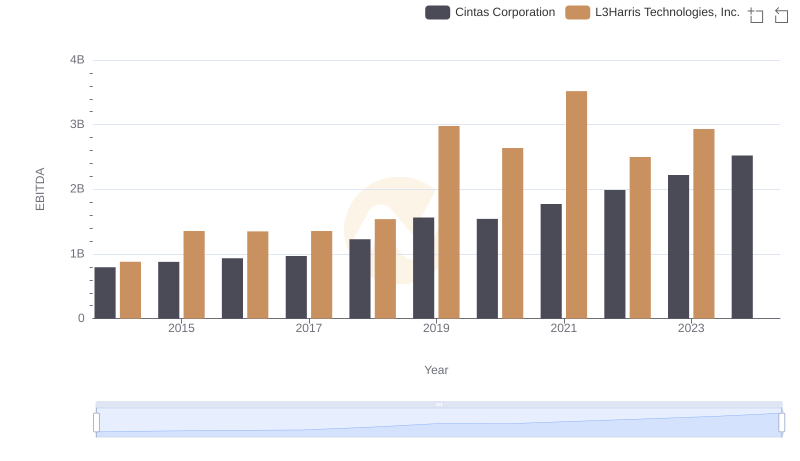

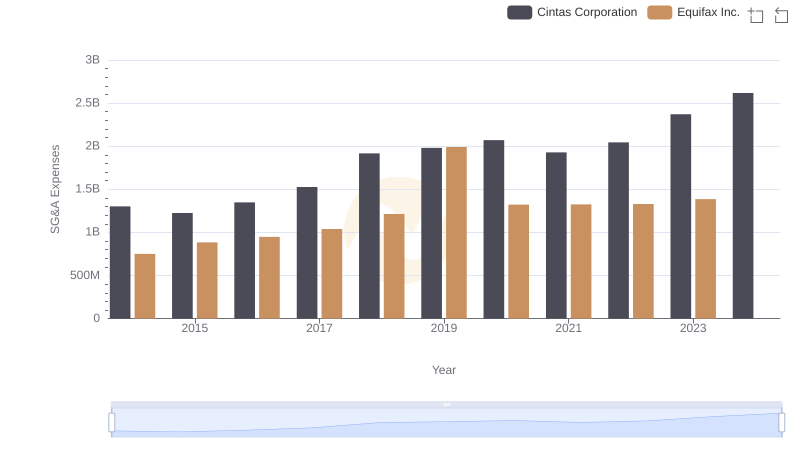

| __timestamp | Cintas Corporation | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 842400000 |

| Thursday, January 1, 2015 | 877761000 | 914600000 |

| Friday, January 1, 2016 | 933728000 | 1116900000 |

| Sunday, January 1, 2017 | 968293000 | 1013900000 |

| Monday, January 1, 2018 | 1227852000 | 770200000 |

| Tuesday, January 1, 2019 | 1564228000 | 29000000 |

| Wednesday, January 1, 2020 | 1542737000 | 1217800000 |

| Friday, January 1, 2021 | 1773591000 | 1575200000 |

| Saturday, January 1, 2022 | 1990046000 | 1672800000 |

| Sunday, January 1, 2023 | 2221676000 | 1579100000 |

| Monday, January 1, 2024 | 2523857000 | 1251200000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. This analysis delves into the EBITDA trends of Cintas Corporation and Equifax Inc. from 2014 to 2023. Over this period, Cintas has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 218%, from $793 million in 2014 to an impressive $2.22 billion in 2023. In contrast, Equifax's EBITDA has shown more volatility, peaking at $1.67 billion in 2022, before a slight dip in 2023.

Cintas's consistent upward trend highlights its strong operational efficiency and market adaptability. Meanwhile, Equifax's fluctuations, including a notable drop in 2019, suggest challenges in maintaining steady growth. This comparative analysis underscores the importance of strategic management in navigating financial landscapes and achieving sustainable growth.

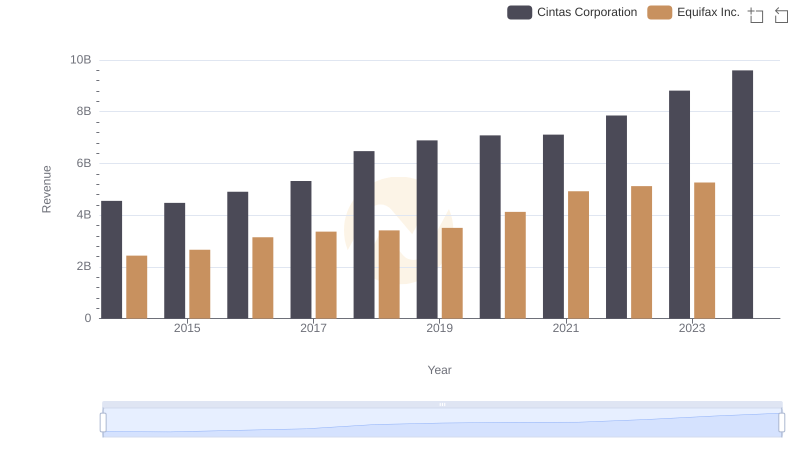

Cintas Corporation vs Equifax Inc.: Examining Key Revenue Metrics

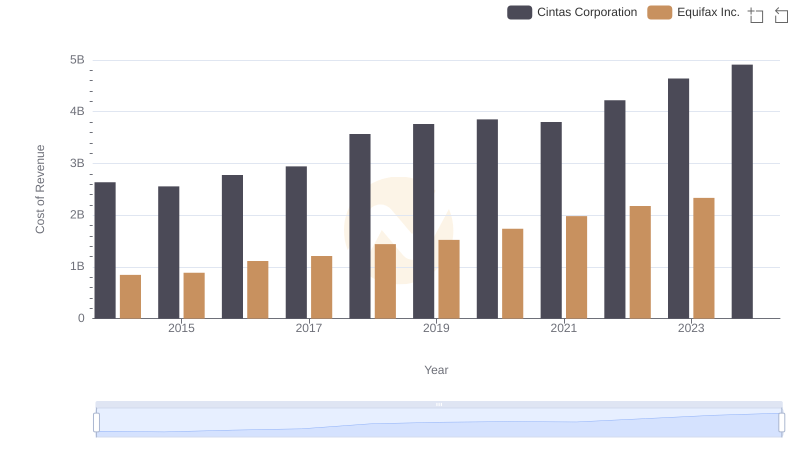

Cost of Revenue Trends: Cintas Corporation vs Equifax Inc.

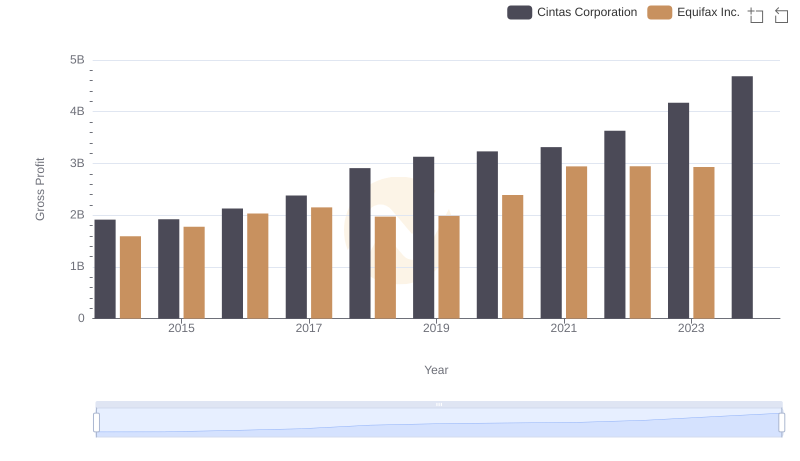

Gross Profit Comparison: Cintas Corporation and Equifax Inc. Trends

Comprehensive EBITDA Comparison: Cintas Corporation vs L3Harris Technologies, Inc.

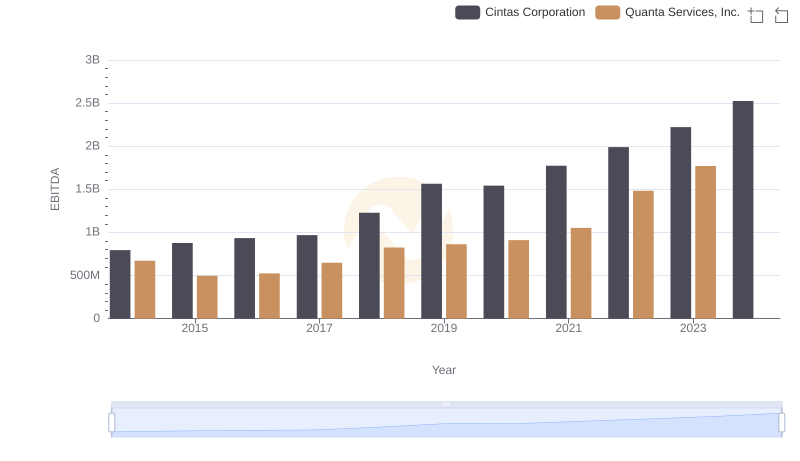

Comparative EBITDA Analysis: Cintas Corporation vs Quanta Services, Inc.

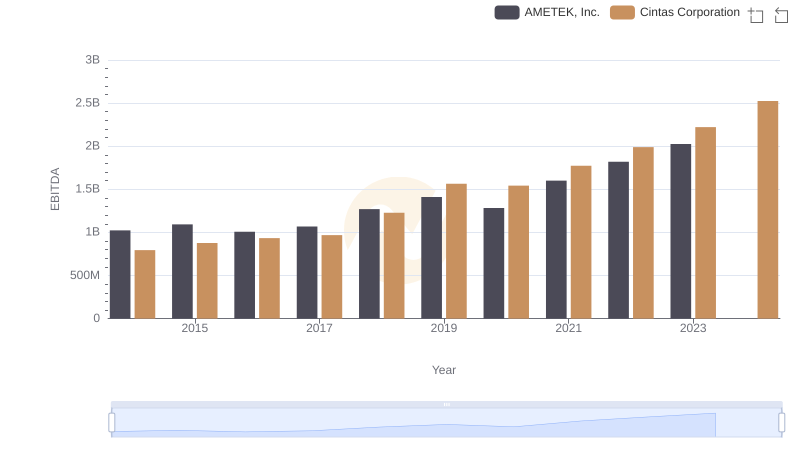

Cintas Corporation vs AMETEK, Inc.: In-Depth EBITDA Performance Comparison

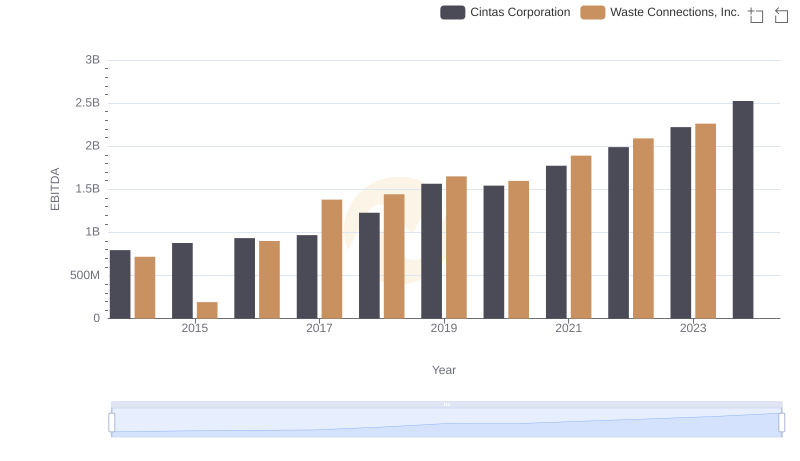

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Waste Connections, Inc.

Breaking Down SG&A Expenses: Cintas Corporation vs Equifax Inc.

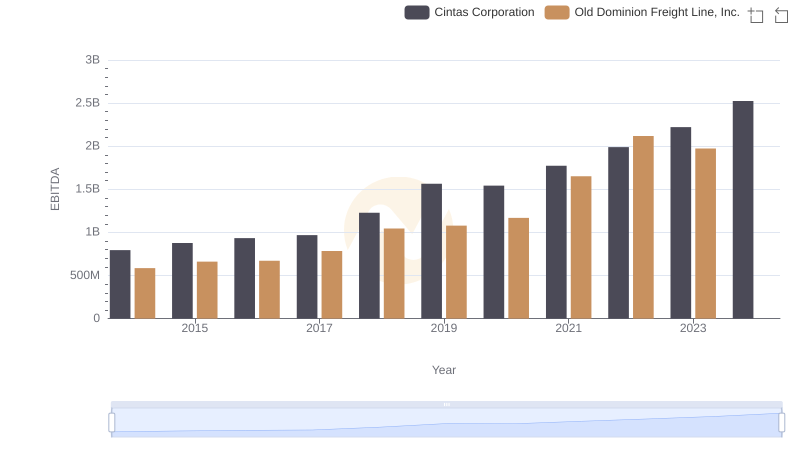

Professional EBITDA Benchmarking: Cintas Corporation vs Old Dominion Freight Line, Inc.

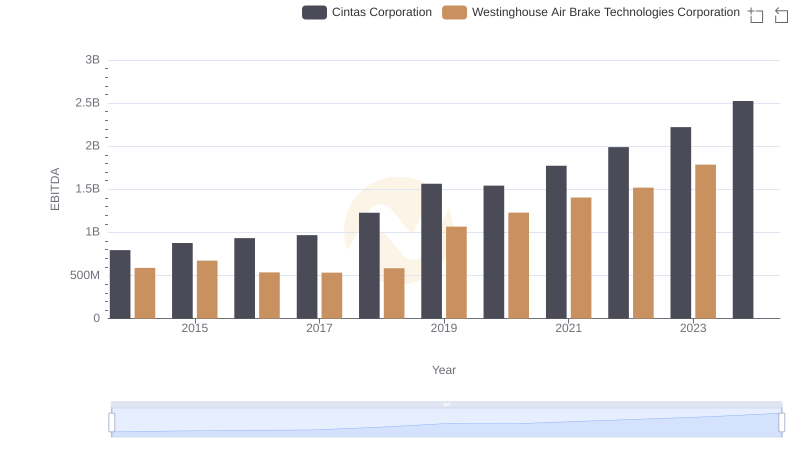

Comprehensive EBITDA Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

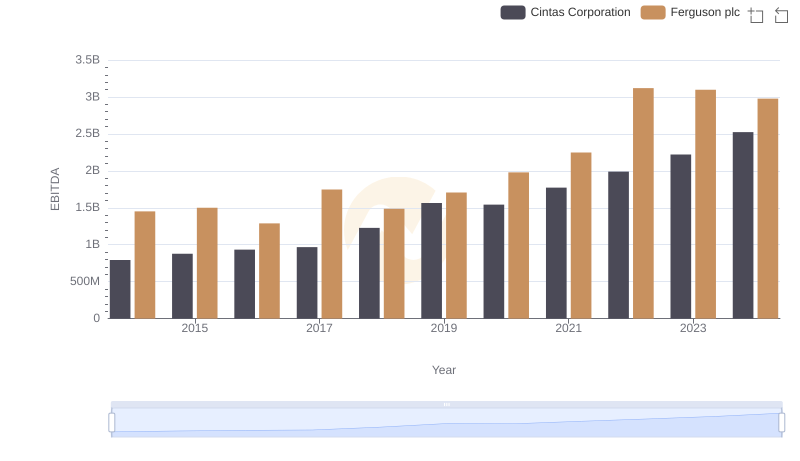

A Professional Review of EBITDA: Cintas Corporation Compared to Ferguson plc

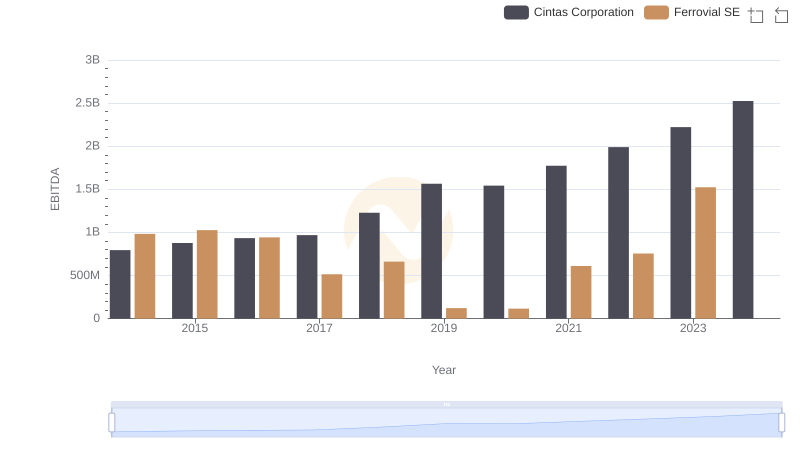

Comparative EBITDA Analysis: Cintas Corporation vs Ferrovial SE