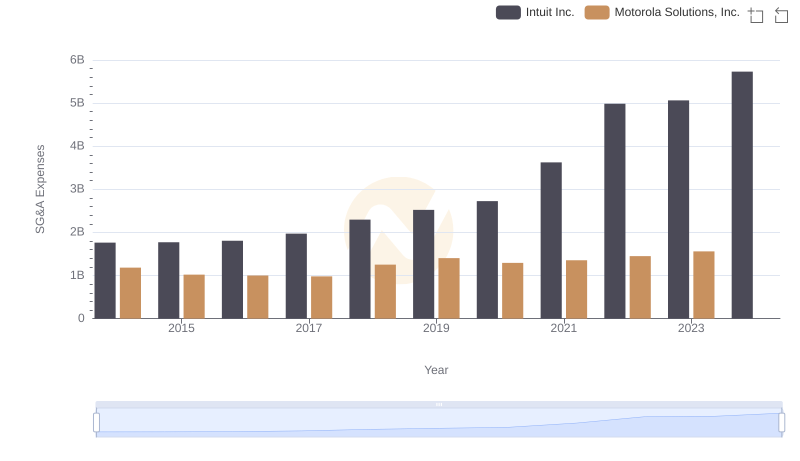

Selling, General, and Administrative Costs: Intuit Inc. vs Motorola Solutions, Inc.