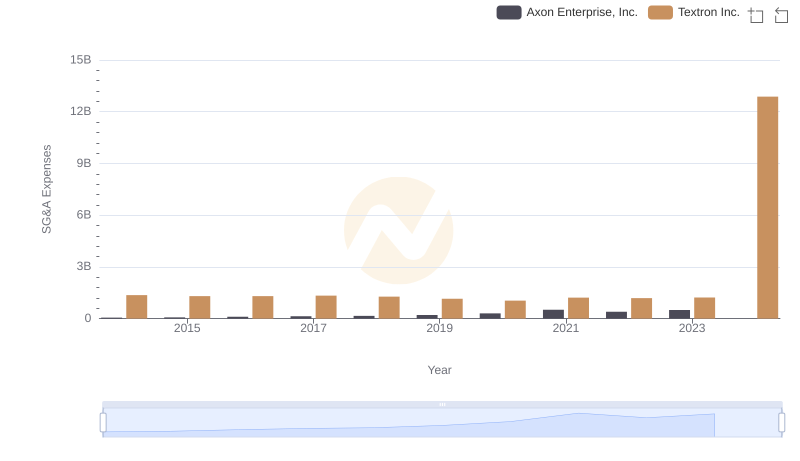

| __timestamp | Axon Enterprise, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 2457000000 |

| Thursday, January 1, 2015 | 128647000 | 2444000000 |

| Friday, January 1, 2016 | 170536000 | 2477000000 |

| Sunday, January 1, 2017 | 207088000 | 2403000000 |

| Monday, January 1, 2018 | 258583000 | 2378000000 |

| Tuesday, January 1, 2019 | 307286000 | 2224000000 |

| Wednesday, January 1, 2020 | 416331000 | 1557000000 |

| Friday, January 1, 2021 | 540910000 | 2085000000 |

| Saturday, January 1, 2022 | 728638000 | 2069000000 |

| Sunday, January 1, 2023 | 955382000 | 2278000000 |

| Monday, January 1, 2024 | 2502000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of American industry, Axon Enterprise, Inc. and Textron Inc. have emerged as significant players. Over the past decade, from 2014 to 2023, these companies have showcased their prowess in generating gross profit. Textron Inc., a diversified conglomerate, consistently outperformed Axon in terms of gross profit, with figures peaking at over $13 billion in 2024. In contrast, Axon, known for its innovative public safety technologies, demonstrated impressive growth, with its gross profit surging by over 840% from 2014 to 2023, reaching nearly $956 million.

While Textron's profits remained relatively stable, Axon's rapid growth trajectory highlights its expanding market influence. However, the data for 2024 is incomplete for Axon, leaving room for speculation on its future performance. This comparison underscores the dynamic nature of the industry and the varying strategies of these two giants.

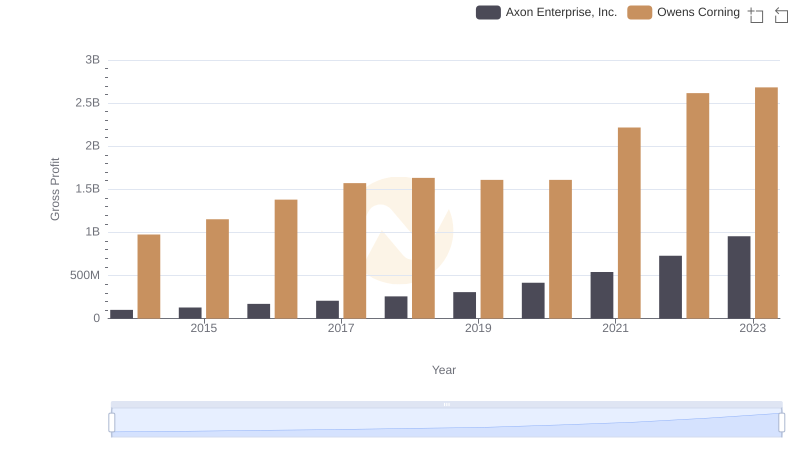

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Owens Corning

Axon Enterprise, Inc. or Textron Inc.: Who Leads in Yearly Revenue?

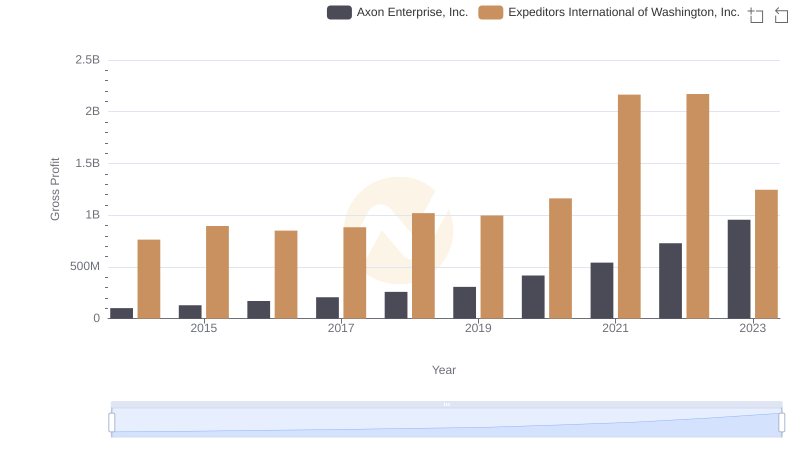

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or Expeditors International of Washington, Inc.

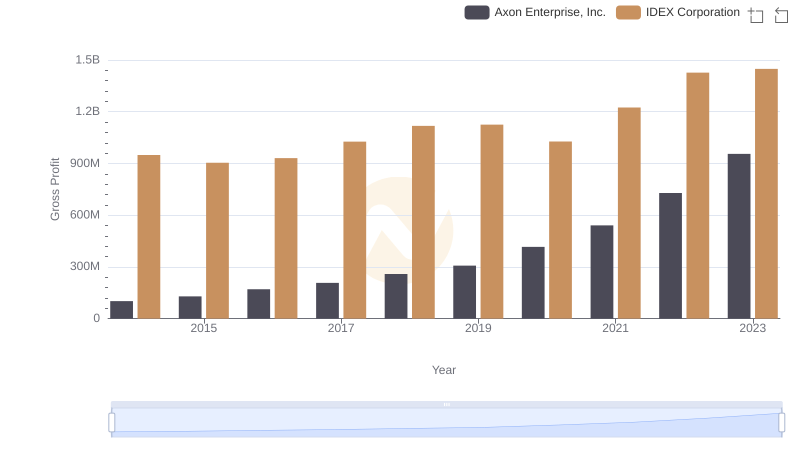

Key Insights on Gross Profit: Axon Enterprise, Inc. vs IDEX Corporation

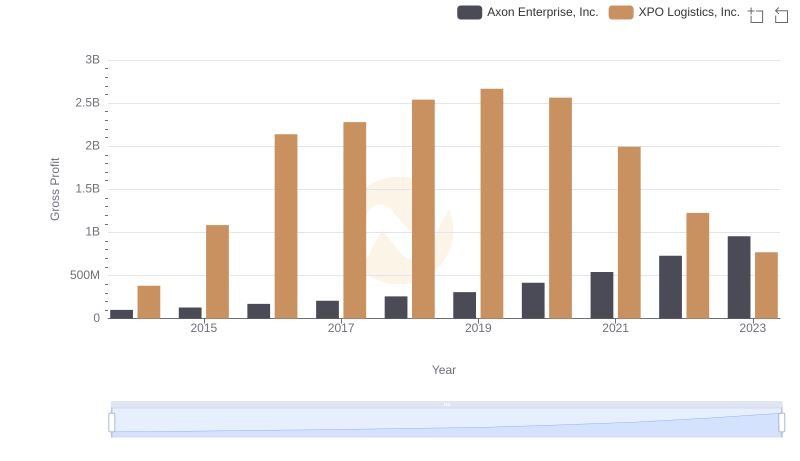

Axon Enterprise, Inc. vs XPO Logistics, Inc.: A Gross Profit Performance Breakdown

Axon Enterprise, Inc. and ZTO Express (Cayman) Inc.: A Detailed Gross Profit Analysis

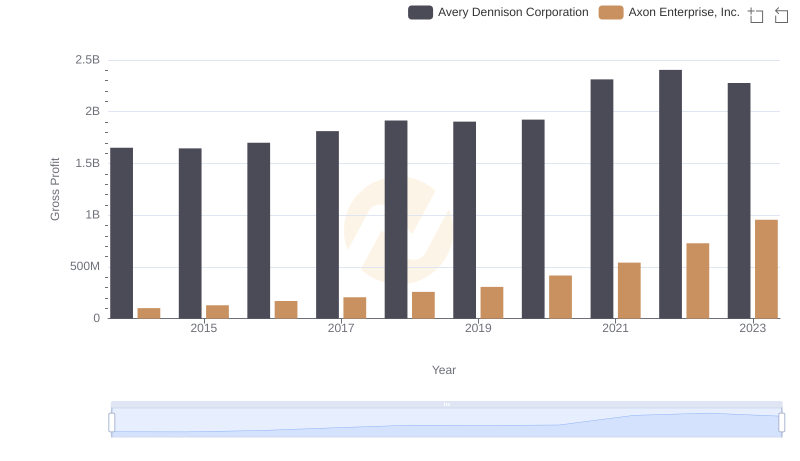

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or Avery Dennison Corporation

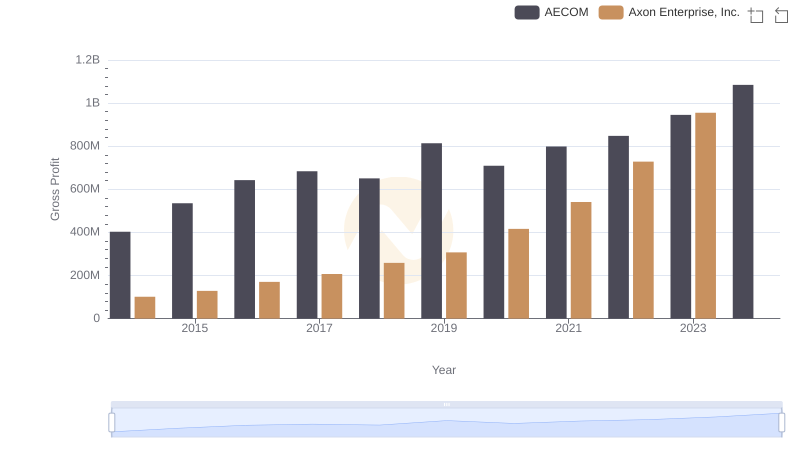

Gross Profit Comparison: Axon Enterprise, Inc. and AECOM Trends

Axon Enterprise, Inc. or Textron Inc.: Who Manages SG&A Costs Better?

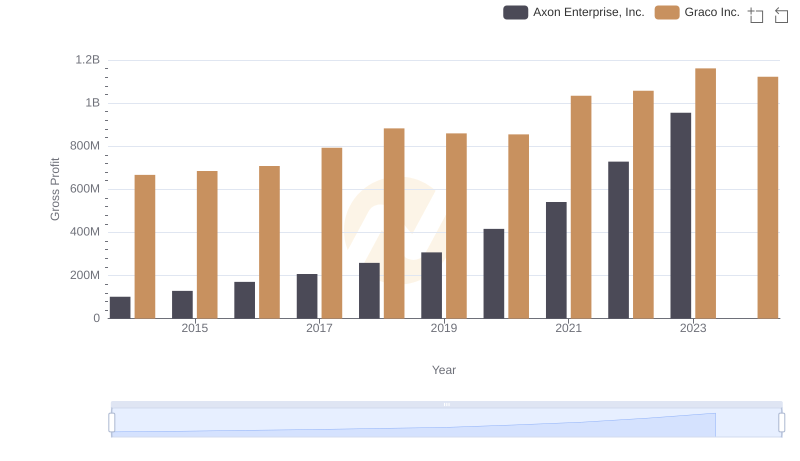

Axon Enterprise, Inc. vs Graco Inc.: A Gross Profit Performance Breakdown

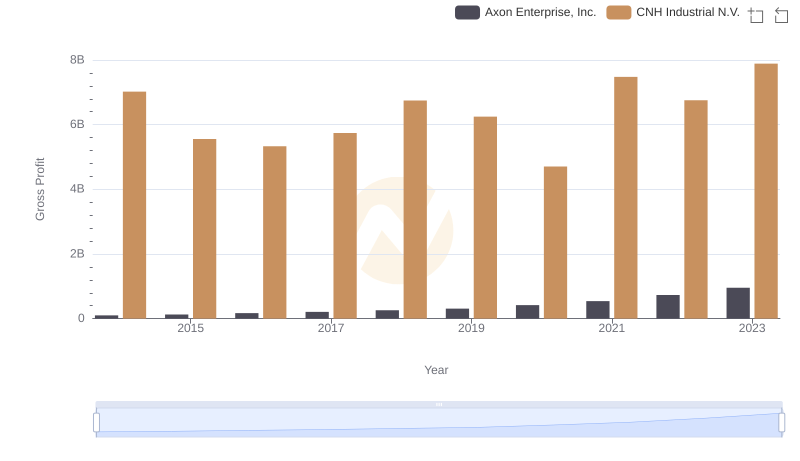

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or CNH Industrial N.V.

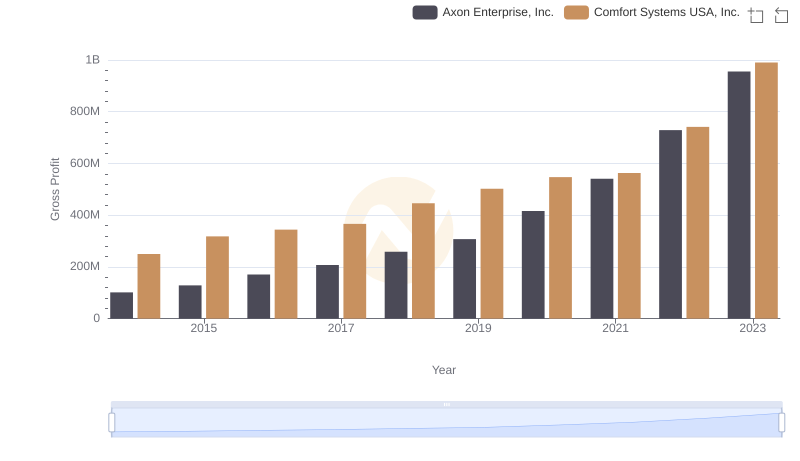

Gross Profit Comparison: Axon Enterprise, Inc. and Comfort Systems USA, Inc. Trends