| __timestamp | AECOM | Axon Enterprise, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 80908000 | 54158000 |

| Thursday, January 1, 2015 | 113975000 | 69698000 |

| Friday, January 1, 2016 | 115088000 | 108076000 |

| Sunday, January 1, 2017 | 133309000 | 138692000 |

| Monday, January 1, 2018 | 135787000 | 156886000 |

| Tuesday, January 1, 2019 | 148123000 | 212959000 |

| Wednesday, January 1, 2020 | 188535000 | 307286000 |

| Friday, January 1, 2021 | 155072000 | 515007000 |

| Saturday, January 1, 2022 | 147309000 | 401575000 |

| Sunday, January 1, 2023 | 153575000 | 496874000 |

| Monday, January 1, 2024 | 160105000 |

Unleashing the power of data

In the competitive landscape of corporate finance, optimizing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. AECOM and Axon Enterprise, Inc. have been at the forefront of this financial strategy since 2014. Over the past decade, AECOM has demonstrated a steady approach, with SG&A expenses increasing by approximately 98% from 2014 to 2024. In contrast, Axon Enterprise, Inc. has seen a more dramatic rise, with expenses surging by over 800% from 2014 to 2023.

While AECOM's expenses peaked in 2020, Axon Enterprise, Inc. reached its highest in 2021, with a notable dip in 2022. This fluctuation suggests a more volatile approach to cost management. As we look to the future, understanding these trends can provide valuable insights into each company's financial strategies and their impact on long-term growth.

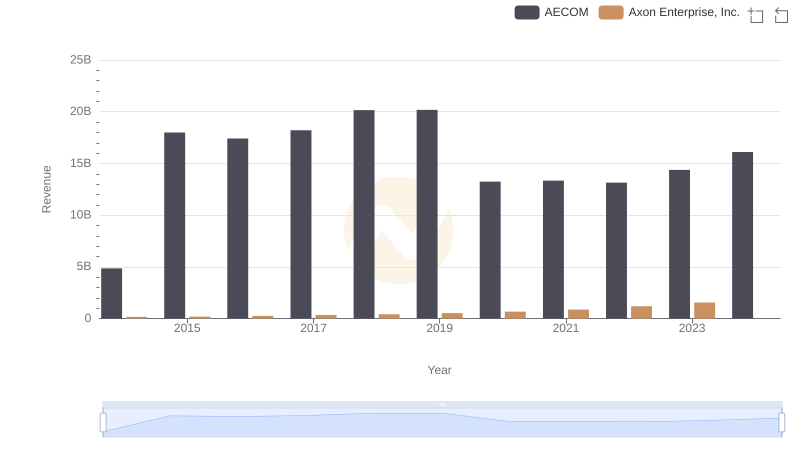

Who Generates More Revenue? Axon Enterprise, Inc. or AECOM

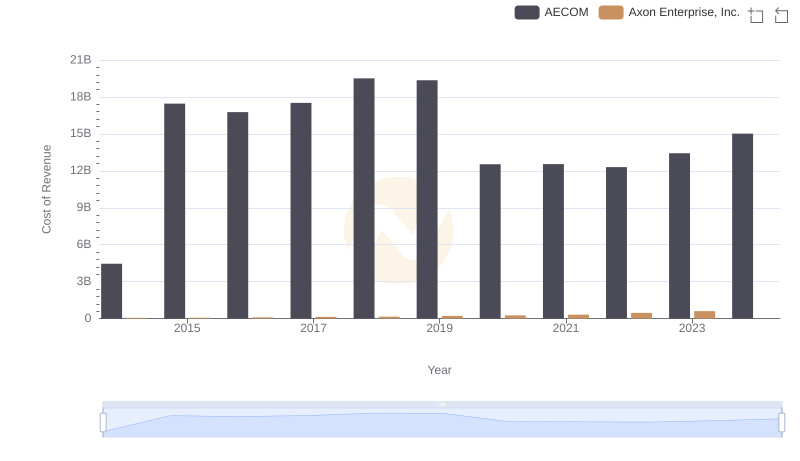

Comparing Cost of Revenue Efficiency: Axon Enterprise, Inc. vs AECOM

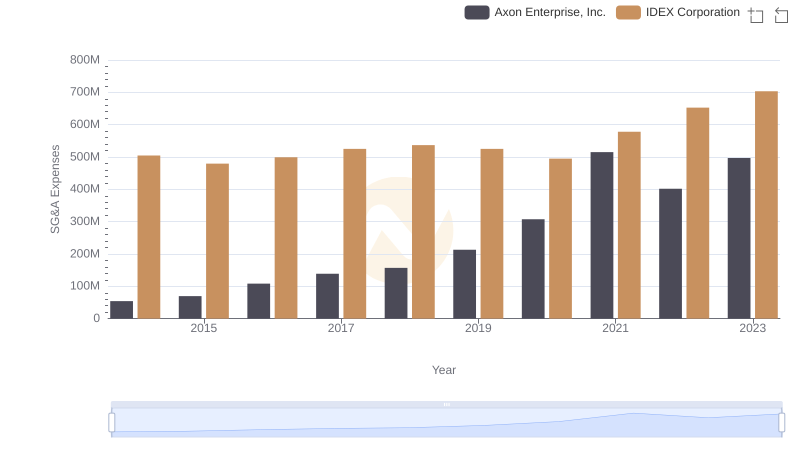

Comparing SG&A Expenses: Axon Enterprise, Inc. vs IDEX Corporation Trends and Insights

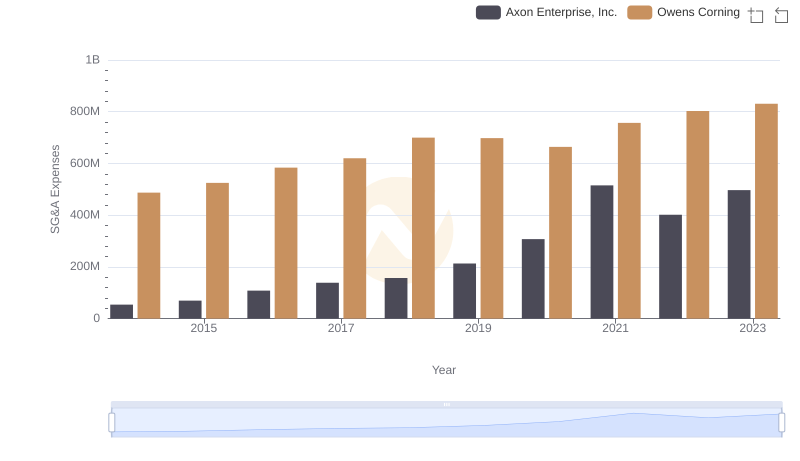

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Owens Corning Trends and Insights

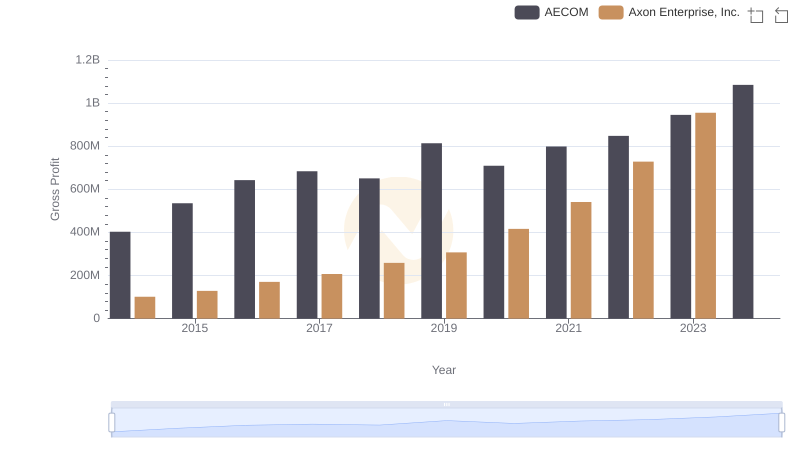

Gross Profit Comparison: Axon Enterprise, Inc. and AECOM Trends

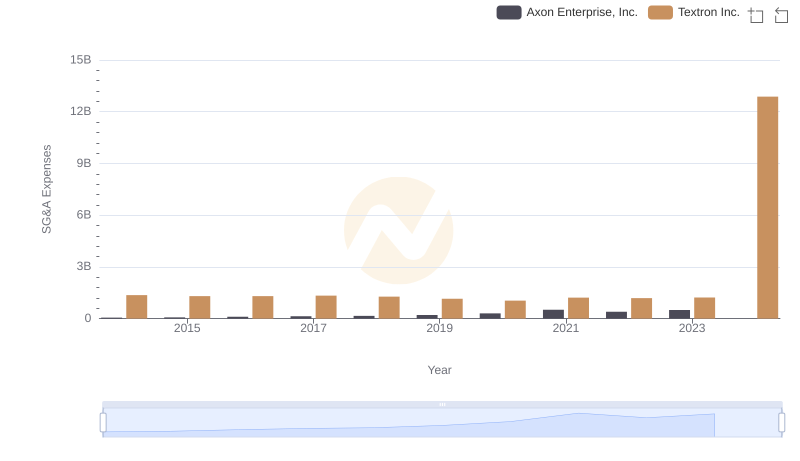

Axon Enterprise, Inc. or Textron Inc.: Who Manages SG&A Costs Better?

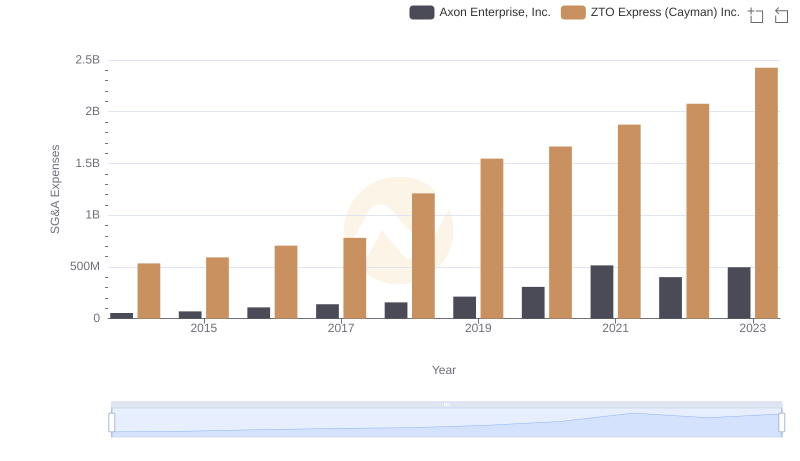

Axon Enterprise, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

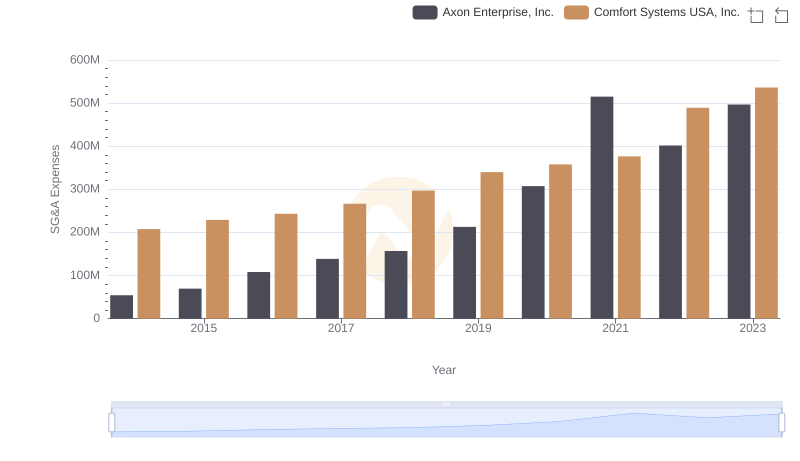

Axon Enterprise, Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

Axon Enterprise, Inc. and Avery Dennison Corporation: SG&A Spending Patterns Compared

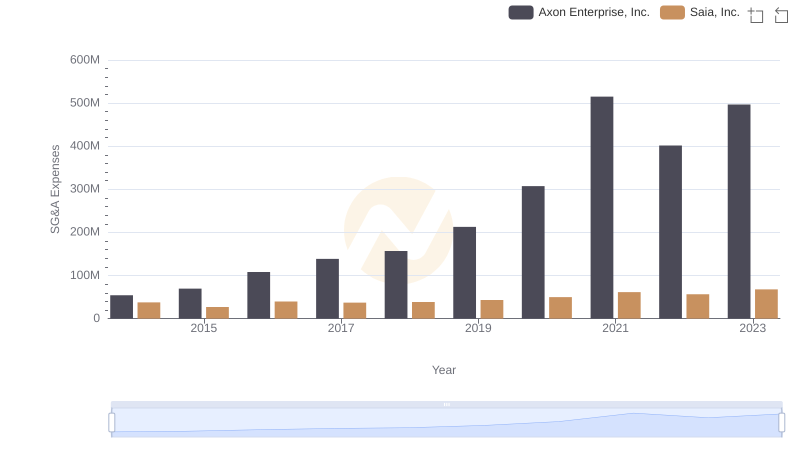

Axon Enterprise, Inc. and Saia, Inc.: SG&A Spending Patterns Compared

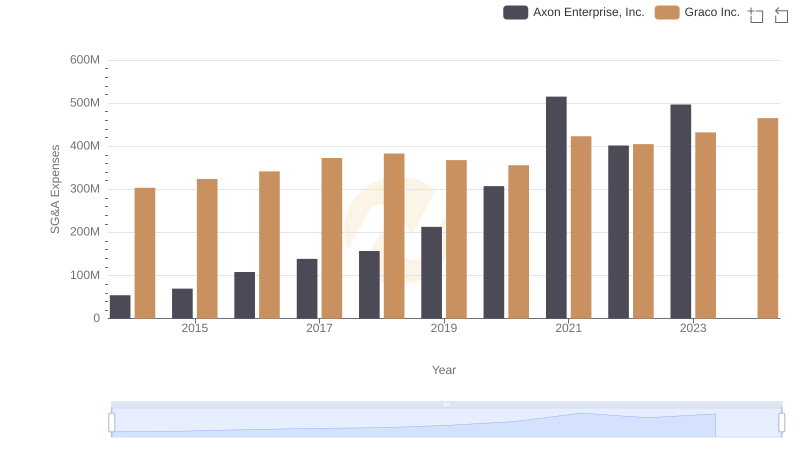

Cost Management Insights: SG&A Expenses for Axon Enterprise, Inc. and Graco Inc.