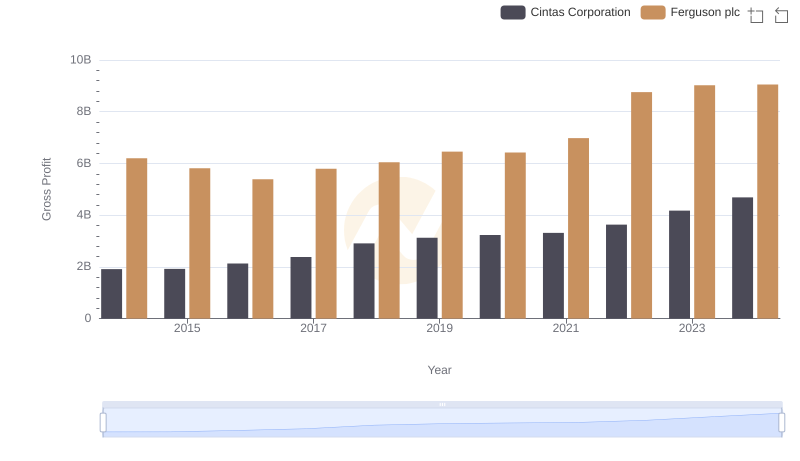

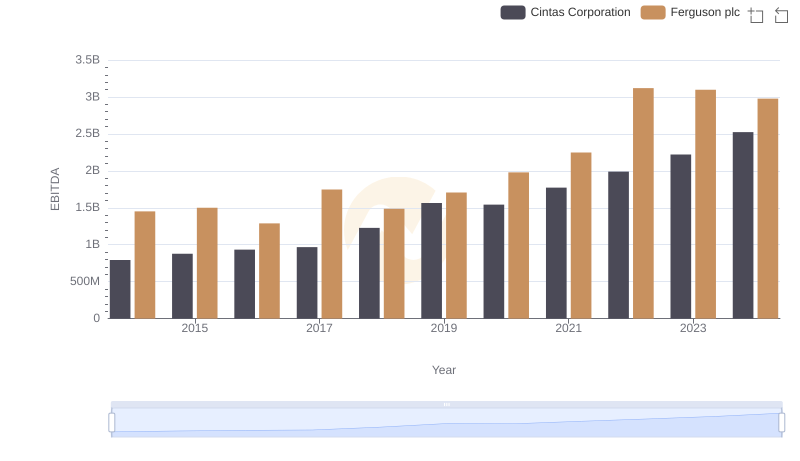

| __timestamp | Cintas Corporation | Ferguson plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 5065428 |

| Thursday, January 1, 2015 | 1224930000 | 3127932 |

| Friday, January 1, 2016 | 1348122000 | 3992798135 |

| Sunday, January 1, 2017 | 1527380000 | 4237396470 |

| Monday, January 1, 2018 | 1916792000 | 4552000000 |

| Tuesday, January 1, 2019 | 1980644000 | 4819000000 |

| Wednesday, January 1, 2020 | 2071052000 | 4260000000 |

| Friday, January 1, 2021 | 1929159000 | 4721000000 |

| Saturday, January 1, 2022 | 2044876000 | 5635000000 |

| Sunday, January 1, 2023 | 2370704000 | 5920000000 |

| Monday, January 1, 2024 | 2617783000 | 6066000000 |

Unleashing insights

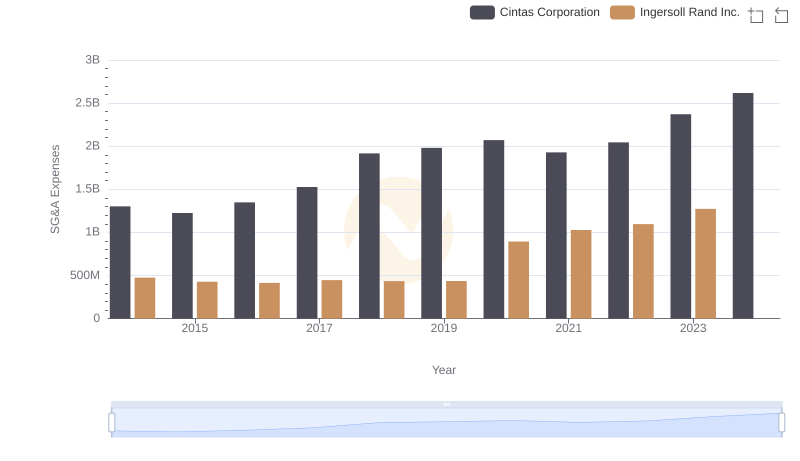

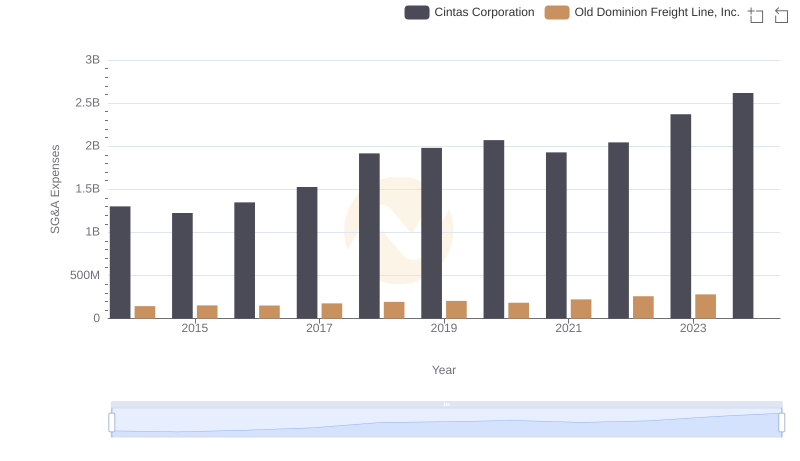

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Cintas Corporation and Ferguson plc have demonstrated contrasting trajectories in their SG&A expenditures. From 2014 to 2024, Cintas Corporation's SG&A expenses have surged by approximately 101%, reflecting a strategic expansion and increased operational costs. In contrast, Ferguson plc's expenses have skyrocketed by an astounding 119,000%, primarily due to a significant jump in 2016, marking a pivotal shift in their financial strategy.

This analysis underscores the diverse financial strategies employed by these industry giants, offering valuable insights for investors and analysts alike.

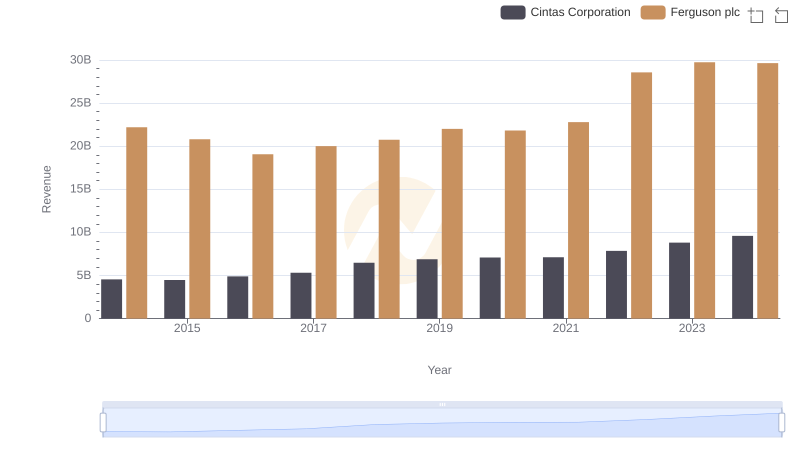

Who Generates More Revenue? Cintas Corporation or Ferguson plc

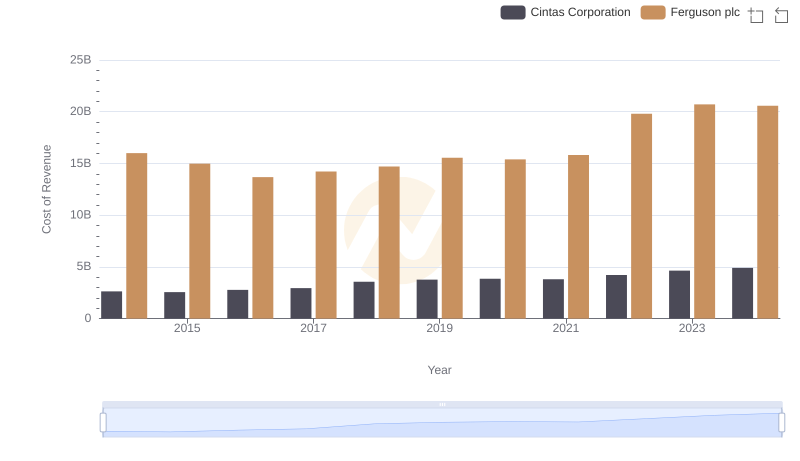

Cost Insights: Breaking Down Cintas Corporation and Ferguson plc's Expenses

Cintas Corporation and Ingersoll Rand Inc.: SG&A Spending Patterns Compared

Selling, General, and Administrative Costs: Cintas Corporation vs Old Dominion Freight Line, Inc.

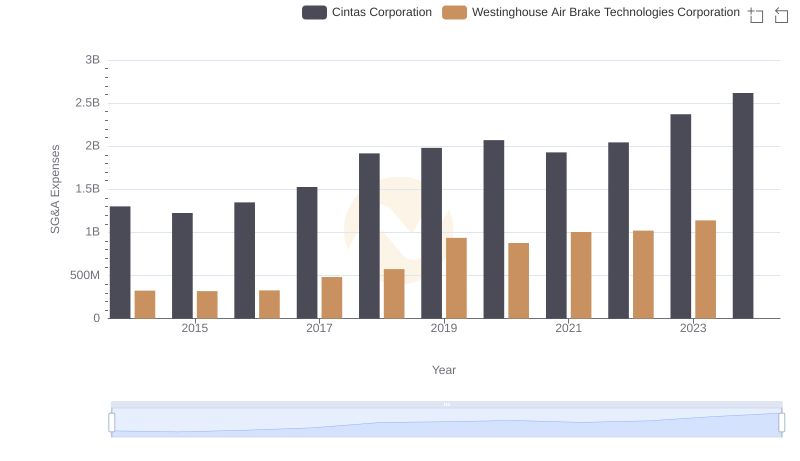

Cintas Corporation vs Westinghouse Air Brake Technologies Corporation: SG&A Expense Trends

Gross Profit Trends Compared: Cintas Corporation vs Ferguson plc

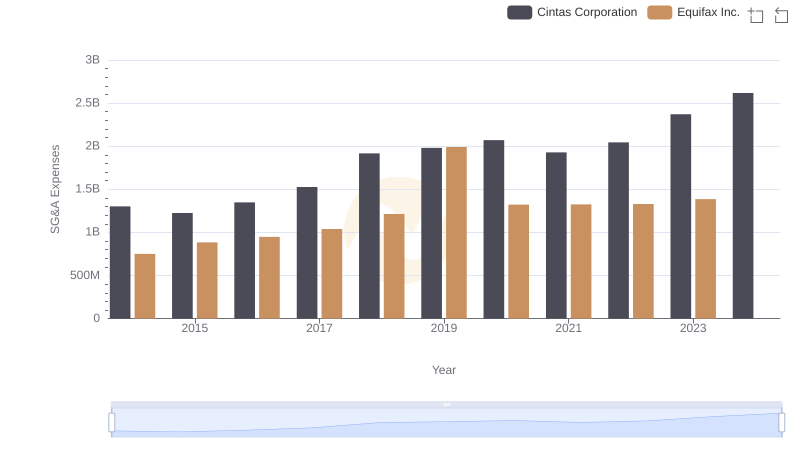

Breaking Down SG&A Expenses: Cintas Corporation vs Equifax Inc.

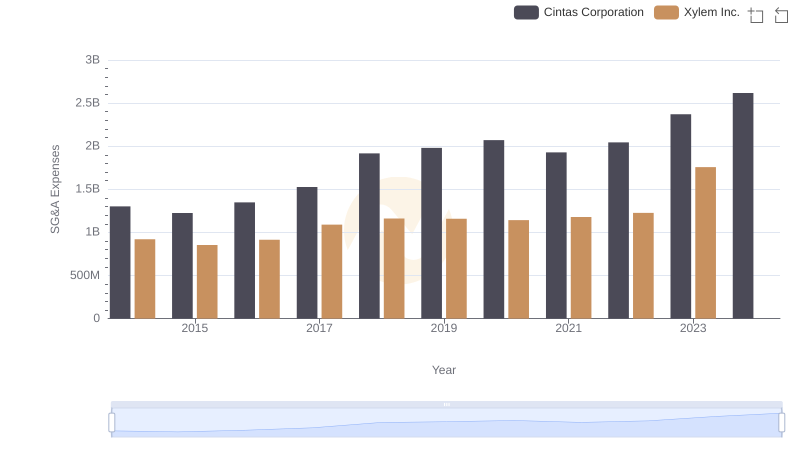

Cintas Corporation or Xylem Inc.: Who Manages SG&A Costs Better?

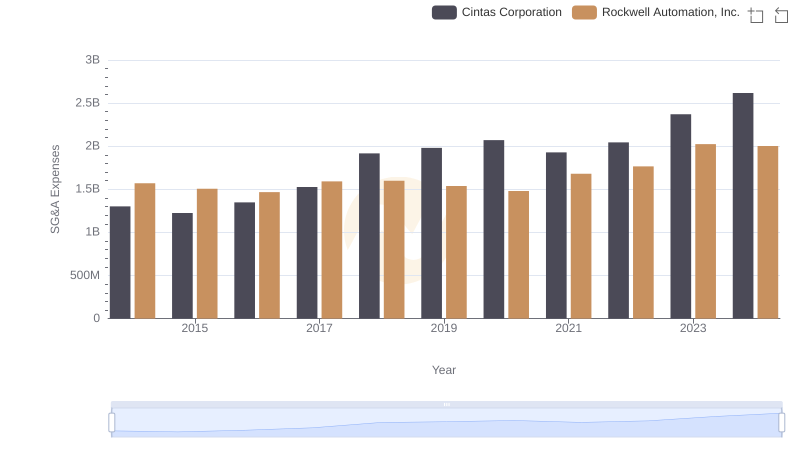

Comparing SG&A Expenses: Cintas Corporation vs Rockwell Automation, Inc. Trends and Insights

A Professional Review of EBITDA: Cintas Corporation Compared to Ferguson plc

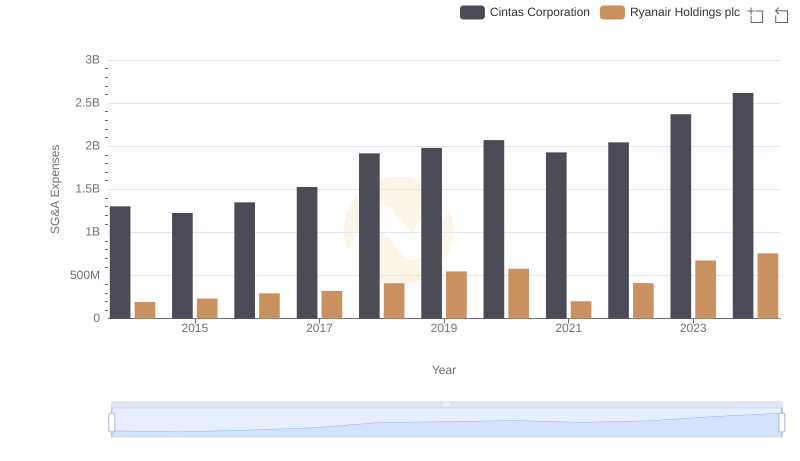

Comparing SG&A Expenses: Cintas Corporation vs Ryanair Holdings plc Trends and Insights