| __timestamp | Axon Enterprise, Inc. | Carlisle Companies Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 379000000 |

| Thursday, January 1, 2015 | 69698000 | 461900000 |

| Friday, January 1, 2016 | 108076000 | 532000000 |

| Sunday, January 1, 2017 | 138692000 | 589400000 |

| Monday, January 1, 2018 | 156886000 | 625400000 |

| Tuesday, January 1, 2019 | 212959000 | 667100000 |

| Wednesday, January 1, 2020 | 307286000 | 603200000 |

| Friday, January 1, 2021 | 515007000 | 698200000 |

| Saturday, January 1, 2022 | 401575000 | 811500000 |

| Sunday, January 1, 2023 | 496874000 | 625200000 |

| Monday, January 1, 2024 | 722800000 |

Unveiling the hidden dimensions of data

In the competitive landscape of corporate America, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. This chart provides a fascinating comparison between Axon Enterprise, Inc. and Carlisle Companies Incorporated from 2014 to 2023.

Axon, known for its innovative public safety technologies, has seen a remarkable increase in SG&A expenses over the years. From 2014 to 2023, Axon's SG&A expenses surged by over 800%, reflecting its aggressive growth strategy and investment in expanding its market presence.

On the other hand, Carlisle, a diversified global manufacturer, experienced a more stable yet significant increase of around 65% in SG&A expenses during the same period. This steady growth aligns with its strategic acquisitions and expansion into new markets.

This comparison highlights the distinct strategies of these two companies, with Axon focusing on rapid expansion and Carlisle on steady growth. Understanding these trends can provide valuable insights for investors and industry analysts alike.

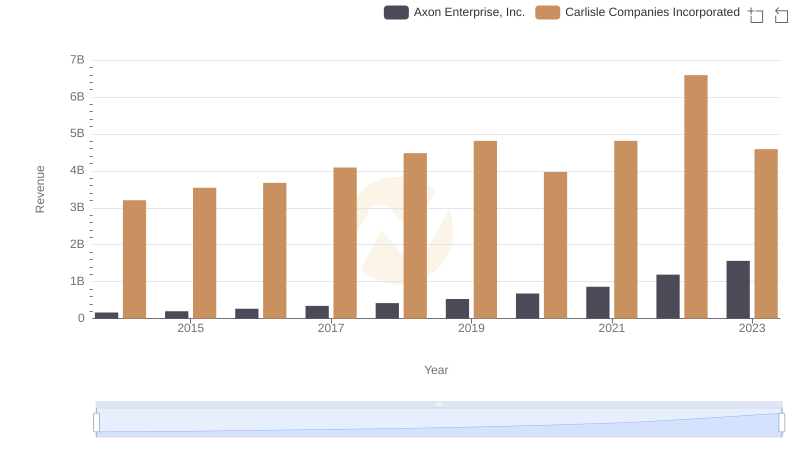

Axon Enterprise, Inc. and Carlisle Companies Incorporated: A Comprehensive Revenue Analysis

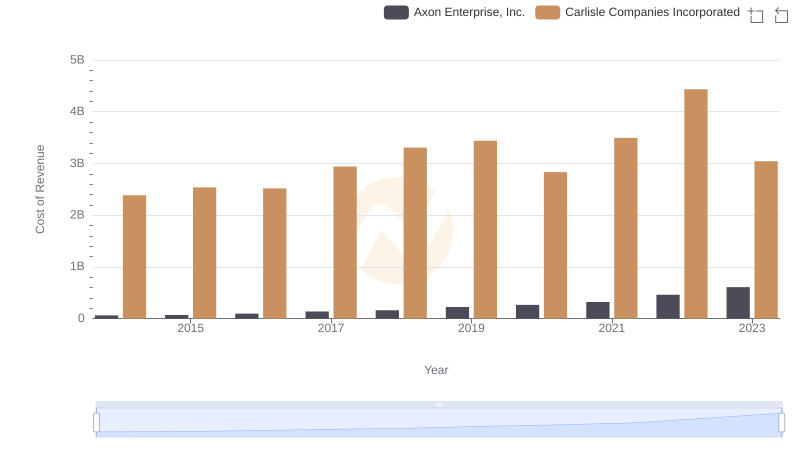

Cost Insights: Breaking Down Axon Enterprise, Inc. and Carlisle Companies Incorporated's Expenses

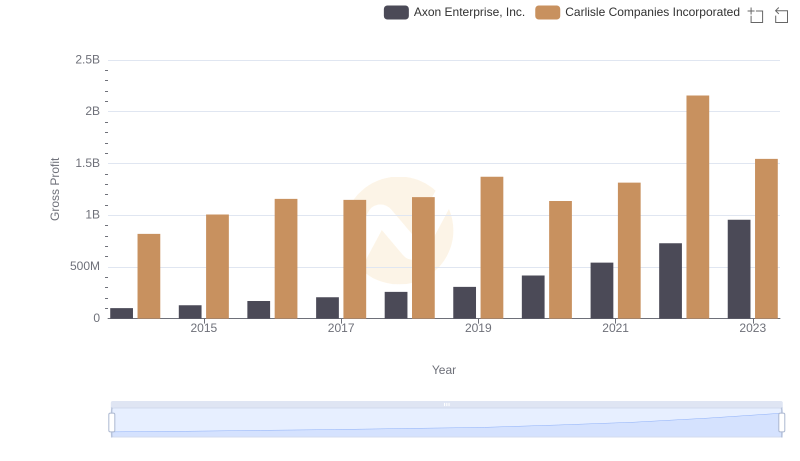

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

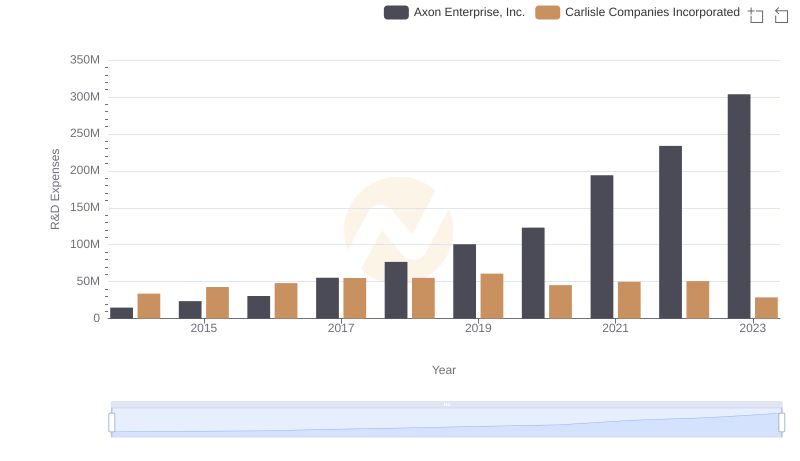

Analyzing R&D Budgets: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

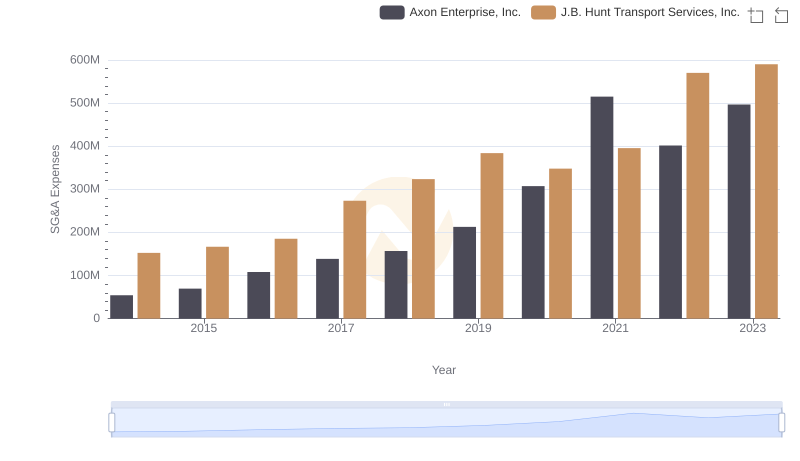

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or J.B. Hunt Transport Services, Inc.

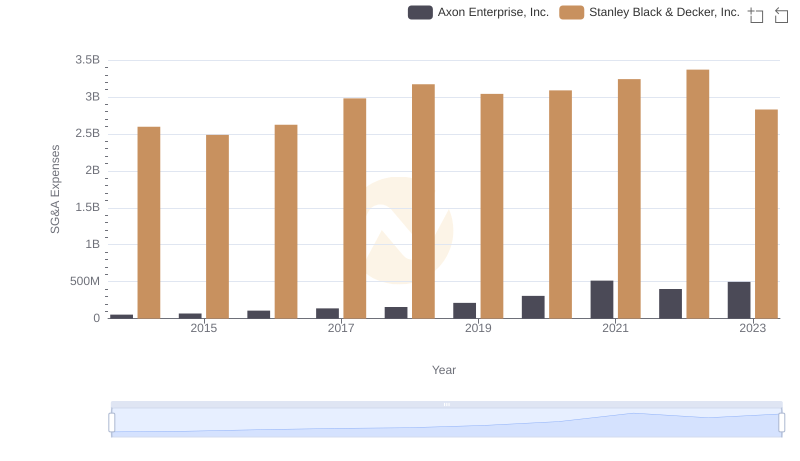

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

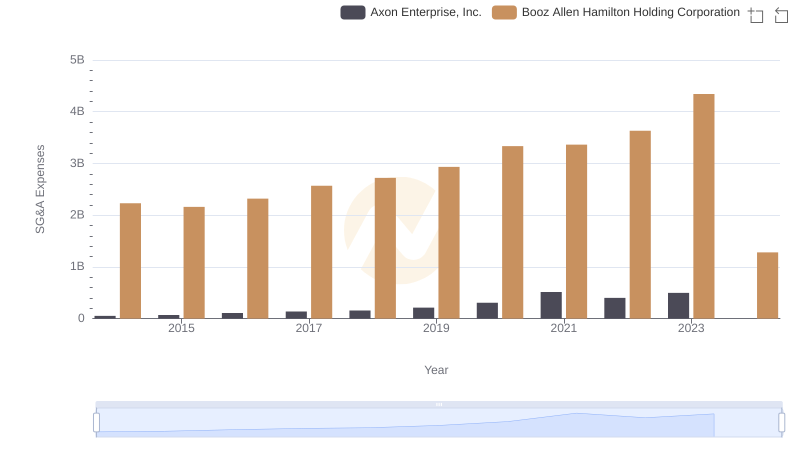

Axon Enterprise, Inc. vs Booz Allen Hamilton Holding Corporation: SG&A Expense Trends

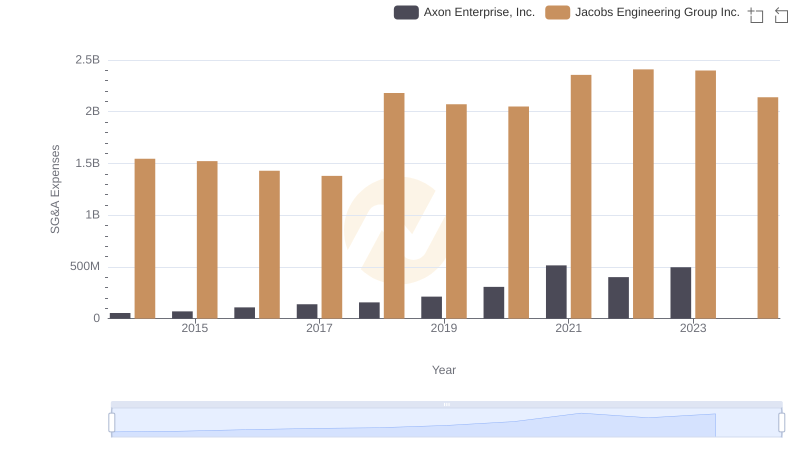

Axon Enterprise, Inc. and Jacobs Engineering Group Inc.: SG&A Spending Patterns Compared

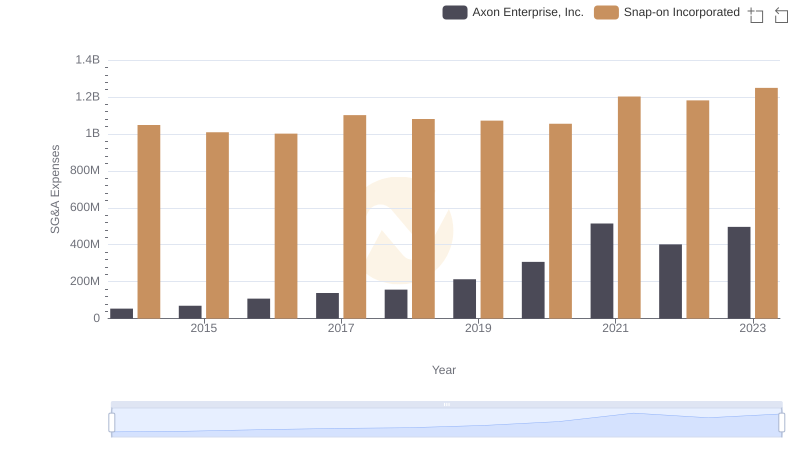

Axon Enterprise, Inc. or Snap-on Incorporated: Who Manages SG&A Costs Better?

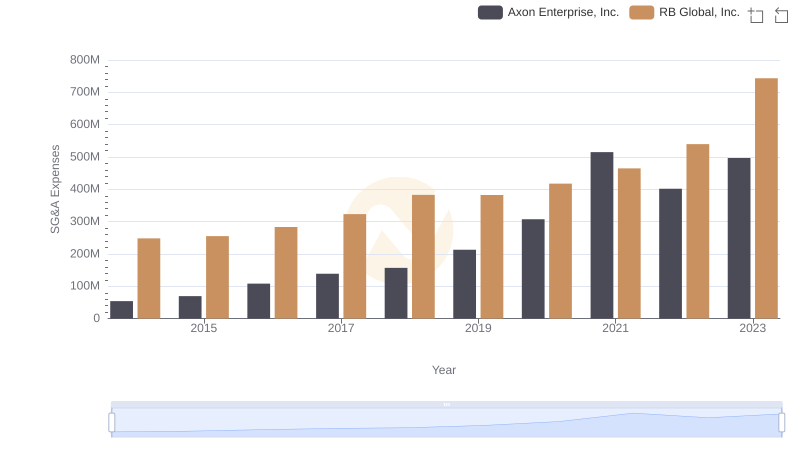

Axon Enterprise, Inc. vs RB Global, Inc.: SG&A Expense Trends

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs China Eastern Airlines Corporation Limited

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Pentair plc