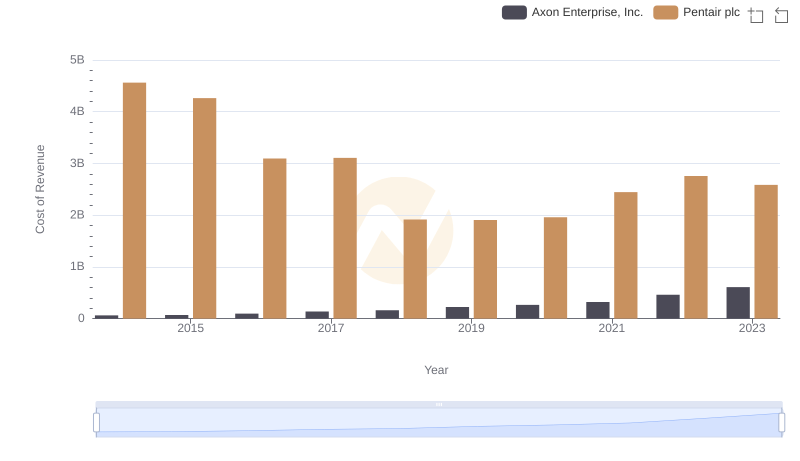

| __timestamp | Axon Enterprise, Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 1493800000 |

| Thursday, January 1, 2015 | 69698000 | 1334300000 |

| Friday, January 1, 2016 | 108076000 | 979300000 |

| Sunday, January 1, 2017 | 138692000 | 1032500000 |

| Monday, January 1, 2018 | 156886000 | 534300000 |

| Tuesday, January 1, 2019 | 212959000 | 540100000 |

| Wednesday, January 1, 2020 | 307286000 | 520500000 |

| Friday, January 1, 2021 | 515007000 | 596400000 |

| Saturday, January 1, 2022 | 401575000 | 677100000 |

| Sunday, January 1, 2023 | 496874000 | 680200000 |

| Monday, January 1, 2024 | 701400000 |

Unlocking the unknown

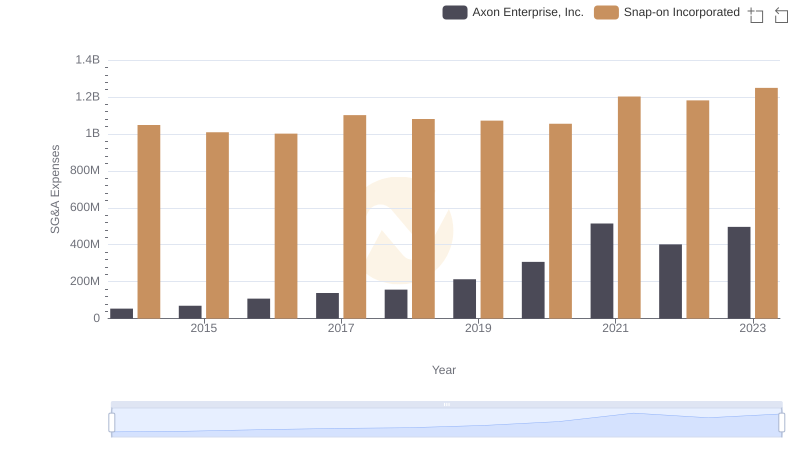

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Axon Enterprise, Inc. and Pentair plc have demonstrated contrasting strategies in optimizing these costs. From 2014 to 2023, Axon Enterprise, Inc. has shown a remarkable increase in SG&A expenses, growing by approximately 817%, from $54 million to nearly $497 million. This reflects their aggressive expansion and investment in growth. In contrast, Pentair plc has managed to reduce its SG&A expenses by about 54% during the same period, from $1.49 billion to $680 million, indicating a strategic focus on cost efficiency. This divergence highlights the different paths companies can take in managing operational costs, with Axon focusing on growth and Pentair on efficiency. Understanding these strategies provides valuable insights into corporate financial management.

Axon Enterprise, Inc. vs Pentair plc: Efficiency in Cost of Revenue Explored

Axon Enterprise, Inc. or Snap-on Incorporated: Who Manages SG&A Costs Better?

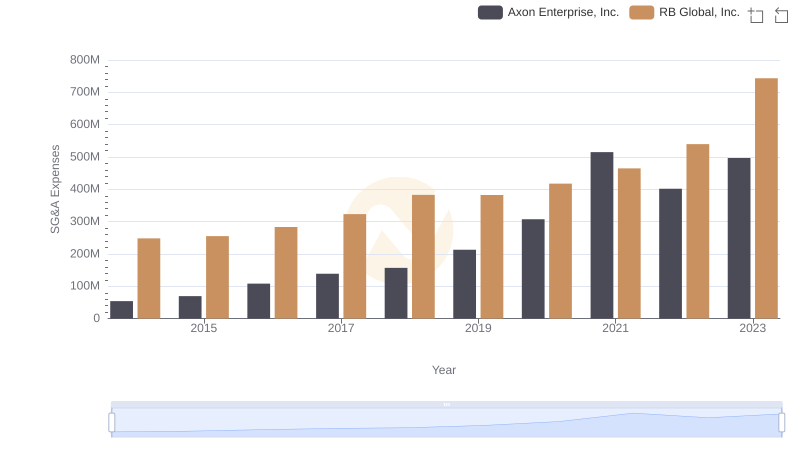

Axon Enterprise, Inc. vs RB Global, Inc.: SG&A Expense Trends

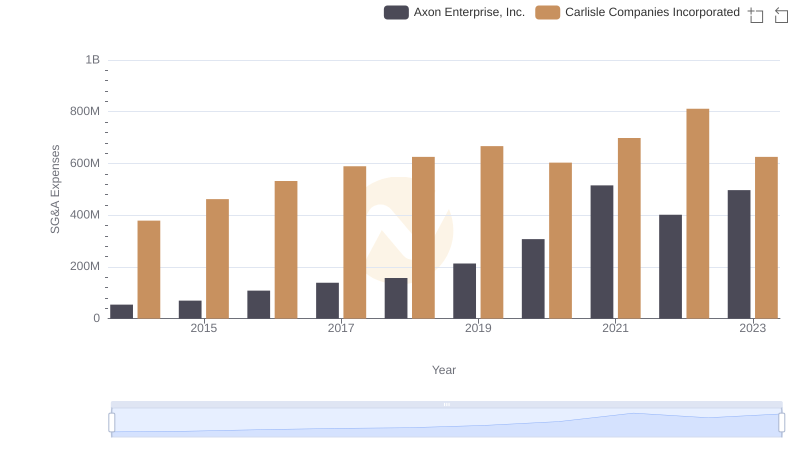

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs China Eastern Airlines Corporation Limited

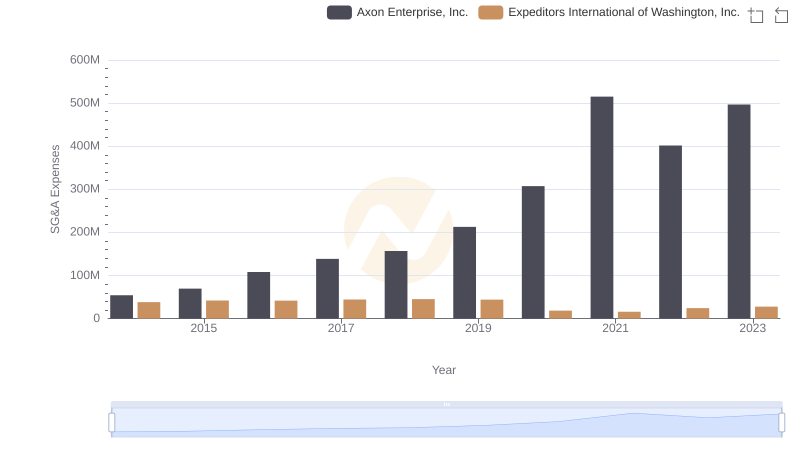

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Expeditors International of Washington, Inc.

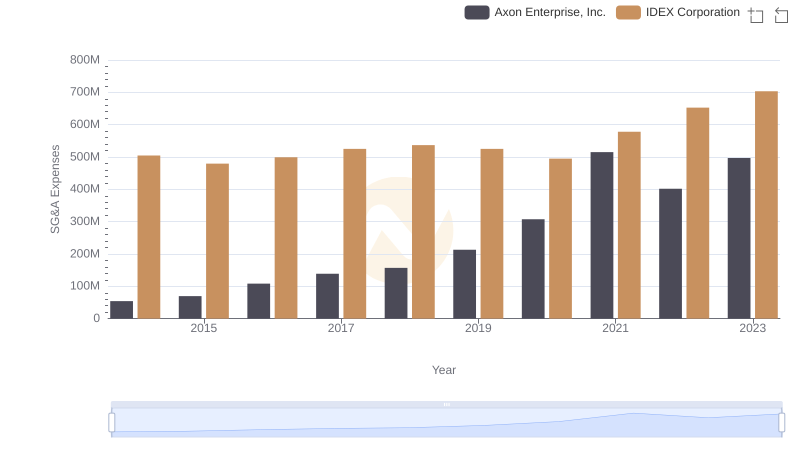

Comparing SG&A Expenses: Axon Enterprise, Inc. vs IDEX Corporation Trends and Insights

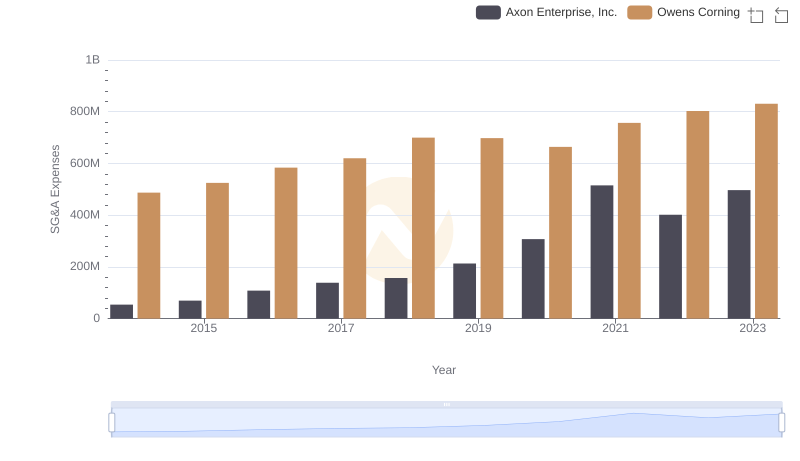

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Owens Corning Trends and Insights