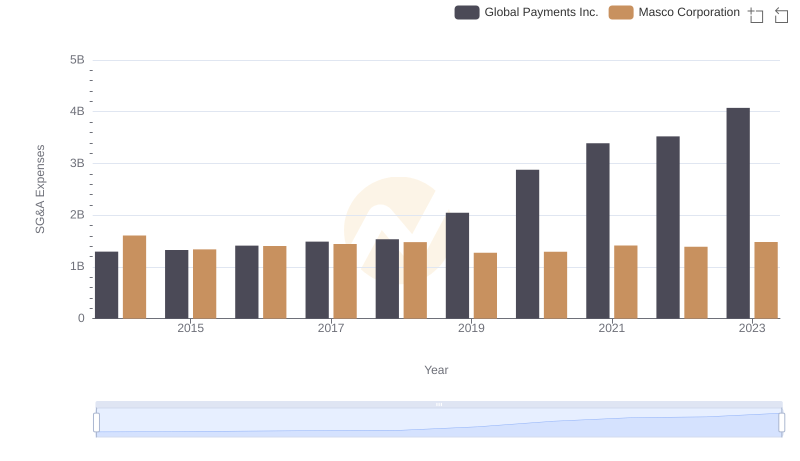

| __timestamp | Booz Allen Hamilton Holding Corporation | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 1295014000 |

| Thursday, January 1, 2015 | 2159439000 | 1325567000 |

| Friday, January 1, 2016 | 2319592000 | 1411096000 |

| Sunday, January 1, 2017 | 2568511000 | 1488258000 |

| Monday, January 1, 2018 | 2719909000 | 1534297000 |

| Tuesday, January 1, 2019 | 2932602000 | 2046672000 |

| Wednesday, January 1, 2020 | 3334378000 | 2878878000 |

| Friday, January 1, 2021 | 3362722000 | 3391161000 |

| Saturday, January 1, 2022 | 3633150000 | 3524578000 |

| Sunday, January 1, 2023 | 4341769000 | 4073768000 |

| Monday, January 1, 2024 | 1281443000 | 4285307000 |

Igniting the spark of knowledge

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis delves into the SG&A cost optimization strategies of two industry giants: Booz Allen Hamilton Holding Corporation and Global Payments Inc., from 2014 to 2023.

Booz Allen Hamilton has shown a consistent increase in SG&A expenses, peaking at approximately $4.34 billion in 2023. This represents a 95% increase from 2014, indicating a strategic expansion or investment in administrative capabilities.

Global Payments Inc. also experienced a significant rise, with SG&A expenses reaching around $4.07 billion in 2023, marking a 214% increase since 2014. This suggests aggressive growth and scaling efforts.

While both companies have seen substantial increases, the data suggests that Global Payments Inc. has been more aggressive in scaling its operations, as evidenced by the higher percentage increase in SG&A costs.

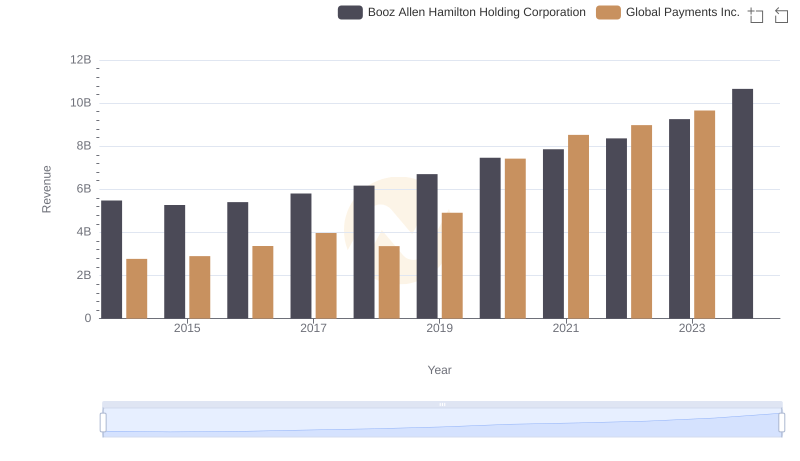

Comparing Revenue Performance: Global Payments Inc. or Booz Allen Hamilton Holding Corporation?

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs Booz Allen Hamilton Holding Corporation

Selling, General, and Administrative Costs: Global Payments Inc. vs TransUnion

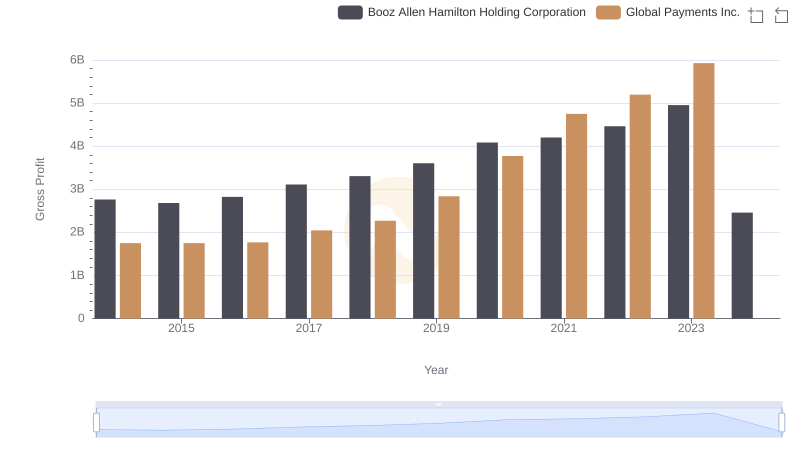

Gross Profit Analysis: Comparing Global Payments Inc. and Booz Allen Hamilton Holding Corporation

Breaking Down SG&A Expenses: Global Payments Inc. vs Masco Corporation

Global Payments Inc. vs J.B. Hunt Transport Services, Inc.: SG&A Expense Trends

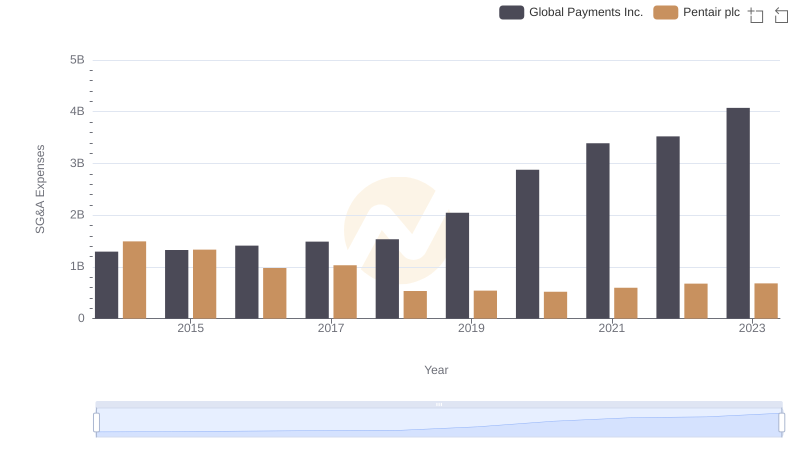

Selling, General, and Administrative Costs: Global Payments Inc. vs Pentair plc

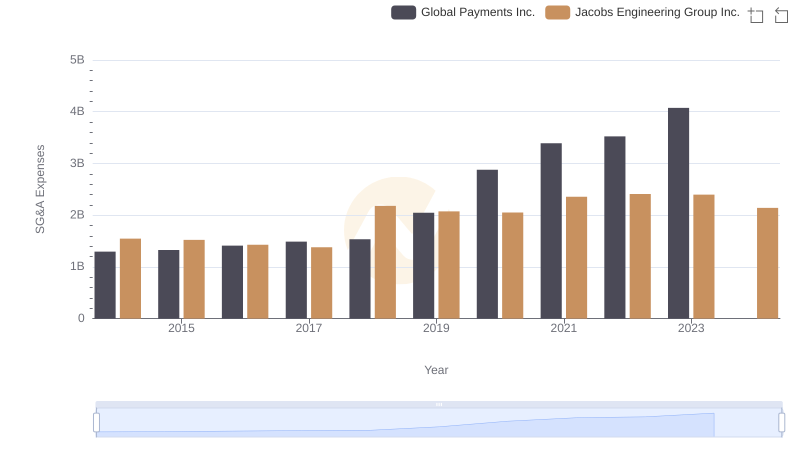

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Jacobs Engineering Group Inc.

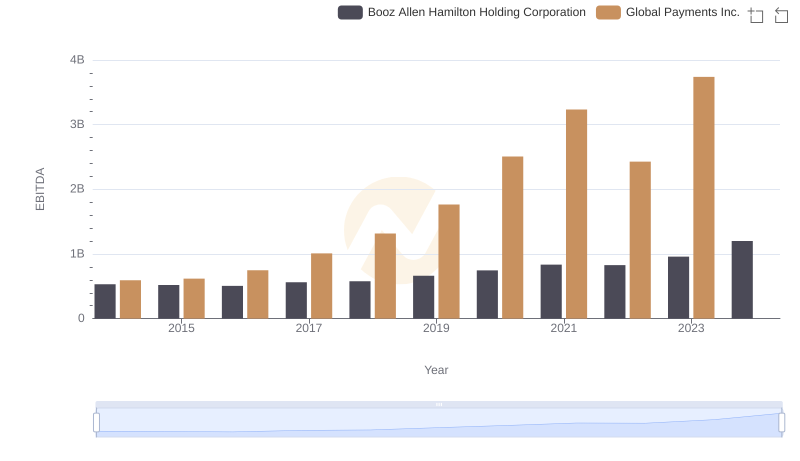

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and Booz Allen Hamilton Holding Corporation

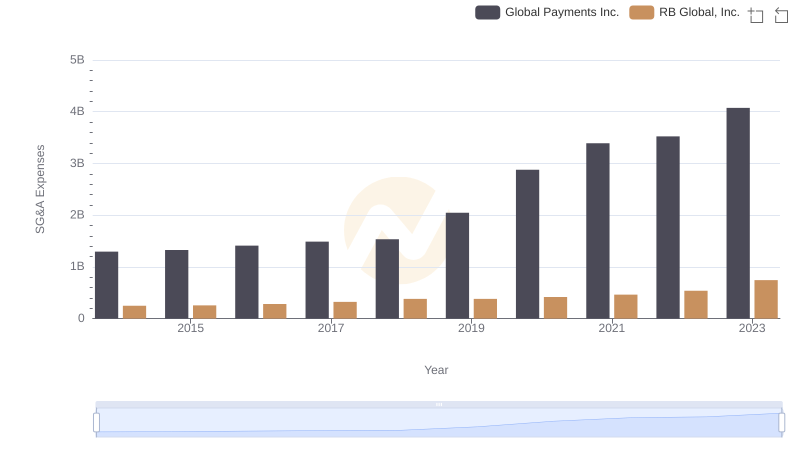

Cost Management Insights: SG&A Expenses for Global Payments Inc. and RB Global, Inc.

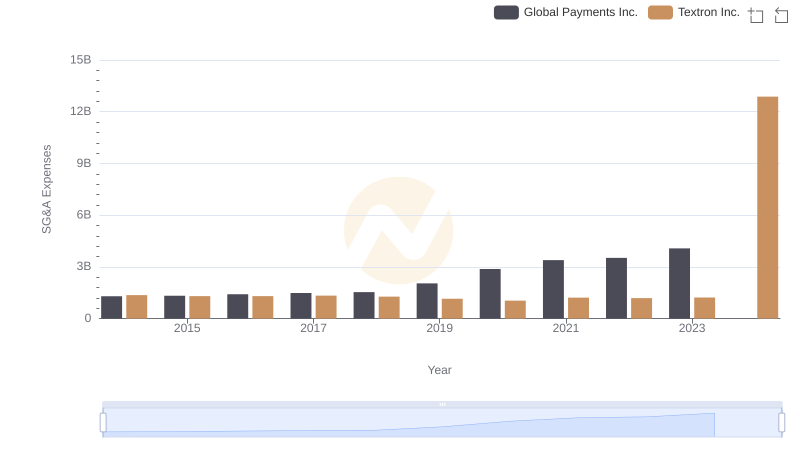

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Textron Inc.