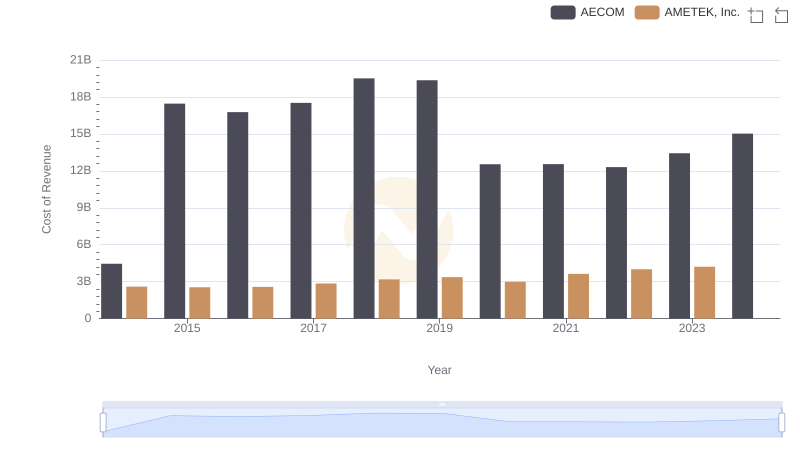

| __timestamp | AECOM | AMETEK, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4855627000 | 4021964000 |

| Thursday, January 1, 2015 | 17989880000 | 3974295000 |

| Friday, January 1, 2016 | 17410825000 | 3840087000 |

| Sunday, January 1, 2017 | 18203402000 | 4300170000 |

| Monday, January 1, 2018 | 20155512000 | 4845872000 |

| Tuesday, January 1, 2019 | 20173329000 | 5158557000 |

| Wednesday, January 1, 2020 | 13239976000 | 4540029000 |

| Friday, January 1, 2021 | 13340852000 | 5546514000 |

| Saturday, January 1, 2022 | 13148182000 | 6150530000 |

| Sunday, January 1, 2023 | 14378461000 | 6596950000 |

| Monday, January 1, 2024 | 16105498000 | 6941180000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial and infrastructure sectors, AMETEK, Inc. and AECOM have been key players. Over the past decade, AECOM has consistently outpaced AMETEK, Inc. in revenue generation. From 2014 to 2023, AECOM's revenue surged by approximately 196%, peaking in 2019 with a remarkable 20% increase from the previous year. In contrast, AMETEK, Inc. experienced a steady growth of around 64% over the same period, with its highest revenue recorded in 2023. Notably, AECOM's revenue dipped in 2020, likely due to global economic challenges, but it rebounded by 2024. Meanwhile, AMETEK, Inc. showed resilience with consistent growth, even as some data for 2024 remains unavailable. This analysis highlights the dynamic nature of these industries and the strategic maneuvers companies must make to stay ahead.

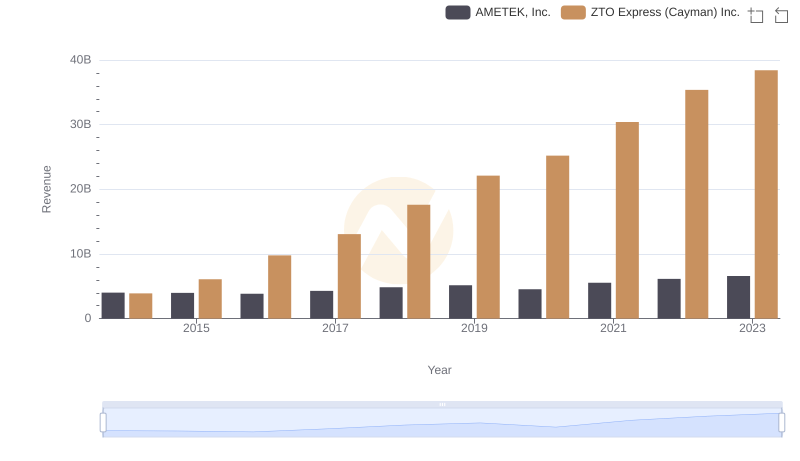

AMETEK, Inc. and ZTO Express (Cayman) Inc.: A Comprehensive Revenue Analysis

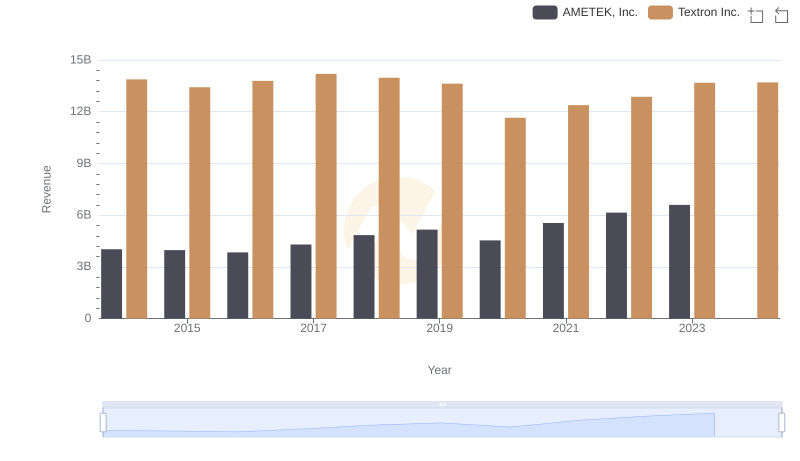

Breaking Down Revenue Trends: AMETEK, Inc. vs Textron Inc.

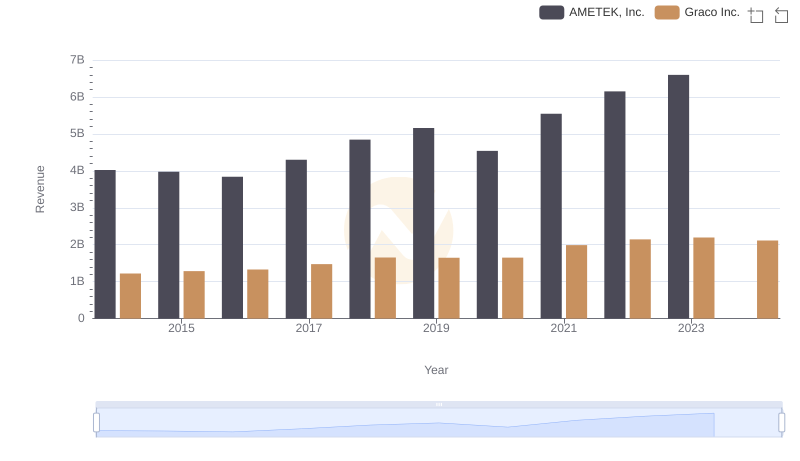

Annual Revenue Comparison: AMETEK, Inc. vs Graco Inc.

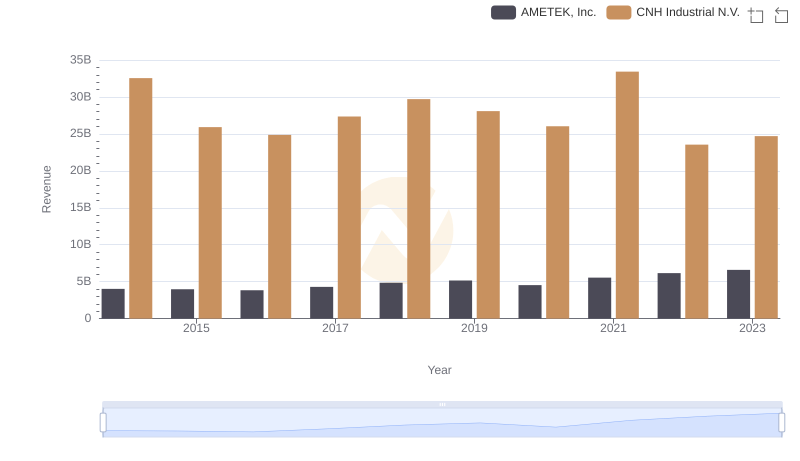

AMETEK, Inc. and CNH Industrial N.V.: A Comprehensive Revenue Analysis

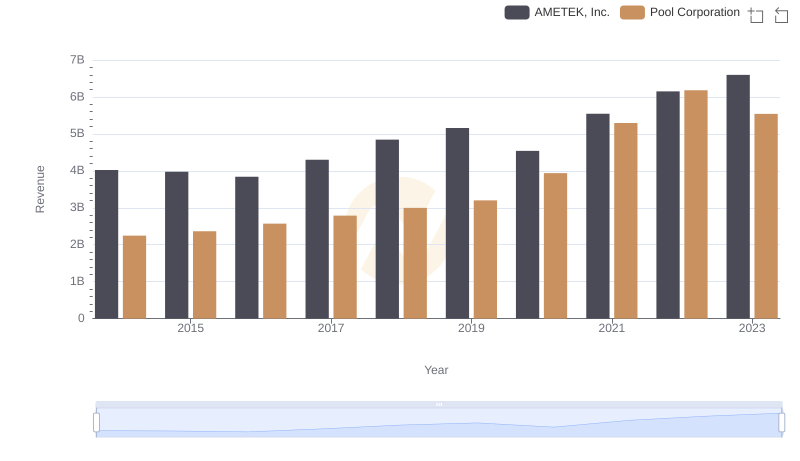

AMETEK, Inc. vs Pool Corporation: Annual Revenue Growth Compared

Cost of Revenue: Key Insights for AMETEK, Inc. and AECOM

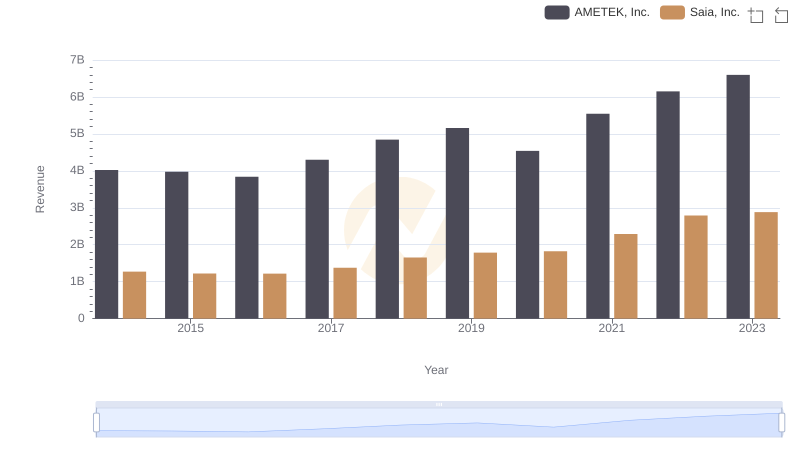

Revenue Showdown: AMETEK, Inc. vs Saia, Inc.

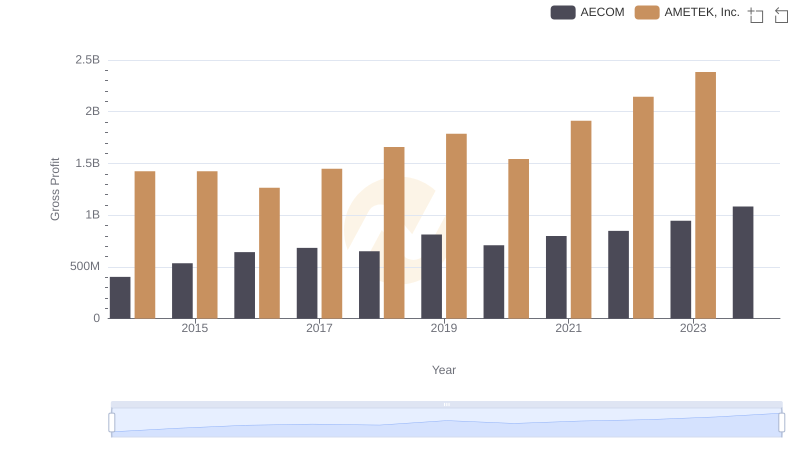

Gross Profit Trends Compared: AMETEK, Inc. vs AECOM

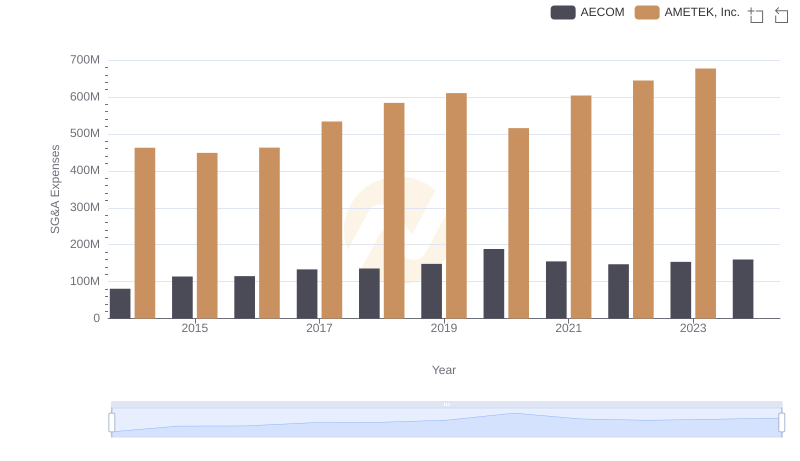

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and AECOM

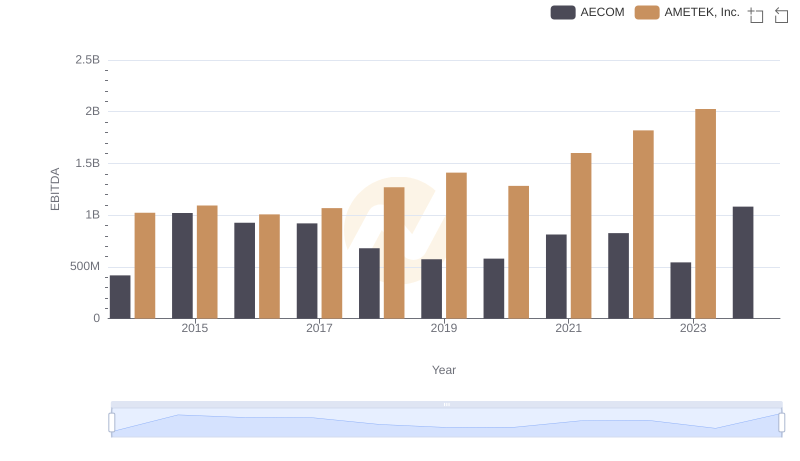

AMETEK, Inc. and AECOM: A Detailed Examination of EBITDA Performance