| __timestamp | Axon Enterprise, Inc. | RB Global, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 248220000 |

| Thursday, January 1, 2015 | 69698000 | 254990000 |

| Friday, January 1, 2016 | 108076000 | 283529000 |

| Sunday, January 1, 2017 | 138692000 | 323270000 |

| Monday, January 1, 2018 | 156886000 | 382676000 |

| Tuesday, January 1, 2019 | 212959000 | 382389000 |

| Wednesday, January 1, 2020 | 307286000 | 417523000 |

| Friday, January 1, 2021 | 515007000 | 464599000 |

| Saturday, January 1, 2022 | 401575000 | 539933000 |

| Sunday, January 1, 2023 | 496874000 | 743700000 |

| Monday, January 1, 2024 | 773900000 |

Unveiling the hidden dimensions of data

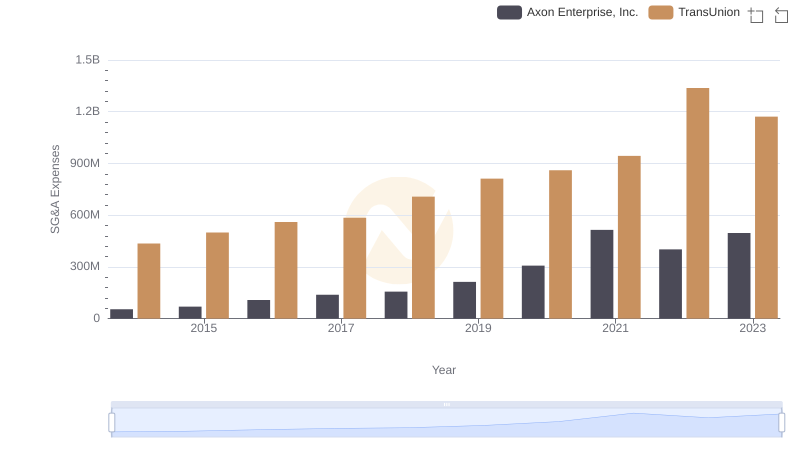

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for investors and analysts alike. Over the past decade, Axon Enterprise, Inc. and RB Global, Inc. have shown distinct trajectories in their SG&A expenditures. From 2014 to 2023, Axon Enterprise's SG&A expenses surged by over 800%, reflecting its aggressive growth strategy and expansion efforts. In contrast, RB Global's expenses increased by approximately 200%, indicating a more stable yet consistent growth pattern.

These trends highlight the strategic differences between the two companies, offering valuable insights for stakeholders.

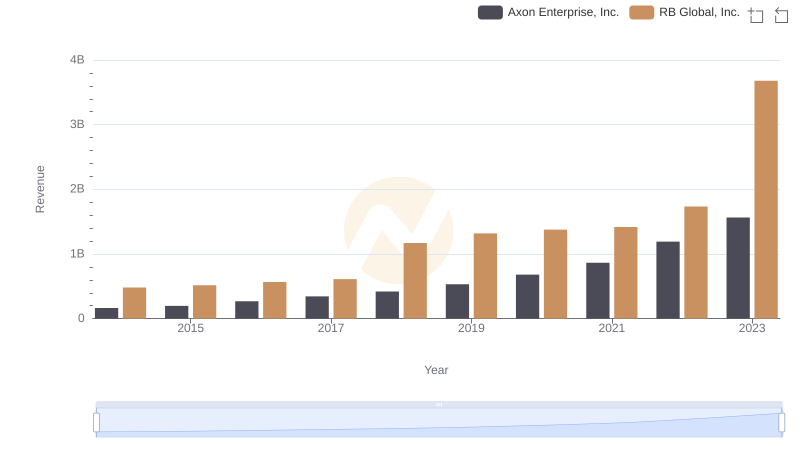

Revenue Insights: Axon Enterprise, Inc. and RB Global, Inc. Performance Compared

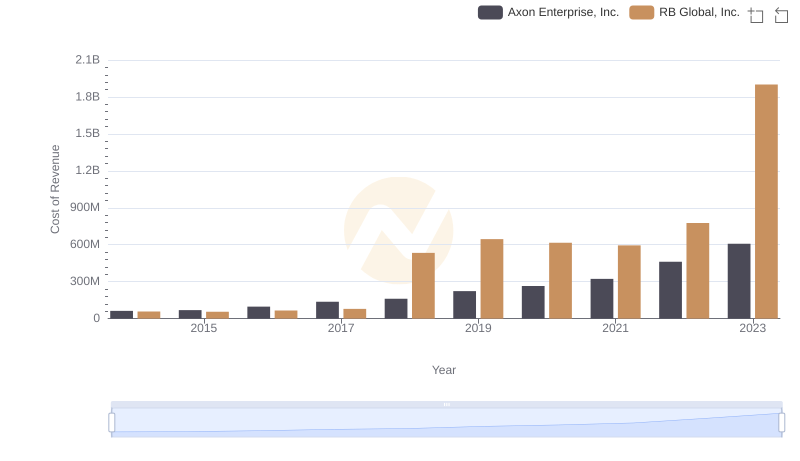

Cost Insights: Breaking Down Axon Enterprise, Inc. and RB Global, Inc.'s Expenses

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs TransUnion

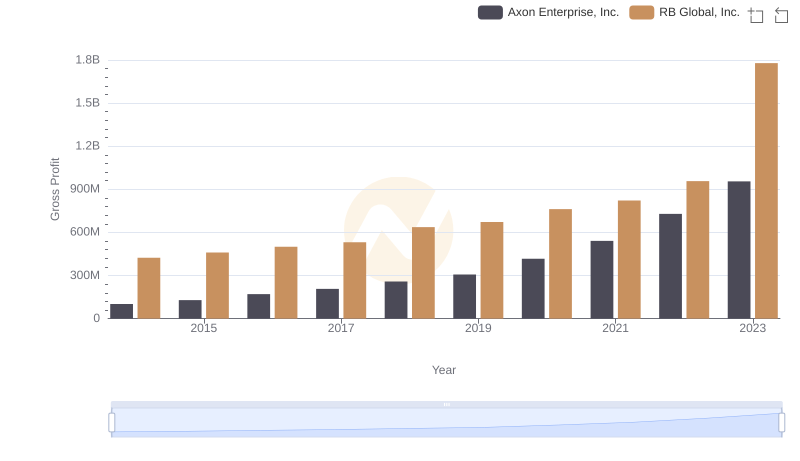

Gross Profit Trends Compared: Axon Enterprise, Inc. vs RB Global, Inc.

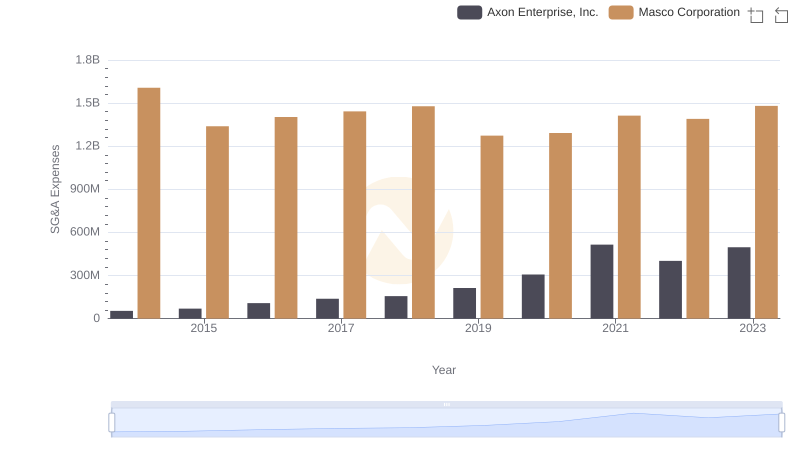

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Masco Corporation

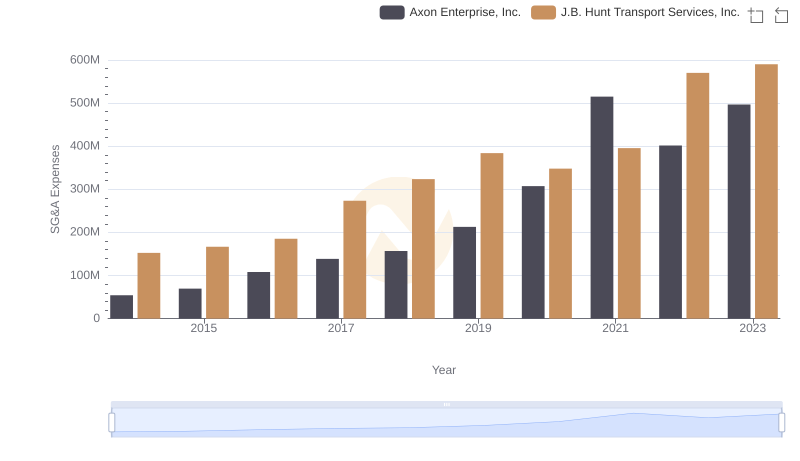

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or J.B. Hunt Transport Services, Inc.

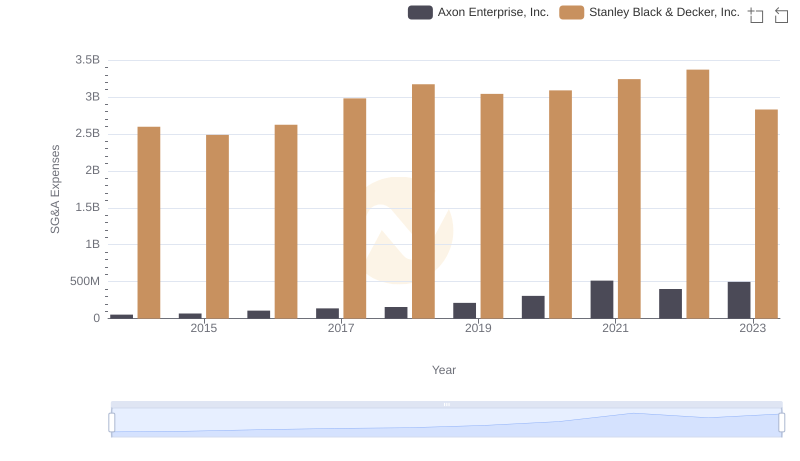

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

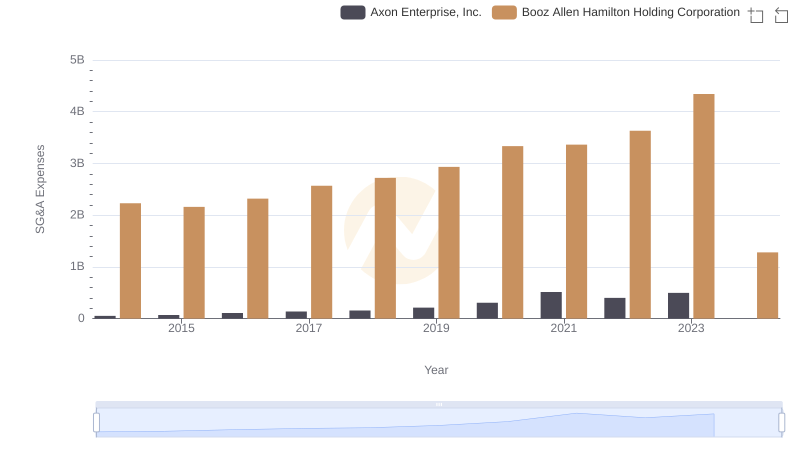

Axon Enterprise, Inc. vs Booz Allen Hamilton Holding Corporation: SG&A Expense Trends

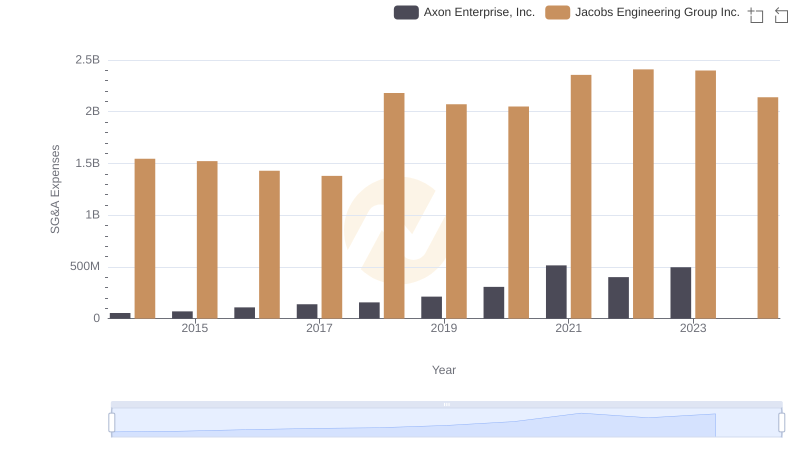

Axon Enterprise, Inc. and Jacobs Engineering Group Inc.: SG&A Spending Patterns Compared

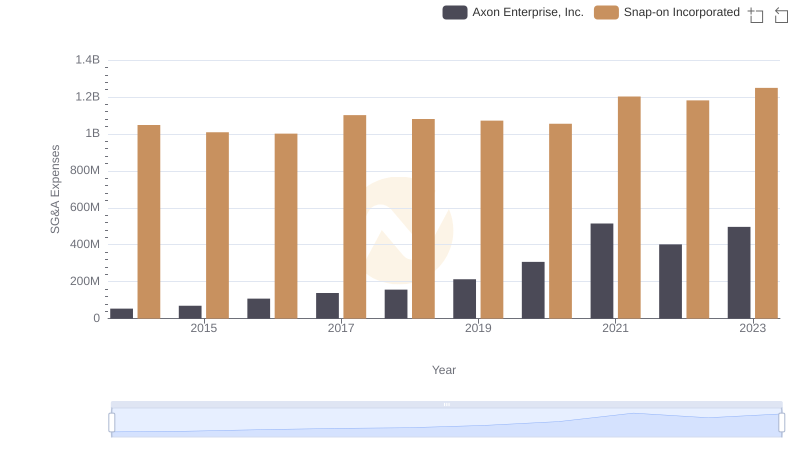

Axon Enterprise, Inc. or Snap-on Incorporated: Who Manages SG&A Costs Better?

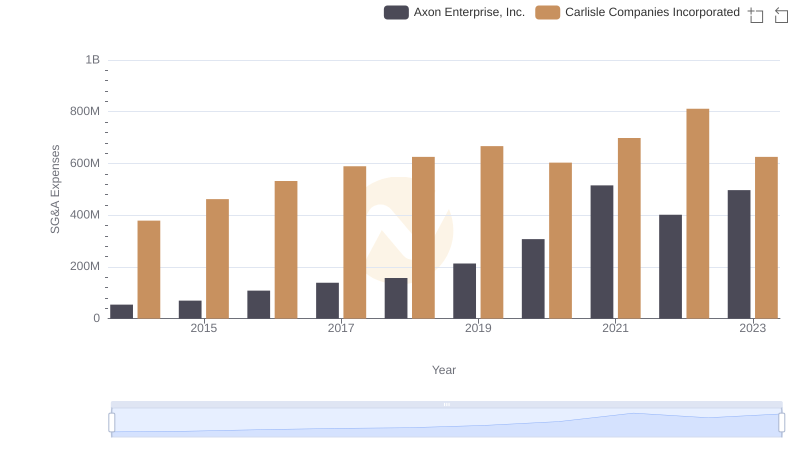

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs China Eastern Airlines Corporation Limited