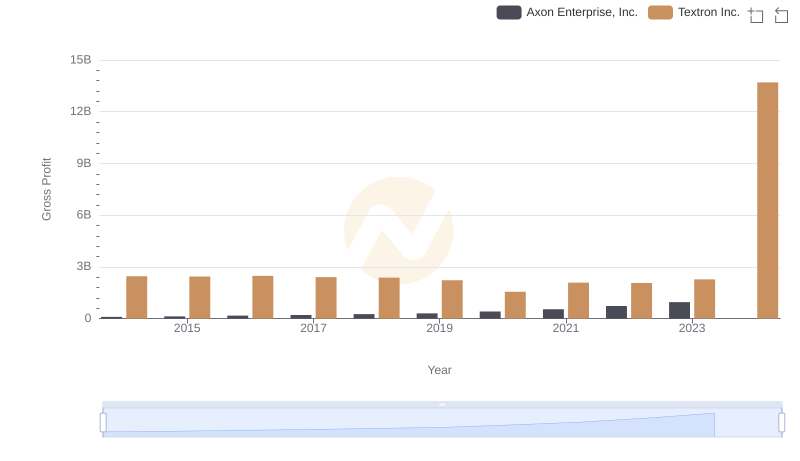

| __timestamp | Axon Enterprise, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 1361000000 |

| Thursday, January 1, 2015 | 69698000 | 1304000000 |

| Friday, January 1, 2016 | 108076000 | 1304000000 |

| Sunday, January 1, 2017 | 138692000 | 1337000000 |

| Monday, January 1, 2018 | 156886000 | 1275000000 |

| Tuesday, January 1, 2019 | 212959000 | 1152000000 |

| Wednesday, January 1, 2020 | 307286000 | 1045000000 |

| Friday, January 1, 2021 | 515007000 | 1221000000 |

| Saturday, January 1, 2022 | 401575000 | 1186000000 |

| Sunday, January 1, 2023 | 496874000 | 1225000000 |

| Monday, January 1, 2024 | 1156000000 |

Unleashing insights

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Axon Enterprise, Inc. and Textron Inc. have demonstrated contrasting approaches to SG&A cost management. From 2014 to 2023, Axon saw a significant increase in SG&A expenses, growing by approximately 817%, reflecting its aggressive expansion strategy. In contrast, Textron maintained a more stable SG&A trajectory, with expenses fluctuating modestly around a 10% range. Notably, in 2023, Textron's SG&A expenses were nearly 2.5 times higher than Axon's, highlighting its larger operational scale. However, the data for 2024 is incomplete, leaving room for speculation on future trends. This analysis underscores the importance of strategic cost management in sustaining competitive advantage and profitability in the ever-evolving business environment.

Axon Enterprise, Inc. or Textron Inc.: Who Leads in Yearly Revenue?

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs China Eastern Airlines Corporation Limited

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Pentair plc

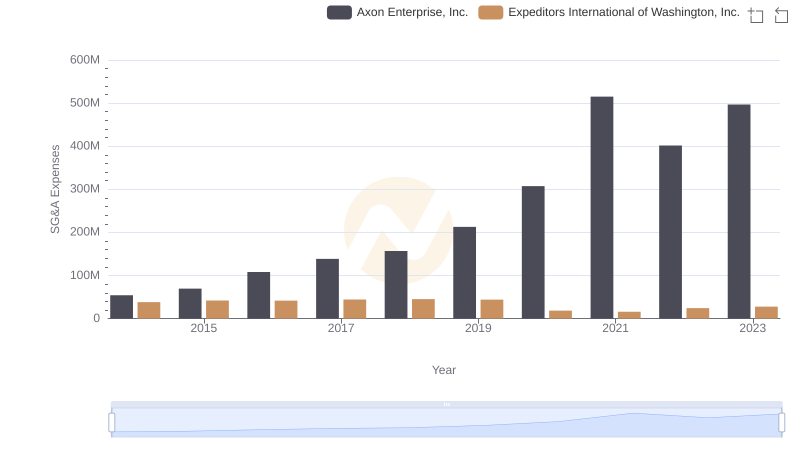

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Expeditors International of Washington, Inc.

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or Textron Inc.

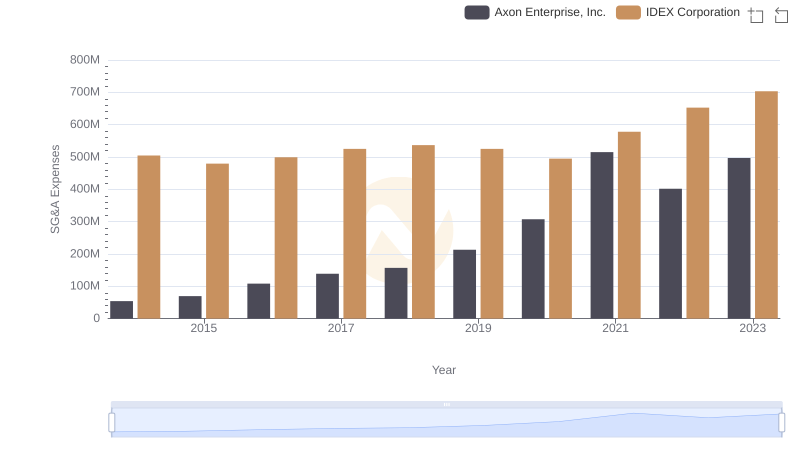

Comparing SG&A Expenses: Axon Enterprise, Inc. vs IDEX Corporation Trends and Insights

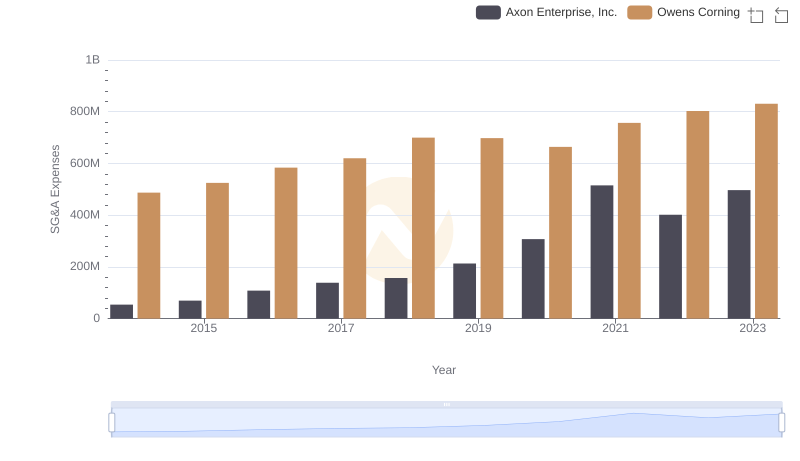

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Owens Corning Trends and Insights

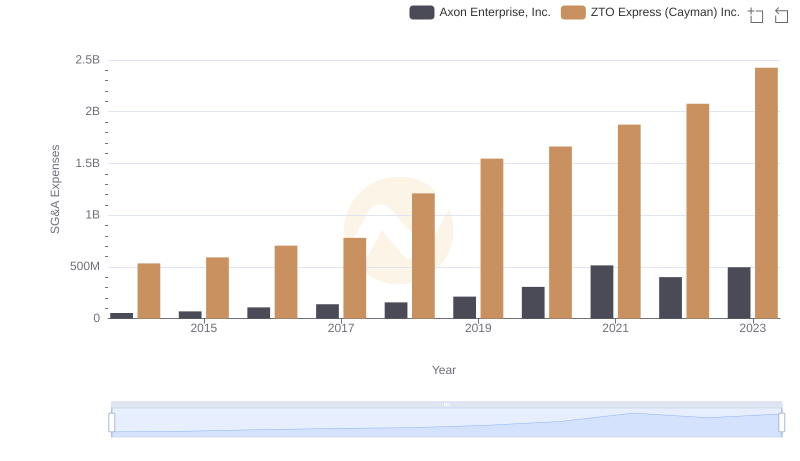

Axon Enterprise, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

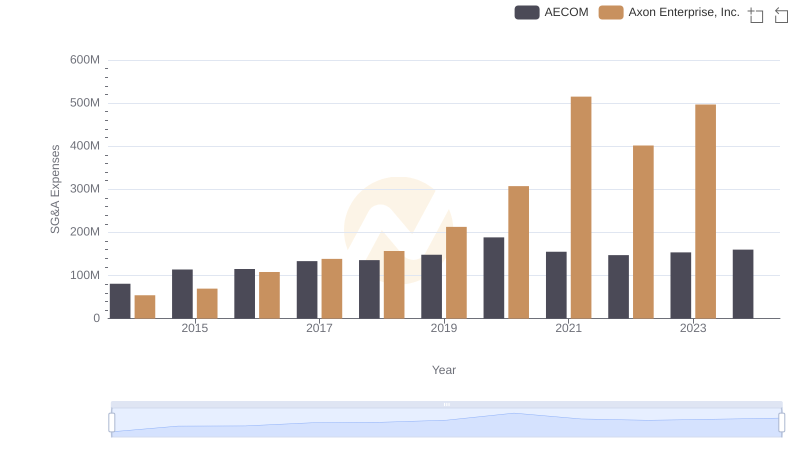

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or AECOM

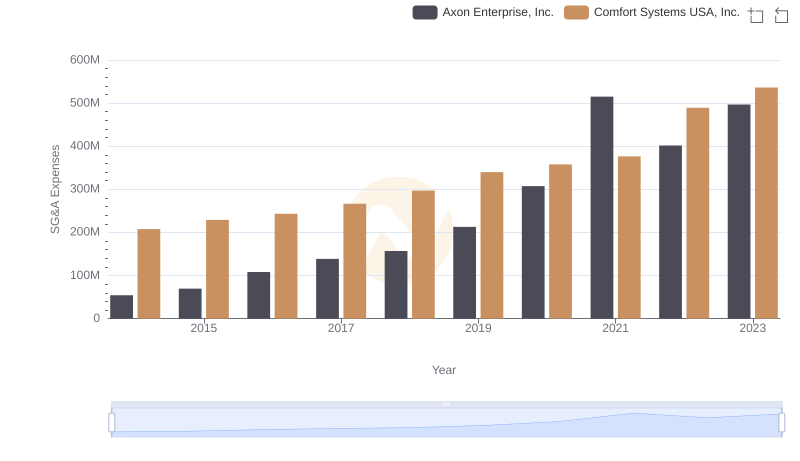

Axon Enterprise, Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

Axon Enterprise, Inc. and Avery Dennison Corporation: SG&A Spending Patterns Compared