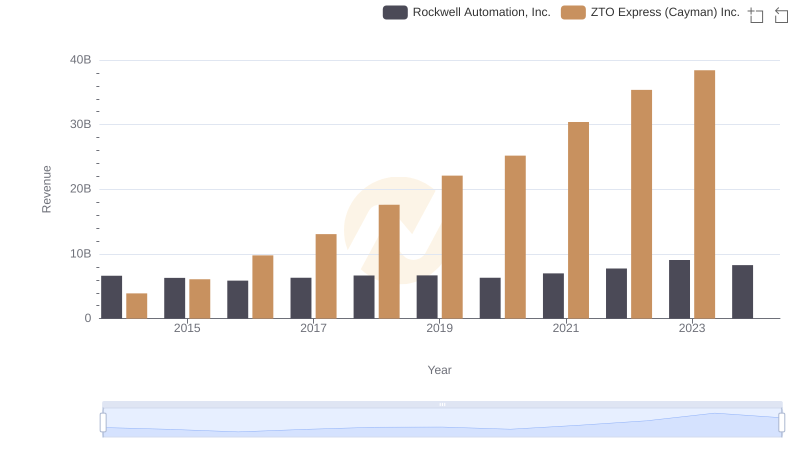

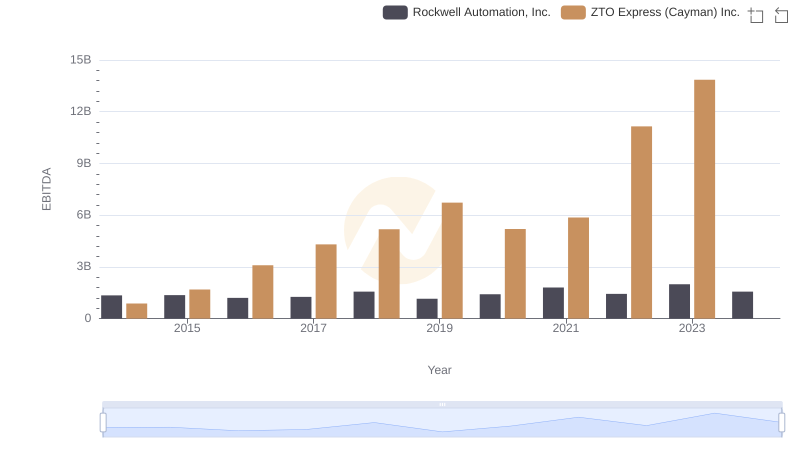

| __timestamp | Rockwell Automation, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3869600000 | 2770530000 |

| Thursday, January 1, 2015 | 3604800000 | 3998737000 |

| Friday, January 1, 2016 | 3404000000 | 6345899000 |

| Sunday, January 1, 2017 | 3687100000 | 8714489000 |

| Monday, January 1, 2018 | 3793800000 | 12239568000 |

| Tuesday, January 1, 2019 | 3794700000 | 15488778000 |

| Wednesday, January 1, 2020 | 3734600000 | 19377184000 |

| Friday, January 1, 2021 | 4099700000 | 23816462000 |

| Saturday, January 1, 2022 | 4658400000 | 26337721000 |

| Sunday, January 1, 2023 | 5341000000 | 26756389000 |

| Monday, January 1, 2024 | 5070800000 |

Unlocking the unknown

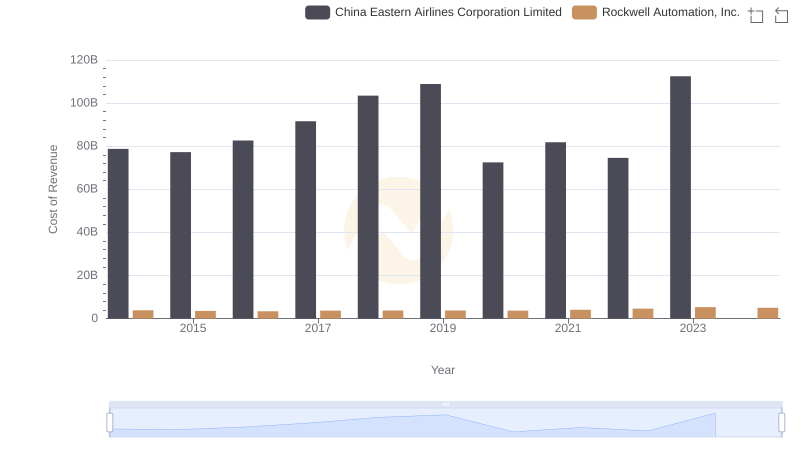

In the ever-evolving landscape of global business, cost efficiency remains a pivotal factor for success. This analysis delves into the cost of revenue trends for Rockwell Automation, Inc. and ZTO Express (Cayman) Inc. from 2014 to 2023. Over this decade, Rockwell Automation's cost of revenue increased by approximately 38%, peaking in 2023. In contrast, ZTO Express experienced a staggering 866% rise, highlighting its rapid expansion in the logistics sector.

Rockwell Automation, a leader in industrial automation, maintained a steady growth trajectory, reflecting its strategic cost management. Meanwhile, ZTO Express, a key player in China's express delivery market, showcased aggressive growth, albeit with higher cost implications. The data reveals a fascinating narrative of two companies navigating their respective industries with distinct strategies. As we look to the future, understanding these trends offers valuable insights into the dynamics of cost efficiency in diverse sectors.

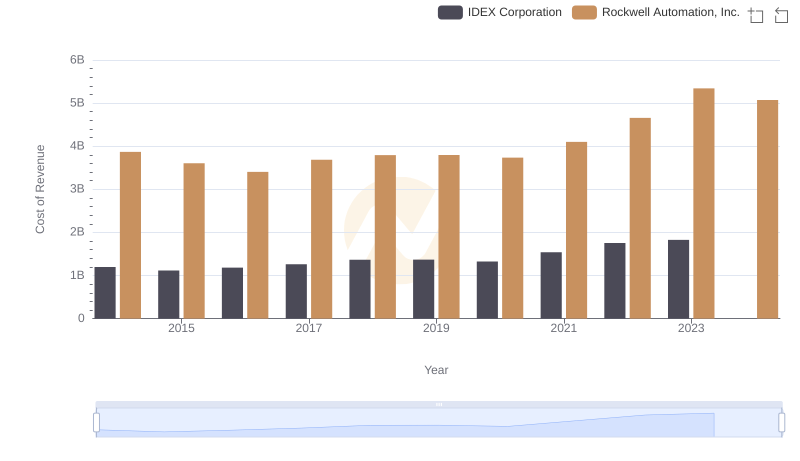

Cost Insights: Breaking Down Rockwell Automation, Inc. and IDEX Corporation's Expenses

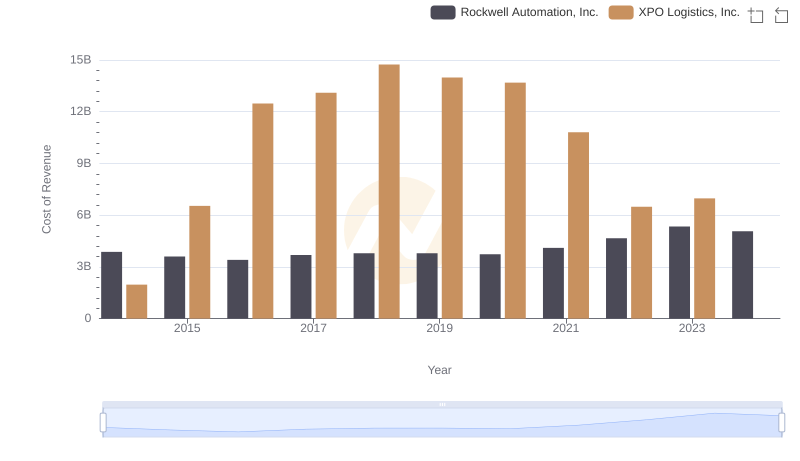

Cost of Revenue: Key Insights for Rockwell Automation, Inc. and XPO Logistics, Inc.

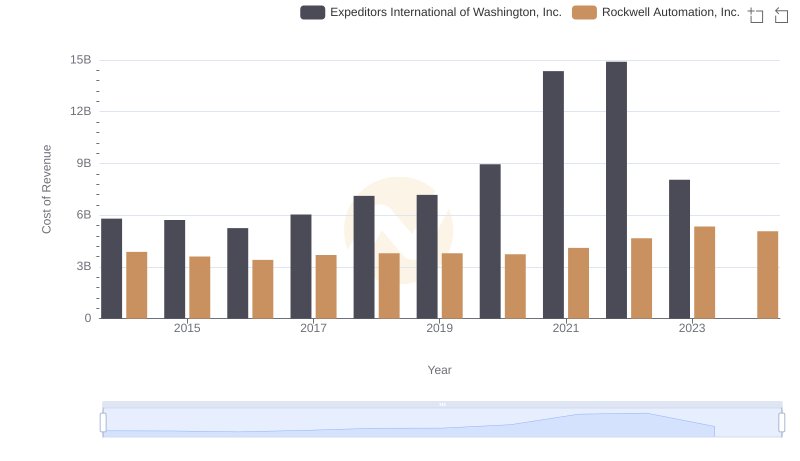

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Expeditors International of Washington, Inc.

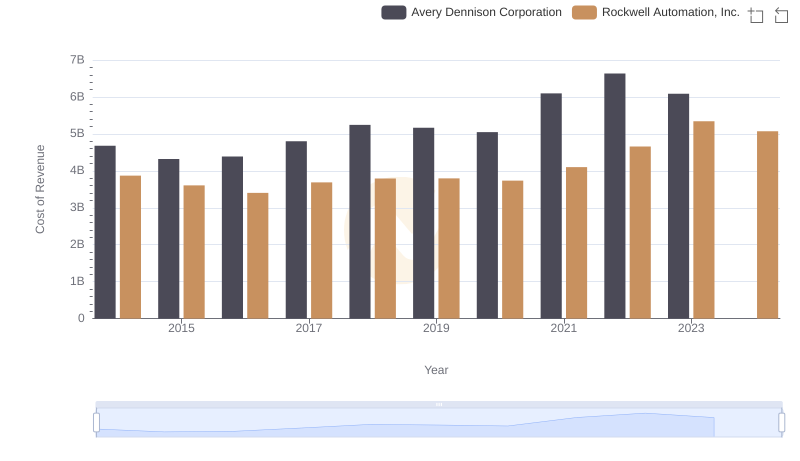

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Avery Dennison Corporation

Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.: Annual Revenue Growth Compared

Cost of Revenue: Key Insights for Rockwell Automation, Inc. and China Eastern Airlines Corporation Limited

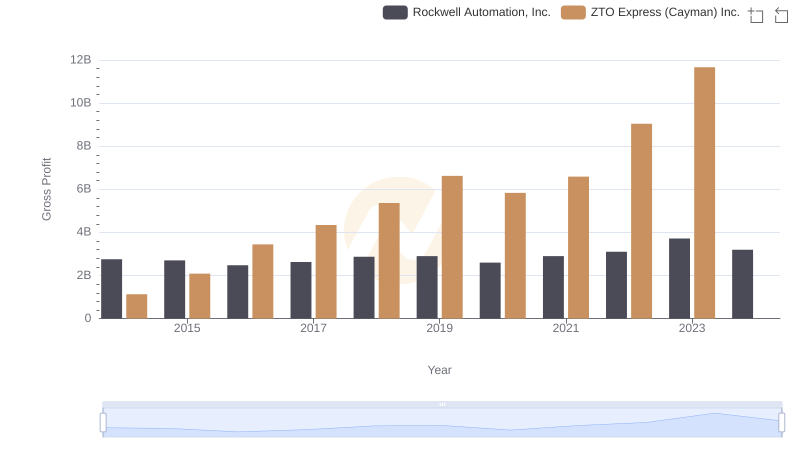

Key Insights on Gross Profit: Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.

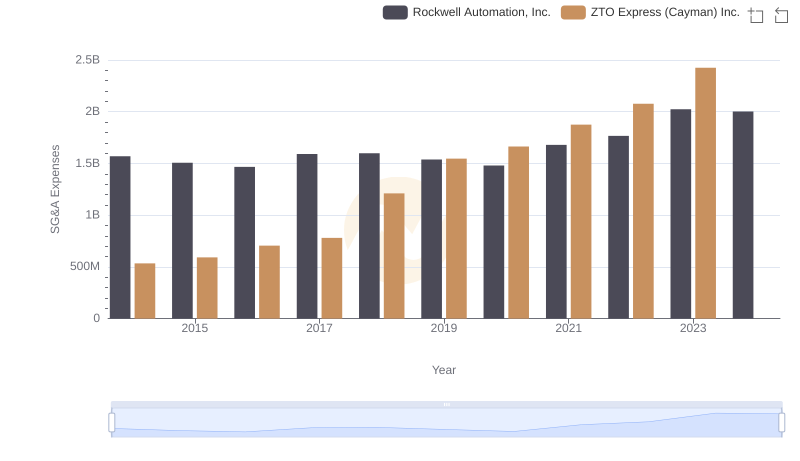

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or ZTO Express (Cayman) Inc.

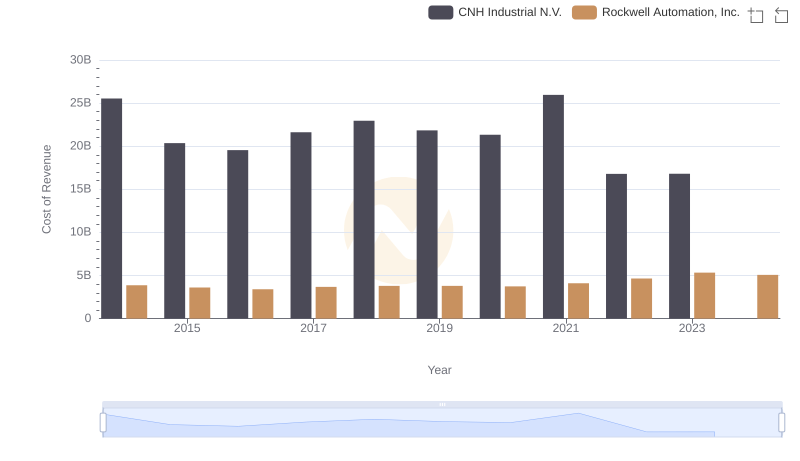

Comparing Cost of Revenue Efficiency: Rockwell Automation, Inc. vs CNH Industrial N.V.

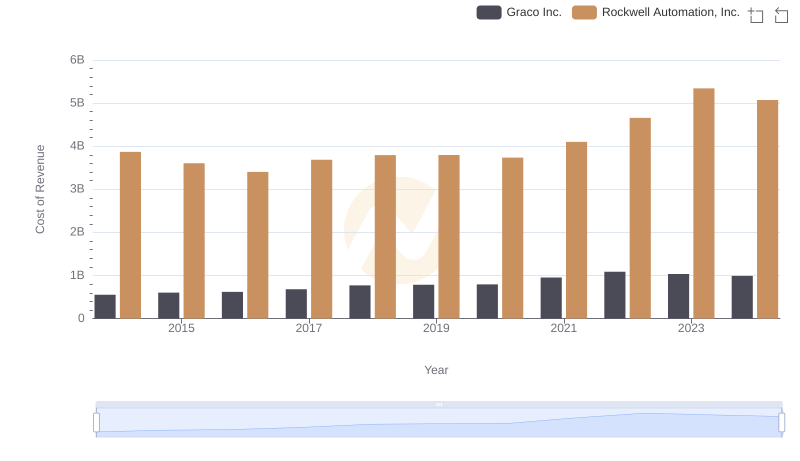

Cost Insights: Breaking Down Rockwell Automation, Inc. and Graco Inc.'s Expenses

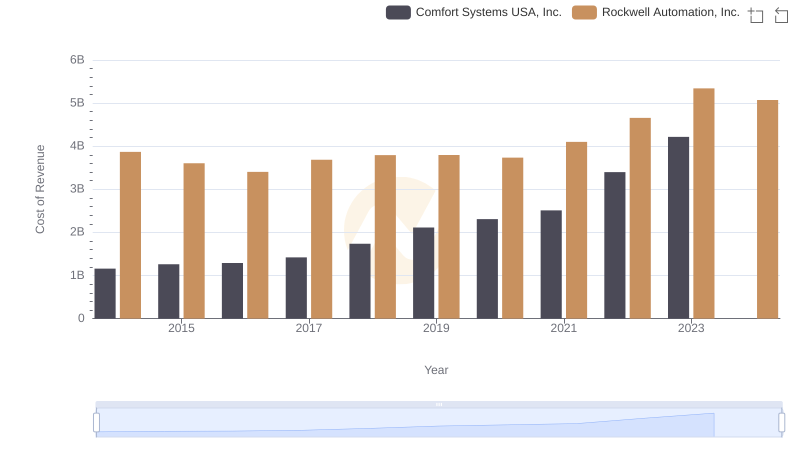

Cost of Revenue: Key Insights for Rockwell Automation, Inc. and Comfort Systems USA, Inc.

EBITDA Performance Review: Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.