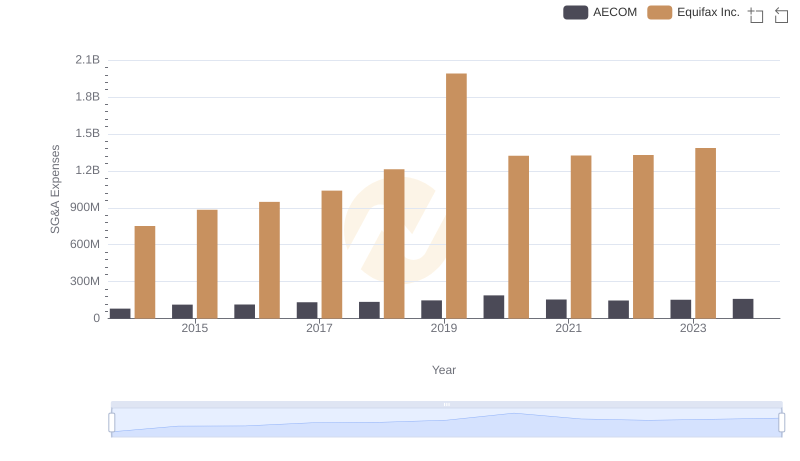

| __timestamp | Equifax Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 37563000 |

| Thursday, January 1, 2015 | 884300000 | 26832000 |

| Friday, January 1, 2016 | 948200000 | 39625000 |

| Sunday, January 1, 2017 | 1039100000 | 37162000 |

| Monday, January 1, 2018 | 1213300000 | 38425000 |

| Tuesday, January 1, 2019 | 1990200000 | 43073000 |

| Wednesday, January 1, 2020 | 1322500000 | 49761000 |

| Friday, January 1, 2021 | 1324600000 | 61345000 |

| Saturday, January 1, 2022 | 1328900000 | 56601000 |

| Sunday, January 1, 2023 | 1385700000 | 67984000 |

| Monday, January 1, 2024 | 1450500000 |

Cracking the code

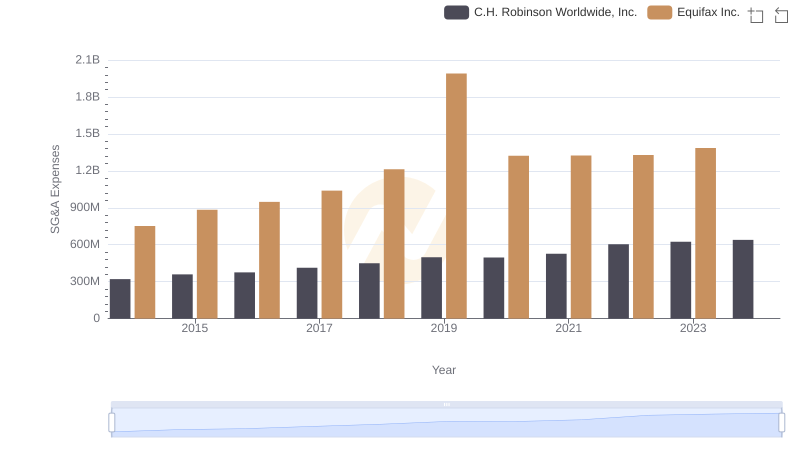

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. Over the past decade, Equifax Inc. and Saia, Inc. have showcased contrasting trends in their Selling, General, and Administrative (SG&A) expenses. Equifax, a global data analytics company, saw its SG&A expenses rise by approximately 84% from 2014 to 2023, peaking in 2019. This surge reflects strategic investments in technology and security post-2017's data breach. Meanwhile, Saia, Inc., a leading transportation company, experienced a more modest 81% increase, highlighting its focus on operational efficiency and expansion. By 2023, Equifax's SG&A expenses were nearly 20 times higher than Saia's, underscoring the scale and scope of their operations. This analysis offers a window into how these industry giants manage their operational costs amidst changing market dynamics.

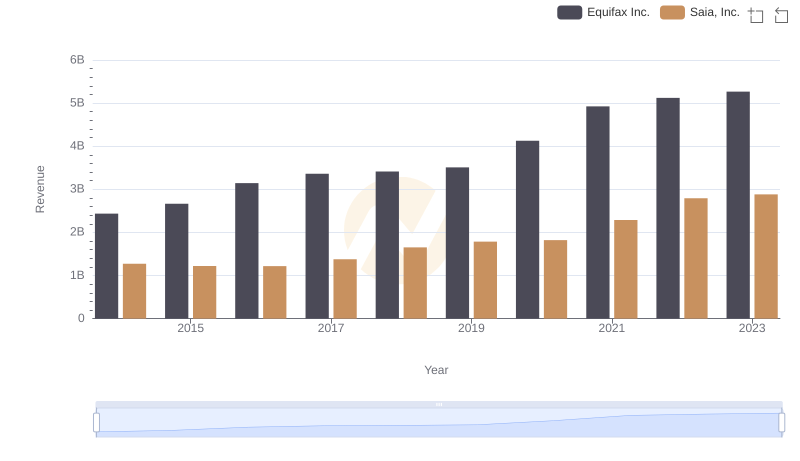

Comparing Revenue Performance: Equifax Inc. or Saia, Inc.?

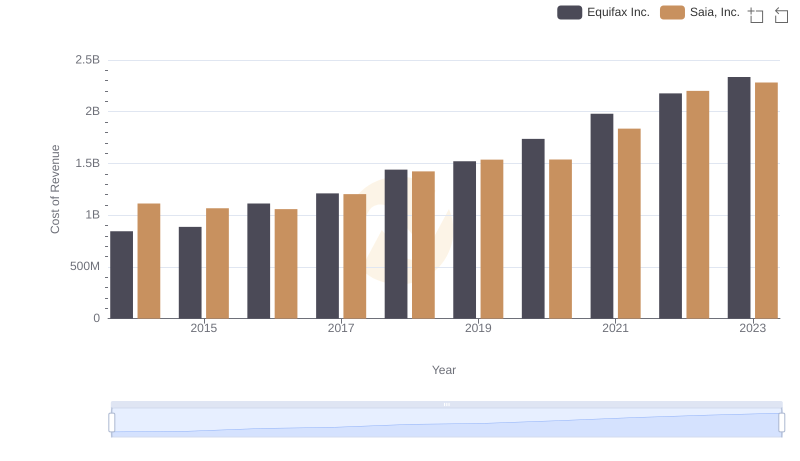

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

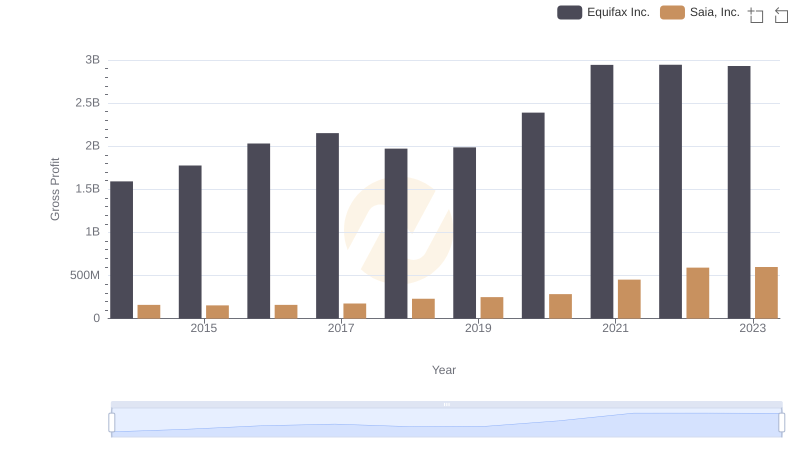

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

Equifax Inc. and AECOM: SG&A Spending Patterns Compared

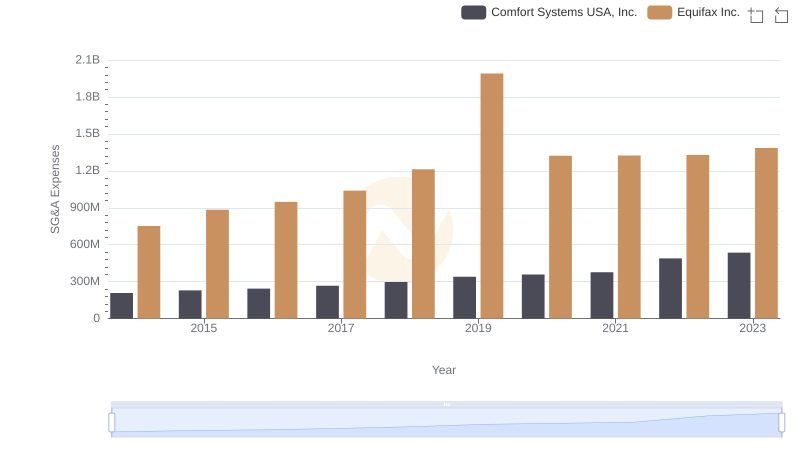

Equifax Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

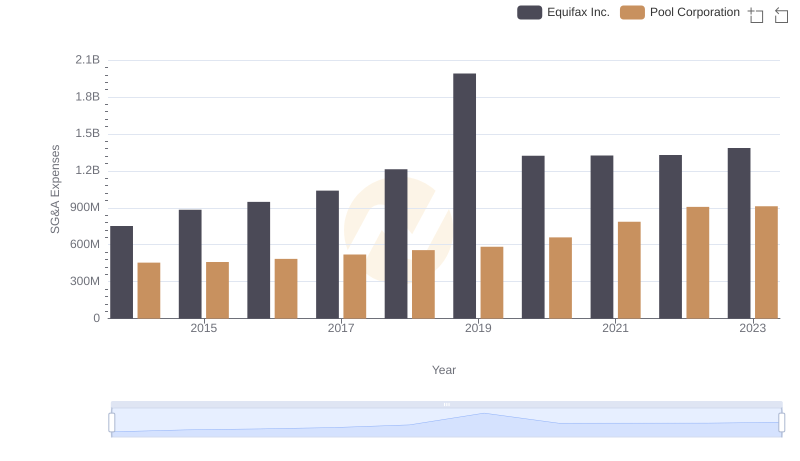

Comparing SG&A Expenses: Equifax Inc. vs Pool Corporation Trends and Insights

Equifax Inc. or Curtiss-Wright Corporation: Who Manages SG&A Costs Better?

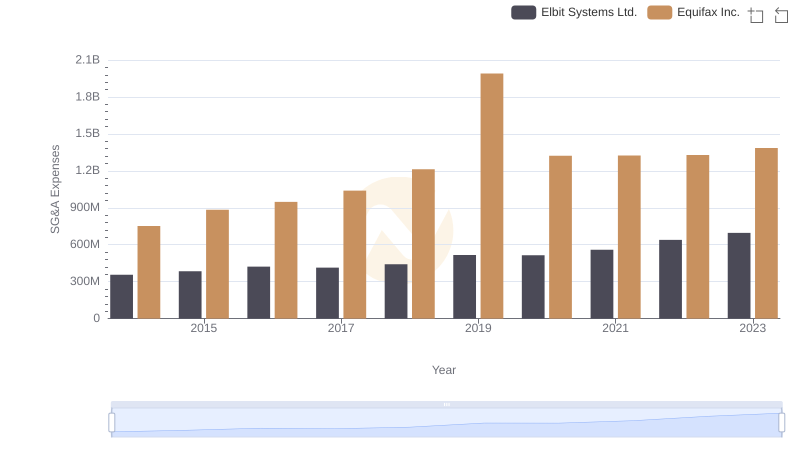

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Elbit Systems Ltd.

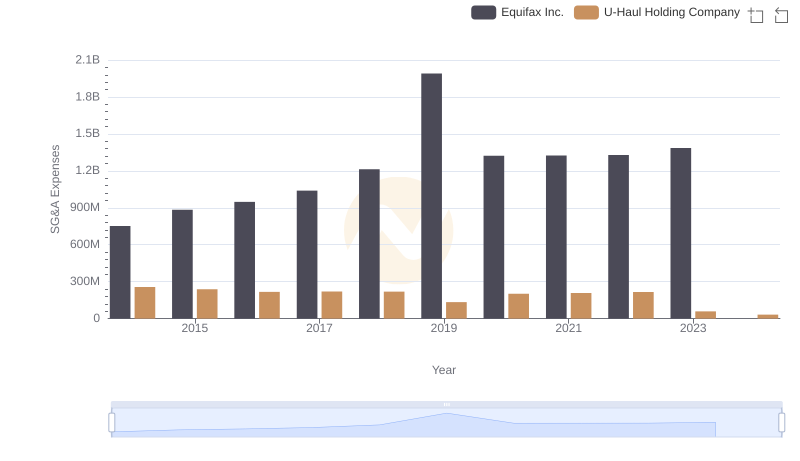

Selling, General, and Administrative Costs: Equifax Inc. vs U-Haul Holding Company

Breaking Down SG&A Expenses: Equifax Inc. vs C.H. Robinson Worldwide, Inc.