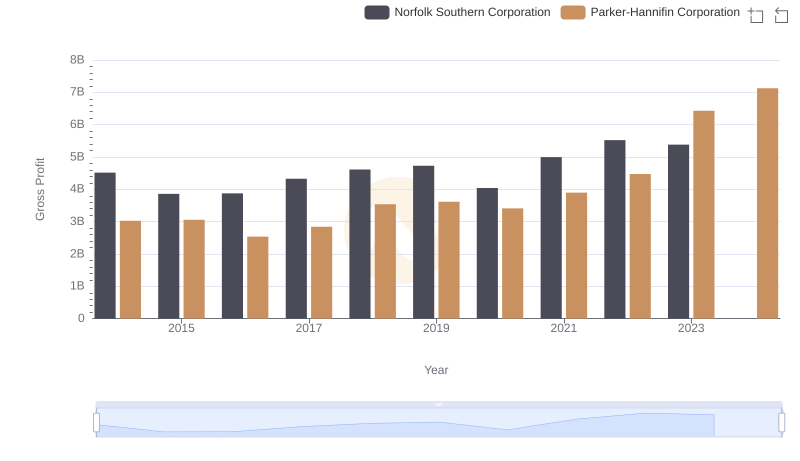

| __timestamp | Norfolk Southern Corporation | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4531000000 | 1832903000 |

| Thursday, January 1, 2015 | 3943000000 | 1861551000 |

| Friday, January 1, 2016 | 4212000000 | 1558088000 |

| Sunday, January 1, 2017 | 4733000000 | 1846306000 |

| Monday, January 1, 2018 | 5128000000 | 2382235000 |

| Tuesday, January 1, 2019 | 5233000000 | 2513468000 |

| Wednesday, January 1, 2020 | 4632000000 | 2431500000 |

| Friday, January 1, 2021 | 5705000000 | 3092383000 |

| Saturday, January 1, 2022 | 6043000000 | 2441242000 |

| Sunday, January 1, 2023 | 4340000000 | 4071687000 |

| Monday, January 1, 2024 | 4071000000 | 5028229000 |

In pursuit of knowledge

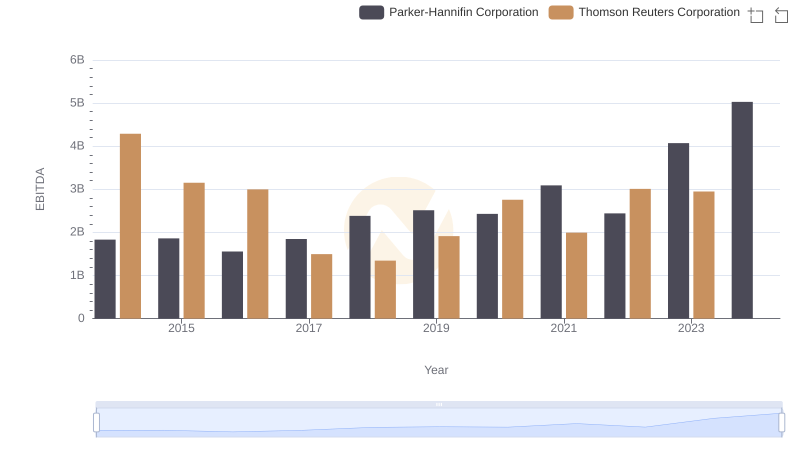

In the ever-evolving landscape of American industry, Parker-Hannifin Corporation and Norfolk Southern Corporation stand as titans in their respective fields. From 2014 to 2023, these companies have showcased distinct EBITDA trajectories, reflecting their strategic maneuvers and market conditions. Norfolk Southern, a leader in rail transportation, saw its EBITDA peak in 2022, marking a 54% increase from 2015. However, 2023 witnessed a decline, highlighting potential challenges in the rail sector. Conversely, Parker-Hannifin, a key player in motion and control technologies, demonstrated a robust growth pattern, with a remarkable 122% rise in EBITDA from 2014 to 2023. This surge underscores the company's adaptability and innovation in a competitive market. Notably, 2024 data for Norfolk Southern is missing, leaving room for speculation on its future performance. This analysis offers a window into the financial health and strategic direction of these industrial giants.

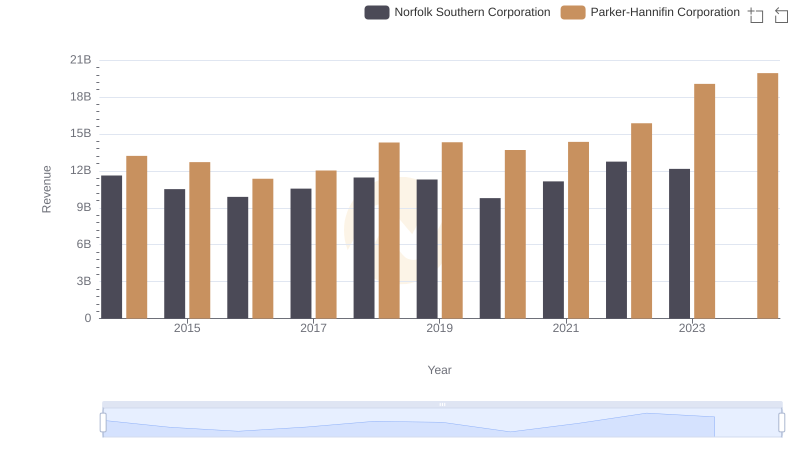

Revenue Insights: Parker-Hannifin Corporation and Norfolk Southern Corporation Performance Compared

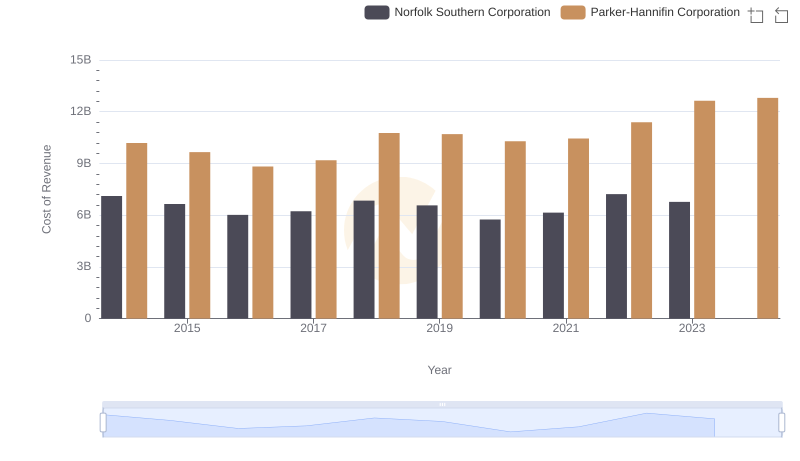

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Norfolk Southern Corporation

EBITDA Metrics Evaluated: Parker-Hannifin Corporation vs Illinois Tool Works Inc.

Parker-Hannifin Corporation vs Thomson Reuters Corporation: In-Depth EBITDA Performance Comparison

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Norfolk Southern Corporation

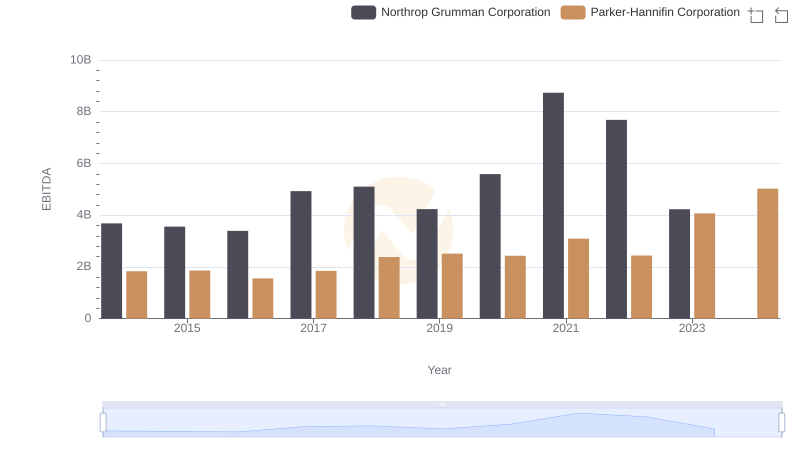

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and Northrop Grumman Corporation

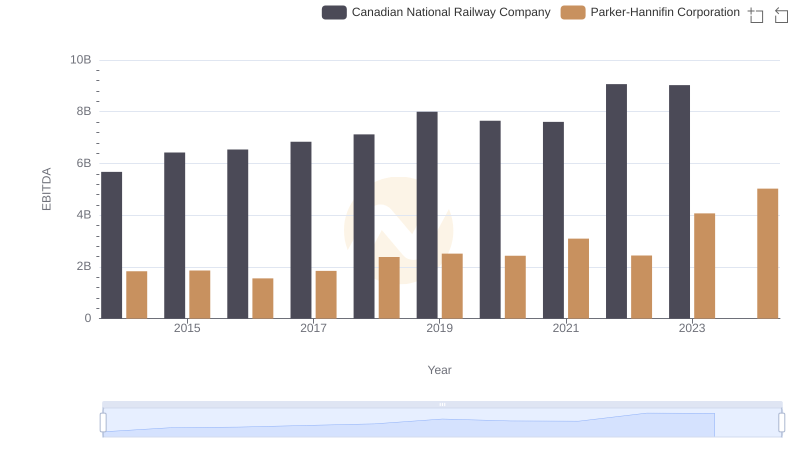

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and Canadian National Railway Company

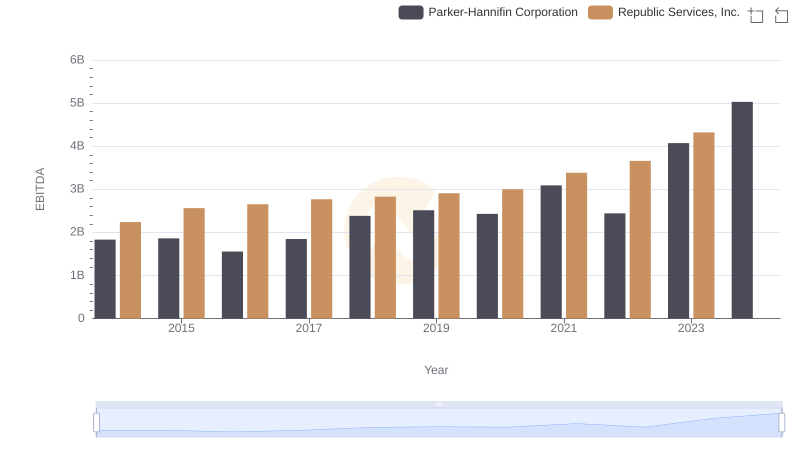

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs Republic Services, Inc.

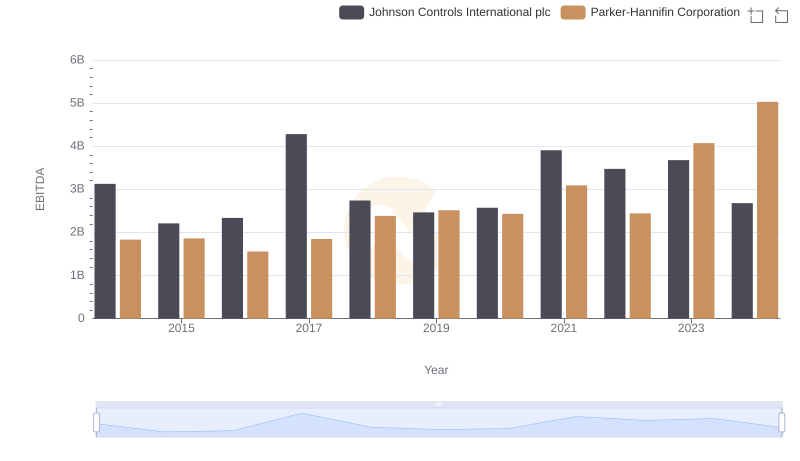

Professional EBITDA Benchmarking: Parker-Hannifin Corporation vs Johnson Controls International plc

EBITDA Metrics Evaluated: Parker-Hannifin Corporation vs Roper Technologies, Inc.

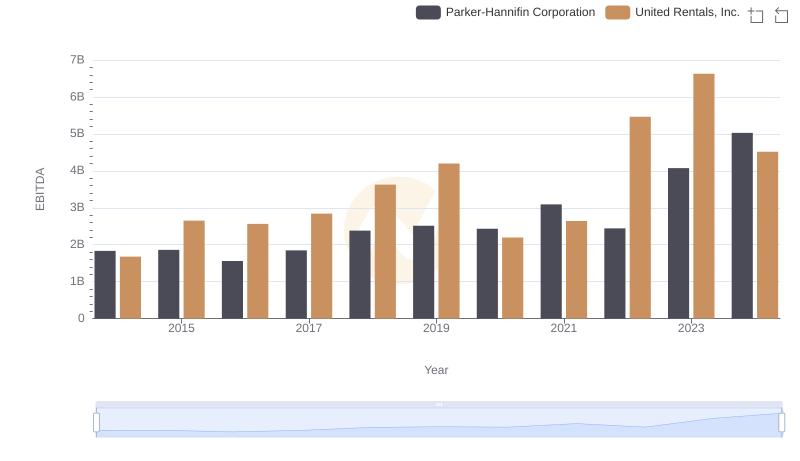

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to United Rentals, Inc.