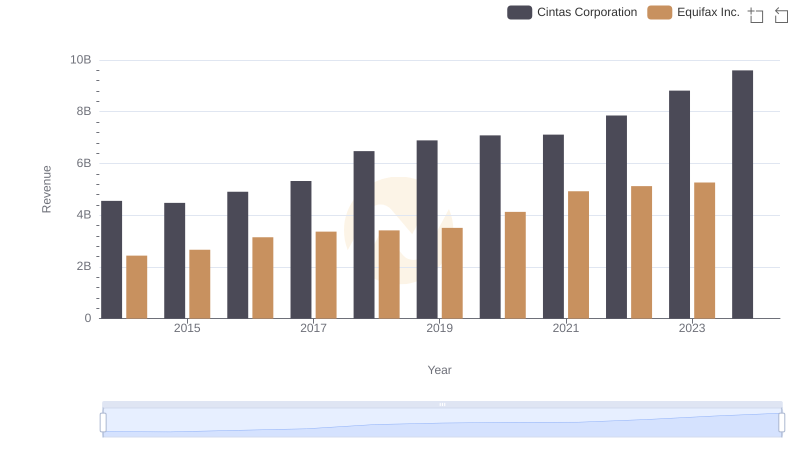

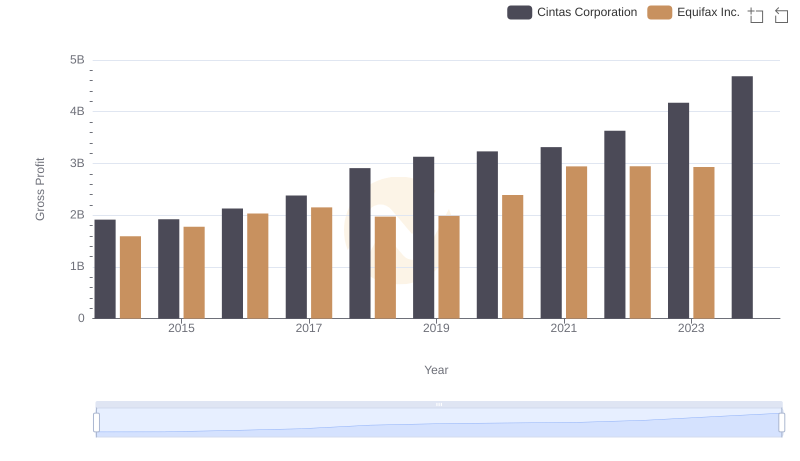

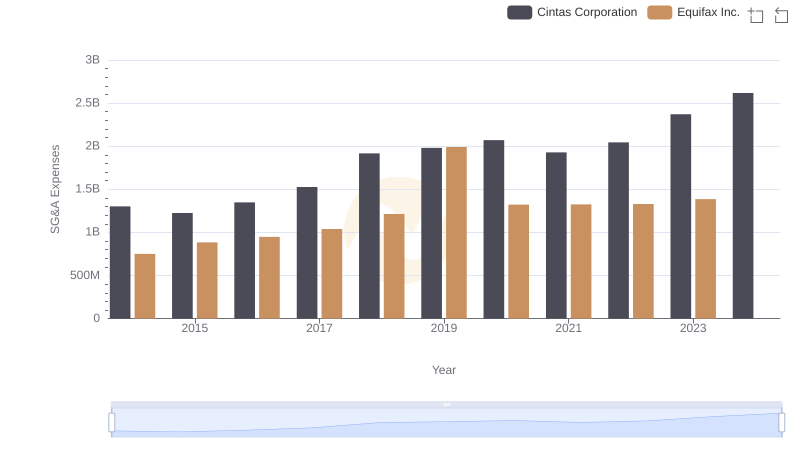

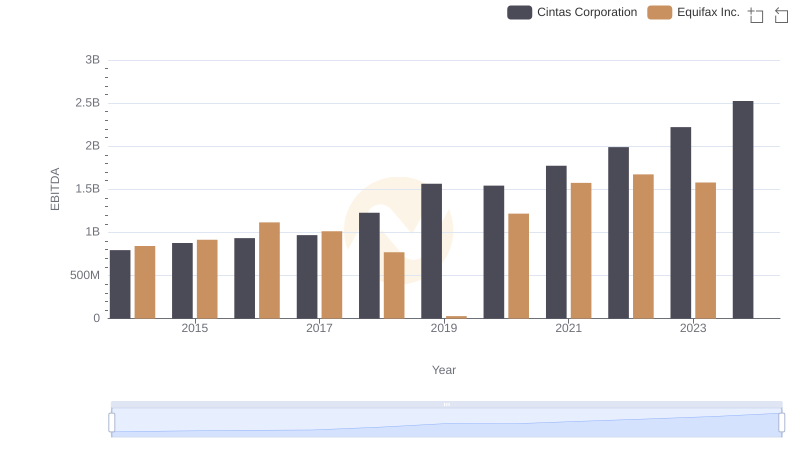

| __timestamp | Cintas Corporation | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 844700000 |

| Thursday, January 1, 2015 | 2555549000 | 887400000 |

| Friday, January 1, 2016 | 2775588000 | 1113400000 |

| Sunday, January 1, 2017 | 2943086000 | 1210700000 |

| Monday, January 1, 2018 | 3568109000 | 1440400000 |

| Tuesday, January 1, 2019 | 3763715000 | 1521700000 |

| Wednesday, January 1, 2020 | 3851372000 | 1737400000 |

| Friday, January 1, 2021 | 3801689000 | 1980900000 |

| Saturday, January 1, 2022 | 4222213000 | 2177200000 |

| Sunday, January 1, 2023 | 4642401000 | 2335100000 |

| Monday, January 1, 2024 | 4910199000 | 0 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate America, understanding cost structures is pivotal. Cintas Corporation and Equifax Inc., two stalwarts in their respective industries, have shown intriguing trends in their cost of revenue over the past decade. From 2014 to 2023, Cintas Corporation's cost of revenue surged by approximately 86%, reflecting its robust growth and expansion strategies. In contrast, Equifax Inc. experienced a 176% increase, highlighting its aggressive market penetration and data-driven services. Notably, Cintas consistently maintained a higher cost of revenue, underscoring its extensive operational scale. However, the data for 2024 remains incomplete for Equifax, leaving room for speculation on its future trajectory. This analysis not only sheds light on the financial dynamics of these corporations but also offers a glimpse into the broader economic trends shaping their industries.

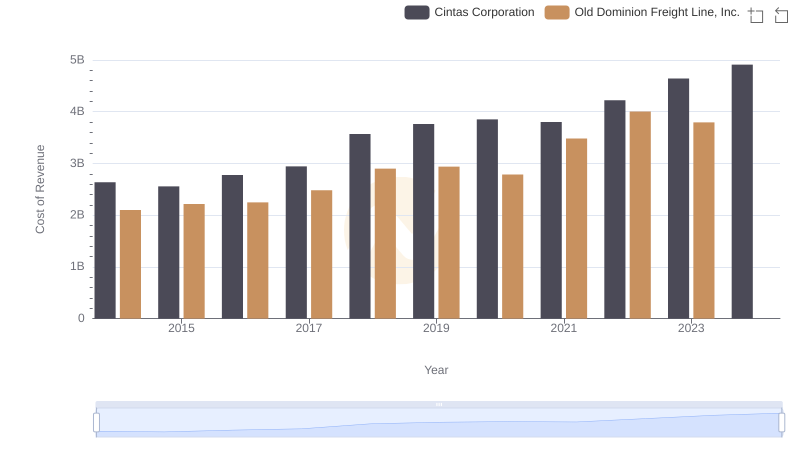

Cost Insights: Breaking Down Cintas Corporation and Old Dominion Freight Line, Inc.'s Expenses

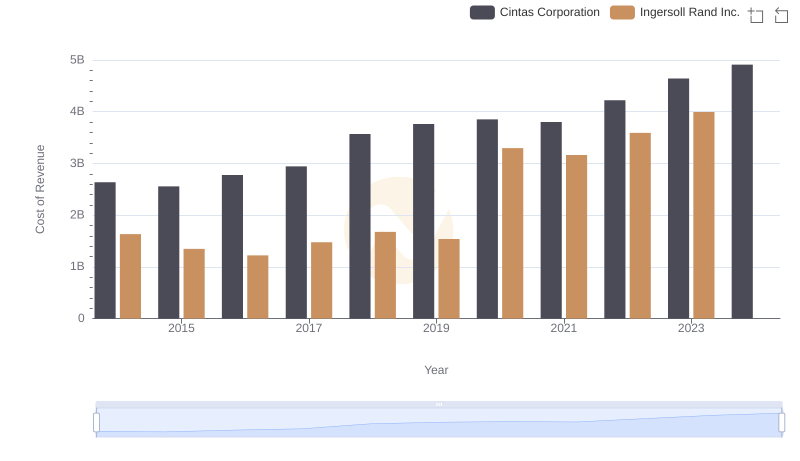

Cost Insights: Breaking Down Cintas Corporation and Ingersoll Rand Inc.'s Expenses

Cintas Corporation vs Equifax Inc.: Examining Key Revenue Metrics

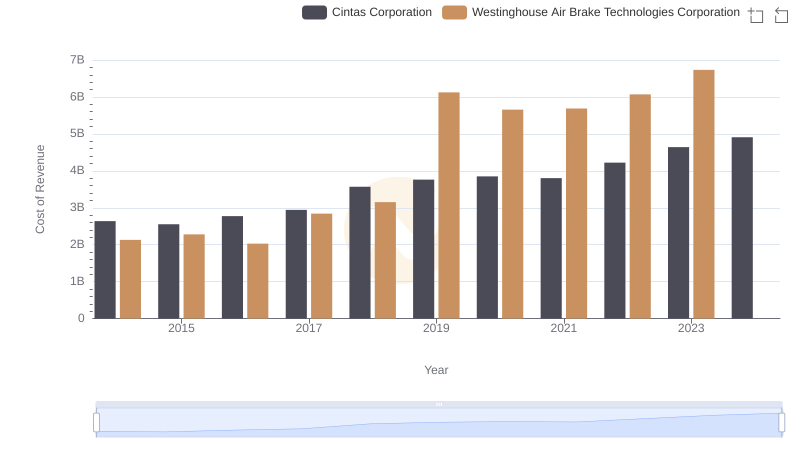

Cost of Revenue Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

Cintas Corporation vs United Airlines Holdings, Inc.: Efficiency in Cost of Revenue Explored

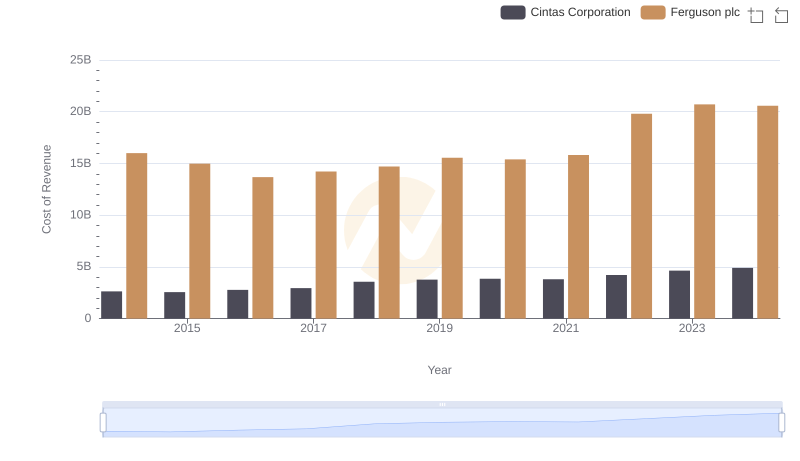

Cost Insights: Breaking Down Cintas Corporation and Ferguson plc's Expenses

Gross Profit Comparison: Cintas Corporation and Equifax Inc. Trends

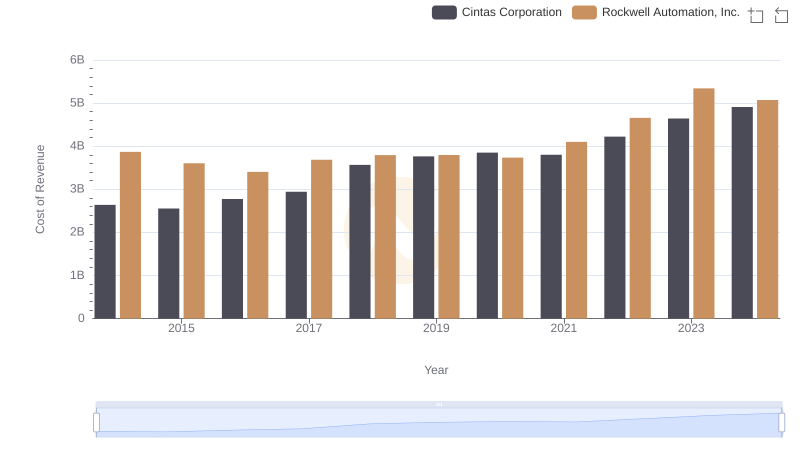

Cost of Revenue Comparison: Cintas Corporation vs Rockwell Automation, Inc.

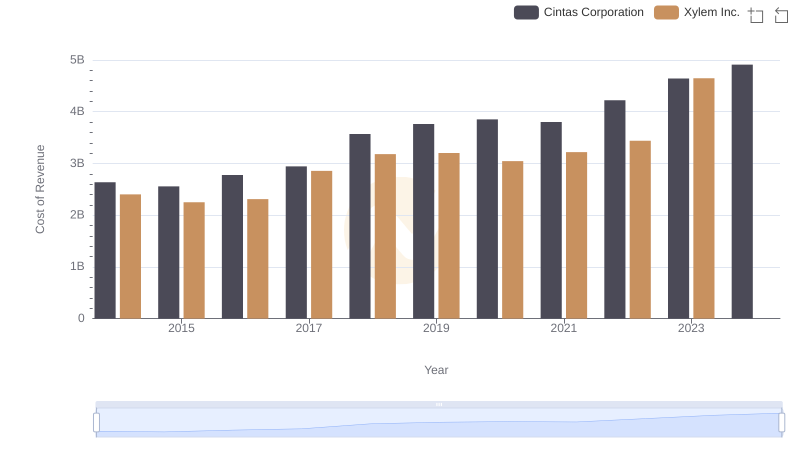

Cost Insights: Breaking Down Cintas Corporation and Xylem Inc.'s Expenses

Breaking Down SG&A Expenses: Cintas Corporation vs Equifax Inc.

A Professional Review of EBITDA: Cintas Corporation Compared to Equifax Inc.