| __timestamp | Axon Enterprise, Inc. | Booz Allen Hamilton Holding Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 2229642000 |

| Thursday, January 1, 2015 | 69698000 | 2159439000 |

| Friday, January 1, 2016 | 108076000 | 2319592000 |

| Sunday, January 1, 2017 | 138692000 | 2568511000 |

| Monday, January 1, 2018 | 156886000 | 2719909000 |

| Tuesday, January 1, 2019 | 212959000 | 2932602000 |

| Wednesday, January 1, 2020 | 307286000 | 3334378000 |

| Friday, January 1, 2021 | 515007000 | 3362722000 |

| Saturday, January 1, 2022 | 401575000 | 3633150000 |

| Sunday, January 1, 2023 | 496874000 | 4341769000 |

| Monday, January 1, 2024 | 1281443000 |

Infusing magic into the data realm

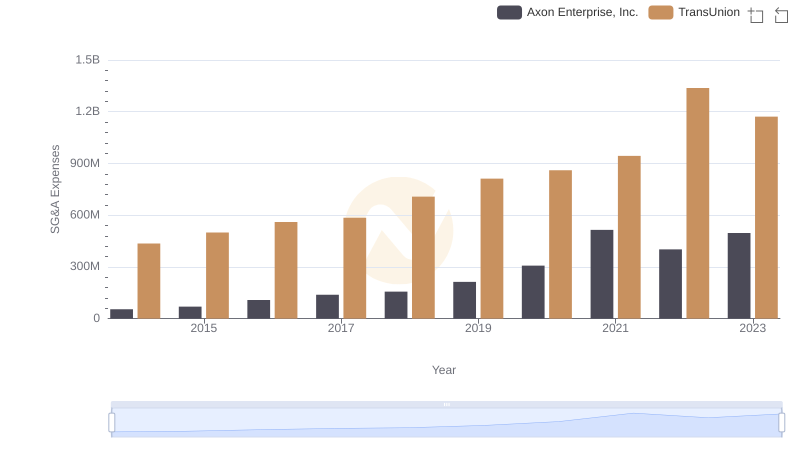

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for investors and analysts alike. Over the past decade, Axon Enterprise, Inc. and Booz Allen Hamilton Holding Corporation have showcased distinct trajectories in their SG&A expenditures.

From 2014 to 2023, Axon Enterprise, Inc. experienced a remarkable increase in SG&A expenses, growing by approximately 817%, from $54 million to nearly $497 million. This surge reflects Axon's aggressive expansion and investment in operational capabilities. In contrast, Booz Allen Hamilton's SG&A expenses rose by about 95% during the same period, reaching over $4.3 billion in 2023. This steady growth underscores Booz Allen's strategic focus on maintaining a robust administrative framework.

While the data for 2024 is incomplete, these trends provide valuable insights into the financial strategies of these industry leaders. Investors should watch for future developments as both companies continue to navigate the complexities of their respective markets.

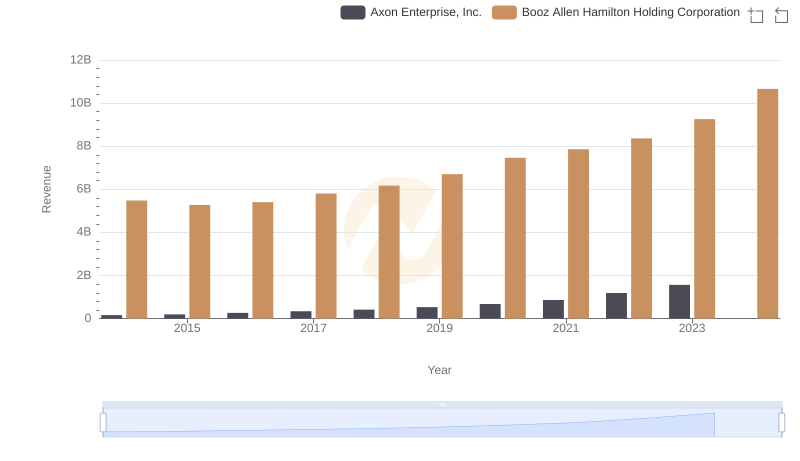

Annual Revenue Comparison: Axon Enterprise, Inc. vs Booz Allen Hamilton Holding Corporation

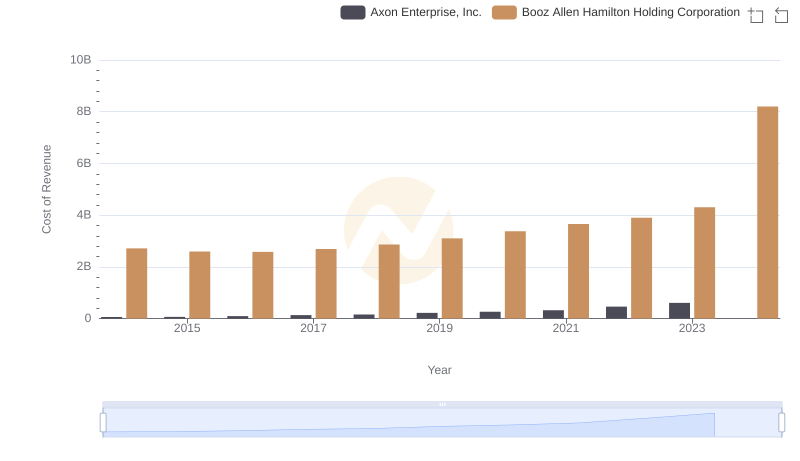

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and Booz Allen Hamilton Holding Corporation

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs TransUnion

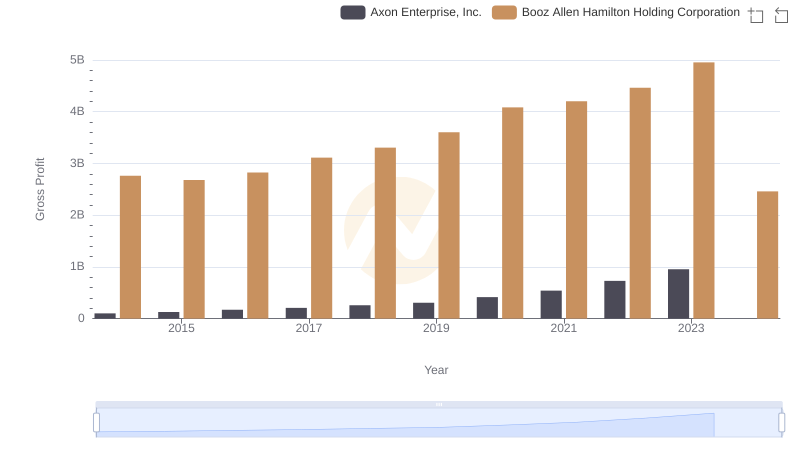

Axon Enterprise, Inc. and Booz Allen Hamilton Holding Corporation: A Detailed Gross Profit Analysis

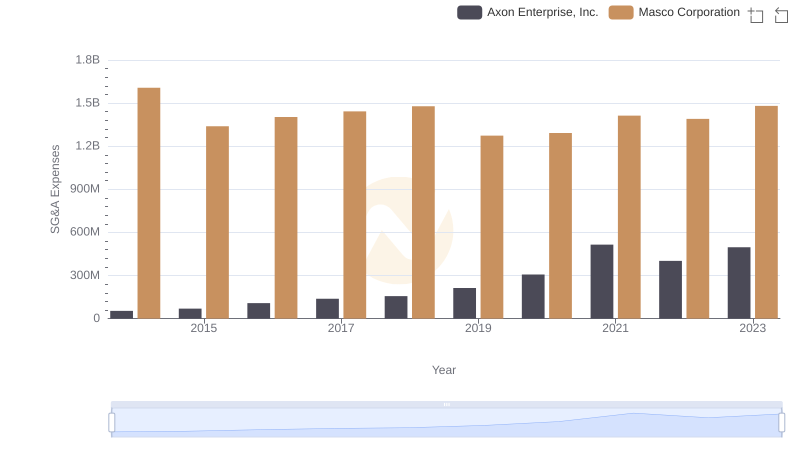

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Masco Corporation

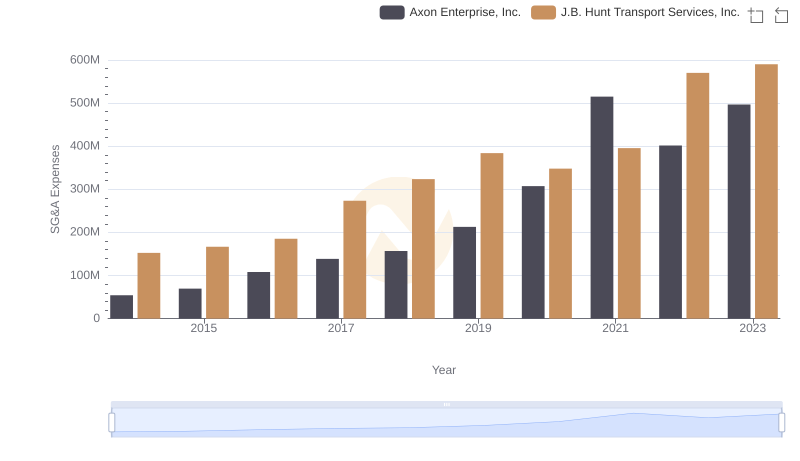

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or J.B. Hunt Transport Services, Inc.

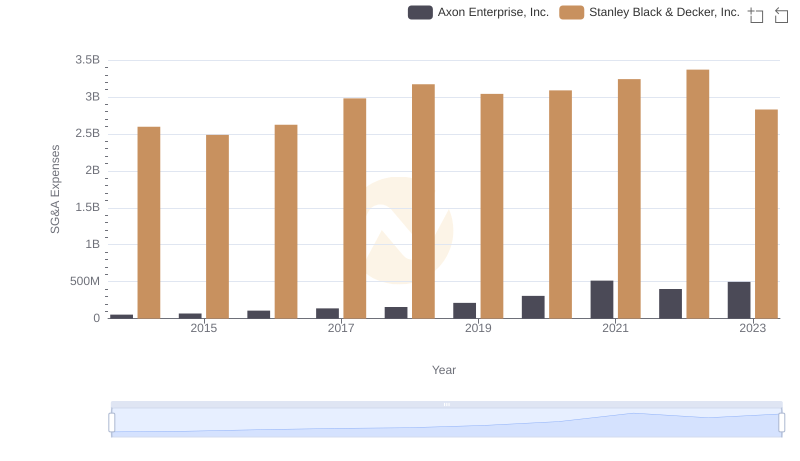

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

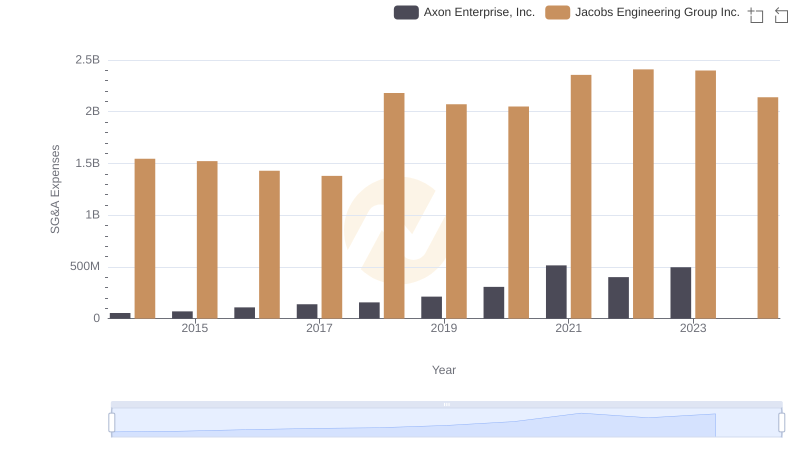

Axon Enterprise, Inc. and Jacobs Engineering Group Inc.: SG&A Spending Patterns Compared

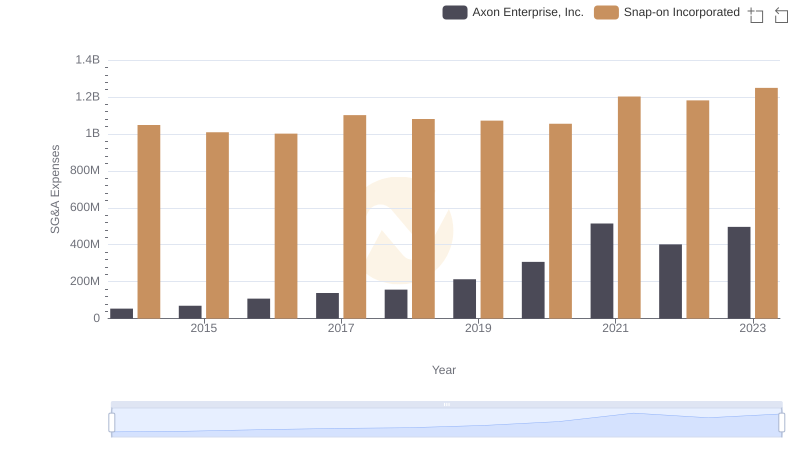

Axon Enterprise, Inc. or Snap-on Incorporated: Who Manages SG&A Costs Better?

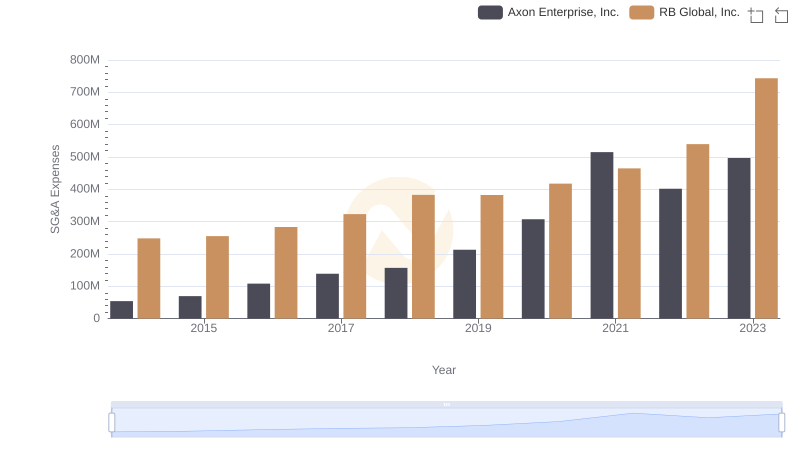

Axon Enterprise, Inc. vs RB Global, Inc.: SG&A Expense Trends

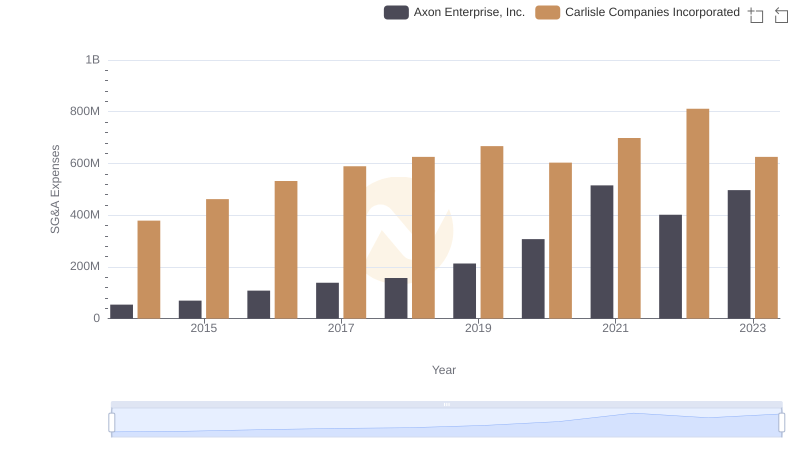

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs China Eastern Airlines Corporation Limited