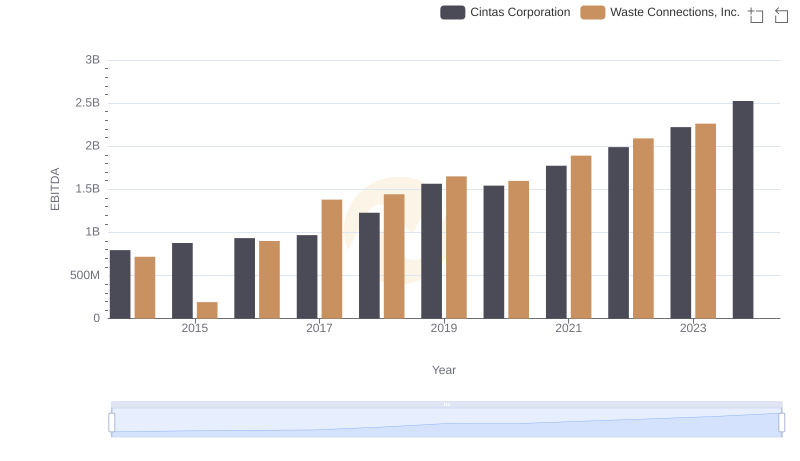

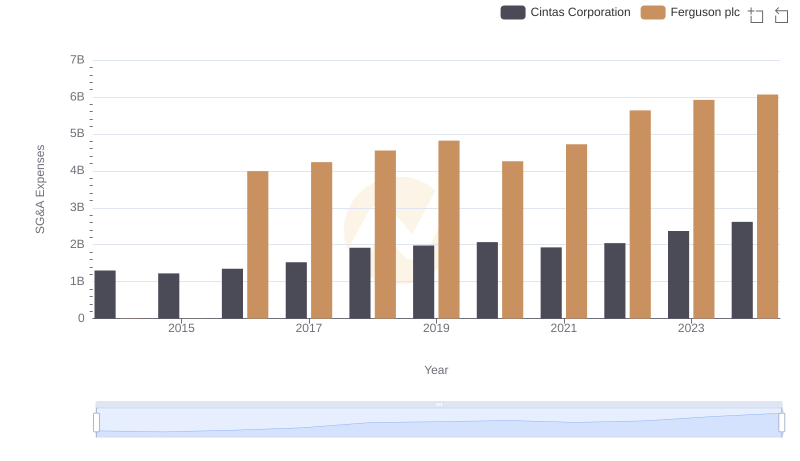

| __timestamp | Cintas Corporation | Ferguson plc |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 1450623023 |

| Thursday, January 1, 2015 | 877761000 | 1500920522 |

| Friday, January 1, 2016 | 933728000 | 1289082542 |

| Sunday, January 1, 2017 | 968293000 | 1746753588 |

| Monday, January 1, 2018 | 1227852000 | 1487000000 |

| Tuesday, January 1, 2019 | 1564228000 | 1707000000 |

| Wednesday, January 1, 2020 | 1542737000 | 1979000000 |

| Friday, January 1, 2021 | 1773591000 | 2248000000 |

| Saturday, January 1, 2022 | 1990046000 | 3120000000 |

| Sunday, January 1, 2023 | 2221676000 | 3097000000 |

| Monday, January 1, 2024 | 2523857000 | 2978000000 |

Unveiling the hidden dimensions of data

In the world of corporate finance, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a crucial indicator of a company's operational performance. Over the past decade, Cintas Corporation and Ferguson plc have demonstrated remarkable growth in this metric, reflecting their robust business strategies and market adaptability.

From 2014 to 2024, Cintas Corporation's EBITDA has surged by over 200%, showcasing a consistent upward trajectory. This growth highlights Cintas's ability to enhance operational efficiency and expand its market presence, even amidst economic fluctuations.

Ferguson plc, on the other hand, has experienced a 105% increase in EBITDA over the same period. Notably, Ferguson's EBITDA peaked in 2022, marking a significant milestone in its financial journey.

Both companies exemplify resilience and strategic foresight, making them leaders in their respective industries.

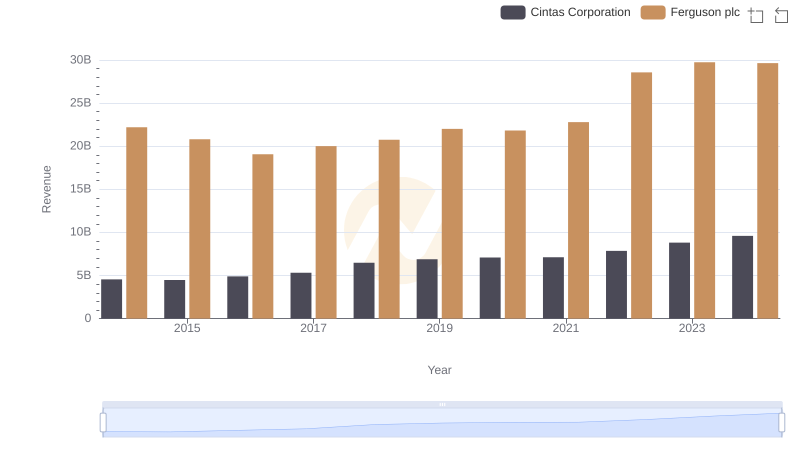

Who Generates More Revenue? Cintas Corporation or Ferguson plc

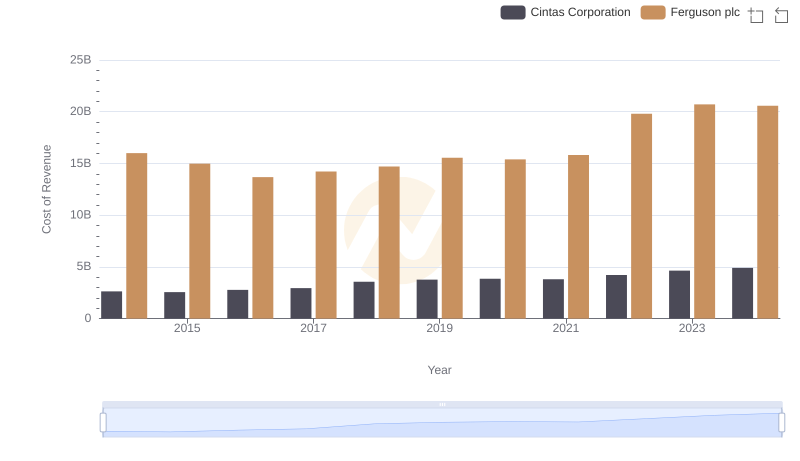

Cost Insights: Breaking Down Cintas Corporation and Ferguson plc's Expenses

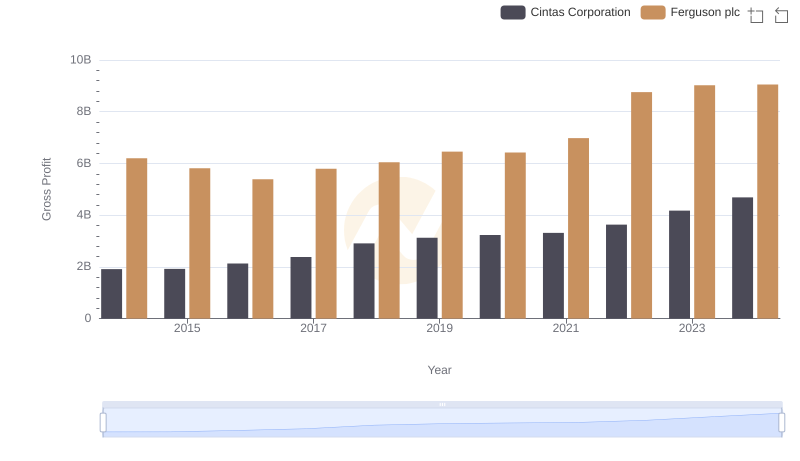

Gross Profit Trends Compared: Cintas Corporation vs Ferguson plc

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Waste Connections, Inc.

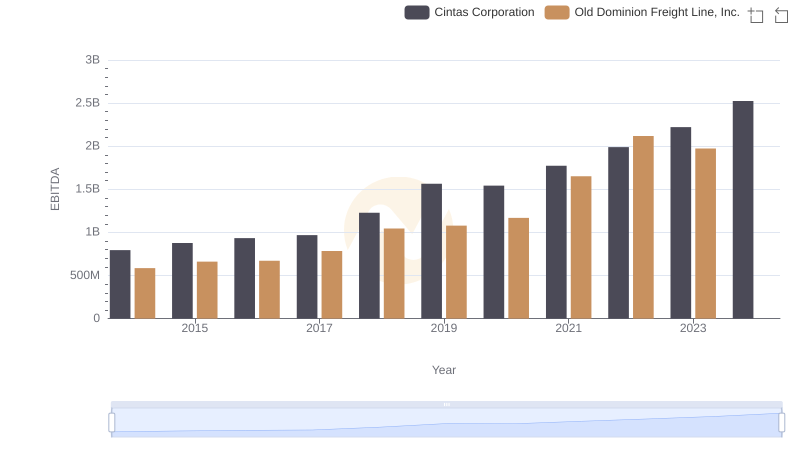

Professional EBITDA Benchmarking: Cintas Corporation vs Old Dominion Freight Line, Inc.

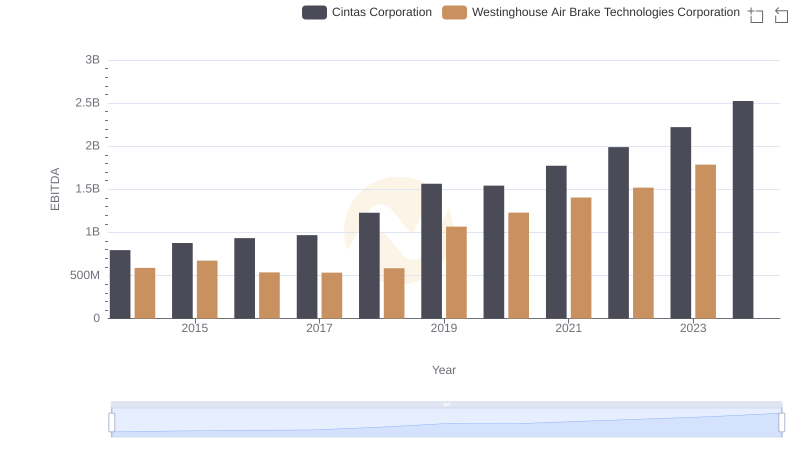

Comprehensive EBITDA Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

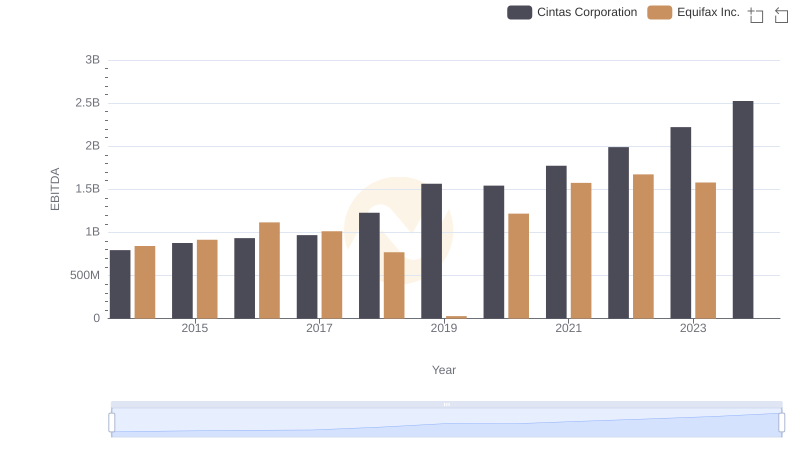

A Professional Review of EBITDA: Cintas Corporation Compared to Equifax Inc.

Selling, General, and Administrative Costs: Cintas Corporation vs Ferguson plc

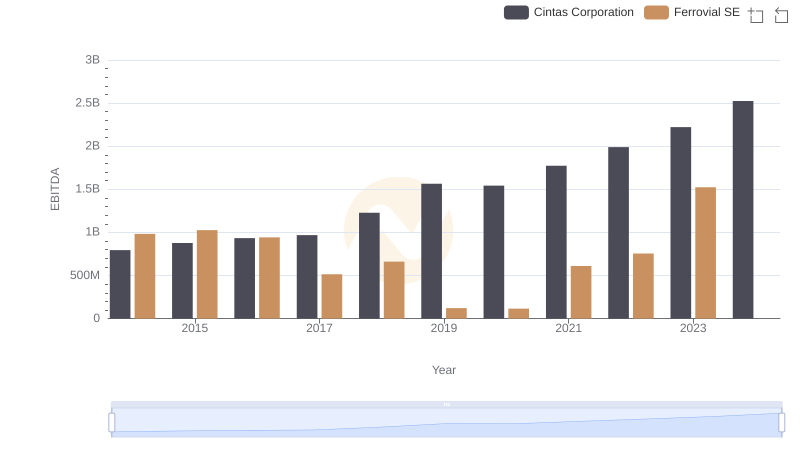

Comparative EBITDA Analysis: Cintas Corporation vs Ferrovial SE

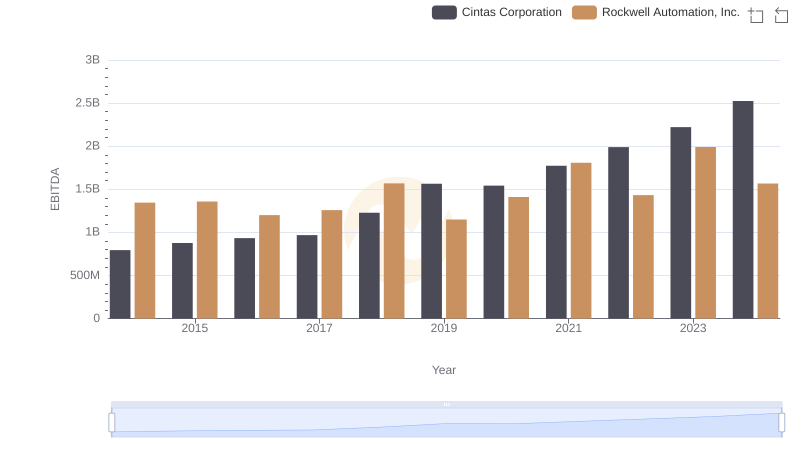

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Rockwell Automation, Inc.

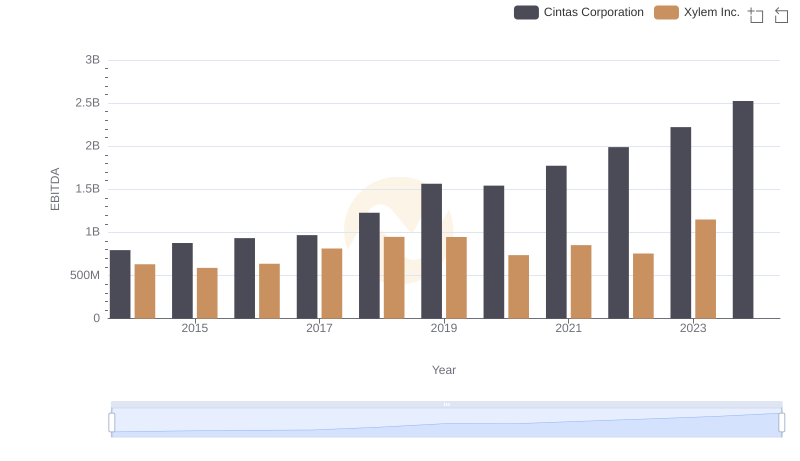

Professional EBITDA Benchmarking: Cintas Corporation vs Xylem Inc.

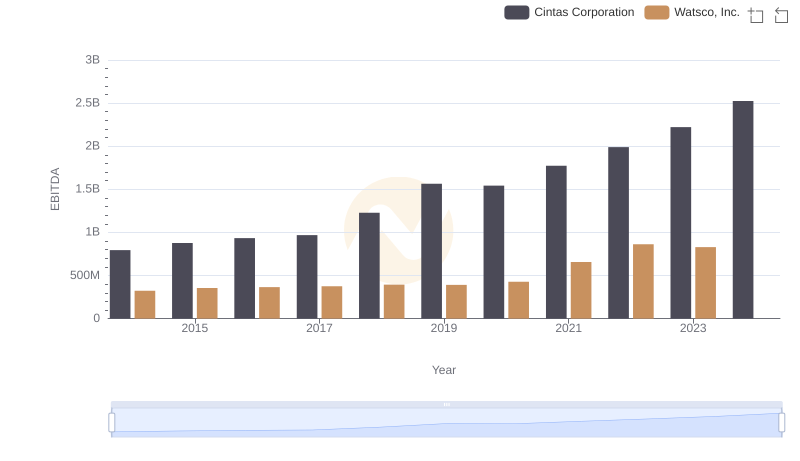

Cintas Corporation and Watsco, Inc.: A Detailed Examination of EBITDA Performance