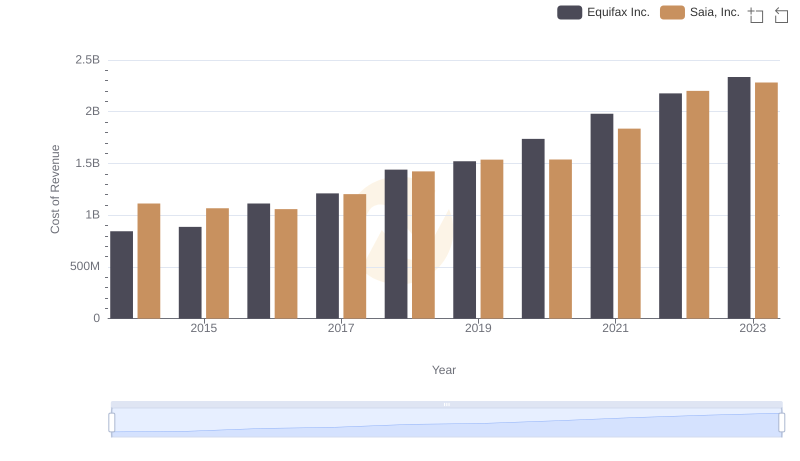

| __timestamp | Equifax Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2436400000 | 1272321000 |

| Thursday, January 1, 2015 | 2663600000 | 1221311000 |

| Friday, January 1, 2016 | 3144900000 | 1218481000 |

| Sunday, January 1, 2017 | 3362200000 | 1378510000 |

| Monday, January 1, 2018 | 3412100000 | 1653849000 |

| Tuesday, January 1, 2019 | 3507600000 | 1786735000 |

| Wednesday, January 1, 2020 | 4127500000 | 1822366000 |

| Friday, January 1, 2021 | 4923900000 | 2288704000 |

| Saturday, January 1, 2022 | 5122200000 | 2792057000 |

| Sunday, January 1, 2023 | 5265200000 | 2881433000 |

| Monday, January 1, 2024 | 5681100000 |

In pursuit of knowledge

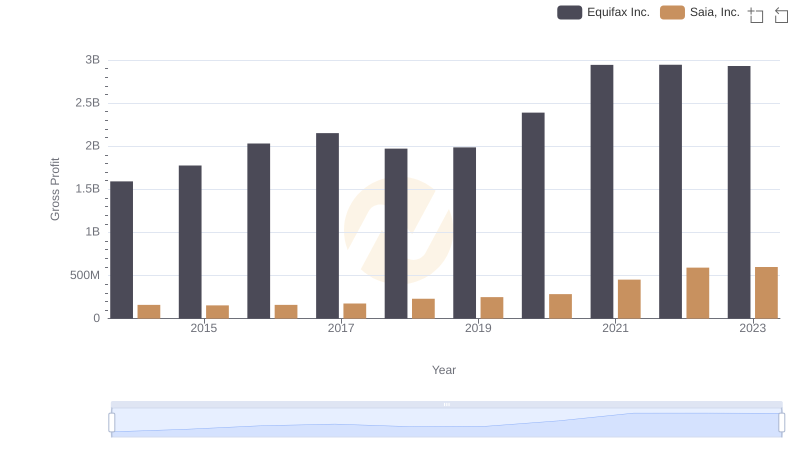

In the ever-evolving landscape of the U.S. stock market, understanding the revenue trajectories of key players is crucial. From 2014 to 2023, Equifax Inc. and Saia, Inc. have demonstrated distinct growth patterns. Equifax, a leader in consumer credit reporting, saw its revenue soar by over 116%, from approximately $2.4 billion in 2014 to $5.3 billion in 2023. This growth reflects its strategic expansions and innovations in data analytics.

Conversely, Saia, Inc., a prominent player in the freight and logistics sector, experienced a remarkable 126% increase in revenue, climbing from $1.3 billion to nearly $2.9 billion over the same period. This surge underscores the growing demand for efficient logistics solutions in a globalized economy. As these companies continue to adapt to market demands, their revenue trends offer valuable insights into their strategic directions and industry dynamics.

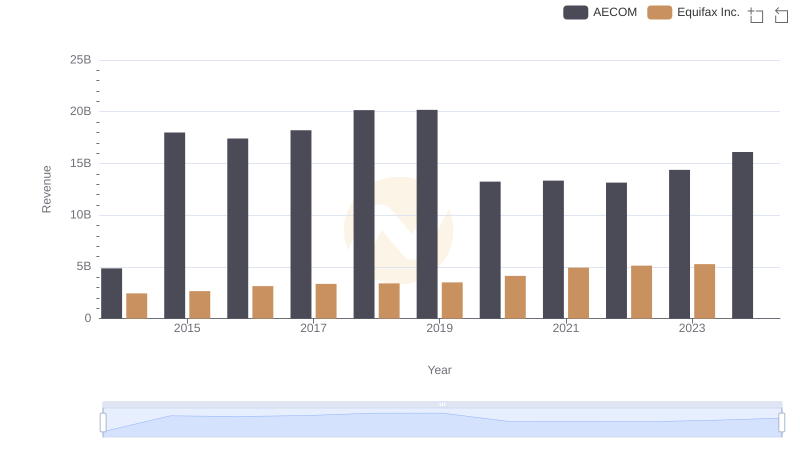

Breaking Down Revenue Trends: Equifax Inc. vs AECOM

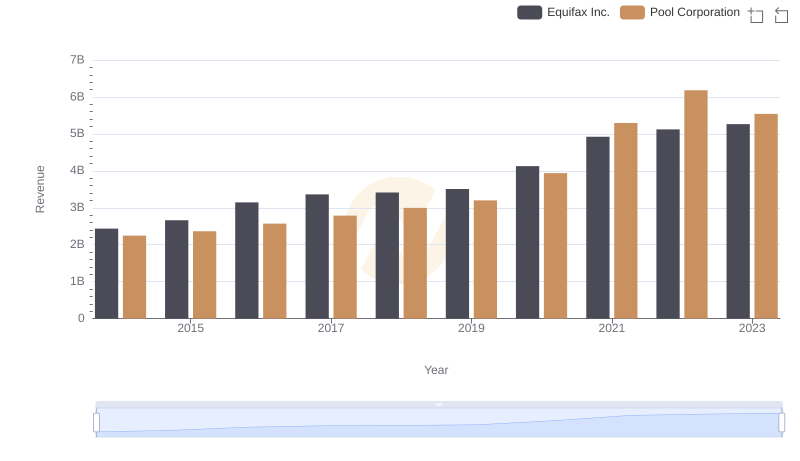

Comparing Revenue Performance: Equifax Inc. or Pool Corporation?

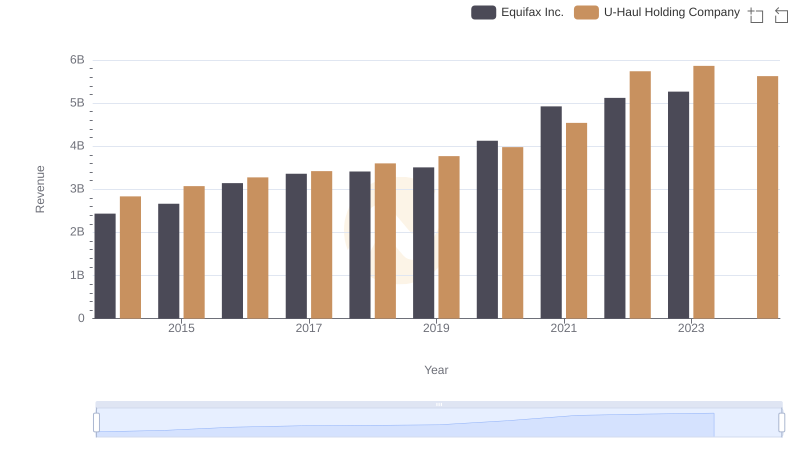

Equifax Inc. or U-Haul Holding Company: Who Leads in Yearly Revenue?

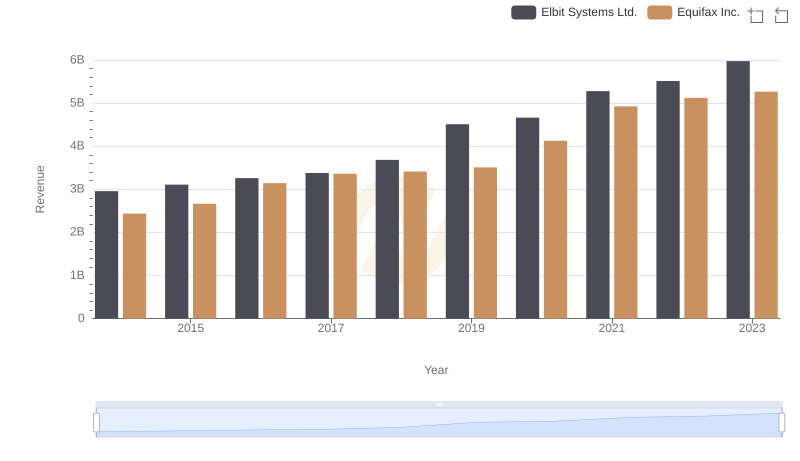

Equifax Inc. or Elbit Systems Ltd.: Who Leads in Yearly Revenue?

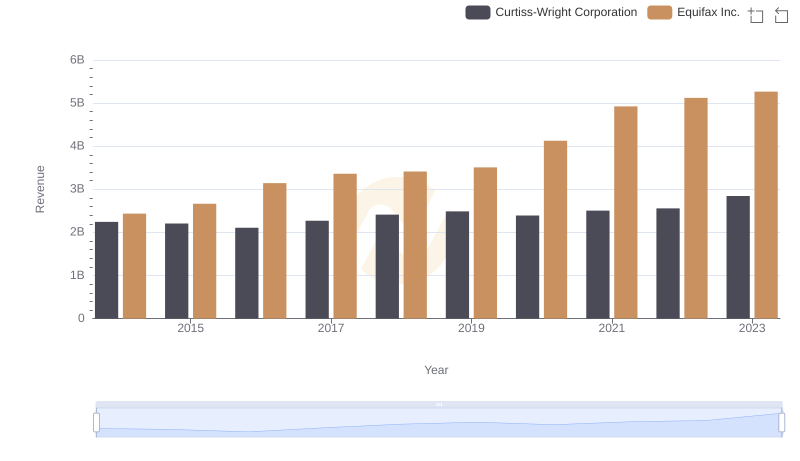

Breaking Down Revenue Trends: Equifax Inc. vs Curtiss-Wright Corporation

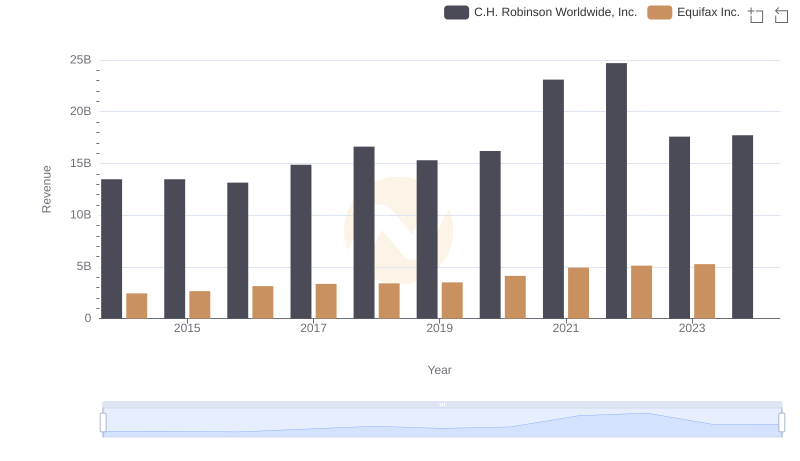

Annual Revenue Comparison: Equifax Inc. vs C.H. Robinson Worldwide, Inc.

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

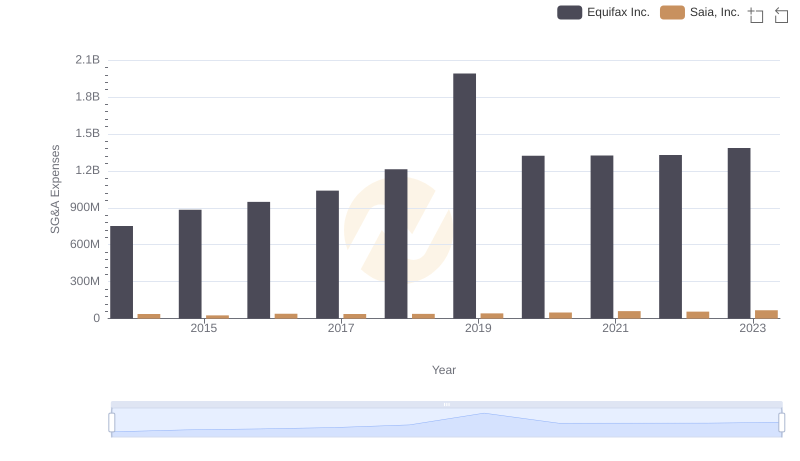

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Saia, Inc.