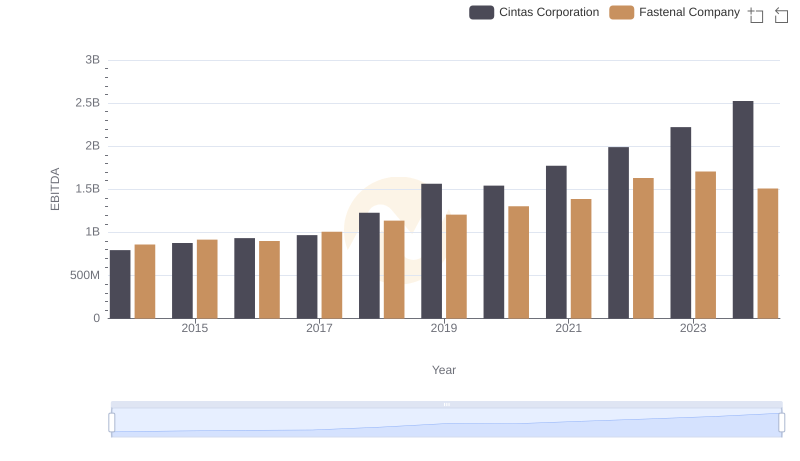

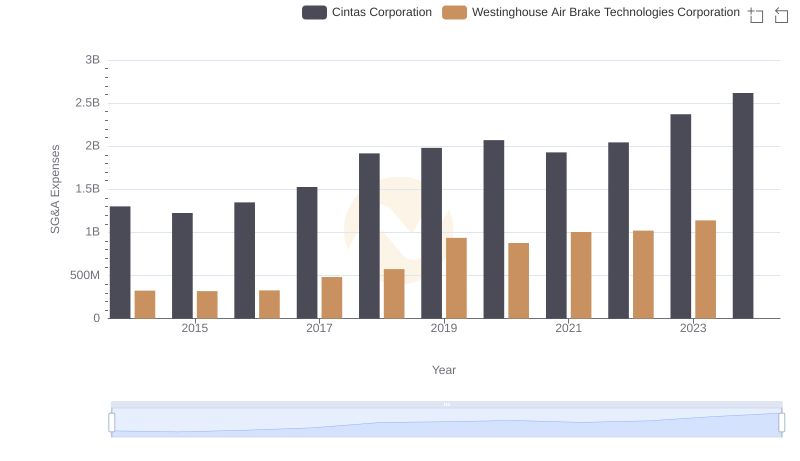

| __timestamp | Cintas Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 588370000 |

| Thursday, January 1, 2015 | 877761000 | 672301000 |

| Friday, January 1, 2016 | 933728000 | 535893000 |

| Sunday, January 1, 2017 | 968293000 | 532795000 |

| Monday, January 1, 2018 | 1227852000 | 584199000 |

| Tuesday, January 1, 2019 | 1564228000 | 1067300000 |

| Wednesday, January 1, 2020 | 1542737000 | 1229400000 |

| Friday, January 1, 2021 | 1773591000 | 1405000000 |

| Saturday, January 1, 2022 | 1990046000 | 1519000000 |

| Sunday, January 1, 2023 | 2221676000 | 1787000000 |

| Monday, January 1, 2024 | 2523857000 | 1609000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial services, Cintas Corporation and Westinghouse Air Brake Technologies Corporation have showcased remarkable financial trajectories over the past decade. Since 2014, Cintas has consistently outperformed, with its EBITDA growing by approximately 218% by 2023. This growth reflects Cintas's strategic expansions and operational efficiencies. Meanwhile, Westinghouse Air Brake Technologies, despite facing challenges, has seen a steady increase of around 204% in EBITDA, highlighting its resilience and adaptability in the transportation sector.

The data reveals a compelling narrative of growth and competition. By 2023, Cintas's EBITDA was nearly 25% higher than Westinghouse's, underscoring its dominant market position. However, the absence of 2024 data for Westinghouse suggests potential volatility or strategic shifts. This comparison not only highlights the financial health of these corporations but also offers insights into their strategic directions in the evolving industrial landscape.

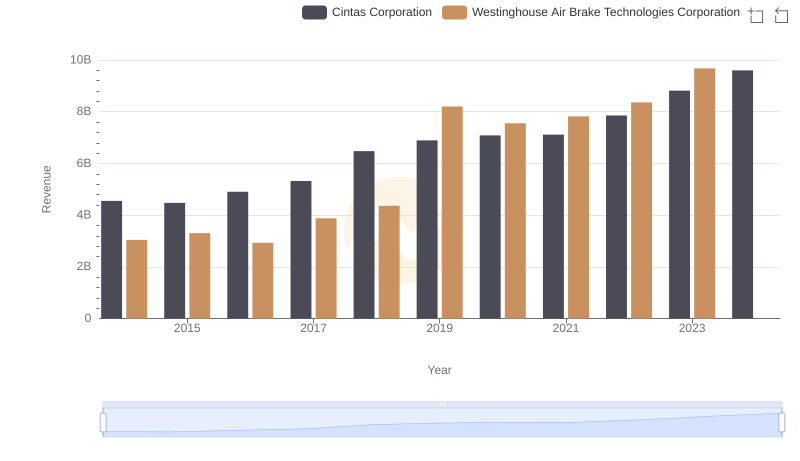

Revenue Showdown: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

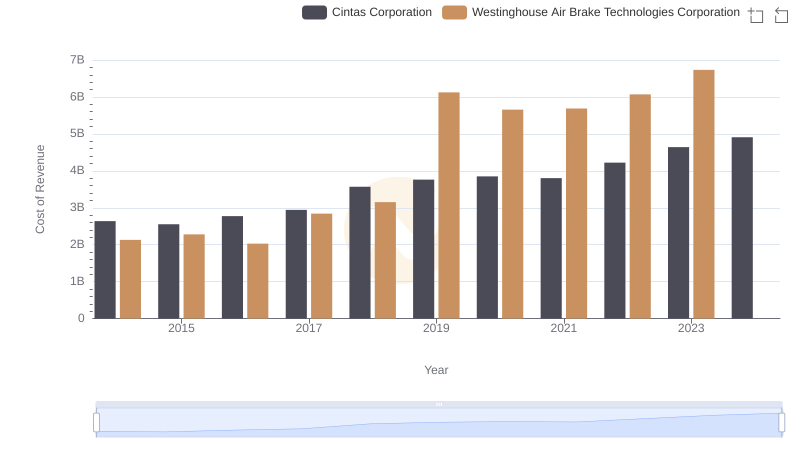

Cost of Revenue Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

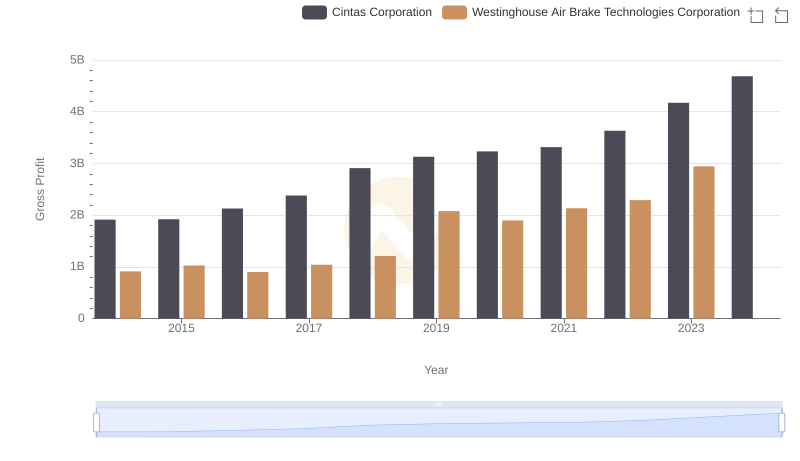

Who Generates Higher Gross Profit? Cintas Corporation or Westinghouse Air Brake Technologies Corporation

EBITDA Analysis: Evaluating Cintas Corporation Against Fastenal Company

Cintas Corporation vs Westinghouse Air Brake Technologies Corporation: SG&A Expense Trends

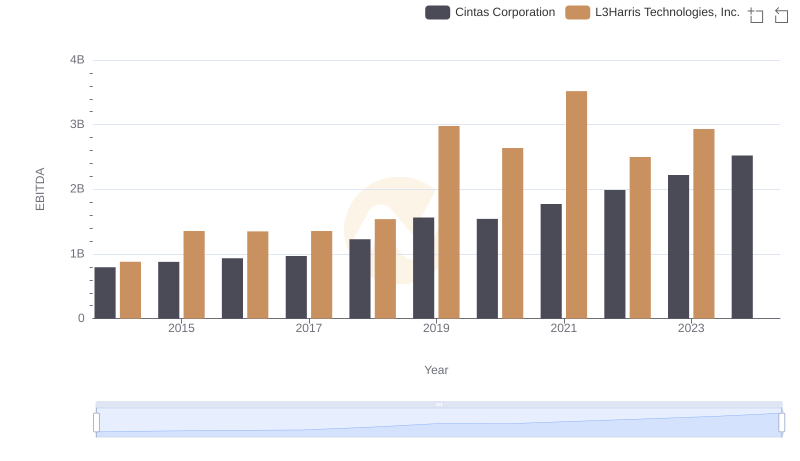

Comprehensive EBITDA Comparison: Cintas Corporation vs L3Harris Technologies, Inc.

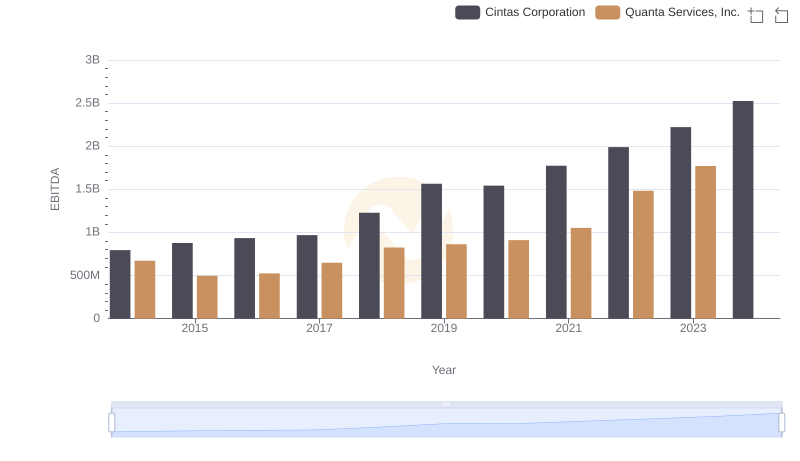

Comparative EBITDA Analysis: Cintas Corporation vs Quanta Services, Inc.

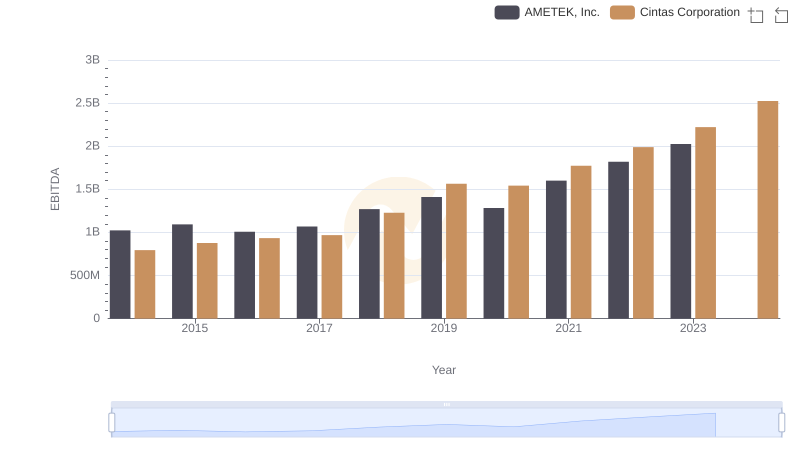

Cintas Corporation vs AMETEK, Inc.: In-Depth EBITDA Performance Comparison

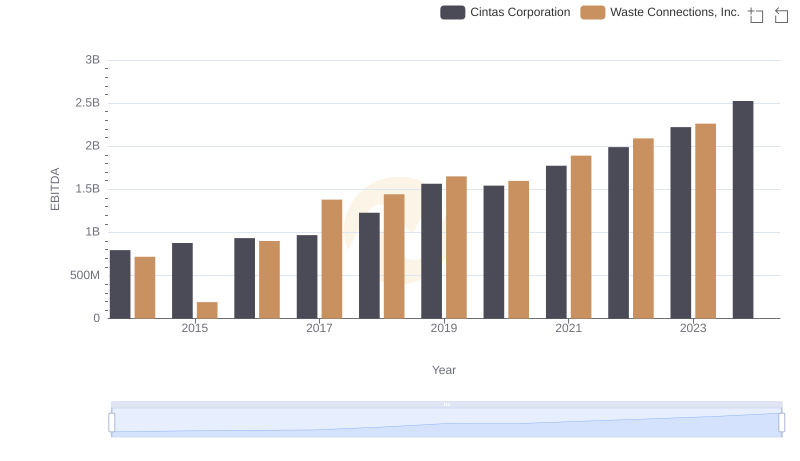

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Waste Connections, Inc.

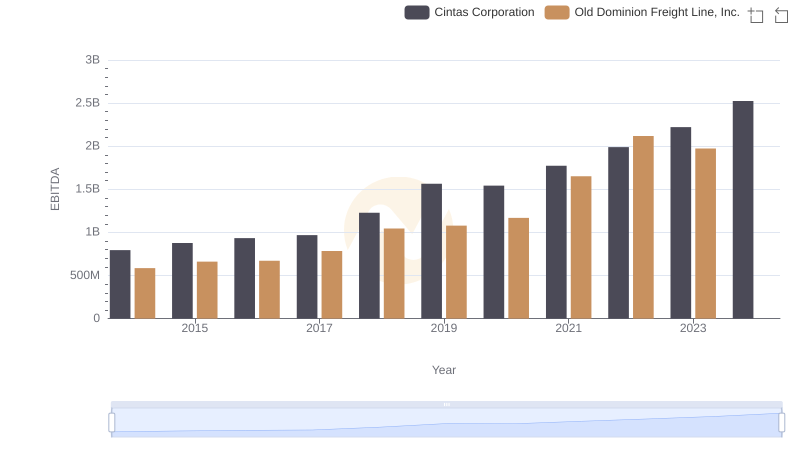

Professional EBITDA Benchmarking: Cintas Corporation vs Old Dominion Freight Line, Inc.

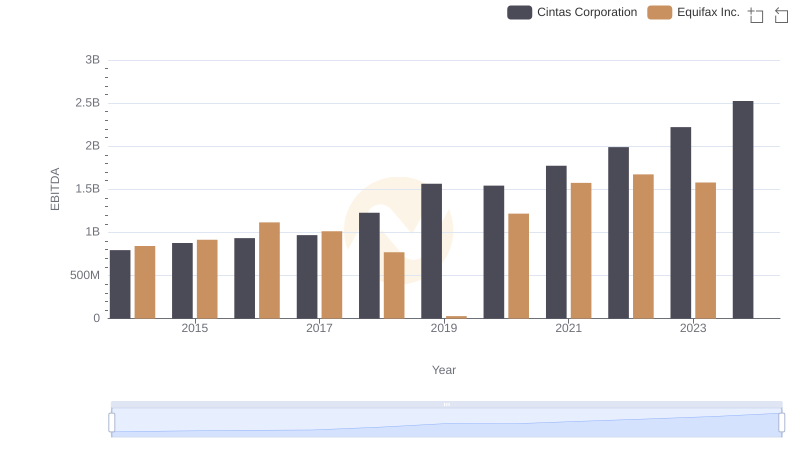

A Professional Review of EBITDA: Cintas Corporation Compared to Equifax Inc.

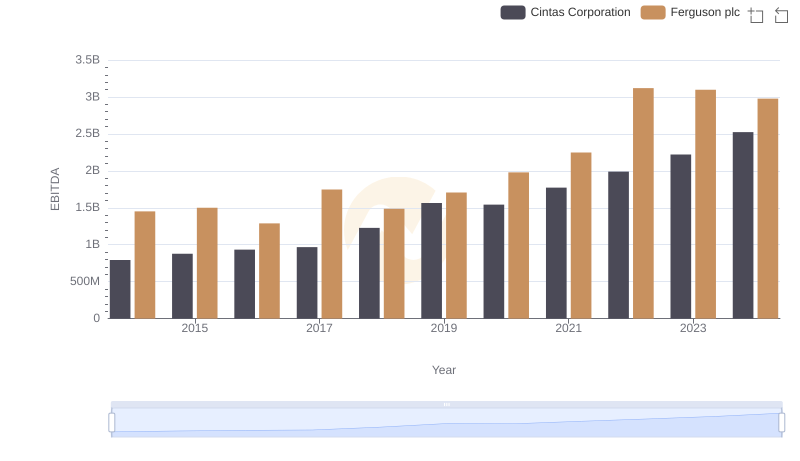

A Professional Review of EBITDA: Cintas Corporation Compared to Ferguson plc