| __timestamp | Illinois Tool Works Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3453000000 | 1832903000 |

| Thursday, January 1, 2015 | 3420000000 | 1861551000 |

| Friday, January 1, 2016 | 3534000000 | 1558088000 |

| Sunday, January 1, 2017 | 3861000000 | 1846306000 |

| Monday, January 1, 2018 | 4065000000 | 2382235000 |

| Tuesday, January 1, 2019 | 3852000000 | 2513468000 |

| Wednesday, January 1, 2020 | 3322000000 | 2431500000 |

| Friday, January 1, 2021 | 3910000000 | 3092383000 |

| Saturday, January 1, 2022 | 4241000000 | 2441242000 |

| Sunday, January 1, 2023 | 4484000000 | 4071687000 |

| Monday, January 1, 2024 | 4264000000 | 5028229000 |

Igniting the spark of knowledge

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and Illinois Tool Works Inc. have been pivotal players. Over the past decade, from 2014 to 2023, these giants have showcased intriguing trends in their EBITDA performance. Illinois Tool Works Inc. consistently led the race until 2023, when Parker-Hannifin surged ahead with a remarkable 24% increase, reaching an EBITDA of approximately $4.07 billion. This leap highlights Parker-Hannifin's strategic advancements and market adaptability.

Illinois Tool Works, despite a steady growth trajectory, saw its EBITDA peak in 2023 at around $4.48 billion, marking a 30% rise from 2014. However, the absence of data for 2024 leaves room for speculation on future trends. As these companies continue to innovate, their financial metrics will be crucial indicators of their market positions.

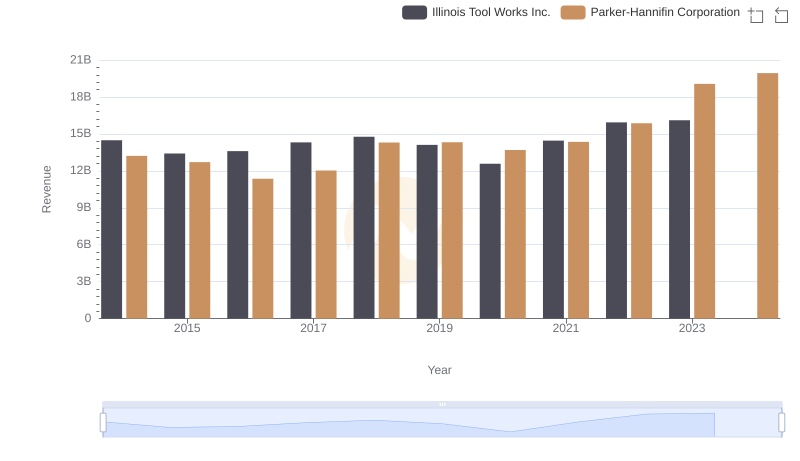

Parker-Hannifin Corporation and Illinois Tool Works Inc.: A Comprehensive Revenue Analysis

Cost of Revenue Trends: Parker-Hannifin Corporation vs Illinois Tool Works Inc.

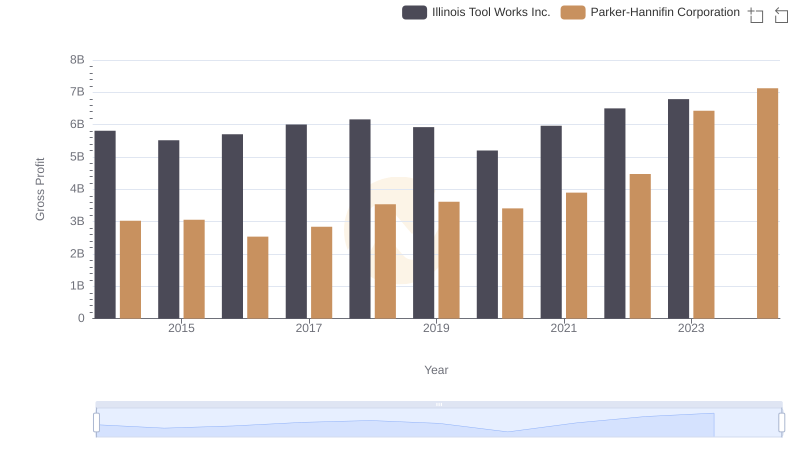

Parker-Hannifin Corporation vs Illinois Tool Works Inc.: A Gross Profit Performance Breakdown

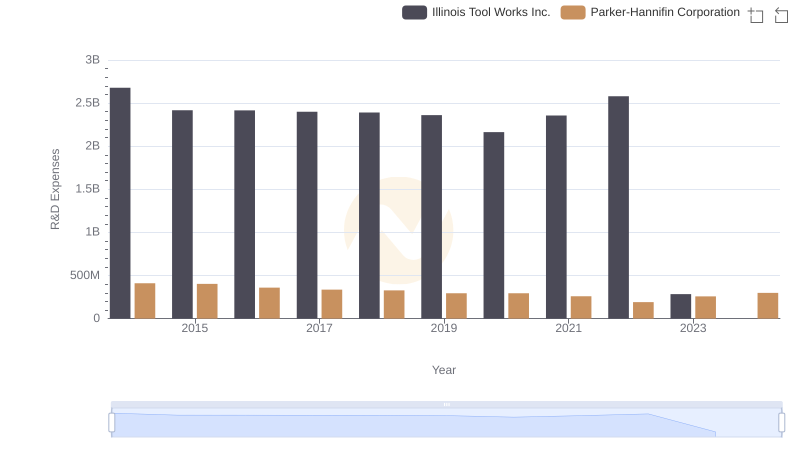

Research and Development Expenses Breakdown: Parker-Hannifin Corporation vs Illinois Tool Works Inc.

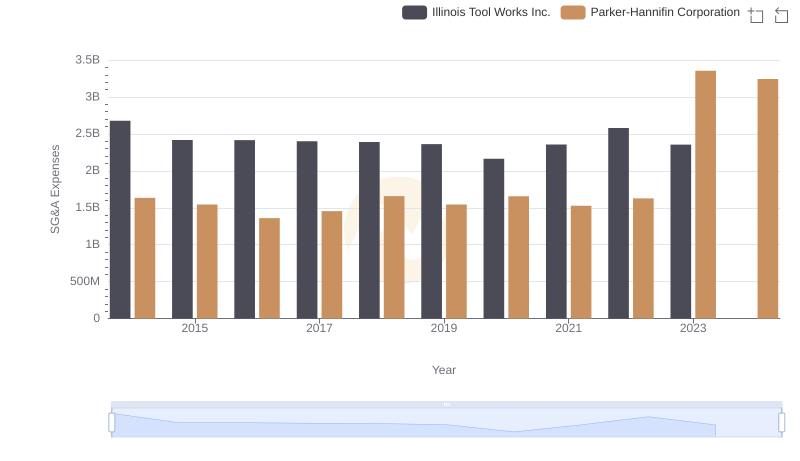

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs Illinois Tool Works Inc.

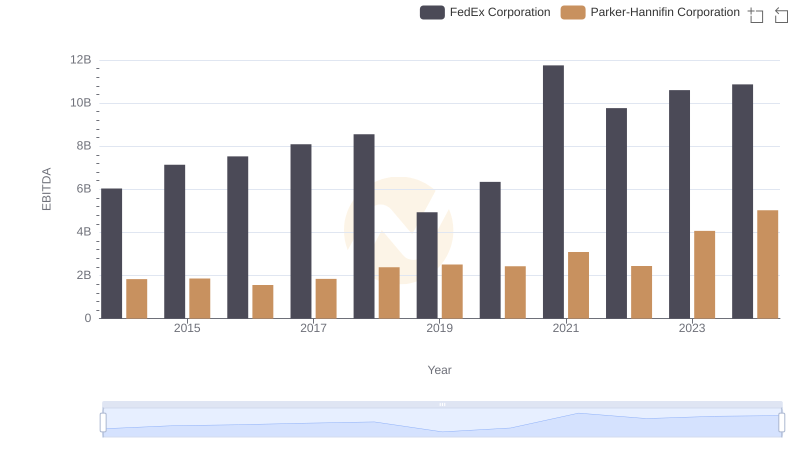

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and FedEx Corporation

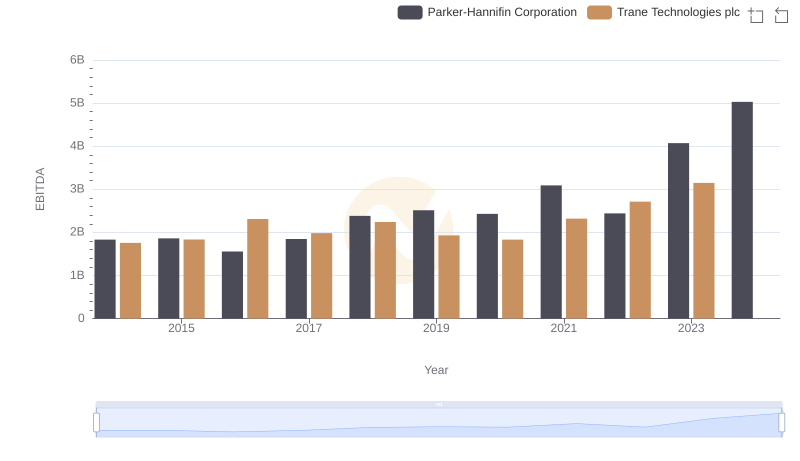

EBITDA Analysis: Evaluating Parker-Hannifin Corporation Against Trane Technologies plc

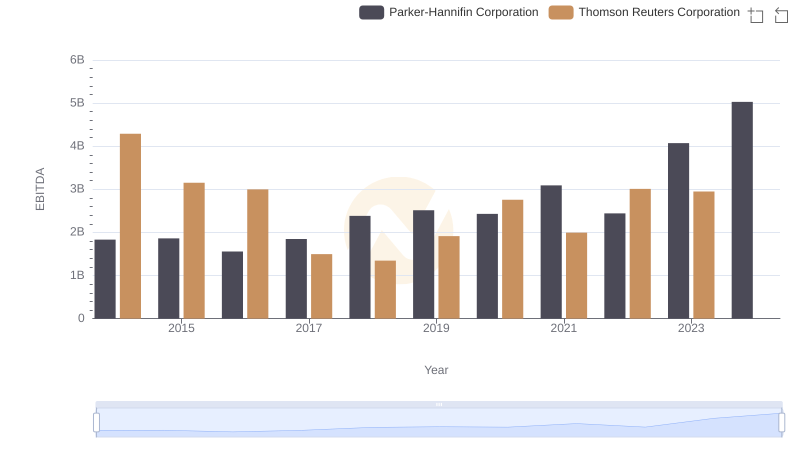

Parker-Hannifin Corporation vs Thomson Reuters Corporation: In-Depth EBITDA Performance Comparison

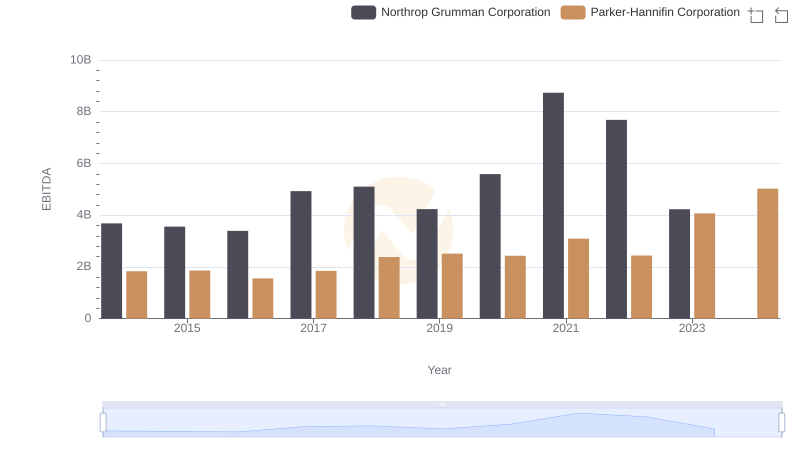

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and Northrop Grumman Corporation