| __timestamp | Axon Enterprise, Inc. | J.B. Hunt Transport Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 152469000 |

| Thursday, January 1, 2015 | 69698000 | 166799000 |

| Friday, January 1, 2016 | 108076000 | 185436000 |

| Sunday, January 1, 2017 | 138692000 | 273440000 |

| Monday, January 1, 2018 | 156886000 | 323587000 |

| Tuesday, January 1, 2019 | 212959000 | 383981000 |

| Wednesday, January 1, 2020 | 307286000 | 348076000 |

| Friday, January 1, 2021 | 515007000 | 395533000 |

| Saturday, January 1, 2022 | 401575000 | 570191000 |

| Sunday, January 1, 2023 | 496874000 | 590242000 |

In pursuit of knowledge

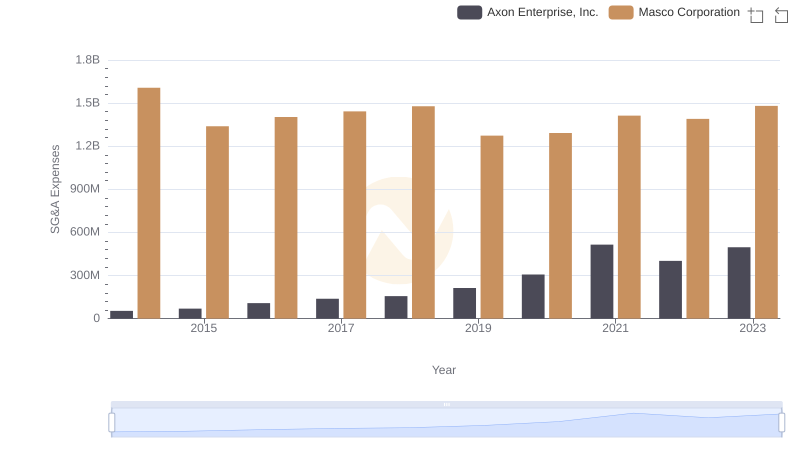

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Axon Enterprise, Inc. and J.B. Hunt Transport Services, Inc. have been navigating this financial terrain since 2014. Over the past decade, Axon has seen its SG&A expenses grow by approximately 817%, while J.B. Hunt's expenses increased by about 287%. Despite this, J.B. Hunt consistently maintained higher SG&A costs, peaking at nearly $590 million in 2023, compared to Axon's $497 million. This trend suggests that while Axon is rapidly expanding its operational costs, J.B. Hunt's larger scale requires more substantial administrative spending. The data highlights the strategic differences in cost management between a tech-driven enterprise and a logistics giant, offering insights into their operational efficiencies and growth strategies.

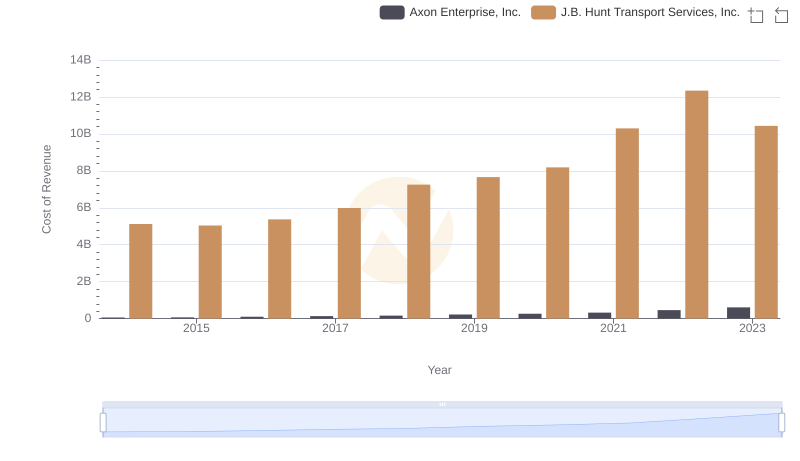

Cost of Revenue Trends: Axon Enterprise, Inc. vs J.B. Hunt Transport Services, Inc.

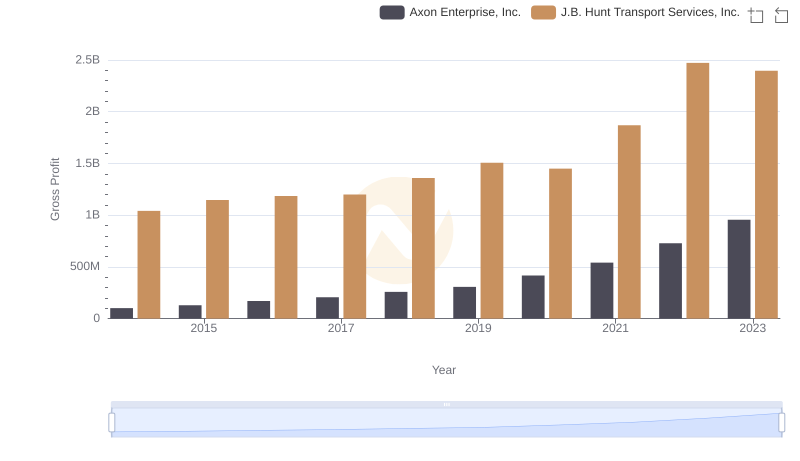

Gross Profit Comparison: Axon Enterprise, Inc. and J.B. Hunt Transport Services, Inc. Trends

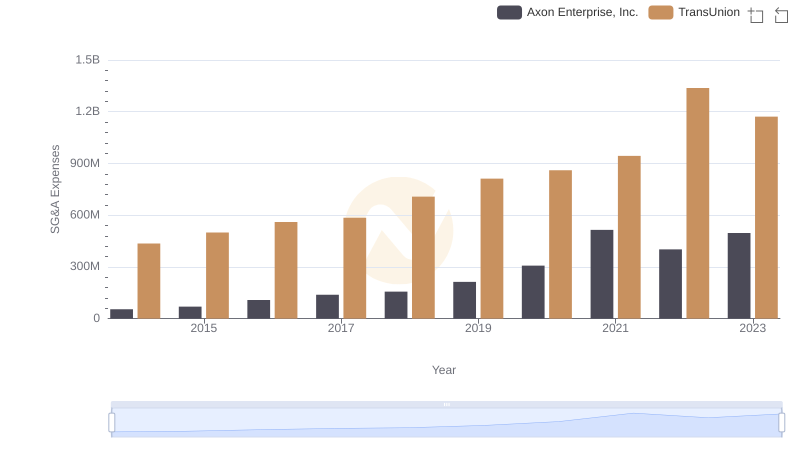

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs TransUnion

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Masco Corporation

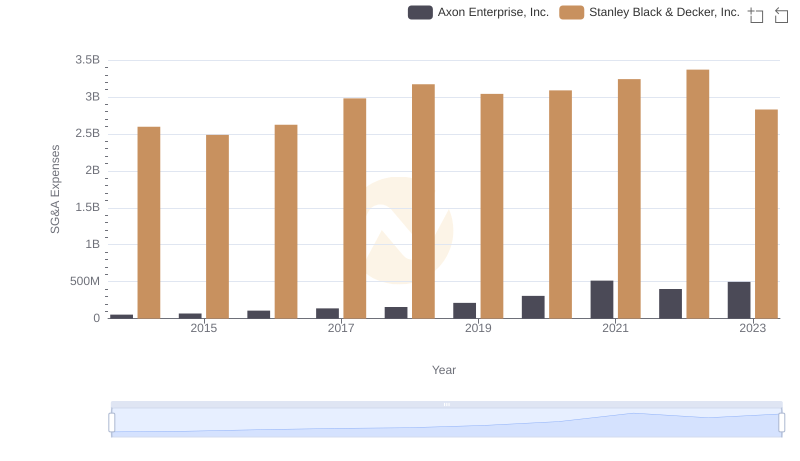

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

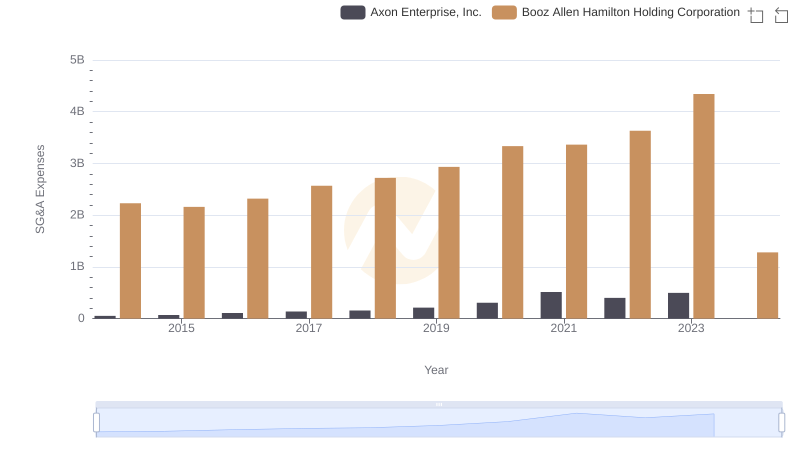

Axon Enterprise, Inc. vs Booz Allen Hamilton Holding Corporation: SG&A Expense Trends

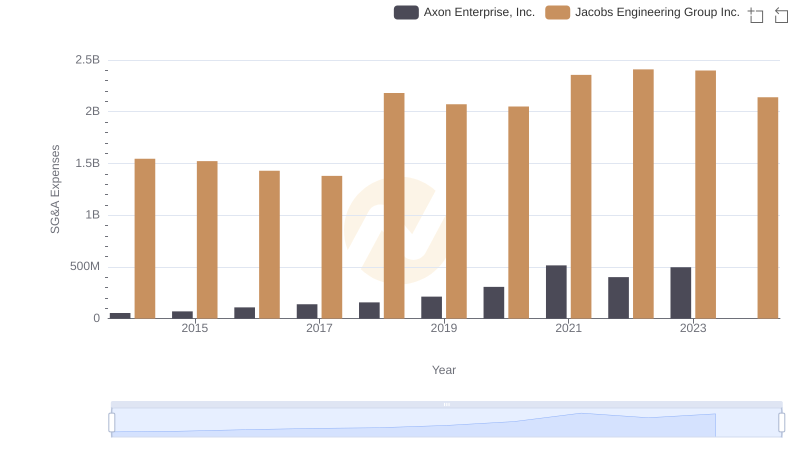

Axon Enterprise, Inc. and Jacobs Engineering Group Inc.: SG&A Spending Patterns Compared

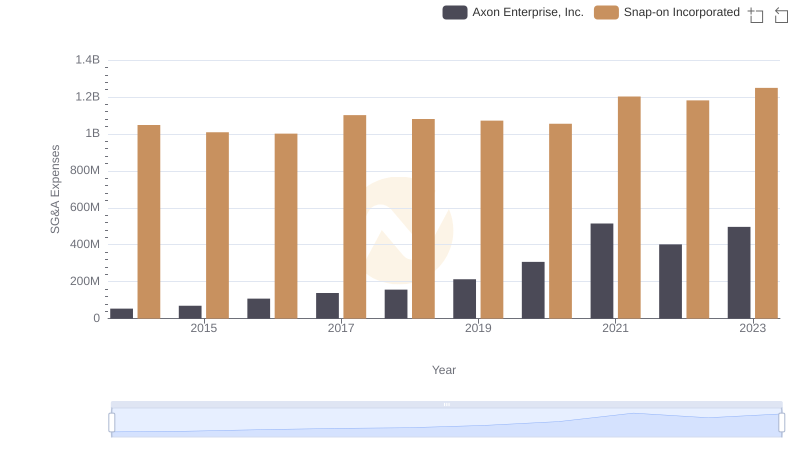

Axon Enterprise, Inc. or Snap-on Incorporated: Who Manages SG&A Costs Better?

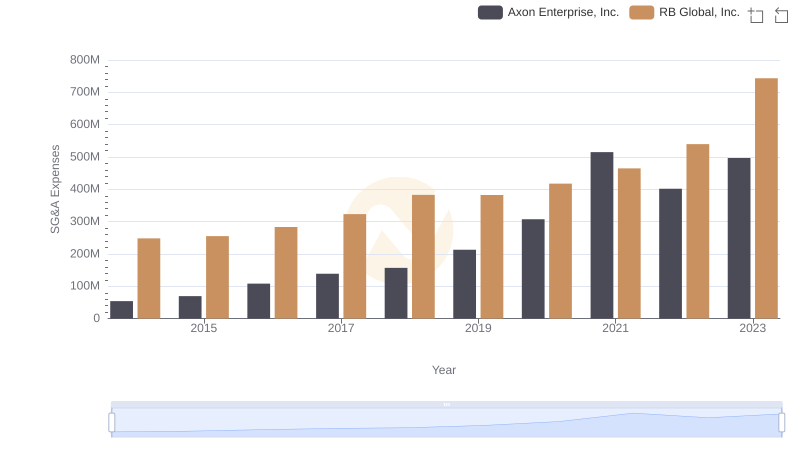

Axon Enterprise, Inc. vs RB Global, Inc.: SG&A Expense Trends

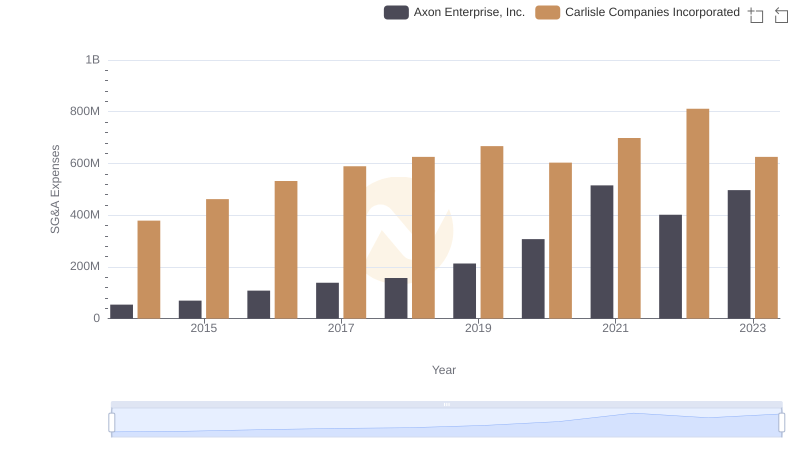

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs China Eastern Airlines Corporation Limited