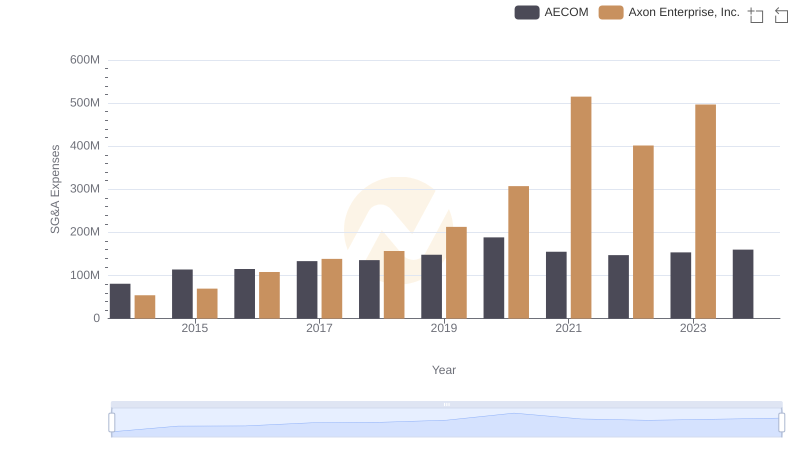

| __timestamp | Axon Enterprise, Inc. | Comfort Systems USA, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 207652000 |

| Thursday, January 1, 2015 | 69698000 | 228965000 |

| Friday, January 1, 2016 | 108076000 | 243201000 |

| Sunday, January 1, 2017 | 138692000 | 266586000 |

| Monday, January 1, 2018 | 156886000 | 296986000 |

| Tuesday, January 1, 2019 | 212959000 | 340005000 |

| Wednesday, January 1, 2020 | 307286000 | 357777000 |

| Friday, January 1, 2021 | 515007000 | 376309000 |

| Saturday, January 1, 2022 | 401575000 | 489344000 |

| Sunday, January 1, 2023 | 496874000 | 536188999 |

Unleashing the power of data

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Axon Enterprise, Inc. and Comfort Systems USA, Inc. have shown distinct trends in their SG&A management from 2014 to 2023. Axon started with lower SG&A expenses, but by 2023, their costs surged by over 800%, reflecting a strategic expansion. Comfort Systems, on the other hand, maintained a steadier growth, with a 160% increase over the same period. This suggests a more controlled approach to scaling operations. While Axon's aggressive growth strategy might indicate a focus on rapid market capture, Comfort Systems' consistent expense management could imply a focus on sustainable growth. Investors and analysts should consider these trends when evaluating the companies' financial health and strategic direction.

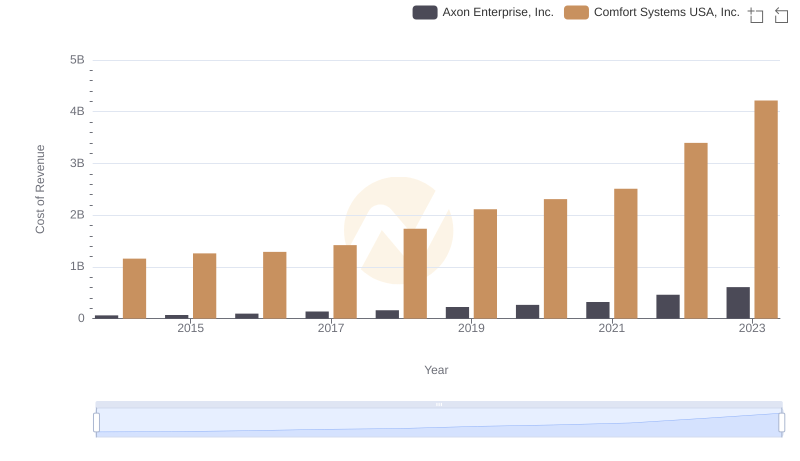

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Comfort Systems USA, Inc.

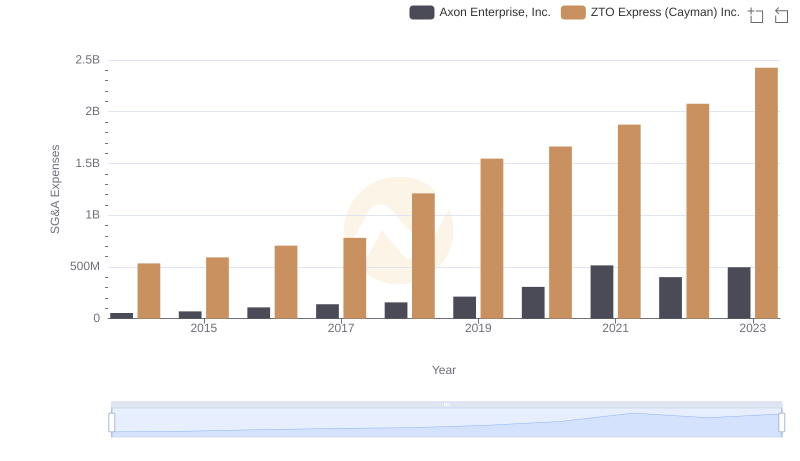

Axon Enterprise, Inc. or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

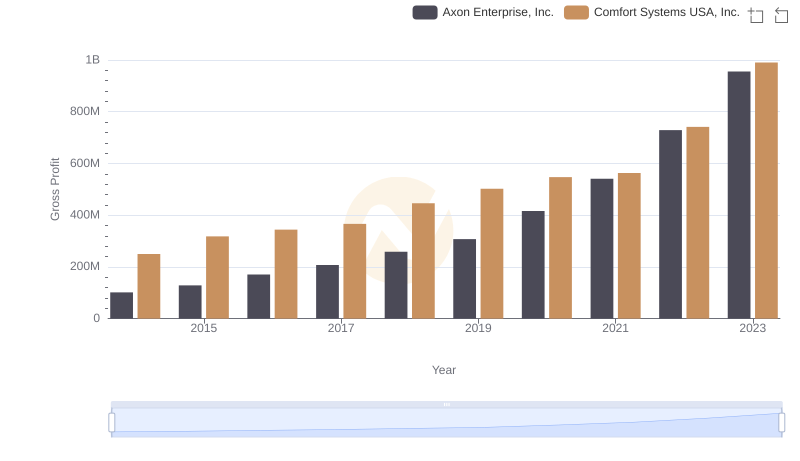

Gross Profit Comparison: Axon Enterprise, Inc. and Comfort Systems USA, Inc. Trends

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or AECOM

Axon Enterprise, Inc. and Avery Dennison Corporation: SG&A Spending Patterns Compared

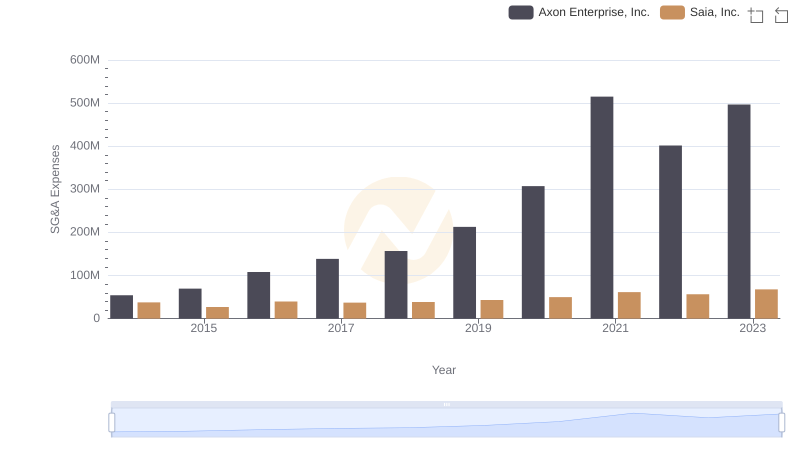

Axon Enterprise, Inc. and Saia, Inc.: SG&A Spending Patterns Compared

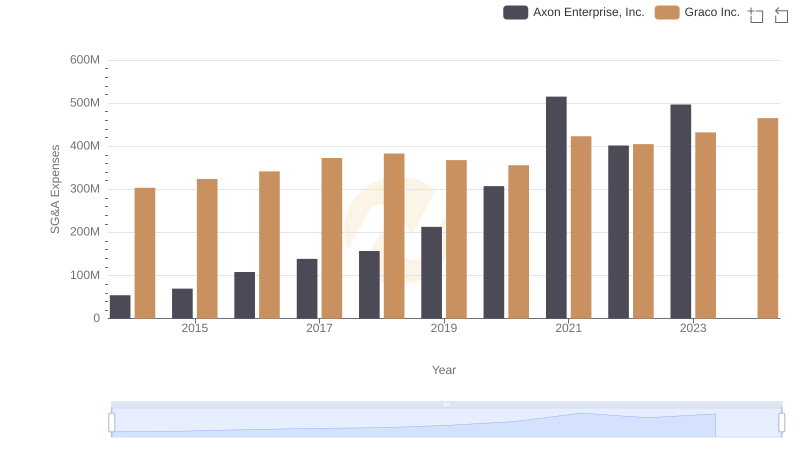

Cost Management Insights: SG&A Expenses for Axon Enterprise, Inc. and Graco Inc.

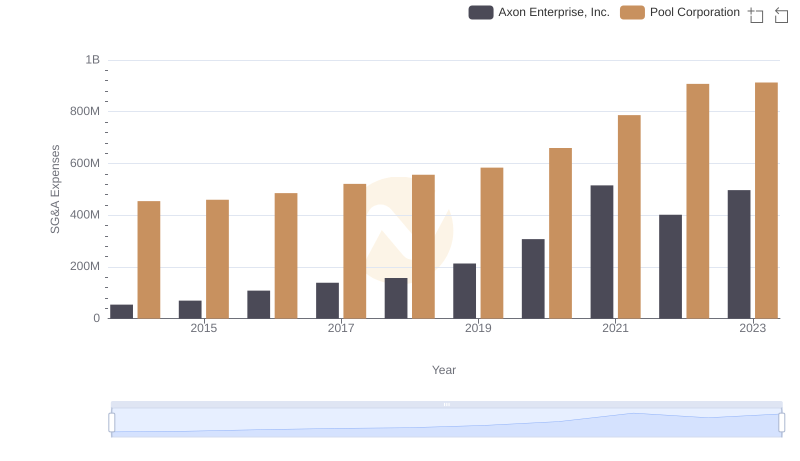

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Pool Corporation Trends and Insights

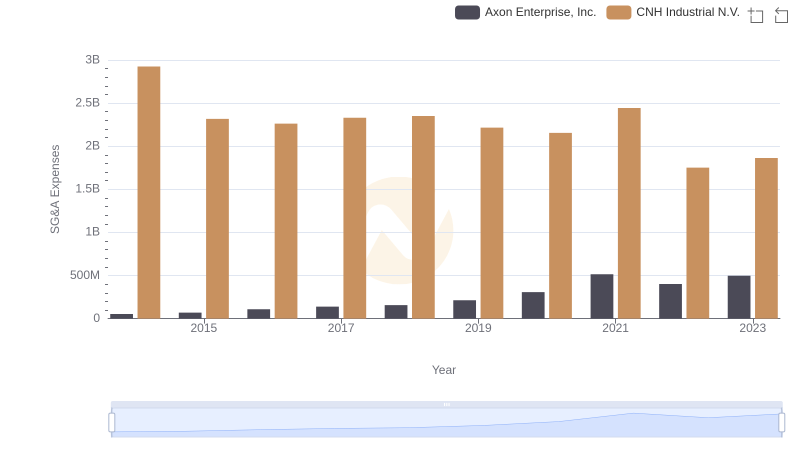

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and CNH Industrial N.V.

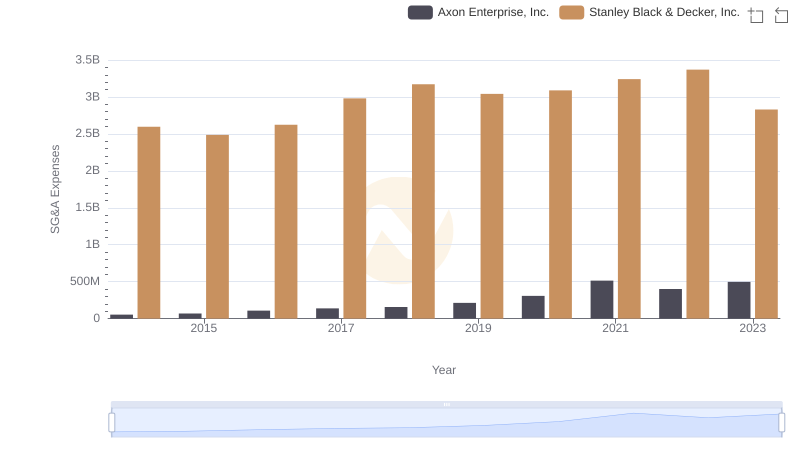

Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.: SG&A Expense Trends

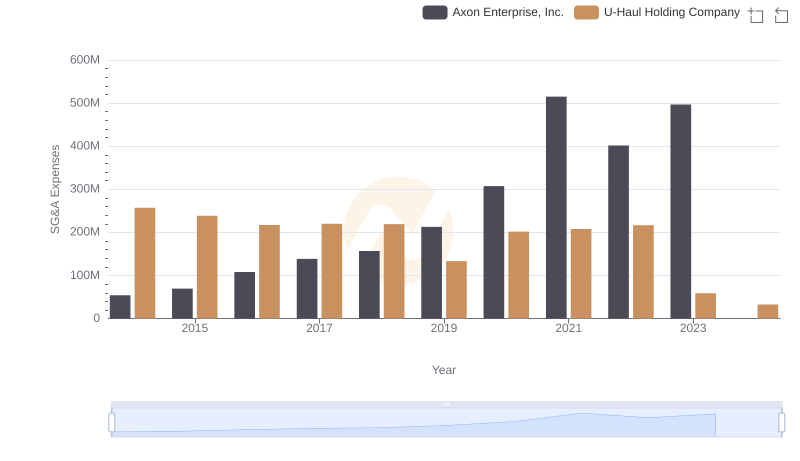

Cost Management Insights: SG&A Expenses for Axon Enterprise, Inc. and U-Haul Holding Company