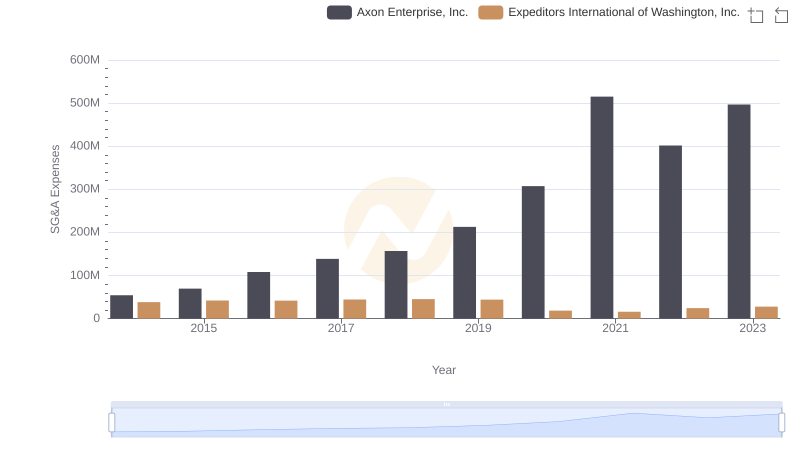

| __timestamp | Axon Enterprise, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 534537000 |

| Thursday, January 1, 2015 | 69698000 | 591738000 |

| Friday, January 1, 2016 | 108076000 | 705995000 |

| Sunday, January 1, 2017 | 138692000 | 780517000 |

| Monday, January 1, 2018 | 156886000 | 1210717000 |

| Tuesday, January 1, 2019 | 212959000 | 1546227000 |

| Wednesday, January 1, 2020 | 307286000 | 1663712000 |

| Friday, January 1, 2021 | 515007000 | 1875869000 |

| Saturday, January 1, 2022 | 401575000 | 2077372000 |

| Sunday, January 1, 2023 | 496874000 | 2425253000 |

Igniting the spark of knowledge

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Axon Enterprise, Inc. and ZTO Express (Cayman) Inc. offer a fascinating comparison in this regard. Over the past decade, ZTO Express has consistently reported higher SG&A expenses, peaking at approximately $2.4 billion in 2023, a staggering 350% increase from 2014. In contrast, Axon Enterprise's SG&A expenses grew by about 800% over the same period, reaching nearly $500 million in 2023.

While ZTO Express's expenses are significantly higher, their growth rate is more moderate compared to Axon. This suggests that Axon is rapidly expanding its operations, potentially investing heavily in marketing and administrative capabilities. Investors and analysts should consider these trends when evaluating the operational efficiency and strategic priorities of these companies. Understanding these dynamics can provide deeper insights into their financial health and future growth potential.

Breaking Down Revenue Trends: Axon Enterprise, Inc. vs ZTO Express (Cayman) Inc.

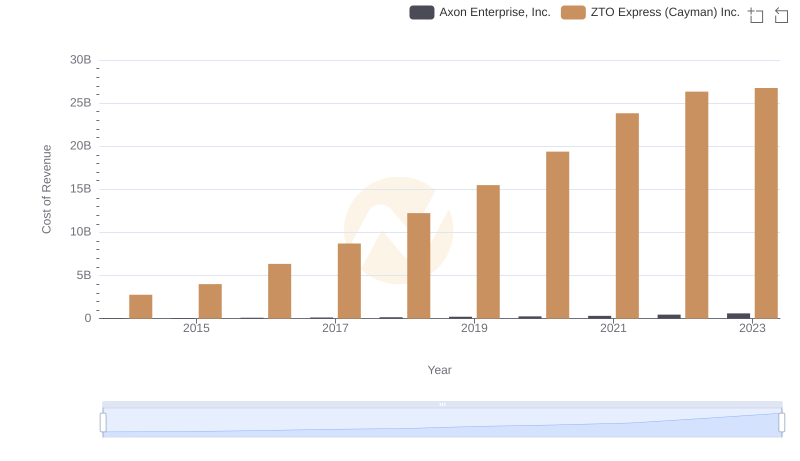

Analyzing Cost of Revenue: Axon Enterprise, Inc. and ZTO Express (Cayman) Inc.

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs China Eastern Airlines Corporation Limited

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Pentair plc

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Expeditors International of Washington, Inc.

Axon Enterprise, Inc. and ZTO Express (Cayman) Inc.: A Detailed Gross Profit Analysis

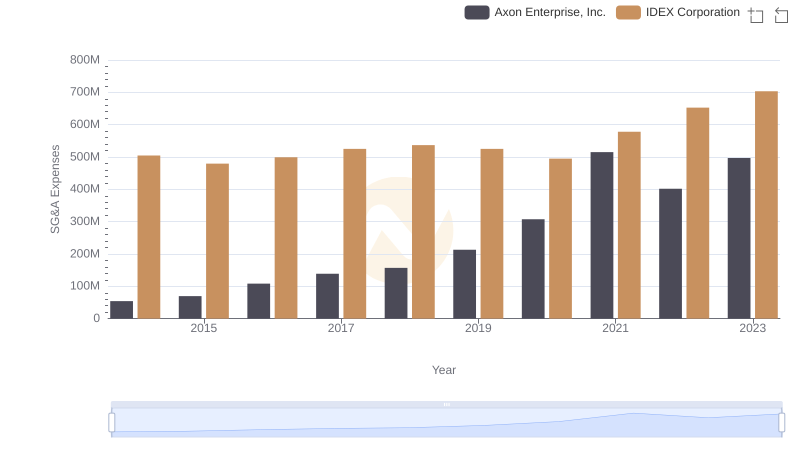

Comparing SG&A Expenses: Axon Enterprise, Inc. vs IDEX Corporation Trends and Insights

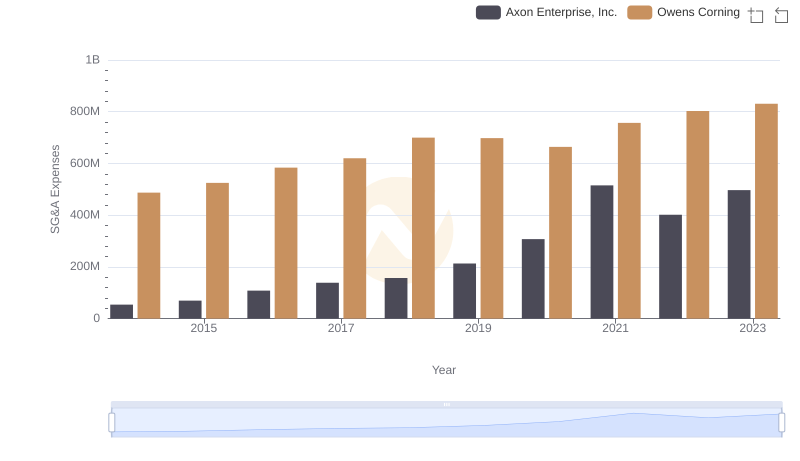

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Owens Corning Trends and Insights

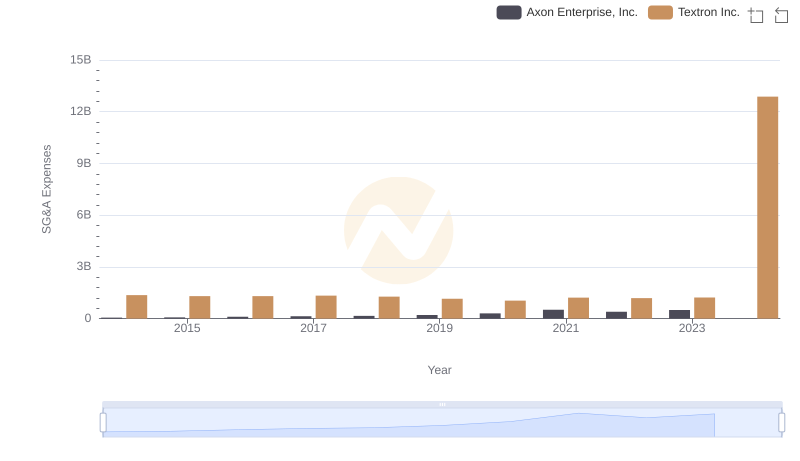

Axon Enterprise, Inc. or Textron Inc.: Who Manages SG&A Costs Better?

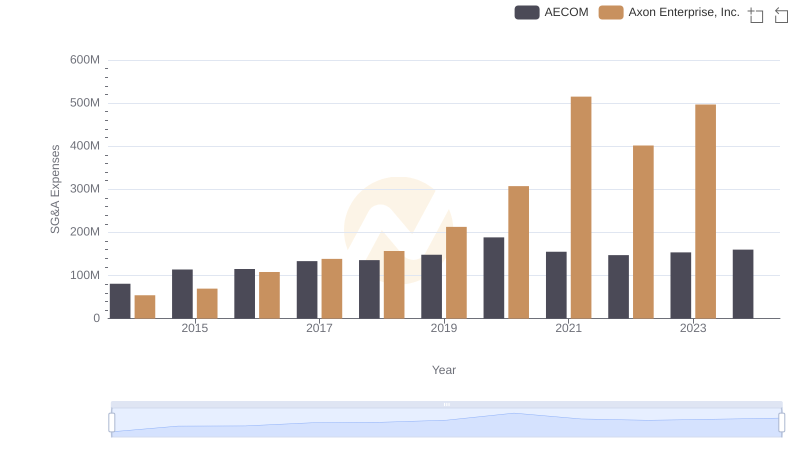

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or AECOM

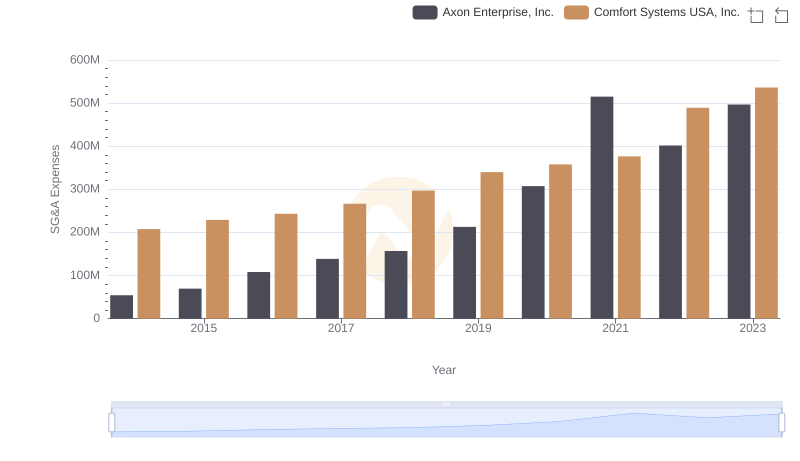

Axon Enterprise, Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?