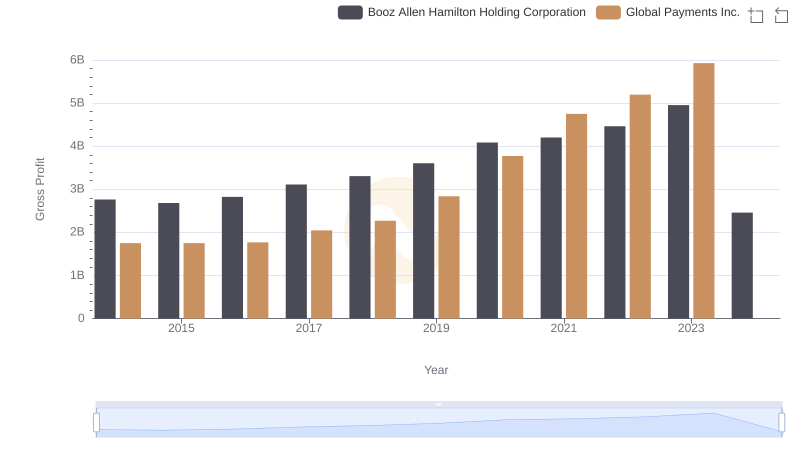

| __timestamp | Booz Allen Hamilton Holding Corporation | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5478693000 | 2773718000 |

| Thursday, January 1, 2015 | 5274770000 | 2898150000 |

| Friday, January 1, 2016 | 5405738000 | 3370976000 |

| Sunday, January 1, 2017 | 5804284000 | 3975163000 |

| Monday, January 1, 2018 | 6171853000 | 3366366000 |

| Tuesday, January 1, 2019 | 6704037000 | 4911892000 |

| Wednesday, January 1, 2020 | 7463841000 | 7423558000 |

| Friday, January 1, 2021 | 7858938000 | 8523762000 |

| Saturday, January 1, 2022 | 8363700000 | 8975515000 |

| Sunday, January 1, 2023 | 9258911000 | 9654419000 |

| Monday, January 1, 2024 | 10661896000 | 10105894000 |

In pursuit of knowledge

In the ever-evolving landscape of financial services and consulting, Booz Allen Hamilton Holding Corporation and Global Payments Inc. have demonstrated remarkable revenue trajectories over the past decade. From 2014 to 2023, Booz Allen Hamilton's revenue surged by approximately 95%, reflecting its robust growth strategy and market adaptability. Meanwhile, Global Payments Inc. showcased an impressive 248% increase in revenue, underscoring its dynamic expansion in the payments industry.

While 2024 data for Global Payments is missing, the upward trend for both companies is undeniable, marking them as key players in their respective fields.

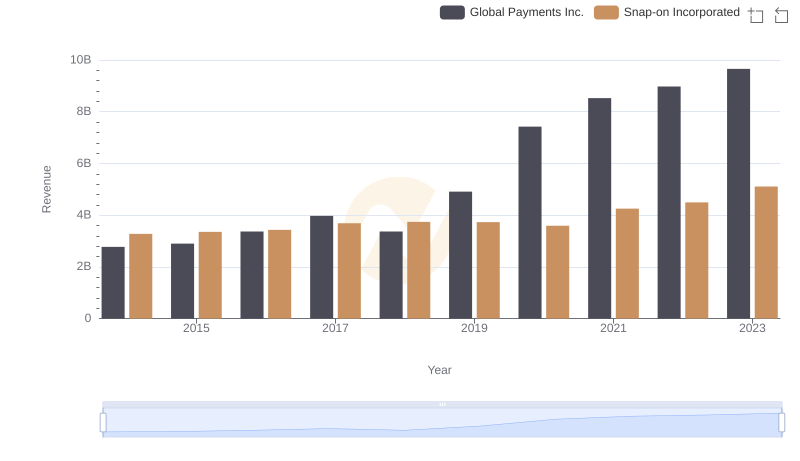

Global Payments Inc. vs Snap-on Incorporated: Examining Key Revenue Metrics

Revenue Insights: Global Payments Inc. and TransUnion Performance Compared

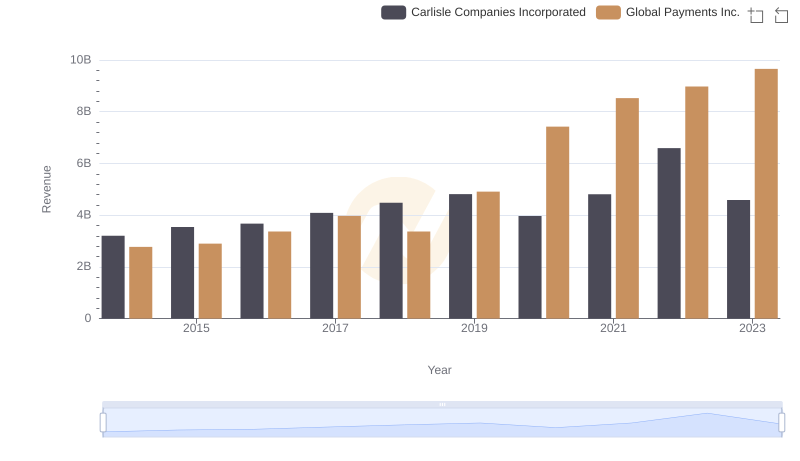

Global Payments Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

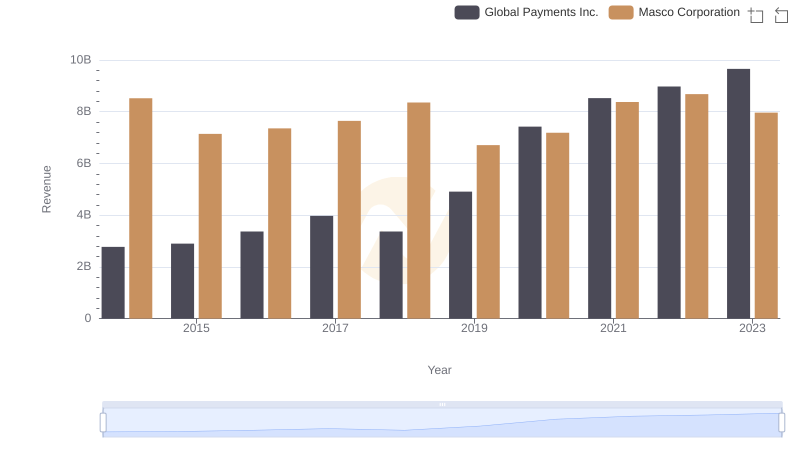

Global Payments Inc. vs Masco Corporation: Examining Key Revenue Metrics

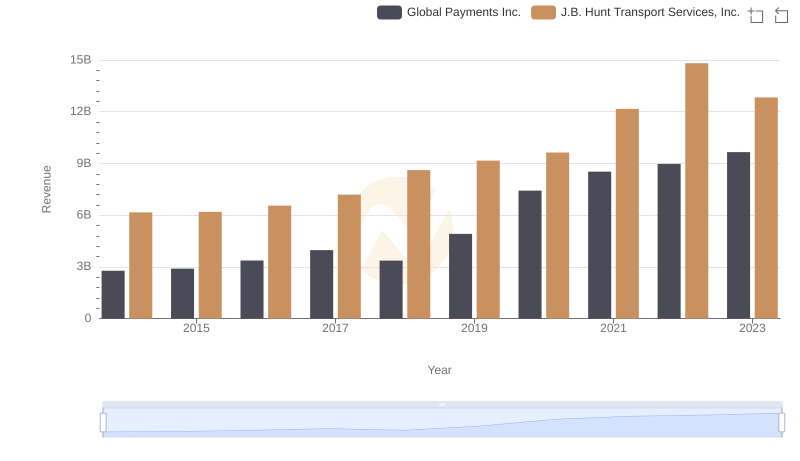

Global Payments Inc. or J.B. Hunt Transport Services, Inc.: Who Leads in Yearly Revenue?

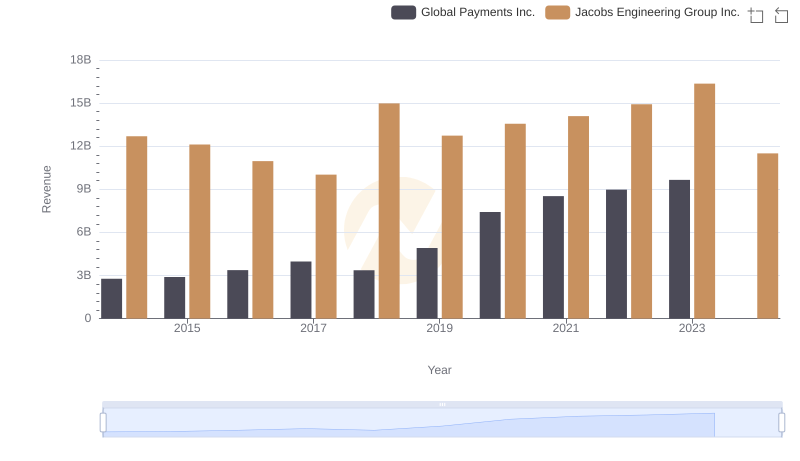

Revenue Insights: Global Payments Inc. and Jacobs Engineering Group Inc. Performance Compared

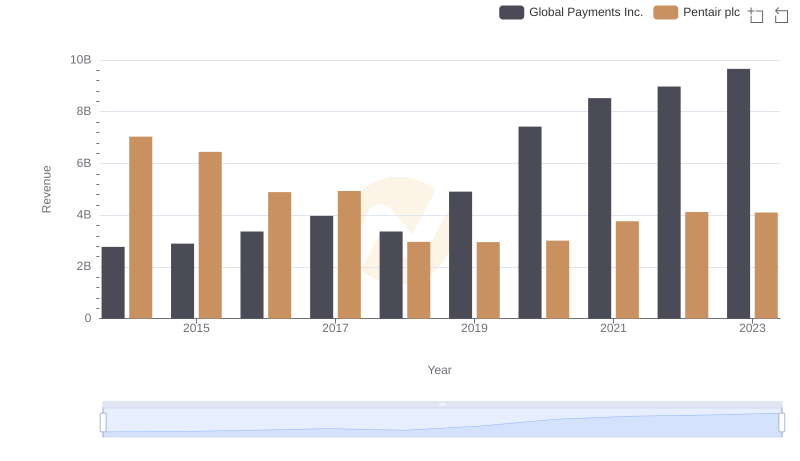

Global Payments Inc. vs Pentair plc: Examining Key Revenue Metrics

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs Booz Allen Hamilton Holding Corporation

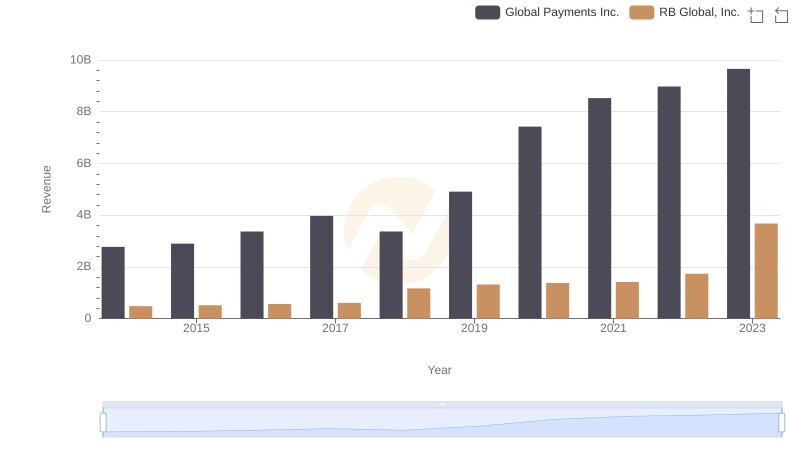

Comparing Revenue Performance: Global Payments Inc. or RB Global, Inc.?

Gross Profit Analysis: Comparing Global Payments Inc. and Booz Allen Hamilton Holding Corporation

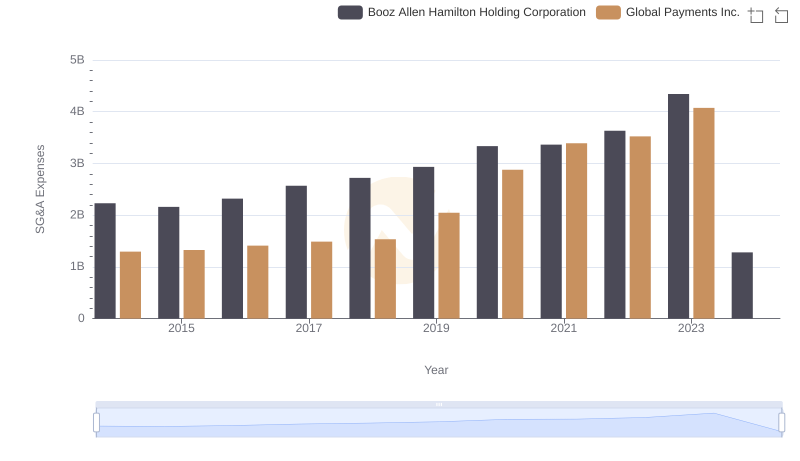

Who Optimizes SG&A Costs Better? Global Payments Inc. or Booz Allen Hamilton Holding Corporation

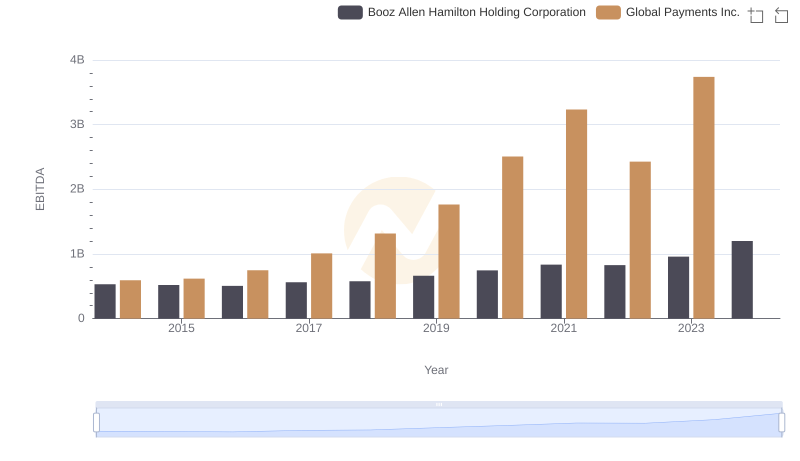

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and Booz Allen Hamilton Holding Corporation