| __timestamp | AECOM | AMETEK, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 417662000 | 1023344000 |

| Thursday, January 1, 2015 | 1020478000 | 1093776000 |

| Friday, January 1, 2016 | 926466000 | 1007213000 |

| Sunday, January 1, 2017 | 920292000 | 1068174000 |

| Monday, January 1, 2018 | 680801000 | 1269415000 |

| Tuesday, January 1, 2019 | 573352000 | 1411422000 |

| Wednesday, January 1, 2020 | 580017000 | 1283159000 |

| Friday, January 1, 2021 | 813356000 | 1600782000 |

| Saturday, January 1, 2022 | 826856000 | 1820119000 |

| Sunday, January 1, 2023 | 543642000 | 2025843000 |

| Monday, January 1, 2024 | 1082384000 | 1779562000 |

Data in motion

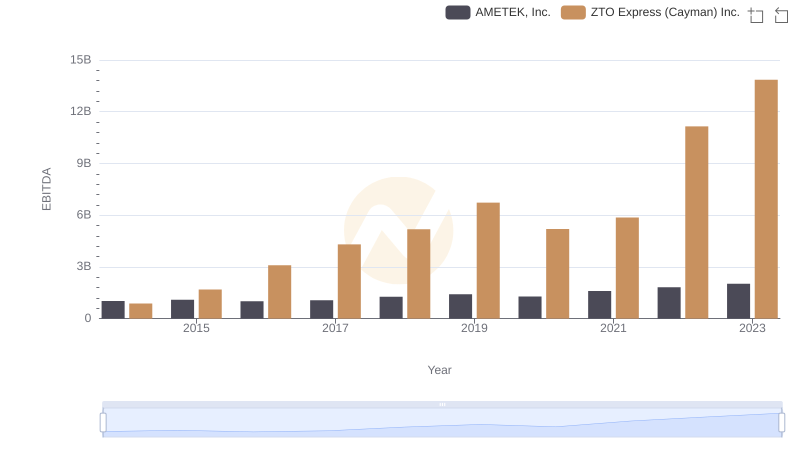

In the ever-evolving landscape of industrial and infrastructure sectors, AMETEK, Inc. and AECOM stand as significant players. Over the past decade, from 2014 to 2023, these companies have showcased intriguing EBITDA trends. AMETEK, Inc. has consistently outperformed AECOM, with its EBITDA peaking at approximately 2 billion in 2023, marking a remarkable growth of nearly 98% from its 2014 figures. In contrast, AECOM's EBITDA has experienced fluctuations, with a notable dip in 2023, reaching around 543 million, a 48% decrease from its 2015 peak. This disparity highlights AMETEK's robust financial health and strategic prowess. The data also reveals missing values for AMETEK in 2024, suggesting potential reporting delays or strategic shifts. As these giants navigate the complexities of their industries, their financial trajectories offer valuable insights into their operational efficiencies and market strategies.

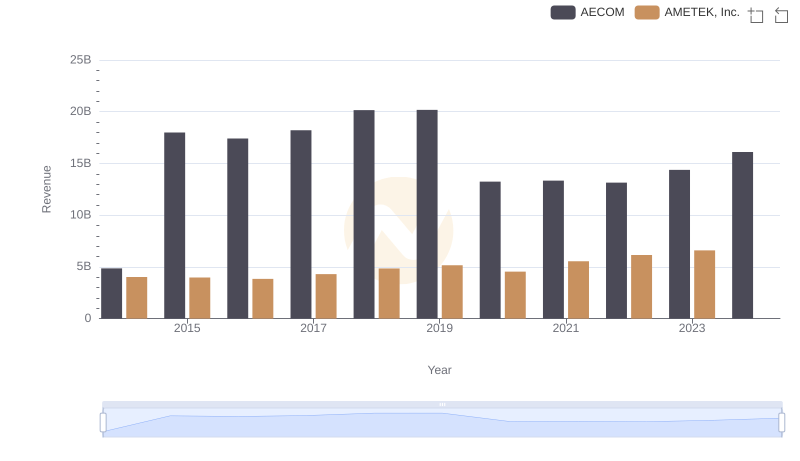

Who Generates More Revenue? AMETEK, Inc. or AECOM

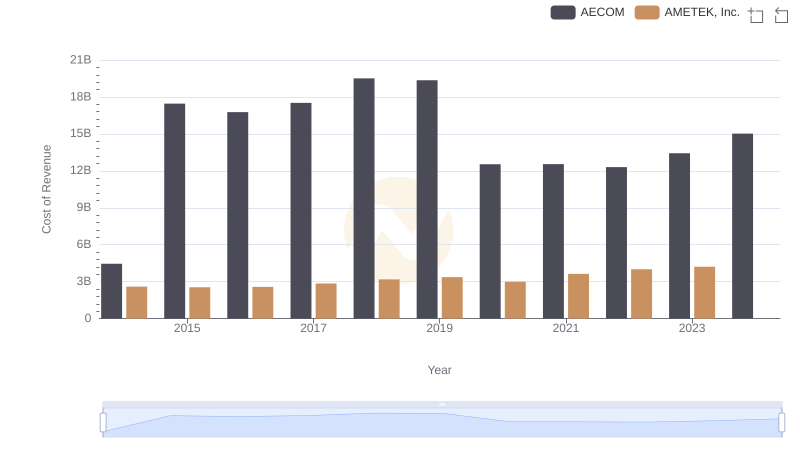

Cost of Revenue: Key Insights for AMETEK, Inc. and AECOM

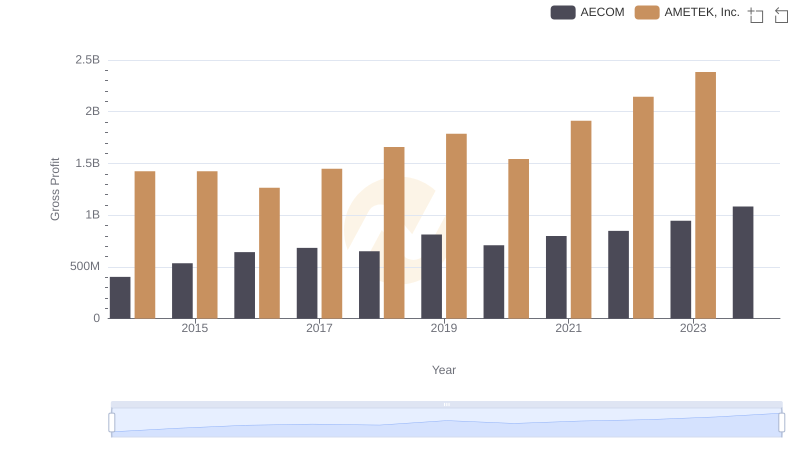

Gross Profit Trends Compared: AMETEK, Inc. vs AECOM

EBITDA Analysis: Evaluating AMETEK, Inc. Against ZTO Express (Cayman) Inc.

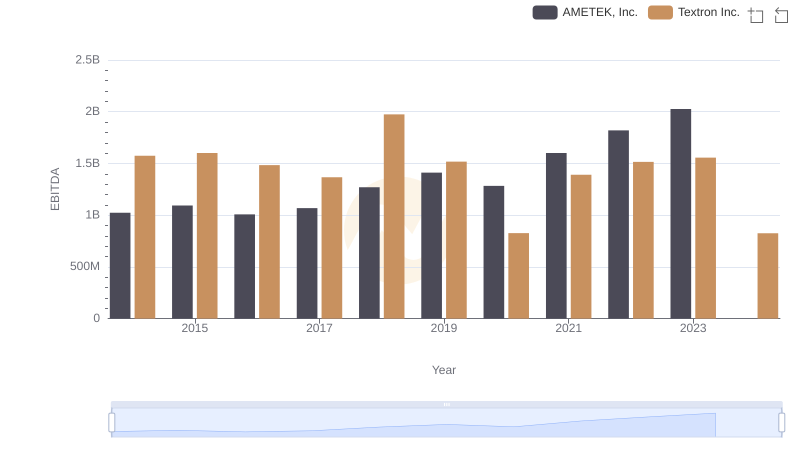

A Professional Review of EBITDA: AMETEK, Inc. Compared to Textron Inc.

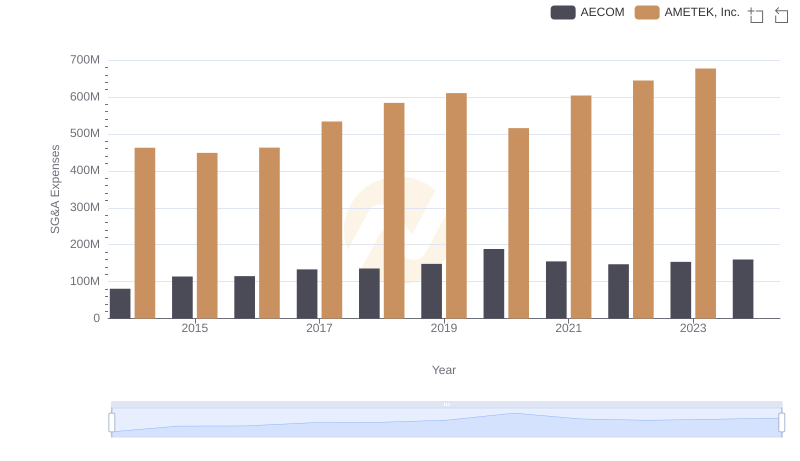

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and AECOM

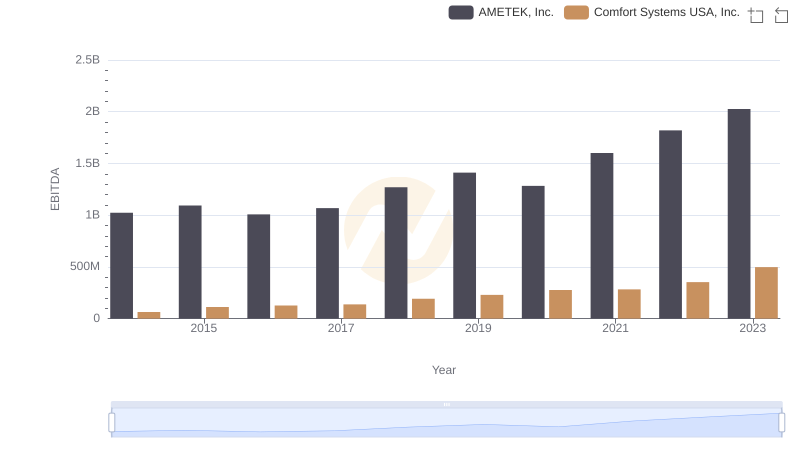

A Side-by-Side Analysis of EBITDA: AMETEK, Inc. and Comfort Systems USA, Inc.

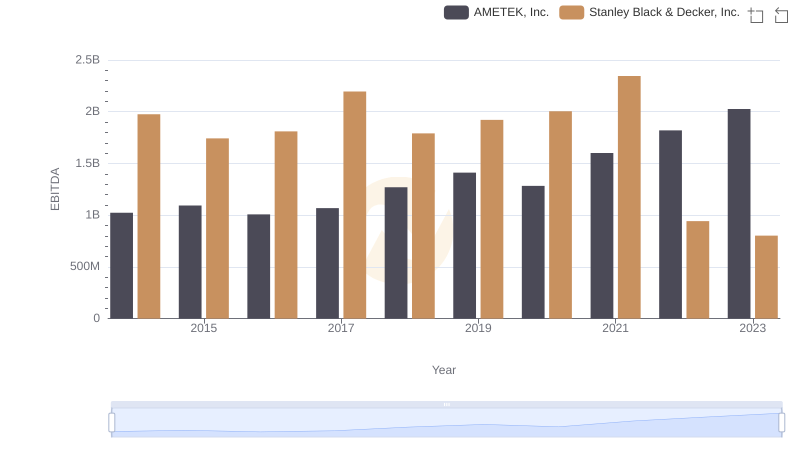

Professional EBITDA Benchmarking: AMETEK, Inc. vs Stanley Black & Decker, Inc.

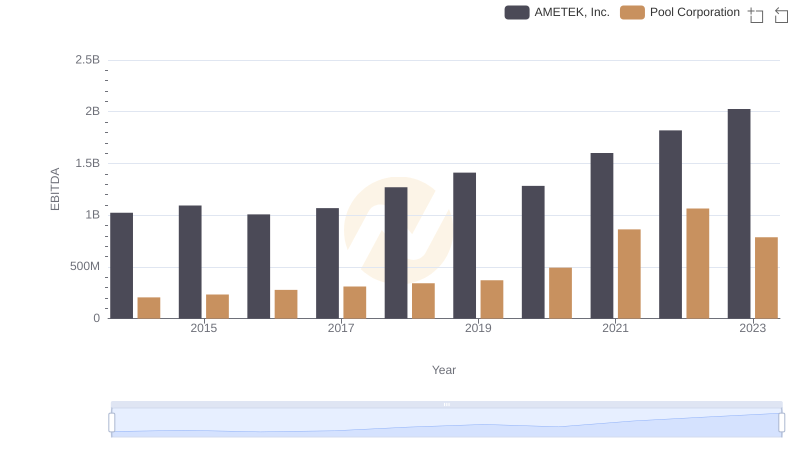

Professional EBITDA Benchmarking: AMETEK, Inc. vs Pool Corporation

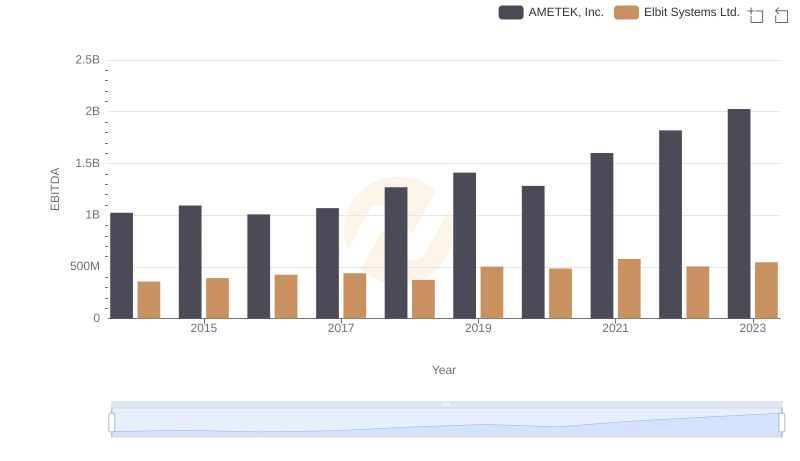

EBITDA Metrics Evaluated: AMETEK, Inc. vs Elbit Systems Ltd.

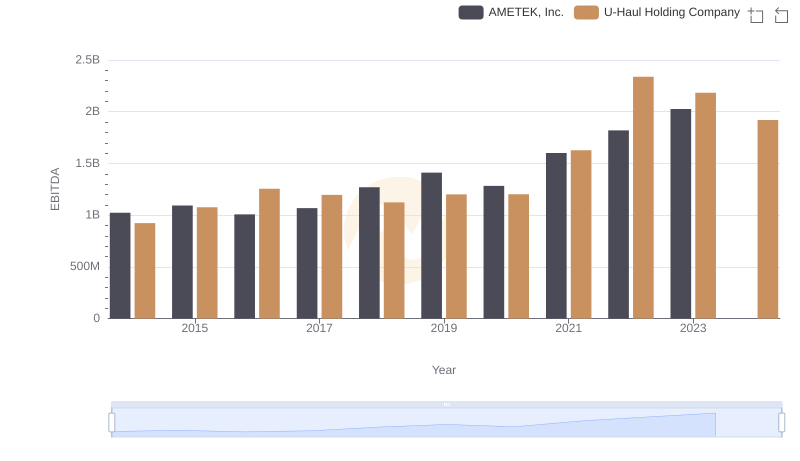

EBITDA Analysis: Evaluating AMETEK, Inc. Against U-Haul Holding Company